Is Palantir's High Stock Price Justified? Analyzing Past Performance

Table of Contents

Palantir's Business Model and Revenue Growth

Palantir's revenue stream is largely bifurcated: government contracts and commercial sector partnerships. Understanding the dynamics of each is crucial to assessing Palantir's stock price.

Government Contracts and their Impact

Government contracts form a significant pillar of Palantir's revenue. Their inherent stability offers predictability, but reliance on government funding also presents risks.

- Stability and Predictability: Long-term contracts with government agencies provide a reliable revenue stream, mitigating short-term fluctuations. However, the renewal of these contracts can be subject to budgetary constraints and political shifts.

- Risks Associated with Government Funding: Budget cuts, shifting geopolitical priorities, and changes in government administrations can impact contract renewals and future funding.

- Examples of Large Government Contracts: Palantir's work with the US intelligence community and various defense agencies represents a substantial portion of its revenue. Specific contract details are often confidential due to national security concerns.

- Revenue Growth from Government Contracts: While Palantir doesn't always break down revenue by specific client type, analyzing annual reports reveals the considerable contribution of government contracts to its overall revenue growth.

Commercial Sector Expansion and Challenges

Palantir's expansion into the commercial sector is crucial for long-term growth and reducing reliance on government contracts. However, this market presents distinct challenges.

- Growth Rate in the Commercial Sector: Analyzing Palantir's financial reports shows a varying growth rate in its commercial revenue, demonstrating both success and challenges in penetrating this competitive market.

- Competitiveness of the Commercial Market: Palantir competes with established players and emerging startups offering similar data analytics and software solutions. This intensifies the pressure to demonstrate a clear competitive advantage.

- Success Rate of Commercial Partnerships: While Palantir boasts several significant commercial partnerships, assessing the success rate of these collaborations requires a thorough examination of contract terms, revenue generation, and long-term sustainability.

- Examples of Successful Commercial Deployments: High-profile partnerships across various industries (e.g., healthcare, finance) showcase Palantir's ability to adapt its platform to diverse commercial needs. Successful deployments demonstrate the value proposition of their offerings.

Profitability and Financial Performance

Evaluating Palantir's financial performance is essential to assessing the justification of its stock price. Key indicators include profit margins and cash flow.

Profit Margin Analysis

Analyzing Palantir's profit margins offers insights into its operational efficiency and pricing strategies.

- Gross and Net Profit Margin Trends: Graphs and charts visualizing gross and net profit margins over time reveal trends in profitability and highlight periods of growth or decline. These should be analyzed in conjunction with revenue growth.

- Factors Influencing Profitability: Factors such as research and development spending, sales and marketing expenses, and pricing strategies significantly impact Palantir's profitability.

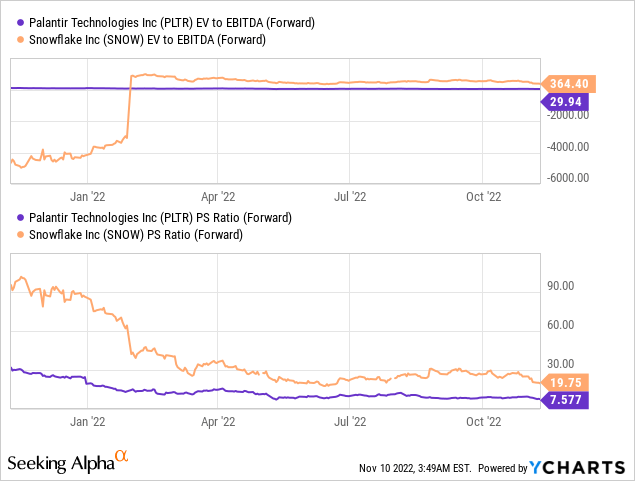

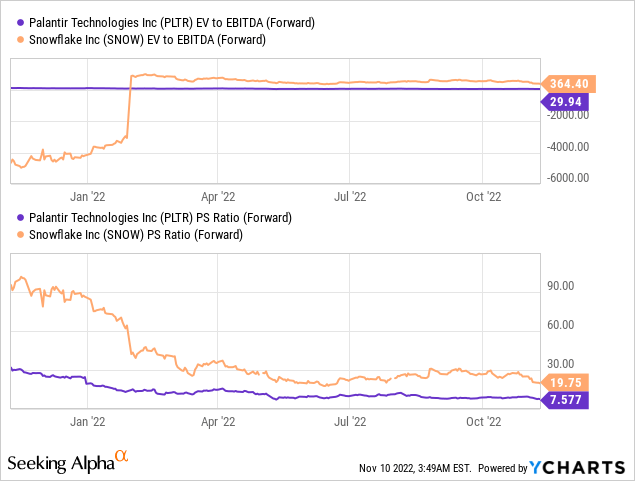

- Comparison to Competitors: Benchmarking Palantir's profit margins against its main competitors provides valuable context and helps determine its relative financial strength.

- Research and Development Spending: High R&D spending indicates a commitment to innovation, but it also impacts short-term profitability. This balance needs to be considered.

Cash Flow and Debt

A strong cash flow is crucial for a company's long-term financial health and sustainability.

- Free Cash Flow Trends: Analyzing free cash flow trends over time reveals Palantir's ability to generate cash from its operations after accounting for capital expenditures.

- Impact of Debt on Financial Health: High levels of debt can increase financial risk, so it's vital to assess Palantir's debt levels and its ability to service its debt obligations.

- Comparison to Industry Averages: Comparing Palantir's cash flow metrics to industry averages offers a valuable benchmark to assess its relative financial performance.

- Long-Term Financial Sustainability: Assessing the long-term financial sustainability of Palantir requires analyzing its cash flow generation, debt levels, and overall financial strategy.

Competitive Landscape and Market Position

Palantir operates in a competitive market, and understanding its market position is critical.

Key Competitors and Market Share

Identifying Palantir's main competitors and analyzing its market share provide a clearer picture of its competitive strength.

- Major Competitors: Companies offering similar data analytics and software solutions, including both established players and emerging startups, compete with Palantir.

- Competitive Advantages and Disadvantages: Palantir's competitive advantages and disadvantages need careful assessment to understand its strengths and areas for improvement.

- Market Share Data (if available): While precise market share data is often difficult to obtain, analyzing available industry reports can provide insights.

- Future Market Trends: Analyzing future market trends and their potential impact on Palantir's competitive position is vital for assessing its long-term prospects.

Technological Innovation and Future Outlook

Palantir's commitment to technological innovation will be key to its future success.

- Key Technological Innovations: Identifying and assessing the impact of Palantir's key technological innovations is crucial for determining its competitive edge.

- Potential for Further Innovation and Expansion: Palantir's potential for further innovation and expansion into new markets will significantly shape its future prospects.

- Impact of Emerging Technologies: The impact of emerging technologies, such as artificial intelligence and machine learning, on Palantir's competitive position should be carefully analyzed.

Conclusion

Analyzing Palantir's past performance reveals a complex picture. While its government contracts provide a stable revenue base, its success in the commercial sector and its ability to maintain profitability and manage debt will be crucial factors determining its future stock price. Whether Palantir's current stock price is justified depends largely on future performance and the company's ability to navigate the competitive landscape and capitalize on emerging technologies. Ultimately, determining whether Palantir's high stock price is justified requires thorough due diligence. Continue your research into Palantir's stock price and consider consulting with a financial advisor before making any investment decisions.

Featured Posts

-

The Central Bank Of Thailand And The Response To Deflation

May 07, 2025

The Central Bank Of Thailand And The Response To Deflation

May 07, 2025 -

Analyzing The Fit Would Julius Randle Thrive With The Timberwolves

May 07, 2025

Analyzing The Fit Would Julius Randle Thrive With The Timberwolves

May 07, 2025 -

Edwards Self Promotional Stunt A Randle Press Conference Hijack

May 07, 2025

Edwards Self Promotional Stunt A Randle Press Conference Hijack

May 07, 2025 -

Police Involved After Simone Biles Receives Threatening Texts Regarding Nassar And Owens

May 07, 2025

Police Involved After Simone Biles Receives Threatening Texts Regarding Nassar And Owens

May 07, 2025 -

Does Home Court Matter In The Warriors Vs Rockets Playoffs

May 07, 2025

Does Home Court Matter In The Warriors Vs Rockets Playoffs

May 07, 2025