Is Uber Stock Recession-Resistant? A Deep Dive

Table of Contents

- Uber's Business Model and Recessionary Resilience

- The Two-Sided Marketplace Advantage

- Diversification Beyond Ridesharing

- Analyzing Financial Performance During Previous Downturns

- Historical Data and Stock Performance

- Key Financial Indicators

- Potential Risks and Vulnerabilities

- Fuel Price Fluctuations

- Competition and Market Saturation

- Economic Factors Beyond Control

- Conclusion: Is Uber Stock a Recession-Resistant Investment? The Verdict

Uber's Business Model and Recessionary Resilience

Uber's success hinges on its robust two-sided marketplace connecting riders and drivers. This inherent structure provides a degree of resilience against economic downturns.

The Two-Sided Marketplace Advantage

- Increased Rider Demand During Downturns: When economic conditions worsen, some individuals may opt for more cost-effective transportation options. Uber's flexible pricing and widespread availability can make it an attractive alternative to car ownership or public transit, potentially boosting demand during recessions.

- Driver Flexibility: The gig economy nature of Uber's driver model offers a degree of income diversification. Drivers can adjust their working hours based on their needs, making it a potentially valuable supplemental income stream during economic hardship. This flexibility contributes to the platform's resilience.

- Dynamic Pricing: Uber's algorithm adjusts pricing based on real-time demand. During periods of high demand, prices increase, potentially offsetting any decrease in ride volume. This adaptive pricing strategy helps cushion the impact of economic fluctuations.

Diversification Beyond Ridesharing

Uber's expansion beyond ridesharing further bolsters its recession-resistant potential. Uber Eats, its food delivery service, has become a significant revenue contributor.

- Uber Eats Growth Potential: The demand for food delivery often remains relatively stable even during economic downturns. People may cut back on dining out, but home delivery can persist as a convenient alternative. This diversification strategy reduces reliance on rideshare revenue alone.

- Other Diversification Efforts: Uber's foray into freight transportation and ongoing investments in autonomous vehicle technology represent additional avenues for growth and diversification. These long-term strategies aim to create a less volatile revenue stream, making the company more resilient to economic shocks.

Analyzing Financial Performance During Previous Downturns

Assessing Uber's past performance during economic downturns is crucial for evaluating its recession-resistant qualities. While Uber is relatively young compared to some established companies, analyzing its performance since its IPO and during periods of market volatility provides insights.

Historical Data and Stock Performance

(Note: This section would ideally include specific data points, charts, and graphs comparing Uber's stock performance to that of comparable companies during past economic downturns or periods of high market volatility. Access to financial databases is needed to populate this section accurately.)

For instance, comparing Uber's stock performance during the COVID-19 pandemic to that of other transportation companies would be insightful. Did Uber’s stock price fall less dramatically or recover faster than its competitors? This analysis provides a crucial element in determining the company's recession resistance.

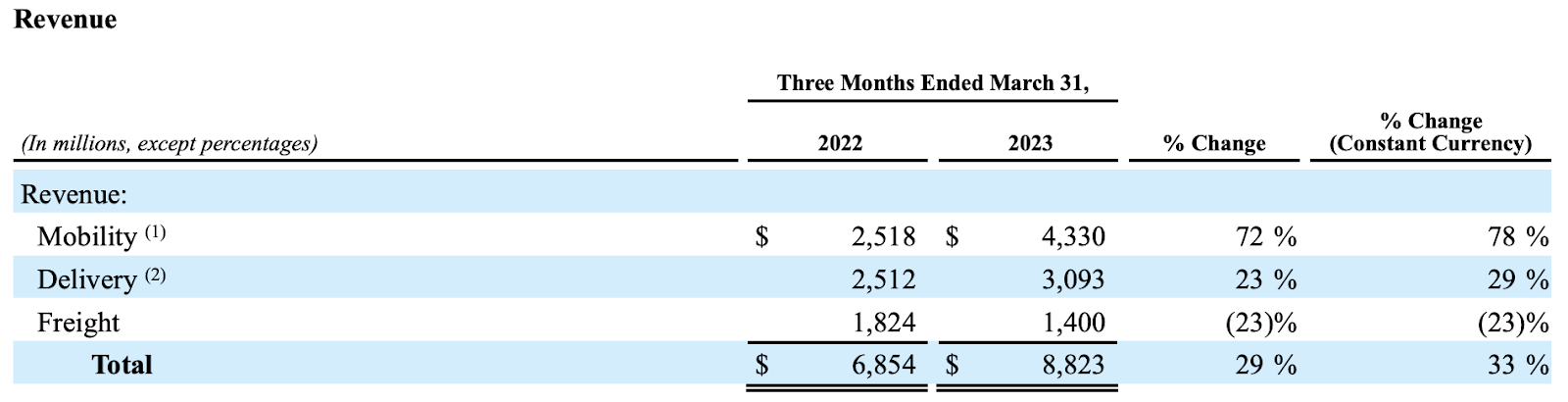

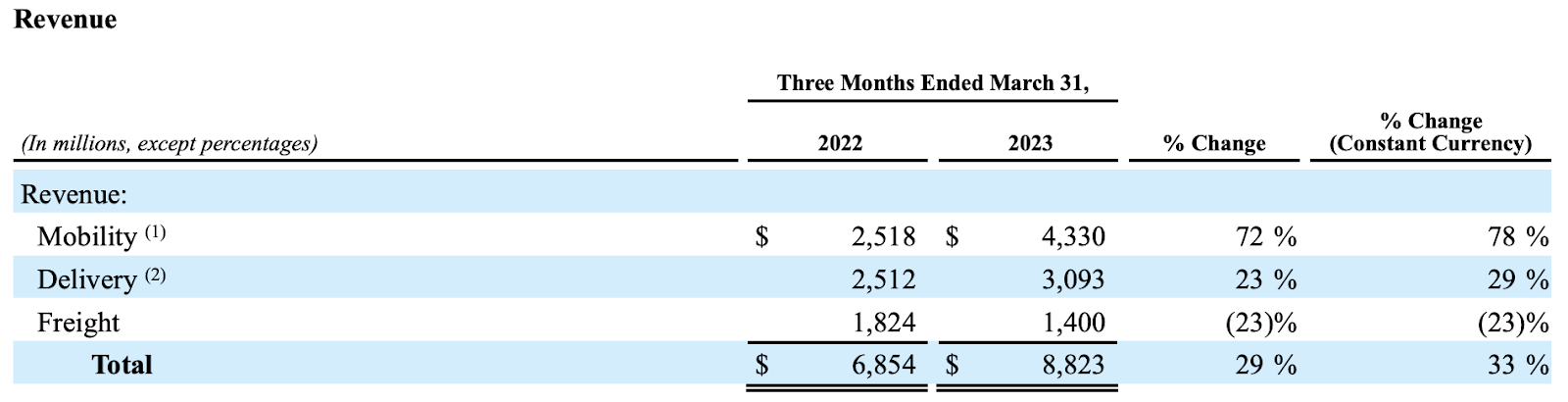

Key Financial Indicators

Analyzing key financial metrics helps paint a clearer picture of Uber's financial health and its potential resilience during a recession.

- Strong Cash Reserves: A substantial cash reserve can help Uber weather economic storms by allowing it to continue operations and invest in growth even when revenue is temporarily affected.

- Cost-Cutting Measures: The ability to implement effective cost-cutting measures without severely impacting service quality is crucial. This demonstrates financial discipline and adaptability.

- Adaptable Pricing Strategies: The effectiveness of Uber's dynamic pricing strategy in maintaining profitability during periods of reduced demand is a key indicator of its resilience.

Potential Risks and Vulnerabilities

While Uber exhibits some signs of recession resilience, certain factors could negatively impact its performance during an economic downturn.

Fuel Price Fluctuations

Rising fuel costs directly affect driver earnings and profitability.

- Impact on Driver Earnings: High fuel prices can reduce drivers' net income, potentially leading to decreased driver availability and impacting the platform's ability to meet rider demand.

- Mitigating the Risk: Uber could explore strategies to offset fuel price increases, such as adjusting commission rates or offering fuel subsidies to drivers.

Competition and Market Saturation

The ride-sharing market is competitive, and market saturation poses a significant risk.

- Competitive Landscape: The presence of strong competitors like Lyft and other emerging players constantly challenges Uber's market share.

- Regulatory Changes: Government regulations and potential changes to labor laws could also impact profitability.

Economic Factors Beyond Control

Macroeconomic conditions significantly influence Uber's performance.

- Consumer Spending: A general decline in consumer spending during a recession directly impacts the demand for ride-sharing and food delivery services.

- Unemployment: High unemployment can lead to reduced rider demand and a larger pool of drivers competing for fewer fares.

Conclusion: Is Uber Stock a Recession-Resistant Investment? The Verdict

Uber's two-sided marketplace, diversification efforts, and dynamic pricing model offer a degree of resilience against economic downturns. However, vulnerabilities exist due to fuel price fluctuations, competition, and macroeconomic factors beyond its control. Whether "Uber stock is recession-resistant" is not a simple yes or no answer.

Investing in Uber stock during uncertain economic times requires careful consideration of both its strengths and weaknesses. A thorough analysis of historical performance, financial indicators, and potential risks is crucial. Remember to consider your own risk tolerance and the overall economic climate before making any investment decisions. Consult with a qualified financial advisor before investing in recession-proof Uber stock or any other investment. Don't rely solely on this article; conduct your own thorough research on Uber stock during recessionary periods to inform your decision. Is Uber a recession-resistant investment for you? Only you can decide after careful consideration.

Spring Breakout 2025 Roster Spotlights And Team Previews

Spring Breakout 2025 Roster Spotlights And Team Previews

Sunday May 11 Nyt Mini Crossword Complete Guide To Clues And Solutions

Sunday May 11 Nyt Mini Crossword Complete Guide To Clues And Solutions

Brooklyn Bridge Park Homicide Investigation Following Gunshot Death

Brooklyn Bridge Park Homicide Investigation Following Gunshot Death

The Collapse Of Russias Peace Talks Putins Diplomatic Miscalculation

The Collapse Of Russias Peace Talks Putins Diplomatic Miscalculation

How To See Taylor Swifts Eras Tour Wardrobe Up Close Photos And Details

How To See Taylor Swifts Eras Tour Wardrobe Up Close Photos And Details