Is This XRP's Big Moment? ETF Approvals, SEC Developments, And Market Ripple Effects

Table of Contents

H2: The Impact of Potential ETF Approvals on XRP

The potential approval of XRP exchange-traded funds (ETFs) could be a game-changer for the cryptocurrency. This development holds significant implications for both XRP's price and the overall cryptocurrency market.

H3: Increased Institutional Investment:

- ETF approval would likely open the floodgates for institutional investors. Pension funds, hedge funds, and other large financial players, currently hesitant due to regulatory uncertainty, could finally allocate capital to XRP.

- This influx of capital would dramatically increase demand, potentially driving up the XRP price significantly. We could see a substantial increase in trading volume and liquidity.

- Increased institutional involvement often leads to partnerships with established financial institutions, further boosting XRP's legitimacy and adoption. This could lead to increased utility and real-world applications for the cryptocurrency.

H3: Enhanced Regulatory Clarity:

- The listing of an XRP ETF on major exchanges would signal a degree of regulatory acceptance, a crucial factor for institutional investors.

- This would alleviate concerns about regulatory uncertainty, a major barrier to wider adoption of cryptocurrencies.

- Greater regulatory clarity attracts more risk-averse investors, broadening the investor base and increasing demand.

- Positive regulatory sentiment surrounding XRP could have a ripple effect, boosting confidence in the entire crypto market and potentially increasing the prices of other crypto assets.

H2: The Ongoing SEC Lawsuit and Its Potential Resolution

The SEC lawsuit against Ripple Labs, XRP's creator, remains a significant overhang on the cryptocurrency's price and future. The outcome of this legal battle will have a profound impact on XRP's trajectory.

H3: Ripple's Legal Battles:

- The SEC alleges that Ripple sold XRP as an unregistered security, while Ripple argues that XRP is a decentralized digital asset not subject to SEC regulations. The legal arguments are complex and involve a deep dive into the nature of blockchain technology and digital assets.

- Potential outcomes range from a complete SEC victory, potentially severely impacting XRP's price, to a favorable ruling for Ripple, potentially leading to a significant price surge. A settlement is also a possibility, with various potential terms that could influence the market.

- Recent court hearings and filings offer valuable clues about the likely outcome. Closely monitoring these developments is essential for informed investment decisions.

- The recent focus on "programmatic sales" versus other XRP distributions has added another layer of complexity to the case, highlighting the evolving regulatory landscape for cryptocurrencies.

H3: Impact on Investor Sentiment:

- The SEC lawsuit significantly impacts investor confidence in XRP. Negative news related to the case often results in price drops, while positive developments can trigger rallies.

- Media coverage plays a crucial role in shaping public and investor perception. Positive media attention can attract new investors, while negative coverage can deter them.

- Comparing investor sentiment before and after key legal developments helps analyze the impact of the lawsuit on market behavior and price movements.

H2: Market Ripple Effects of XRP Price Movements

XRP's price movements don't exist in isolation; they have wider implications for the cryptocurrency market and the broader financial landscape.

H3: Correlation with Other Cryptocurrencies:

- XRP shows some correlation with Bitcoin and other major cryptocurrencies, but its price is also influenced by unique factors related to the Ripple case and its potential adoption in various payment systems.

- Significant price surges or drops in XRP can trigger ripple effects (pun intended!) in the broader crypto market, influencing the prices of other digital assets.

- A dramatic increase in XRP's price could lead to increased investor interest in the entire crypto space, while a significant drop could cause a general market downturn, especially for altcoins.

H3: Impact on the Decentralized Finance (DeFi) Ecosystem:

- XRP plays a role in the DeFi space, particularly in facilitating cross-border payments due to its speed and low transaction costs.

- Price changes in XRP could impact the efficiency and cost of transactions within DeFi applications that use it.

- Increased adoption of XRP in DeFi applications could further drive its price up, creating a positive feedback loop.

H3: Long-Term Price Predictions and Investment Strategies:

- Predicting XRP's long-term price is challenging given the uncertainties surrounding the SEC lawsuit and the broader crypto market. Both optimistic and pessimistic scenarios are possible, demanding careful consideration.

- Investing in XRP carries significant risk due to regulatory uncertainty and market volatility. It's crucial to perform your due diligence, and only invest what you can afford to lose.

- Diversification is a key strategy for managing risk. Don't put all your eggs in one basket; spreading investments across different cryptocurrencies and asset classes is recommended.

3. Conclusion:

The future of XRP hinges on the resolution of the SEC lawsuit and the potential approval of XRP ETFs. While ETF approvals could significantly boost XRP's price and adoption, the ongoing legal battle creates considerable uncertainty. Understanding these competing factors is paramount for making informed investment decisions. Whether this is XRP's "big moment" remains uncertain, but staying informed about legal updates, market trends, and price predictions is crucial for navigating this dynamic market. Conduct thorough research, carefully assess the risks, and consider diversification before investing in XRP or any cryptocurrency. Remember that past performance is not indicative of future results.

Featured Posts

-

Rising Taiwan Dollar A Catalyst For Economic Overhaul

May 08, 2025

Rising Taiwan Dollar A Catalyst For Economic Overhaul

May 08, 2025 -

Nathan Fillions Iconic Wwii Movie Role A Look Back

May 08, 2025

Nathan Fillions Iconic Wwii Movie Role A Look Back

May 08, 2025 -

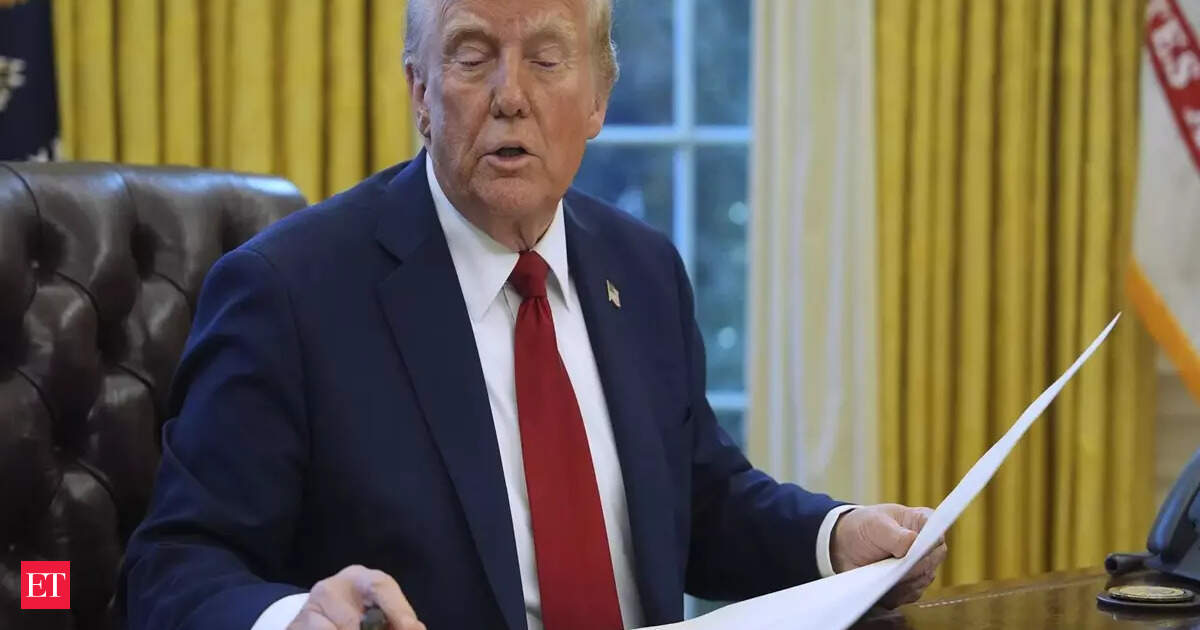

The Economic Fallout Of Liberation Day Tariffs Stock Market Predictions And Strategies

May 08, 2025

The Economic Fallout Of Liberation Day Tariffs Stock Market Predictions And Strategies

May 08, 2025 -

Analysis Uber Stock And The Promise And Peril Of Robotaxis

May 08, 2025

Analysis Uber Stock And The Promise And Peril Of Robotaxis

May 08, 2025 -

Gambits New Weapon A Poignant Tribute To Rogue

May 08, 2025

Gambits New Weapon A Poignant Tribute To Rogue

May 08, 2025