Is This XRP's Big Moment? ETF Approvals, SEC Developments, And Ripple's Future

Table of Contents

The Impact of Potential ETF Approvals on XRP

H3: Understanding the ETF Landscape: Exchange-traded funds (ETFs) are investment funds traded on stock exchanges, offering diversified exposure to a specific asset class. The approval of cryptocurrency ETFs would significantly impact the crypto market by boosting liquidity, attracting institutional investors, and increasing mainstream adoption.

- ETF Approval Process: A rigorous process involving regulatory filings, compliance checks, and market analysis. Successful approval hinges on demonstrating the ETF's ability to manage risk and protect investors.

- Potential Benefits: Increased institutional investment, improved price stability due to increased trading volume, and greater accessibility for retail investors.

- Challenges: Stringent regulatory hurdles, concerns about market manipulation, and the inherent volatility of cryptocurrencies pose significant obstacles to ETF approval.

H3: XRP's Eligibility for ETF Listing: XRP's eligibility for inclusion in ETFs is heavily dependent on the outcome of the SEC lawsuit against Ripple and the overall regulatory clarity surrounding the asset.

- Strengths: XRP's established technology, its extensive use in cross-border payments, and a large, active community.

- Weaknesses: The ongoing SEC lawsuit casts a shadow of uncertainty, and its classification as a security (as claimed by the SEC) could hinder its eligibility for ETF inclusion. Competition from other cryptocurrencies with established market positions also poses a challenge.

H3: Predicting the Price Effects of XRP ETF Approval: The approval of an XRP ETF could significantly impact its price, potentially leading to substantial gains.

- Bullish Scenario: Increased demand from institutional investors could drive up XRP's price substantially, mirroring the price surges seen in other cryptocurrencies after ETF approvals.

- Bearish Scenario: If the SEC maintains its stance against XRP, ETF approval might be delayed or denied, limiting price increases. Market saturation and overall crypto market conditions could also influence the price impact.

- Realistic Expectations: While ETF approval could boost XRP's price, investors should manage expectations and consider market volatility. Significant price increases are possible, but not guaranteed.

The SEC's Ongoing Legal Battle with Ripple and its Effects on XRP

H3: Recap of the Ripple vs. SEC Case: The SEC sued Ripple in 2020, alleging that XRP is an unregistered security. Ripple counters that XRP is a decentralized digital asset and not subject to SEC regulations.

- Key Legal Developments: Recent court rulings have hinted at potential outcomes, with some suggesting a partial victory for Ripple. The case is still ongoing, and the final decision will be crucial for XRP's future.

- Implications: The outcome significantly impacts XRP's regulatory landscape and investor sentiment. A Ripple victory could lead to increased adoption and price appreciation; conversely, an SEC victory could severely hamper XRP's growth.

H3: Potential Outcomes and Their Impact on XRP's Price: Several potential outcomes exist, each with drastically different consequences for XRP's price.

- Ripple Wins: A clear victory could lead to a significant surge in XRP's price, driven by positive investor sentiment and renewed confidence.

- SEC Wins: A decisive SEC win could severely depress XRP's price, potentially causing significant losses for investors.

- Settlement: A settlement could lead to a mixed reaction, with the price potentially stabilizing or experiencing a modest increase or decrease, depending on the terms of the settlement.

H3: Long-Term Regulatory Implications for XRP: The Ripple vs. SEC case sets a precedent for how the SEC views cryptocurrencies and could influence future regulations for digital assets.

- Regulatory Clarity: Regardless of the outcome, the case will provide some clarity regarding the regulatory landscape for cryptocurrencies, potentially impacting not only XRP but the entire crypto market.

- Future Regulations: The outcome will influence future regulatory frameworks, impacting XRP's future prospects and adoption rate. A favorable ruling could lead to increased regulatory acceptance.

Ripple's Strategic Moves and XRP's Future Development

H3: Ripple's Technology and Partnerships: RippleNet, Ripple's payment network, continues to expand, fostering partnerships with financial institutions globally. These strategic moves can propel XRP adoption.

- Key Partnerships: Ripple's partnerships with major banks and financial institutions provide real-world use cases for XRP and enhance its credibility.

- Technological Advancements: Ongoing development of Ripple's technology, including improvements in speed, scalability, and security, further strengthens XRP's position.

H3: The Future of XRP's Use Cases: Beyond cross-border payments, XRP has the potential to be utilized in various applications.

- Decentralized Finance (DeFi): XRP's potential integration into DeFi platforms could unlock new opportunities.

- Supply Chain Management: XRP's speed and efficiency could streamline transactions in supply chain management.

- Other Emerging Technologies: Further exploration of XRP's applicability in other technologies remains a possibility.

H3: Community Sentiment and Market Speculation: Positive community sentiment and rising market speculation are crucial factors influencing XRP's price.

- Social Media Trends: Tracking social media activity can provide insights into current investor sentiment.

- Expert Opinions: Analysis from industry experts helps shape market perceptions and future expectations.

- Market Trends: Overall market conditions and prevailing trends in the crypto space significantly influence XRP's performance.

Conclusion

The future of XRP is intertwined with the outcomes of ETF approvals, the SEC lawsuit, and Ripple's strategic initiatives. While the uncertainties remain significant, understanding these interconnected factors is crucial for navigating the potential of XRP. Is this truly XRP's big moment? Only time will tell, but by staying informed about these developments and carefully assessing the risks and rewards, investors can make informed decisions about incorporating XRP into their investment strategies. Conduct further research, stay updated on market developments, and consider XRP’s potential as part of a diversified investment portfolio. Remember to always conduct your own thorough research before making any investment decisions.

Featured Posts

-

Gillian Anderson And David Duchovnys Sag Awards Reunion

May 01, 2025

Gillian Anderson And David Duchovnys Sag Awards Reunion

May 01, 2025 -

Astrology Predictions For April 17 2025 Your Daily Horoscope

May 01, 2025

Astrology Predictions For April 17 2025 Your Daily Horoscope

May 01, 2025 -

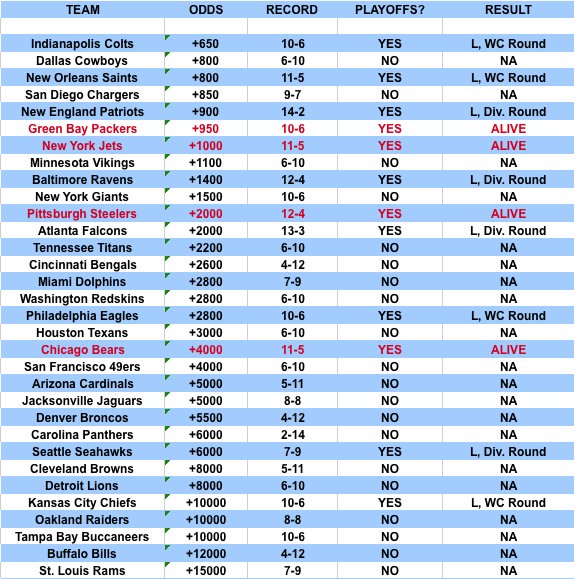

De Andre Hunters Stellar Game Propels Cavaliers Past Trail Blazers

May 01, 2025

De Andre Hunters Stellar Game Propels Cavaliers Past Trail Blazers

May 01, 2025 -

Enexis Lange Wachttijden Voor Limburgse Ondernemers

May 01, 2025

Enexis Lange Wachttijden Voor Limburgse Ondernemers

May 01, 2025 -

Eurovision 2025 Your Guide To Betting Odds And Predictions

May 01, 2025

Eurovision 2025 Your Guide To Betting Odds And Predictions

May 01, 2025