Is This AI Quantum Computing Stock A Smart Investment Right Now?

Table of Contents

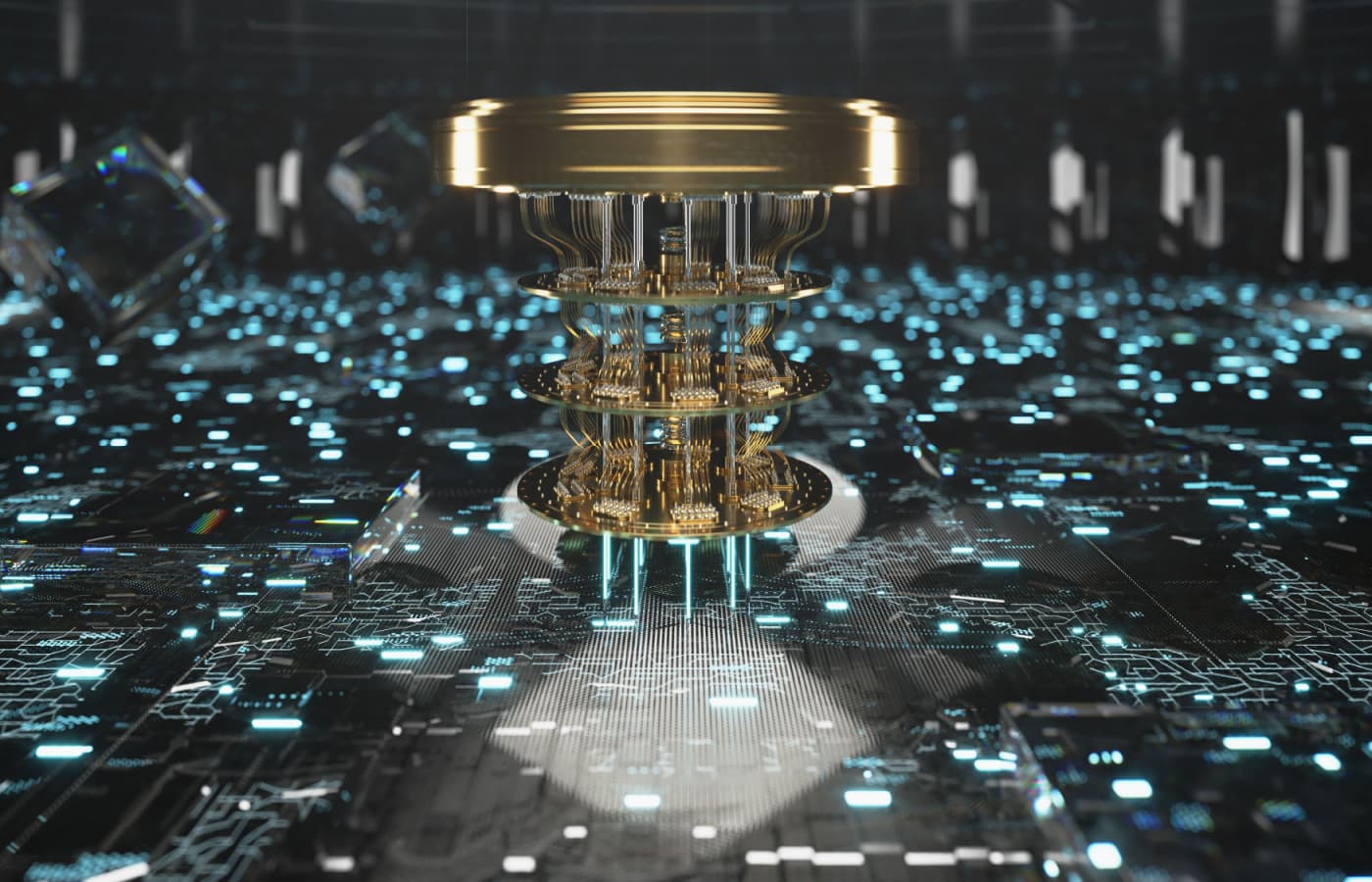

The convergence of artificial intelligence (AI) and quantum computing promises revolutionary advancements, sparking significant interest in related stocks. But is investing in this emerging sector a smart move right now? This article examines the current landscape of AI quantum computing stocks, weighing the potential for explosive growth against inherent risks. We'll explore key factors to consider before investing in this exciting, yet volatile, area.

Understanding the AI Quantum Computing Market

The Potential of Quantum Computing in AI

The synergy between AI and quantum computing is transformative. Quantum computers, leveraging principles of quantum mechanics, possess the potential to solve complex problems far beyond the capabilities of classical computers. This opens doors for unprecedented advancements in various fields:

- Drug Discovery: Quantum algorithms can significantly accelerate the process of drug discovery and development by simulating molecular interactions with unparalleled accuracy. This leads to faster development of new medicines and treatments for diseases.

- Materials Science: Designing new materials with specific properties (e.g., superconductivity, strength) is a computationally intensive task. Quantum computing can revolutionize this field, leading to breakthroughs in areas like energy storage and advanced manufacturing.

- Financial Modeling: Quantum computers can handle complex financial models and risk assessments with greater speed and precision, leading to more accurate predictions and better investment strategies. This includes optimizing portfolios and managing risk more effectively.

Key players like IBM, Google, and Microsoft are making significant strides in developing quantum computing hardware and software, constantly pushing the boundaries of what's possible. The speed and efficiency advantages of quantum algorithms are expected to far surpass classical algorithms for specific types of problems.

Current Market Size and Growth Projections

The current market for quantum computing is relatively small, but projections indicate explosive growth. While precise figures vary depending on the source, reports suggest the market is valued in the billions of dollars currently, with a Compound Annual Growth Rate (CAGR) projected to be in the high double digits or even triple digits over the next 5-10 years. Several reputable research firms, such as Gartner and IDC, are providing forecasts that paint a picture of substantial expansion.

[Insert a chart or graph here visually representing market size and growth projections. Source the data clearly.]

This rapid growth is driven by increased investment in research and development, along with growing adoption across various industries. However, it's crucial to remember that these are projections, and actual growth may vary.

Evaluating AI Quantum Computing Stocks

Identifying Promising Companies

Several publicly traded companies are involved in the development and application of AI quantum computing technologies. However, carefully analyzing each company is vital before investing. Consider factors such as:

- Technology: Does the company possess a unique and potentially disruptive technology?

- Market Position: What is the company's competitive advantage in the market? Are they a leader or a follower?

- Financial Health: Examine key metrics like revenue, profit margins, debt levels, and cash flow. A strong balance sheet is crucial, especially for companies in a high-risk sector.

- Management Team: Does the company have a strong and experienced leadership team?

[Include a table listing several publicly traded companies involved in AI quantum computing, along with brief analyses of their strengths and weaknesses. Note: This section requires significant research and should be updated regularly due to market dynamics.]

Analyzing Investment Risks

Investing in AI quantum computing stocks carries inherent risks:

- Market Volatility: The technology sector, especially the emerging quantum computing space, is known for its volatility. Stock prices can fluctuate significantly based on technological breakthroughs, market sentiment, and economic conditions.

- Long-Term Investments: Significant returns in this sector are likely to be long-term. Investors need to be prepared for potentially slow growth in the early stages.

- Regulatory Hurdles: Government regulations and policies can significantly impact the development and adoption of quantum computing technologies.

- Technological Barriers: There are considerable technological challenges to overcome before quantum computers reach their full potential. Unforeseen difficulties can delay progress and impact investment returns.

- Early-Stage Companies: Many companies in this space are relatively young and may have limited track records. This increases the risk of failure.

Factors to Consider Before Investing

Your Investment Goals and Risk Tolerance

Before investing in AI quantum computing stocks, it’s critical to assess your individual financial goals and risk tolerance. Are you a long-term investor comfortable with significant volatility? This sector is not suitable for risk-averse investors seeking short-term gains. Remember to diversify your portfolio to mitigate risks.

Due Diligence and Research

Thorough research is paramount before making any investment decisions. Don't rely solely on hype or marketing materials. Consult reputable financial news sources, industry reports, and analytical tools to gain a comprehensive understanding of the companies you are considering. Consider seeking guidance from a qualified financial advisor.

Long-Term Perspective

Investing in AI quantum computing requires a long-term perspective. Patience and resilience are crucial, as significant returns are unlikely to materialize overnight. Be prepared for periods of volatility and potential setbacks. This is a marathon, not a sprint.

Conclusion

Investing in AI quantum computing stocks presents both significant opportunities and considerable risks. The potential for groundbreaking technological advancements is undeniable, but the market's volatility and long-term nature require careful consideration. Thorough research, understanding your risk tolerance, and a long-term perspective are crucial for success.

Call to Action: Before making any investment decisions regarding AI quantum computing stocks, conduct extensive research and consider seeking advice from a financial professional. Remember, investing in AI quantum computing stocks should be a strategic part of a diversified portfolio. Learn more about responsible investing in AI quantum computing and make informed decisions. Don't let the potential of AI quantum computing pass you by – but invest wisely.

Featured Posts

-

L Essor Des Tours Nantaises Et L Activite Croissante Des Cordistes

May 21, 2025

L Essor Des Tours Nantaises Et L Activite Croissante Des Cordistes

May 21, 2025 -

Bbc Antiques Roadshow Couple Jailed For Unknowingly Trafficking National Treasure

May 21, 2025

Bbc Antiques Roadshow Couple Jailed For Unknowingly Trafficking National Treasure

May 21, 2025 -

The Life And Times Of A Billionaire Boy Inheritance Influence And Impact

May 21, 2025

The Life And Times Of A Billionaire Boy Inheritance Influence And Impact

May 21, 2025 -

Updated Rain Forecast Predicting On And Off Showers

May 21, 2025

Updated Rain Forecast Predicting On And Off Showers

May 21, 2025 -

Accelerating Drug Discovery The Impact Of D Waves Quantum Computing Qbts And Ai

May 21, 2025

Accelerating Drug Discovery The Impact Of D Waves Quantum Computing Qbts And Ai

May 21, 2025