Is The Canadian Dollar Overvalued Against The US Dollar? Experts Weigh In

Table of Contents

Analyzing Key Economic Indicators Affecting the CAD/USD Exchange Rate

Several key economic indicators significantly influence the CAD/USD exchange rate. Analyzing these factors provides valuable insight into the current valuation of the Canadian dollar.

Commodity Prices and Their Impact on the Canadian Dollar

Canada's economy is heavily reliant on commodity exports, particularly oil and lumber. The Canadian dollar's value is strongly correlated with the prices of these commodities.

- Strong commodity prices: When global demand for oil and lumber is high, pushing prices upward, the Canadian dollar tends to strengthen against the USD. Increased export revenues bolster the Canadian economy, making the CAD more attractive to investors.

- Weak commodity prices: Conversely, a decline in commodity prices weakens the Canadian dollar. Reduced export earnings negatively impact the Canadian economy, leading to a decrease in demand for the CAD.

- Supply and demand dynamics: Fluctuations in global supply and demand for these commodities directly impact their prices and, consequently, the CAD/USD exchange rate. Geopolitical events, changes in global energy consumption, and weather patterns can all play a significant role. For example, a disruption to oil supply due to geopolitical instability can lead to a surge in oil prices, strengthening the CAD.

For instance, a historical analysis shows a significant positive correlation between the average price of West Texas Intermediate (WTI) crude oil and the CAD/USD exchange rate. When WTI prices rise, the CAD tends to appreciate against the USD, and vice versa.

Interest Rate Differentials Between Canada and the US

Interest rate decisions by the Bank of Canada and the Federal Reserve significantly influence the CAD/USD exchange rate.

- Higher Canadian interest rates: If the Bank of Canada raises interest rates relative to the Federal Reserve, it attracts foreign investment into Canada, increasing demand for the CAD and strengthening it against the USD. Investors seek higher returns, making Canadian assets more appealing.

- Higher US interest rates: Conversely, higher interest rates in the US attract investment away from Canada, weakening the CAD relative to the USD. Capital flows towards higher-yielding assets in the US.

- Interest rate divergence: The difference in interest rates between the two countries (the interest rate differential) is a crucial factor influencing the CAD/USD exchange rate. A widening differential typically favors the currency of the country with higher interest rates.

For example, periods of higher interest rates in Canada compared to the US have historically resulted in a stronger CAD.

Geopolitical Factors and Their Influence

Global events and political uncertainty significantly impact currency markets, including the CAD/USD exchange rate.

- Global economic shocks: Major global economic events, such as recessions or financial crises, can trigger volatility in the CAD/USD exchange rate. Investors often seek safe haven assets during uncertainty, potentially impacting the relative strength of the CAD and USD.

- Political instability: Political instability in either Canada or the US can lead to currency market uncertainty and fluctuations.

- Trade disputes: Trade disputes between Canada and the US or other major trading partners can significantly affect the CAD/USD exchange rate. Trade tensions introduce uncertainty and can impact investment flows.

Expert Opinions on the CAD/USD Exchange Rate Valuation

Understanding the perspectives of leading economists and financial analysts provides valuable insight into the current market sentiment regarding the CAD/USD exchange rate.

Views from Leading Economists and Financial Analysts

A diverse range of opinions exists regarding the CAD's valuation against the USD. Some analysts believe the Canadian dollar is currently overvalued, citing factors such as high commodity prices and relatively high interest rates. Others argue that the CAD is fairly valued or even slightly undervalued, pointing to economic vulnerabilities and potential future interest rate cuts.

- Overvaluation arguments: High commodity prices and a relatively strong Canadian economy compared to the US economy sometimes lead to an overvaluation argument. However, external shocks can quickly reverse this trend.

- Undervaluation arguments: Concerns about the long-term sustainability of Canada’s commodity-driven economy and potential future interest rate adjustments sometimes lead to an undervaluation argument.

Market Sentiment and Trading Activity

Market sentiment and trading activity play a significant role in short-term fluctuations in the CAD/USD exchange rate.

- Speculative trading: Short-term movements are often influenced by speculative trading, where traders bet on the future direction of the exchange rate. High trading volumes can exacerbate short-term volatility.

- Investor confidence: Investor confidence in the Canadian economy impacts the demand for the CAD. Positive news about the Canadian economy typically strengthens the CAD, while negative news weakens it.

Potential Future Scenarios for the CAD/USD Exchange Rate

Predicting the future direction of the CAD/USD exchange rate is inherently complex and uncertain. However, analyzing potential future economic scenarios can provide some insight into likely future movements.

Factors Likely to Influence Future Exchange Rate Movements

Several factors are likely to influence future CAD/USD exchange rate movements.

- Economic growth prospects: The relative strength of the Canadian and US economies will be a primary driver. Stronger growth in Canada compared to the US would tend to strengthen the CAD.

- Commodity price outlook: The future trajectory of global commodity prices will remain a crucial influence. Continued high prices would support a stronger CAD.

- Monetary policy decisions: Future interest rate decisions by the Bank of Canada and the Federal Reserve will significantly influence the CAD/USD exchange rate.

- Geopolitical risks: Any significant geopolitical events or shifts in global trade relations will impact currency markets and, consequently, the CAD/USD exchange rate.

Predicting Short-Term and Long-Term Trends

Based on the current analysis, it's difficult to make definitive predictions. However, considering the complex interplay of economic indicators and expert opinions, a cautious approach is warranted. Short-term fluctuations will likely continue, driven by market sentiment and speculative trading. The long-term trend will largely depend on the relative economic performance of Canada and the US, as well as commodity price movements and global geopolitical factors. Significant uncertainty remains, emphasizing the need for continuous monitoring and analysis.

Conclusion

Determining whether the Canadian dollar is currently overvalued against the US dollar requires a careful consideration of various factors. While commodity prices and interest rate differentials can influence the CAD's strength, geopolitical events and market sentiment play a significant role in short-term fluctuations. Expert opinions are divided, highlighting the complexity of the issue. Understanding the dynamics between the Canadian dollar and the US dollar requires close monitoring of key economic indicators and a continuous assessment of the evolving economic and geopolitical landscape.

Stay informed about fluctuations in the Canadian dollar and US dollar exchange rate by regularly reviewing economic news and analysis. Understanding the factors impacting the CAD/USD exchange rate is crucial for anyone involved in international trade or currency trading. Continue your research into the Canadian dollar vs. US dollar exchange rate to make informed decisions.

Featured Posts

-

2025 Release Date Announced For Stephen King Adaptation Directed By The Hunger Games Director

May 08, 2025

2025 Release Date Announced For Stephen King Adaptation Directed By The Hunger Games Director

May 08, 2025 -

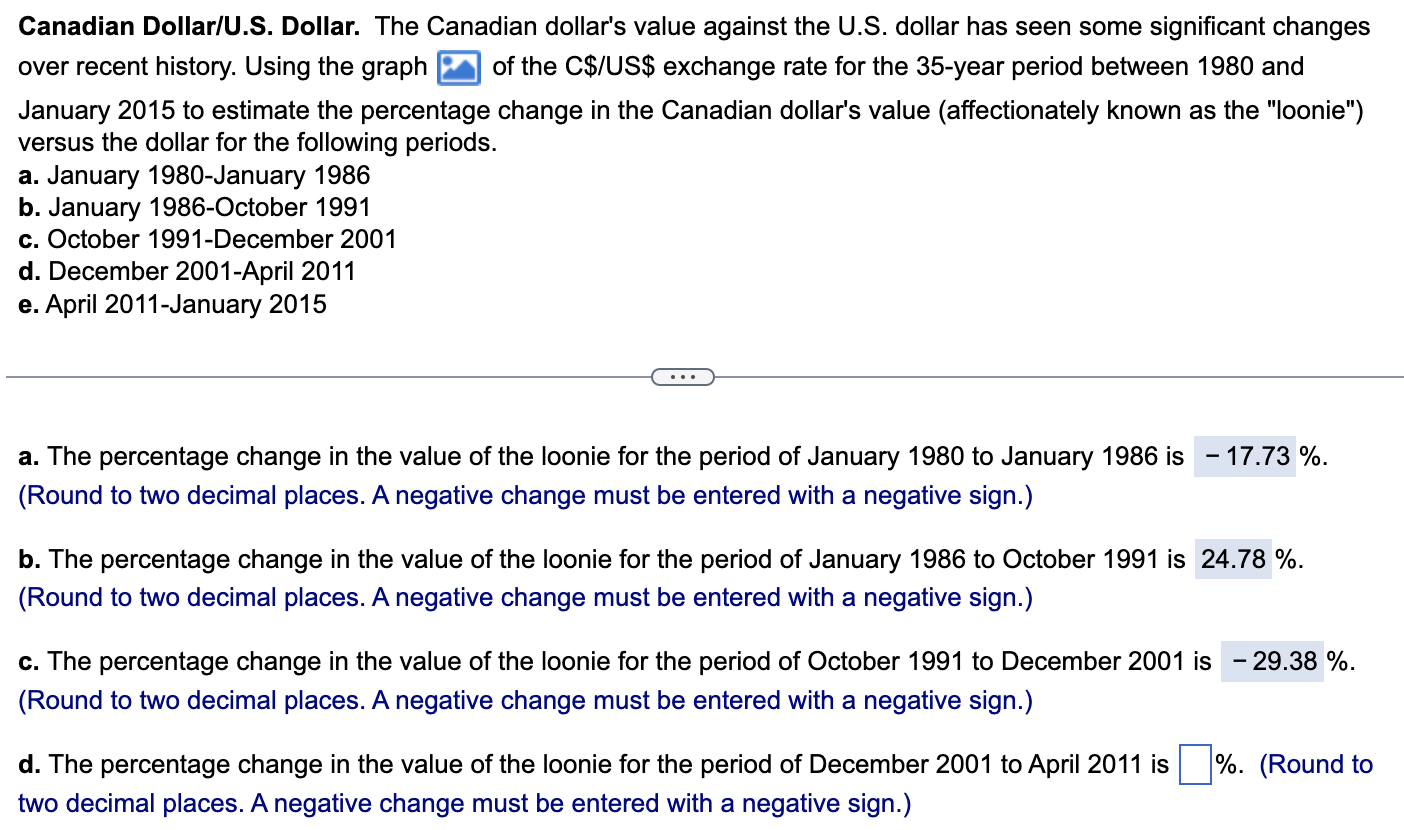

Ethereum Price Prediction 2 700 Target As Wyckoff Accumulation Concludes

May 08, 2025

Ethereum Price Prediction 2 700 Target As Wyckoff Accumulation Concludes

May 08, 2025 -

Is Bitcoins Rebound Just The Beginning A Comprehensive Analysis

May 08, 2025

Is Bitcoins Rebound Just The Beginning A Comprehensive Analysis

May 08, 2025 -

Arsenal Ps Zh Golem Duel Vo Ligata Na Shampionite

May 08, 2025

Arsenal Ps Zh Golem Duel Vo Ligata Na Shampionite

May 08, 2025 -

The Next Gen Leap Exploring The New Ps 5 Pro

May 08, 2025

The Next Gen Leap Exploring The New Ps 5 Pro

May 08, 2025