Is Uber Stock (UBER) A Good Long-Term Investment?

Table of Contents

Uber's Current Market Position and Competitive Landscape

Uber's market share in the ride-sharing industry is undeniably substantial, boasting a significant global presence. However, understanding the competitive landscape is critical for assessing the long-term viability of a UBER stock investment.

-

Dominant Position, but Not Unchallenged: While Uber holds a leading position in many markets, its dominance isn't absolute. Competitors like Lyft, especially within the US market, represent a considerable challenge. The ride-sharing market isn't static; new entrants and evolving technologies constantly reshape the competitive dynamics.

-

The Autonomous Vehicle Factor: The development and implementation of autonomous vehicle technology present both an opportunity and a threat. While autonomous vehicles could significantly reduce operational costs, their widespread adoption could also disrupt the existing ride-sharing model, potentially impacting Uber's profitability and market share. The success or failure of Uber's autonomous driving initiatives will be a major factor influencing the UBER stock price.

-

Uber Eats: A Two-Sided Market: Uber's expansion into food delivery through Uber Eats has created another revenue stream. However, this segment is fiercely competitive, with established players like DoorDash and Grubhub vying for market dominance. Analyzing Uber Eats' market share and profitability is crucial when evaluating the overall health of the company.

-

Market Saturation Concerns: The ride-sharing market, particularly in established urban areas, may be approaching saturation. Further growth will likely depend on expanding into new markets, developing new services, or increasing market share through strategic acquisitions.

Financial Performance and Growth Prospects

Understanding Uber's financial performance is essential for evaluating its long-term investment potential. Examining key financial metrics will illuminate the company's current health and future prospects.

-

Revenue Growth and Profitability: While Uber has demonstrated impressive revenue growth, consistently achieving profitability remains a challenge. Analyzing the company's financial statements, particularly revenue growth rates, earnings per share (EPS), and operating margins, is vital for assessing its financial health. Understanding the drivers behind revenue growth – whether from increased ridership or expansion into new services – is also important.

-

Strategies for Profitability: Uber's path to sustained profitability involves a multifaceted approach, including optimizing operational efficiency, implementing dynamic pricing strategies, and exploring new revenue streams. The success of these strategies will significantly impact the future UBER stock price.

-

Long-Term Growth Potential: Analyzing market projections for the ride-sharing and food delivery sectors is crucial for gauging Uber's long-term growth potential. Uber's expansion plans into new international markets and its development of new services will significantly influence its future trajectory.

-

Debt Levels and Financial Health: A careful assessment of Uber's debt levels and overall financial health is vital for discerning its risk profile. High levels of debt can hinder future growth and increase vulnerability to economic downturns.

Risks and Challenges Facing Uber

Investing in any company involves inherent risks, and Uber is no exception. Understanding these potential pitfalls is crucial for responsible investment decisions.

-

Regulatory Hurdles: Uber faces ongoing regulatory challenges in various markets regarding driver classification, licensing requirements, and safety regulations. These legal and regulatory battles can significantly impact operating costs and profitability.

-

Driver Lawsuits and Safety Concerns: Numerous lawsuits and safety concerns related to driver classifications, background checks, and incidents involving Uber drivers present significant reputational and financial risks.

-

Autonomous Driving Uncertainties: The transition to autonomous vehicles is fraught with technological, regulatory, and financial uncertainties. Significant investments in this technology could prove unsuccessful, negatively affecting the UBER stock price.

-

Economic Downturn Vulnerability: Ride-sharing and food delivery services are often considered discretionary spending. During economic downturns, consumers may reduce their utilization of these services, impacting revenue and profitability.

Long-Term Growth Drivers and Opportunities

Despite the challenges, several factors could drive Uber's long-term growth and justify an investment in UBER stock.

-

Technological Innovation: Uber's ongoing investments in technology, including advancements in its app, mapping technology, and autonomous vehicle development, could enhance efficiency, customer experience, and overall competitiveness.

-

International Expansion: Expanding into new international markets presents significant growth opportunities, particularly in regions with less developed public transportation systems.

-

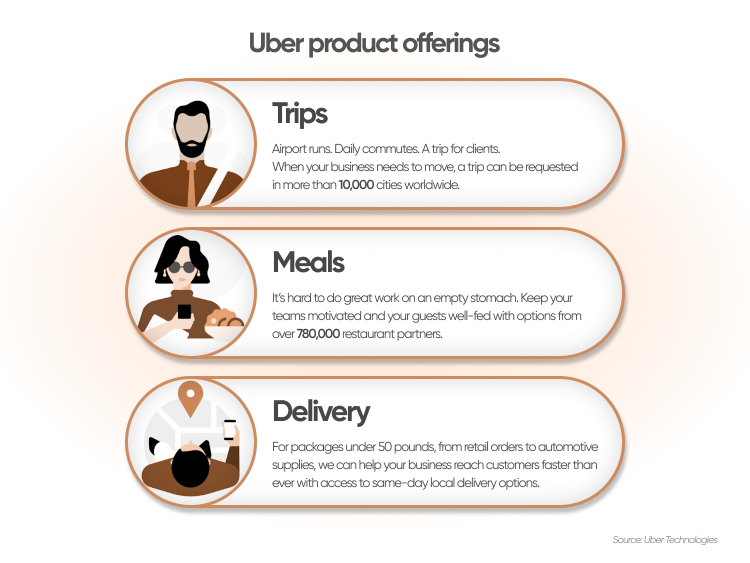

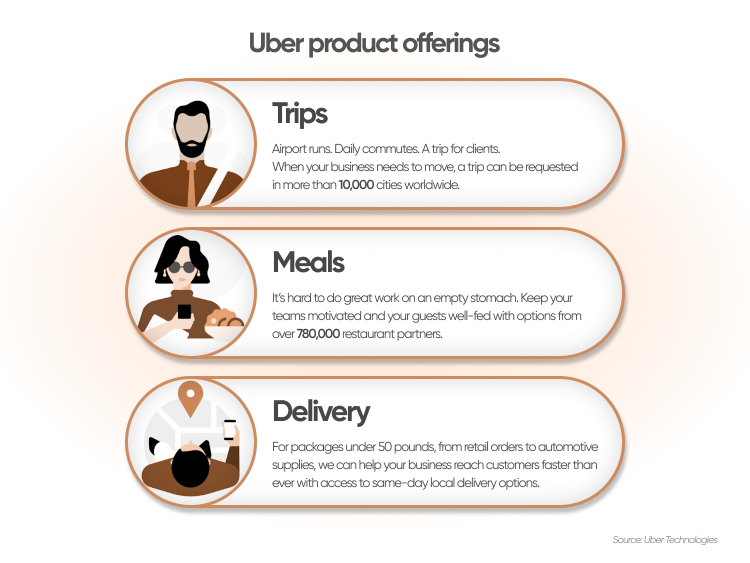

Diversification Beyond Ride-Sharing: Uber's expansion into freight transportation, delivery services (Uber Eats), and other mobility solutions diversifies its revenue streams and mitigates reliance on a single market segment.

-

Strategic Partnerships and Acquisitions: Strategic partnerships and acquisitions can accelerate growth by expanding market access, enhancing technology, and integrating complementary services.

Conclusion

Investing in Uber stock (UBER) presents both significant opportunities and considerable risks. The company's dominant position in the ride-sharing market and potential for future growth through technological innovation and market expansion are undeniable. However, investors must carefully weigh the regulatory hurdles, competitive pressures, and inherent financial uncertainties.

Ultimately, whether Uber stock is a good long-term investment for you depends on your individual risk tolerance and investment goals. Conduct thorough due diligence, consult with a financial advisor, and carefully consider the factors outlined in this analysis before making any investment decisions regarding Uber stock (UBER). Remember to regularly review your Uber investment strategy as market conditions and company performance evolve.

Featured Posts

-

Urgent Action Needed The Overvalued Canadian Dollar And Its Economic Impact

May 08, 2025

Urgent Action Needed The Overvalued Canadian Dollar And Its Economic Impact

May 08, 2025 -

Major Xrp Whale Acquires 20 Million Tokens Market Analysis

May 08, 2025

Major Xrp Whale Acquires 20 Million Tokens Market Analysis

May 08, 2025 -

Carney And Trump On Cusma Agreement And Potential Termination

May 08, 2025

Carney And Trump On Cusma Agreement And Potential Termination

May 08, 2025 -

Kripto Varlik Piyasasinda Yeni Bir Doenem Spk Nin Duezenlemeleri

May 08, 2025

Kripto Varlik Piyasasinda Yeni Bir Doenem Spk Nin Duezenlemeleri

May 08, 2025 -

Secure Your Psl 10 Tickets Sale Starts Today

May 08, 2025

Secure Your Psl 10 Tickets Sale Starts Today

May 08, 2025