Is The Bitcoin Rebound Sustainable? Factors To Consider

Table of Contents

Macroeconomic Factors Influencing Bitcoin's Price: Global Economic Conditions and Bitcoin's Correlation

The global economic landscape plays a significant role in shaping Bitcoin's price. Inflation, interest rates, and overall economic growth all have a demonstrable impact on investor behavior and, consequently, Bitcoin's value. A strong correlation exists between traditional markets and Bitcoin’s price movements, meaning that a downturn in the stock market often influences Bitcoin's price negatively, and vice versa.

- Inflationary pressures: High inflation often drives investors to seek alternative assets as a hedge against inflation. Bitcoin, with its fixed supply, has become an attractive option for some, boosting demand and potentially contributing to a Bitcoin rebound.

- Rising interest rates: Conversely, rising interest rates can reduce investment in riskier assets, such as Bitcoin. Higher interest rates make traditional savings accounts and bonds more attractive, potentially diverting funds away from cryptocurrencies and dampening the Bitcoin rebound.

- Global economic uncertainty: Periods of global economic uncertainty can trigger a flight to safety, potentially benefiting Bitcoin. However, this uncertainty can also lead to increased risk aversion, causing investors to sell off their Bitcoin holdings, impacting the sustainability of any Bitcoin rebound.

Regulatory Landscape and its Impact on Bitcoin: Governmental Regulations and Their Influence on the Bitcoin Market

Governmental regulations around the world significantly influence Bitcoin's adoption and price. Supportive regulatory frameworks can foster investor confidence and boost market participation, while restrictive measures can hinder growth and negatively impact price. The evolving regulatory landscape is a crucial factor in determining the future of the Bitcoin rebound.

- Positive regulatory developments: Clear regulatory guidelines, particularly in major markets, can legitimize Bitcoin and attract institutional investors, supporting a sustained Bitcoin rebound.

- Negative regulatory news: Conversely, news of stricter regulations, bans, or crackdowns can trigger sell-offs and price corrections, jeopardizing the sustainability of any Bitcoin rebound.

- Regulatory clarity: The lack of clear, consistent global regulations creates uncertainty for investors, impacting the long-term outlook for Bitcoin. Increased regulatory clarity is essential for a sustained and healthy Bitcoin price rebound.

Bitcoin's Underlying Technology and Adoption: Technological Advancements and Bitcoin Adoption Rates

Bitcoin's underlying technology and its adoption rate are critical factors driving its price. Advancements in scalability, transaction speed, and the development of layer-2 solutions like the Lightning Network are improving Bitcoin's functionality and usability. Furthermore, increased adoption by institutional investors and a growing user base contribute to a more stable and resilient Bitcoin ecosystem.

- Technological improvements: Enhanced scalability and faster transaction speeds make Bitcoin more attractive for everyday use and potentially fuel further price increases, contributing to a sustainable Bitcoin rebound.

- Institutional adoption: The growing involvement of institutional investors signals a shift towards greater stability and potentially reduces the impact of short-term market fluctuations on the Bitcoin rebound.

- Growing user base: A broader user base fosters a more robust and resilient ecosystem, strengthening Bitcoin's long-term value proposition and influencing the sustainability of any Bitcoin rebound.

Market Sentiment and Investor Behavior: Bitcoin Market Sentiment and Investor Psychology

Market sentiment and investor psychology significantly influence Bitcoin's price. Social media trends, news cycles, and overall market hype can trigger rapid price swings. Understanding the prevailing sentiment, including fear, uncertainty, and doubt (FUD), is crucial for analyzing the sustainability of any Bitcoin price movement. The "hodl" strategy (holding onto Bitcoin regardless of short-term price fluctuations) also plays a vital role in determining the long-term outlook.

- Positive news and hype: Positive news and social media hype can create speculative bubbles, leading to rapid price increases but potentially unsustainable Bitcoin rebounds.

- Negative news and fear: Negative news or fear-mongering can trigger panic selling, leading to significant price drops and jeopardizing the sustainability of any Bitcoin rebound.

- Understanding investor psychology: Analyzing investor psychology and market sentiment is vital for predicting Bitcoin's price movements and assessing the likelihood of a sustained Bitcoin rebound.

Conclusion: Assessing the Long-Term Sustainability of the Bitcoin Rebound

The sustainability of the recent Bitcoin rebound depends on a complex interplay of macroeconomic factors, regulatory developments, technological advancements, and market sentiment. While positive factors such as increasing institutional adoption and technological improvements offer potential for future growth, risks remain, including regulatory uncertainty and the inherent volatility of the cryptocurrency market. A balanced assessment of these factors is crucial for determining the likelihood of a sustained Bitcoin rebound. Before investing in Bitcoin, conduct thorough research and consider the potential risks and rewards. Understanding the factors influencing a Bitcoin price rebound is critical for making informed investment decisions regarding the future Bitcoin rebound and ensuring a potentially sustained Bitcoin rebound.

Featured Posts

-

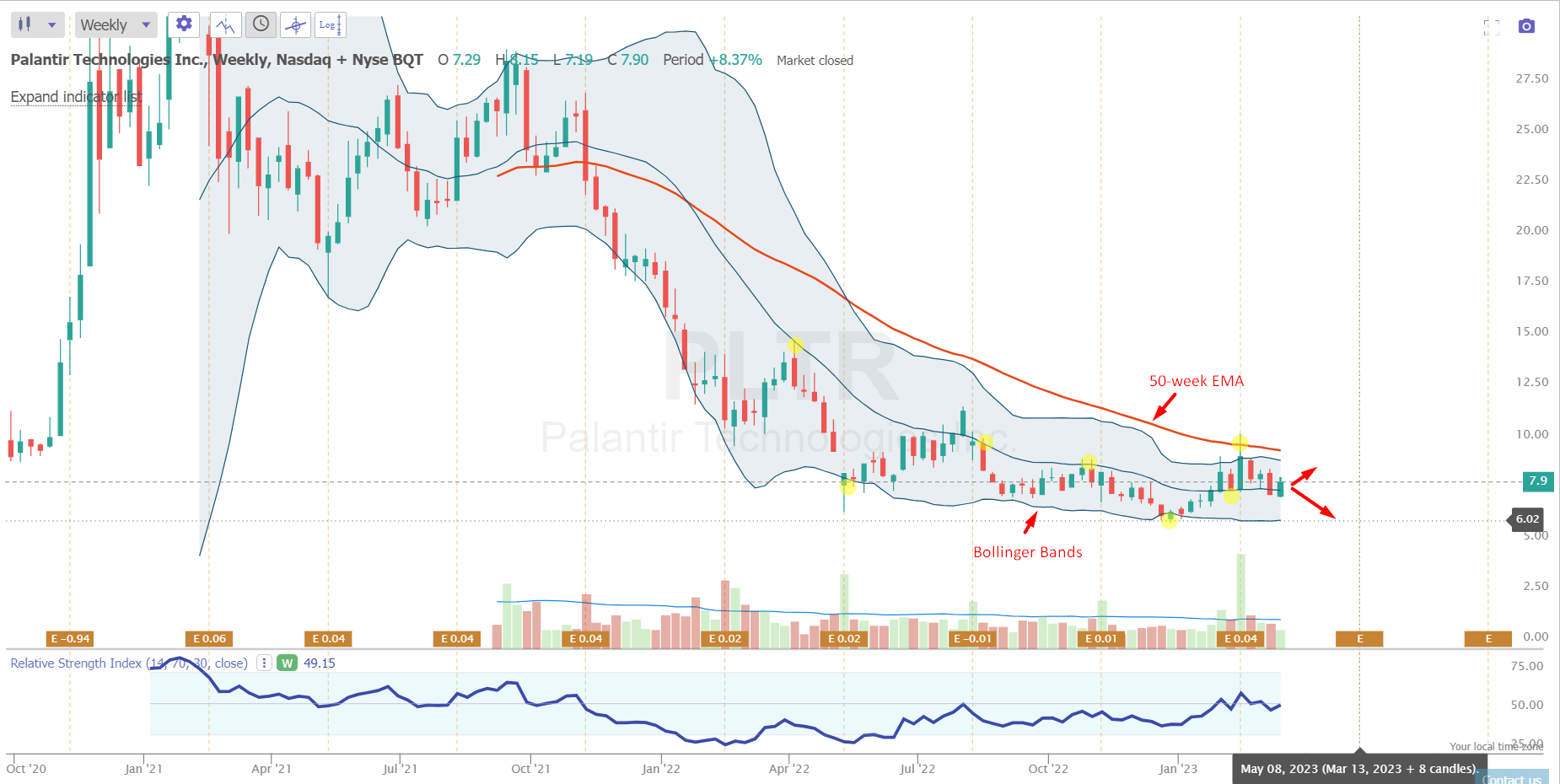

Palantir Stock Forecast Revised Understanding The Recent Market Rally

May 09, 2025

Palantir Stock Forecast Revised Understanding The Recent Market Rally

May 09, 2025 -

Palantir Stock Down 30 Is This A Buying Opportunity

May 09, 2025

Palantir Stock Down 30 Is This A Buying Opportunity

May 09, 2025 -

Caravan Encampments And Ghettoisation A Uk Citys Struggle

May 09, 2025

Caravan Encampments And Ghettoisation A Uk Citys Struggle

May 09, 2025 -

Bondi On Epstein Allegations And The Purported Client List

May 09, 2025

Bondi On Epstein Allegations And The Purported Client List

May 09, 2025 -

2 360

May 09, 2025

2 360

May 09, 2025