Is The Recent Bitcoin Rebound Sustainable? Experts Weigh In

Table of Contents

Factors Contributing to the Recent Bitcoin Rebound

Several factors have contributed to Bitcoin's recent price increase. Let's examine the key drivers behind this resurgence:

Macroeconomic Factors

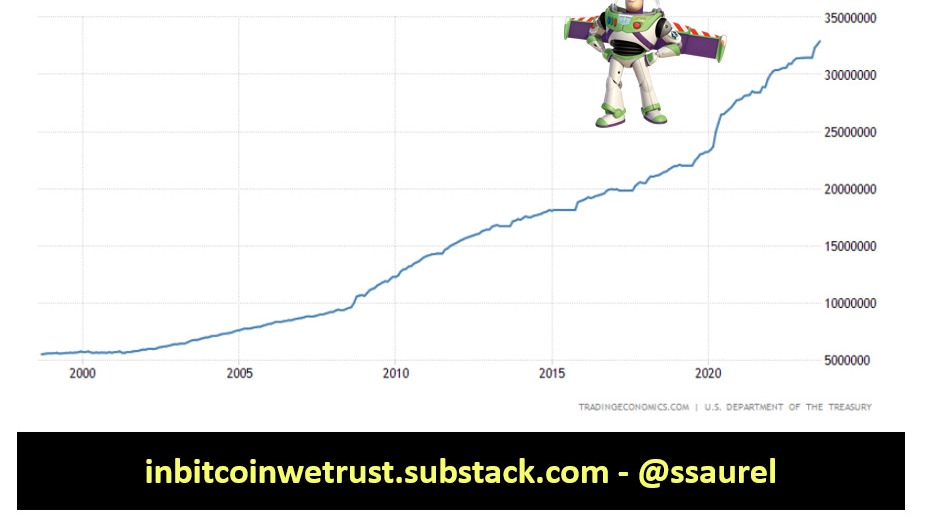

Macroeconomic conditions significantly influence Bitcoin's price. High inflation and uncertain monetary policies often push investors towards alternative assets like Bitcoin, perceived as a hedge against inflation. The performance of traditional markets also correlates with Bitcoin's price; a downturn in stocks can sometimes drive investors towards the perceived safety (or at least diversification) of cryptocurrencies. Global economic uncertainty further fuels investor interest in Bitcoin's decentralized and relatively independent nature.

- Specific Macroeconomic Events:

- Increased inflation rates in major economies.

- Uncertainty surrounding interest rate hikes by central banks.

- Geopolitical instability impacting global markets.

- Decreased trust in traditional fiat currencies.

Regulatory Developments

Regulatory clarity (or the lack thereof) significantly impacts Bitcoin's price volatility. Positive regulatory developments in certain jurisdictions can boost investor confidence, leading to price increases. Conversely, negative news or ambiguous regulatory stances can trigger price drops. Different jurisdictions' approaches to cryptocurrency regulation create a complex landscape affecting overall market sentiment.

- Key Regulatory Updates and Their Influence:

- Gradual acceptance of Bitcoin as a legitimate asset class in some countries.

- Increased scrutiny of crypto exchanges and trading platforms.

- Discussions around Bitcoin ETF approvals in major markets.

- Varying tax policies related to cryptocurrency transactions.

Institutional Adoption and Investment

The increasing adoption of Bitcoin by institutional investors is a crucial factor driving price stability and upward momentum. Large financial institutions and corporations are allocating significant capital to Bitcoin, demonstrating growing acceptance of cryptocurrencies within mainstream finance. The emergence of Bitcoin ETFs and other investment vehicles enhances market liquidity and makes it easier for institutional investors to participate.

- Significant Institutional Investments and Partnerships:

- Large corporations adding Bitcoin to their treasury reserves.

- Increased participation of institutional investors in Bitcoin futures markets.

- The launch of Bitcoin-related investment products and funds.

- Growing partnerships between traditional financial institutions and cryptocurrency companies.

Potential Risks and Challenges to Sustained Growth

Despite the positive momentum, several factors could hinder Bitcoin's sustained growth:

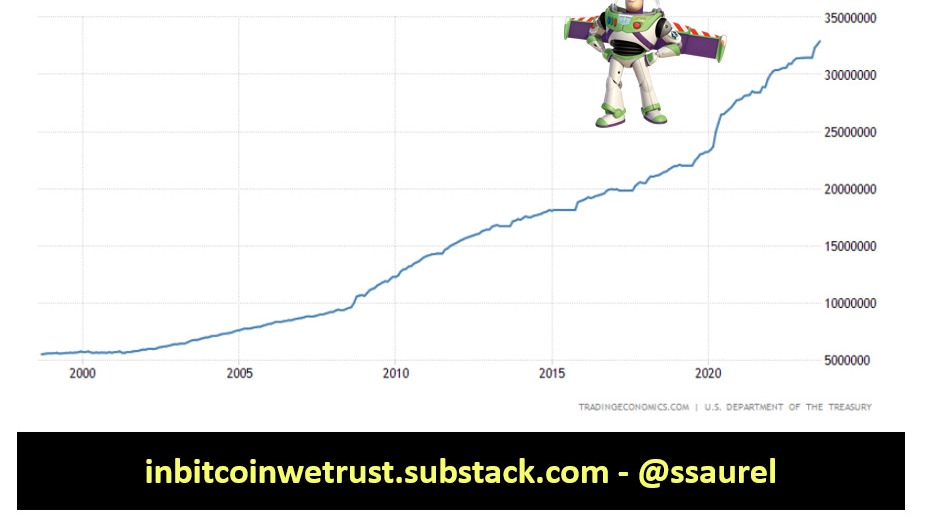

Volatility and Market Sentiment

Bitcoin's inherent volatility remains a significant risk. Sudden price drops can be triggered by negative news, regulatory changes, or shifts in market sentiment. Investor psychology plays a crucial role, with fear and greed often driving short-term price fluctuations.

- Historical Instances of Bitcoin Price Volatility:

- The 2017-2018 crypto winter.

- The 2020-2021 bull market and subsequent correction.

- Recent price swings caused by specific news events.

Technological and Security Risks

Technological vulnerabilities within the Bitcoin network or security breaches at cryptocurrency exchanges can severely impact investor confidence. Scalability challenges also pose a potential constraint on Bitcoin's long-term growth and adoption.

- Potential Technological and Security Risks:

- 51% attacks targeting the Bitcoin network.

- Security vulnerabilities in cryptocurrency wallets and exchanges.

- The ongoing debate surrounding Bitcoin's scalability.

Environmental Concerns

The energy consumption associated with Bitcoin mining raises significant environmental concerns. While efforts are being made to shift towards more sustainable mining practices, this remains a potential obstacle to Bitcoin's long-term acceptance and growth.

- Environmental Concerns and Potential Solutions:

- The carbon footprint of Bitcoin mining.

- The adoption of renewable energy sources for Bitcoin mining.

- Technological advancements to reduce energy consumption.

Expert Opinions and Predictions

Prominent financial analysts and cryptocurrency experts offer diverse opinions on the sustainability of the Bitcoin rebound. Some believe the current upward trend is sustainable, pointing to increasing institutional adoption and macroeconomic factors. Others remain cautious, highlighting the inherent volatility of Bitcoin and the potential for regulatory headwinds.

- Key Expert Predictions (examples, replace with actual quotes):

- "Bitcoin's long-term potential remains strong, but short-term volatility is expected." - Analyst A

- "Regulatory clarity is crucial for sustained Bitcoin growth." - Analyst B

- "Increased institutional adoption will drive price stability." - Analyst C

Conclusion

This article explored the factors contributing to Bitcoin's recent rebound, including macroeconomic conditions, regulatory developments, and institutional adoption. While positive trends exist, significant risks and challenges remain, including volatility, security concerns, and environmental impacts. Expert opinions remain divided on the sustainability of this rebound.

Call to Action: Understanding the complexities surrounding Bitcoin's price is crucial for informed investment decisions. Continue your research on the current state of the Bitcoin market and its potential for future growth. Stay informed about the latest news and expert analysis to make well-informed decisions regarding your Bitcoin investments. Is the recent Bitcoin rebound sustainable? Only time will tell, but diligent research is key.

Featured Posts

-

Six Month Trend Reversal Bitcoin Buying Volume Outpaces Selling On Binance

May 08, 2025

Six Month Trend Reversal Bitcoin Buying Volume Outpaces Selling On Binance

May 08, 2025 -

Could Xrp Hit 5 By 2025 A Realistic Price Prediction

May 08, 2025

Could Xrp Hit 5 By 2025 A Realistic Price Prediction

May 08, 2025 -

Sonys Ps 5 Pro A Deep Dive Into Its Hardware With Official Teardown

May 08, 2025

Sonys Ps 5 Pro A Deep Dive Into Its Hardware With Official Teardown

May 08, 2025 -

Kyle Kuzmas Reaction To Jayson Tatums Viral Instagram Post

May 08, 2025

Kyle Kuzmas Reaction To Jayson Tatums Viral Instagram Post

May 08, 2025 -

Cadillac Celestiq First Drive Review A 360 000 Electric Luxury Experience

May 08, 2025

Cadillac Celestiq First Drive Review A 360 000 Electric Luxury Experience

May 08, 2025