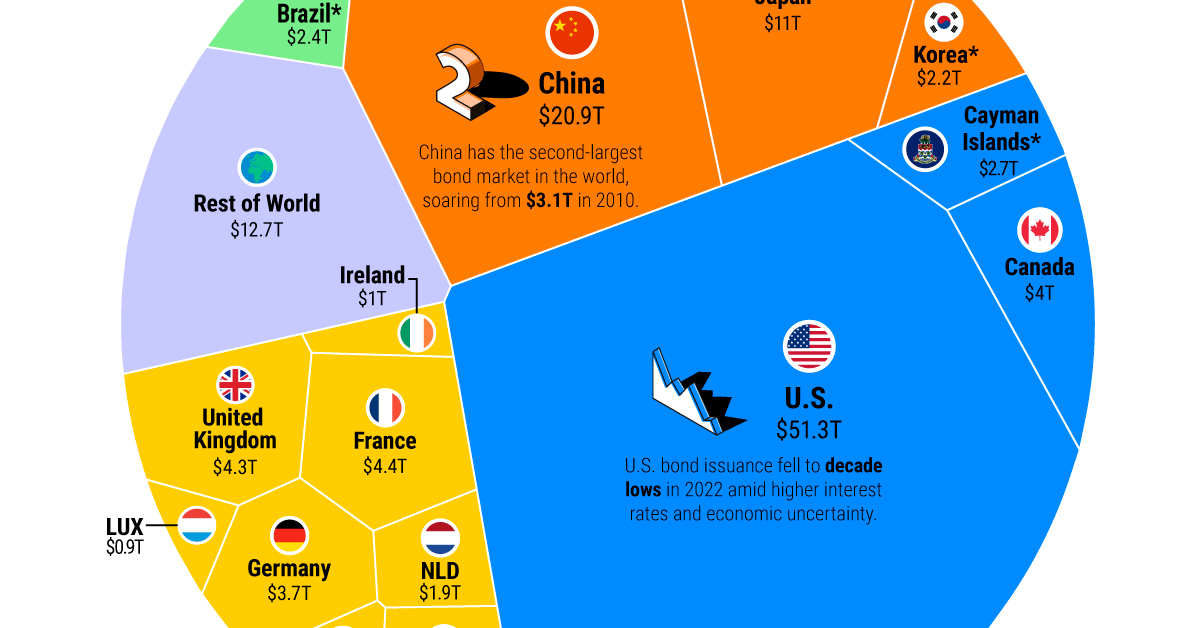

Is Posthaste Trouble Brewing In The World's Largest Bond Market?

Table of Contents

Rising Interest Rates and Their Impact

The Federal Reserve's aggressive monetary policy to combat inflation is a major driver of current market anxieties. These actions, while intended to cool the economy, have created a complex ripple effect throughout the bond market.

The Fed's Aggressive Monetary Policy

The Fed's recent interest rate hikes are aimed at curbing inflation. However, this approach carries significant consequences:

- Increased borrowing costs: Higher interest rates make borrowing more expensive for businesses and consumers, potentially slowing economic growth.

- Impact on inflation: While higher rates aim to curb inflation, they can also have unintended consequences, potentially causing a recession.

- Potential for recession: Aggressive rate hikes increase the risk of a recession, further impacting bond prices.

- Effects on bond yields: Rising interest rates directly impact bond yields, creating uncertainty for investors.

The Inverse Relationship Between Bond Prices and Interest Rates

Understanding the inverse relationship between bond prices and interest rates is crucial. When interest rates rise, the value of existing bonds falls. This is because newly issued bonds offer higher yields, making older bonds less attractive.

- Lower bond prices: Rising rates lead to lower prices for existing bonds, resulting in capital losses for investors.

- Capital losses for investors: Investors holding bonds face potential losses as their investments decline in value.

- Increased risk for bond holders: The risk of capital losses increases as interest rates rise, making bond investments less appealing.

The Flight to Safety Paradox

Despite rising interest rates, US Treasuries remain a safe-haven asset. Investors often flock to them during times of uncertainty, even if yields are lower.

- Demand despite lower yields: The demand for US Treasuries persists despite the lower yields, creating a flight-to-safety dynamic.

- Implications for market stability: While this demand provides stability, it can also mask underlying problems.

- Potential for future price corrections: The sustained demand might lead to a future price correction when investor sentiment shifts.

Inflationary Pressures and Bond Market Dynamics

Persistent inflation is another significant factor affecting the bond market. High inflation erodes the purchasing power of fixed-income investments like bonds.

Persistent Inflation and its Impact on Bond Yields

High inflation significantly impacts bond yields and investor behavior.

- Inflation erodes bond value: The real return on bonds diminishes as inflation eats away at their purchasing power.

- Increased demand for higher-yielding bonds: Investors seek higher yields to compensate for inflation, driving demand for higher-yielding bonds.

- Potential for a yield curve inversion: Persistent inflation can lead to a yield curve inversion, a strong predictor of potential economic downturns.

The Role of Government Spending and Debt

Government spending and the national debt also play a crucial role in influencing bond market stability.

- Increased borrowing: High government spending necessitates increased borrowing, putting upward pressure on interest rates.

- Potential for higher interest rates: Increased borrowing can lead to competition for funds, pushing interest rates higher.

- Credit rating implications: High debt levels can negatively affect a country's credit rating, impacting the demand for its bonds.

Geopolitical Risks and Their Influence on the Bond Market

Geopolitical events and global uncertainty significantly impact investor sentiment and the bond market.

Global Uncertainty and Safe-Haven Demand

Global uncertainty often drives investors towards safe-haven assets like US Treasuries.

- Capital flight to US Treasuries: During times of global turmoil, capital often flows into US Treasuries as a safe haven.

- Increased demand: This increased demand can temporarily stabilize the market, even in the face of rising rates.

- Potential for short-term market distortions: This influx of capital can distort short-term market dynamics.

The Impact of International Conflicts and Economic Slowdowns

International conflicts and economic slowdowns globally can significantly impact investor sentiment towards US Treasury bonds.

- Risk-off sentiment: During times of global uncertainty, investors adopt a “risk-off” strategy, favoring safe-haven assets.

- Increased demand for safe-haven assets: This leads to a surge in demand for US Treasuries, driving up their prices.

- Potential for sustained price increases: The sustained demand can result in sustained price increases in the short term.

Conclusion

The confluence of rising interest rates, inflationary pressures, and geopolitical risks creates a complex and potentially volatile environment for the world's largest bond market. Understanding the interconnectedness of these factors is crucial to anticipating potential "posthaste" trouble. The potential for rapid shifts in market sentiment and prices necessitates vigilance. Understanding the potential for posthaste trouble in the bond market is crucial for investors. Stay informed about the latest developments concerning posthaste shifts in the world's largest bond market and consider diversifying your investment portfolio to mitigate potential risks. Further research into the intricacies of US Treasury bond yields and market dynamics is recommended.

Featured Posts

-

Currans Prediction A Difficult Bd Ahead

May 23, 2025

Currans Prediction A Difficult Bd Ahead

May 23, 2025 -

Bd Challenges Currans Outlook

May 23, 2025

Bd Challenges Currans Outlook

May 23, 2025 -

New Netflix Drama Darkly Funny And Sexy Starring A White Lotus Star And Oscar Winner

May 23, 2025

New Netflix Drama Darkly Funny And Sexy Starring A White Lotus Star And Oscar Winner

May 23, 2025 -

Disney To Release Documentary On Freddie Flintoffs Serious Crash

May 23, 2025

Disney To Release Documentary On Freddie Flintoffs Serious Crash

May 23, 2025 -

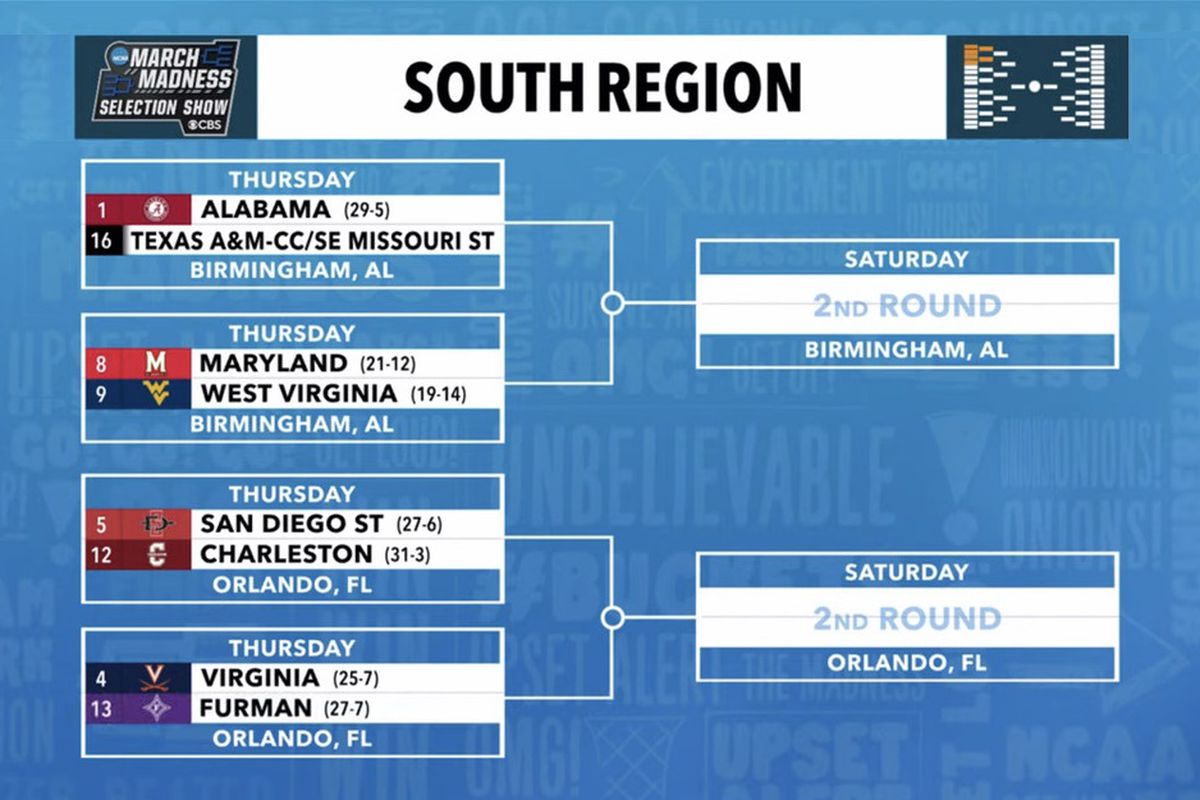

Bishop England Excels Two Graduates Headed To Louisvilles 2025 Ncaa Tournament

May 23, 2025

Bishop England Excels Two Graduates Headed To Louisvilles 2025 Ncaa Tournament

May 23, 2025