Is The Australian Dollar Poised To Outperform The New Zealand Dollar?

Table of Contents

Comparing Economic Fundamentals: Australia vs. New Zealand

Understanding the economic fundamentals of Australia and New Zealand is crucial for predicting the future performance of their currencies. Key factors include GDP growth, inflation rates, interest rates, and trade balances. The Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) play pivotal roles in shaping monetary policy, influencing their respective currencies. Commodity prices also significantly impact both economies.

-

GDP Growth: Australia's historically larger and more diversified economy often translates to stronger GDP growth compared to New Zealand's more export-dependent economy. Fluctuations in global demand for Australian commodities like iron ore and gold heavily influence this growth. New Zealand's economy, while smaller, is highly reliant on tourism and dairy exports, making it more vulnerable to external shocks.

-

Inflation Rates and Interest Rates: A comparison of inflation rates between the two countries is key. Higher inflation usually leads to higher interest rates. If the RBA raises interest rates more aggressively than the RBNZ, it could strengthen the AUD relative to the NZD. This interest rate differential attracts foreign investment seeking higher returns.

-

Trade Balances and Commodity Prices: Australia's significant resource exports, including iron ore, coal, and gold, significantly impact its trade balance. Strong commodity prices bolster the AUD. New Zealand, heavily reliant on dairy and tourism, is more vulnerable to fluctuations in global demand for these products. A decline in dairy prices, for example, could weaken the NZD.

Analyzing Trade Relationships and Global Influences

Global economic growth and the strength of the US dollar significantly influence both the AUD and NZD. The trade relationships of both countries with key partners, particularly China, play a crucial role. Geopolitical factors can also impact currency values.

-

China's Influence: Both Australia and New Zealand are significant trading partners with China. Any slowdown in the Chinese economy or shifts in trade relations would affect both currencies, though the impact might differ based on each country's specific export mix.

-

US Dollar Strength: A stronger US dollar typically puts downward pressure on both the AUD and NZD, as investors shift towards the safer haven currency.

-

Global Risk Appetite and Geopolitical Factors: Periods of increased global uncertainty or geopolitical instability (e.g., natural disasters, political tensions) can lead to investors seeking safer assets, thus weakening both currencies. However, the relative impact on each currency may vary depending on the nature and location of the event.

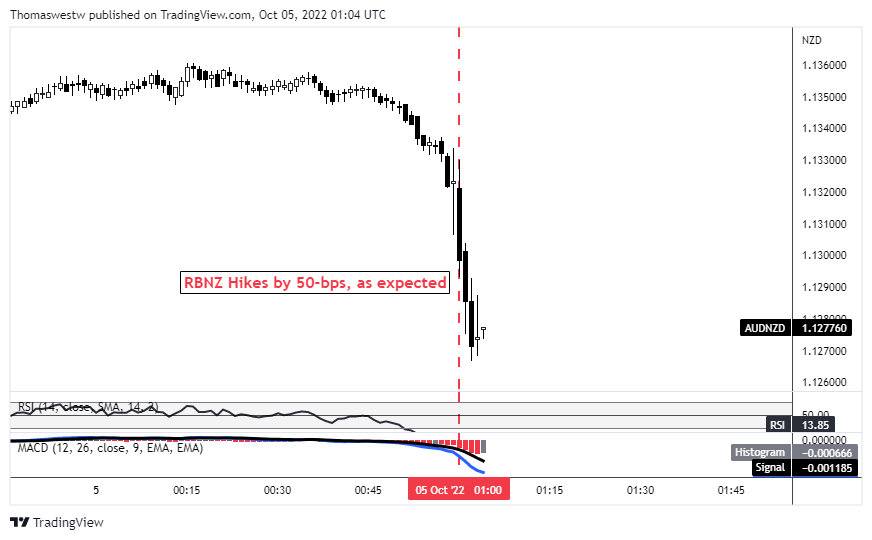

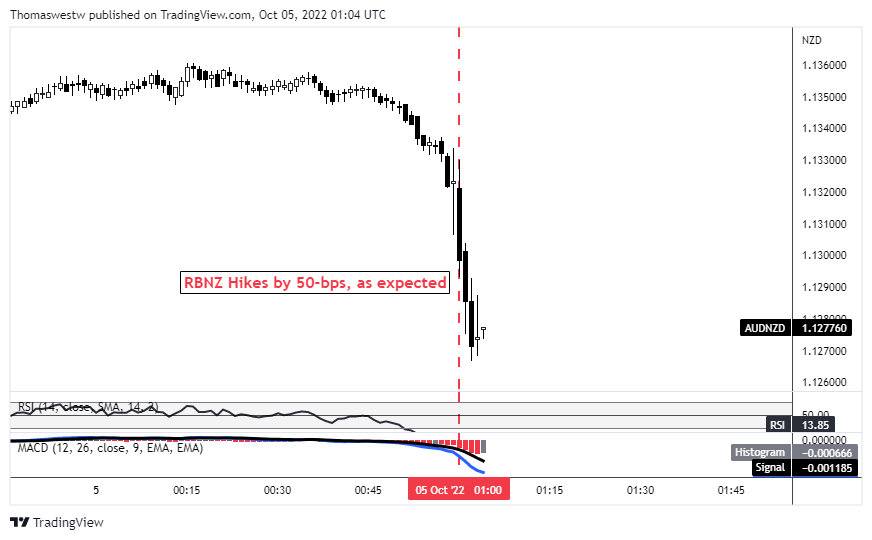

Technical Analysis of the AUD/NZD Exchange Rate

Technical analysis of the AUD/NZD exchange rate provides insights into potential future price movements. By studying chart patterns, support and resistance levels, and technical indicators, traders can attempt to predict future trends. It is vital to note that this is not financial advice.

-

Current AUD/NZD Exchange Rate and Historical Trends: Analyzing the current exchange rate and historical trends offers a starting point for understanding potential future movements. Identifying long-term trends can offer valuable context.

-

Technical Indicators: Moving averages, Relative Strength Index (RSI), and other technical indicators can help assess the momentum and strength of the AUD/NZD exchange rate.

-

Support and Resistance Levels: Identifying key support and resistance levels on charts can help predict potential price reversals. Breakouts above resistance or below support can indicate significant price changes.

Risks and Uncertainties

Predicting currency movements is inherently challenging due to the volatile nature of currency markets. Several factors could impact the accuracy of any forecast.

-

Economic Downturns: Unexpected economic slowdowns in either Australia or New Zealand could significantly affect their respective currencies.

-

Unforeseen Global Events: Global events, such as a major geopolitical crisis or a significant pandemic, introduce uncertainty that can dramatically shift currency values.

-

Currency Volatility: The inherent volatility of the forex market means that predictions are never certain. Unexpected news or events can lead to sharp and sudden movements.

Conclusion

This analysis has compared the economic fundamentals, trade relationships, and technical indicators influencing the Australian and New Zealand dollars. While the Australian dollar currently shows potential for outperformance based on stronger GDP growth and potentially higher interest rates relative to New Zealand, significant uncertainties remain. The impact of global factors, commodity prices, and potential economic shocks cannot be ignored.

Call to Action: Stay informed about the Australian and New Zealand economies to make well-informed decisions regarding AUD and NZD exchange rate movements. Continue researching the Australian Dollar and New Zealand Dollar to formulate your own investment strategy. Remember to consult with a financial advisor before making any investment decisions related to the AUD/NZD exchange rate.

Featured Posts

-

Suki Waterhouse And The Resurgence Of The 70s Shag Haircut

May 06, 2025

Suki Waterhouse And The Resurgence Of The 70s Shag Haircut

May 06, 2025 -

Review Colman Domingo And Marco Calvani Elevate The Four Seasons

May 06, 2025

Review Colman Domingo And Marco Calvani Elevate The Four Seasons

May 06, 2025 -

Gazze Balikcilari Icin Hayatta Kalma Muecadelesi Ekonomik Kriz Ve Coezuem Oenerileri

May 06, 2025

Gazze Balikcilari Icin Hayatta Kalma Muecadelesi Ekonomik Kriz Ve Coezuem Oenerileri

May 06, 2025 -

Laser Treatment Kim Kardashians Met Gala 2025 Prep

May 06, 2025

Laser Treatment Kim Kardashians Met Gala 2025 Prep

May 06, 2025 -

Filmmaker Spike Lee Lauds Sinners Performance

May 06, 2025

Filmmaker Spike Lee Lauds Sinners Performance

May 06, 2025