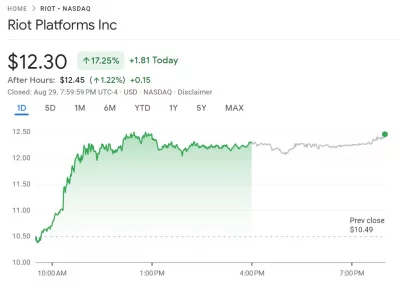

Is Riot Platforms Stock (RIOT) A Good Investment? Comparing With Coinbase (COIN)

Table of Contents

Understanding Riot Platforms (RIOT): A Bitcoin Mining Focus

Riot Platforms' primary business is Bitcoin mining. This involves using powerful computers ("mining rigs") to solve complex mathematical problems, earning Bitcoin as a reward. Let's examine their operations and potential.

Business Model and Revenue Streams

Riot Platforms generates revenue primarily by mining Bitcoin. Their success depends on factors like:

- Hashing Power: The computational power of their mining rigs directly impacts their Bitcoin mining output. Higher hashing power translates to more mined Bitcoin.

- Mining Rigs: The efficiency and technological advancement of their mining equipment significantly affect their profitability. Maintaining a cutting-edge fleet is crucial.

- Energy Consumption: Bitcoin mining is energy-intensive. Riot Platforms' operational costs are heavily influenced by electricity prices and energy efficiency. This is a significant factor in their profitability.

Revenue is generated solely from Bitcoin mining. The Bitcoin price directly impacts their revenue; a rising Bitcoin price increases profitability, while a falling price reduces it. Risks include significant increases in energy costs and the increasing difficulty of Bitcoin mining. Increased competition and technological obsolescence of their mining hardware also pose significant challenges.

Financial Performance and Growth Potential

Analyzing RIOT's financial statements reveals key insights into its performance and potential. Key metrics to consider include:

- Revenue Growth: Examine the trend in RIOT's revenue over time to assess its growth trajectory.

- Profitability: Analyze net income and profit margins to gauge its ability to generate profits. The Bitcoin price directly impacts profitability.

- Debt Levels: Assess RIOT's debt-to-equity ratio to understand its financial leverage.

Future projections depend heavily on Bitcoin's price forecasts and the broader cryptocurrency market. Industry trends, such as advancements in mining technology and regulatory changes, will also significantly impact RIOT's growth potential. Positive projections suggest increased profitability as hashing power improves and energy costs stabilize.

Risks Associated with Investing in RIOT

Investing in RIOT carries substantial risks:

- Cryptocurrency Market Volatility: The cryptocurrency market is notoriously volatile. Bitcoin's price can fluctuate dramatically, directly impacting RIOT's revenue and stock price.

- Regulatory Risk: Government regulations concerning cryptocurrency mining can significantly impact operations and profitability. Changes in regulations could affect RIOT's ability to operate.

- Bitcoin Price Volatility: As mentioned, Bitcoin price fluctuations are the biggest risk. A sustained drop in the Bitcoin price could severely impact RIOT's financial health.

- Technological Obsolescence: The mining hardware industry is rapidly evolving. If RIOT fails to upgrade its equipment, it may become less competitive and less profitable.

- Environmental Concerns: The energy consumption of Bitcoin mining raises environmental concerns, which could lead to increased regulatory scrutiny.

Understanding Coinbase (COIN): A Cryptocurrency Exchange Platform

Coinbase operates as a cryptocurrency exchange, facilitating the buying, selling, and trading of various cryptocurrencies. Its revenue model differs significantly from Riot Platforms.

Business Model and Revenue Streams

Coinbase generates revenue through several streams:

- Trading Fees: Charges levied on users for buying and selling cryptocurrencies. Trading volume directly impacts revenue.

- Custody Fees: Fees charged for storing cryptocurrencies on Coinbase's platform.

- Subscription Fees: Fees associated with premium subscription services.

Coinbase's success depends on trading volume, the number of users, and cryptocurrency market capitalization. Higher trading volumes and more users translate to higher revenue. Its dependence on cryptocurrency prices means that market downturns negatively impact revenue.

Financial Performance and Growth Potential

COIN's financial performance is assessed through:

- Transaction Volume: The total value of cryptocurrency transactions processed on the platform.

- User Growth: The number of registered users and active traders on Coinbase.

- Profitability: Analysis of net income and operating margins.

Future growth potential depends on user adoption, regulatory developments, and the overall growth of the cryptocurrency market. Increased competition from other cryptocurrency exchanges poses a substantial risk.

Risks Associated with Investing in COIN

Investing in COIN also involves significant risks:

- Regulatory Uncertainty: The regulatory landscape for cryptocurrency exchanges is constantly evolving. Changes in regulations could drastically impact Coinbase's operations.

- Security Risks: Cryptocurrency exchanges are potential targets for hackers. Security breaches could lead to substantial financial losses and reputational damage.

- Competition: The cryptocurrency exchange market is highly competitive. New entrants and existing players constantly compete for market share.

Direct Comparison: RIOT vs. COIN

Let's compare RIOT and COIN directly to understand their relative merits.

Valuation and Growth Outlook

Comparing RIOT and COIN requires analyzing key metrics:

- Price-to-Earnings Ratio (P/E): This helps compare their valuations relative to their earnings.

- Market Capitalization: This reflects the overall market value of each company.

| Metric | RIOT | COIN |

|---|---|---|

| P/E Ratio | (Obtain current data) | (Obtain current data) |

| Market Capitalization | (Obtain current data) | (Obtain current data) |

| Revenue Growth | (Obtain current data) | (Obtain current data) |

| Risk Profile | High | Moderate to High |

The risk-reward profile differs significantly. RIOT carries higher risk due to its dependence on Bitcoin's price. COIN's risk is moderate to high, primarily due to regulatory and security concerns.

Investment Strategies and Diversification

Both RIOT and COIN can be part of a diversified investment portfolio. However, the allocation should reflect your risk tolerance and investment goals.

- RIOT: Suitable for investors with higher risk tolerance and a bullish outlook on Bitcoin.

- COIN: Suitable for investors seeking exposure to the broader cryptocurrency exchange market, accepting a moderate to high risk profile.

Diversification is crucial to mitigate risk. Don't over-allocate to either stock, especially given their volatility.

Conclusion

This comparison of Riot Platforms (RIOT) and Coinbase (COIN) reveals distinct investment opportunities within the cryptocurrency sector. RIOT offers direct exposure to Bitcoin mining, while COIN provides exposure to the cryptocurrency exchange market. Both investments carry significant risks associated with cryptocurrency market volatility. The best investment depends on individual risk tolerance, investment goals, and a comprehensive understanding of the cryptocurrency landscape. Conduct thorough due diligence and consult a financial advisor before investing in Riot Platforms (RIOT) or Coinbase (COIN). Remember that both are high-risk investments.

Featured Posts

-

Lisa Ann Keller Obituary And Memorial Details From East Idaho News

May 02, 2025

Lisa Ann Keller Obituary And Memorial Details From East Idaho News

May 02, 2025 -

Kya Shhr Ewrt Hmyshh Ke Lye Khnjr Ke Saye Tle Rhe Ga Ayksprys Ardw Ky Rwshny Myn

May 02, 2025

Kya Shhr Ewrt Hmyshh Ke Lye Khnjr Ke Saye Tle Rhe Ga Ayksprys Ardw Ky Rwshny Myn

May 02, 2025 -

Celebrity Traitors Major Setback For Bbc Show

May 02, 2025

Celebrity Traitors Major Setback For Bbc Show

May 02, 2025 -

Lotto Results Saturday April 12th Jackpot Numbers

May 02, 2025

Lotto Results Saturday April 12th Jackpot Numbers

May 02, 2025 -

Chief Election Commissioner On A Reliable Poll Data System

May 02, 2025

Chief Election Commissioner On A Reliable Poll Data System

May 02, 2025