Is Uber Technologies (UBER) A Smart Investment?

Table of Contents

Uber's Financial Performance and Growth Potential

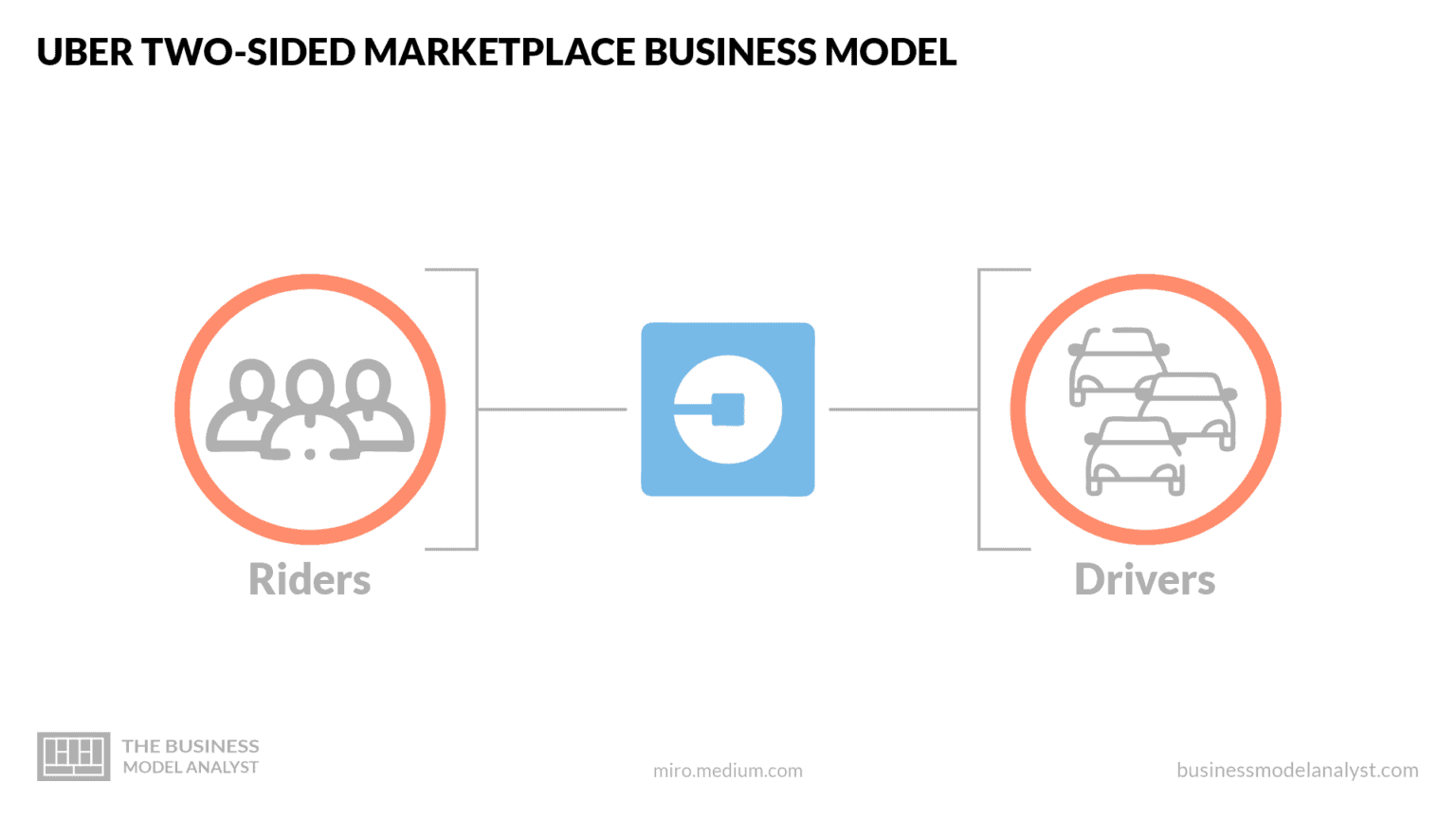

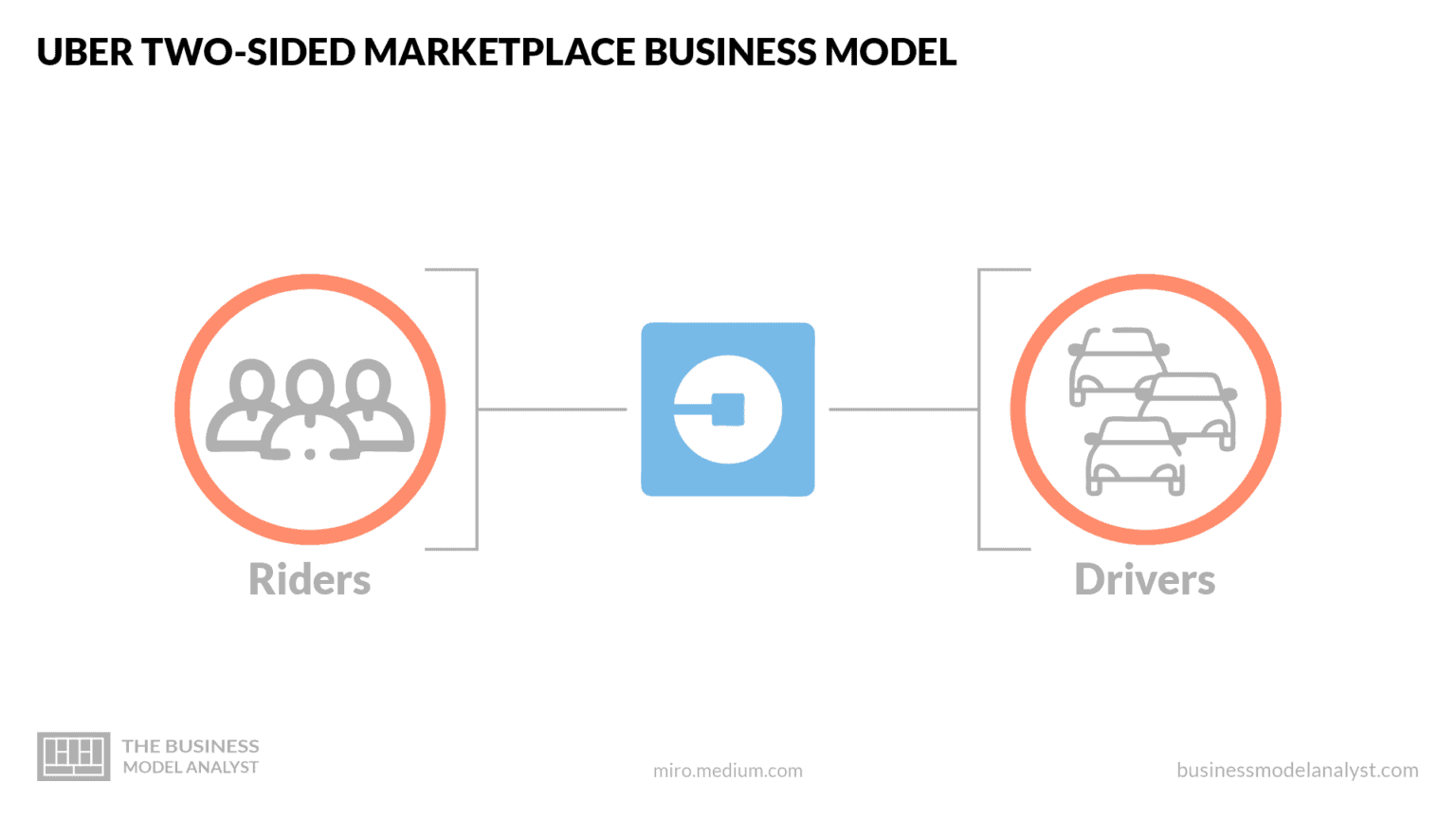

Uber's business model centers around connecting riders with drivers through its app, expanding into food delivery (Uber Eats), freight transportation, and other mobility services. While Uber has achieved significant revenue growth, profitability remains a key challenge. Analyzing its financial statements reveals a complex picture.

- Revenue Growth Year-over-Year: Uber consistently reports substantial year-over-year revenue growth, though the rate fluctuates depending on various economic and operational factors. Analyzing these fluctuations helps predict future growth potential.

- Profit Margins and Profitability Trends: Uber’s profitability is often impacted by high operating expenses, including driver payments and marketing costs. Tracking profit margins is crucial in understanding the company's ability to translate revenue into actual profit.

- Market Capitalization and Stock Performance: Uber's market capitalization reflects investor sentiment and expectations for future growth. Analyzing its stock performance against industry benchmarks provides valuable insights into its relative strength.

- Future Projections for Revenue and Earnings: Analysts' forecasts play a significant role in investment decisions. Examining these projections, alongside any identified growth catalysts, paints a picture of potential future returns.

Several factors influence Uber's growth: expansion into new geographic markets, continued development and integration of technological advancements like autonomous vehicles, and the ever-changing regulatory landscape. Success in these areas is key to long-term profitability.

Competitive Landscape and Market Share

Uber faces intense competition in its core markets. Lyft is its primary competitor in the ride-sharing space, while traditional taxis, public transportation, and emerging transportation-as-a-service (TaaS) platforms also pose challenges.

- Uber's Market Share in Key Regions: Uber dominates many regions, but its market share varies significantly based on geographic location and competitive intensity. Understanding regional market dominance helps assess potential for growth and future revenue streams.

- Analysis of Competitor Strategies and Market Impact: Lyft and other competitors constantly adapt their strategies. Analyzing their moves – such as pricing strategies, service expansions, and technological advancements – is critical to understanding Uber's long-term competitive position.

- Potential Mergers, Acquisitions, or Partnerships: The ride-sharing industry is dynamic, with potential for mergers, acquisitions, and strategic partnerships that could significantly reshape the competitive landscape.

Maintaining a competitive edge requires continuous innovation, effective marketing, and efficient operations. Uber’s ability to navigate this competitive landscape will strongly influence its future success.

Risks and Challenges Facing Uber

Investing in UBER stock carries several risks:

- Regulatory Changes Impacting Ride-Sharing: Government regulations regarding ride-sharing services are constantly evolving. Changes in licensing, insurance requirements, and labor laws can significantly impact Uber's operations and profitability.

- Driver Compensation and Labor Disputes: Uber's relationship with its drivers has been a source of ongoing controversy. Labor disputes, calls for better compensation, and potential reclassification of drivers as employees pose significant operational and financial risks.

- Data Security and Privacy Concerns: Uber handles large amounts of user data, making it a target for cyberattacks and raising concerns about data security and privacy. Breaches could have significant financial and reputational consequences.

- Economic Downturns and Their Impact on Demand: Ride-sharing services are often seen as discretionary spending. Economic downturns usually decrease demand, affecting Uber's revenue and potentially impacting its bottom line.

The long-term sustainability of Uber's business model depends on its ability to mitigate these risks effectively.

Valuation and Investment Strategy

Evaluating Uber's current stock valuation is critical for potential investors. Several key metrics are important to consider:

- Price-to-Earnings Ratio (P/E) and Other Key Valuation Metrics: The P/E ratio and other valuation metrics help determine if Uber's stock is overvalued or undervalued relative to its earnings and growth prospects.

- Comparison with Industry Peers: Comparing Uber's valuation with that of its competitors provides valuable context and insights into its relative attractiveness as an investment.

- Potential for Long-Term Growth Versus Short-Term Gains: Investors need to consider their investment horizon. Uber offers potential for long-term growth, but short-term gains are not guaranteed.

- Risk Tolerance and Investment Timeline Considerations: Investment decisions should align with an investor's risk tolerance and time horizon.

Determining when to buy, hold, or sell UBER stock requires careful consideration of its financial performance, competitive position, and overall market conditions. Professional financial advice is always recommended.

Conclusion: Is Uber Technologies (UBER) a Smart Investment for You?

Uber Technologies presents a complex investment opportunity. While the company boasts significant revenue growth and a dominant position in the ride-sharing market, profitability remains elusive, and substantial risks exist. Regulatory changes, competition, and driver-related issues pose significant challenges. Whether UBER is a smart investment for you depends on your individual risk tolerance, investment horizon, and thorough due diligence. Before investing in Uber Technologies (UBER) or any other stock, conduct thorough research, understand the associated risks, and consult with a qualified financial advisor to ensure your investment aligns with your personal financial goals. Remember, investing in UBER, or any stock, requires careful consideration and a well-defined investment strategy.

Featured Posts

-

How Many Nba Playoffs Triple Doubles Leaders Can You Name

May 08, 2025

How Many Nba Playoffs Triple Doubles Leaders Can You Name

May 08, 2025 -

2 0 76

May 08, 2025

2 0 76

May 08, 2025 -

La Geometrie Chez Les Corneilles Une Intelligence Insoupconnee Qui Surpasse Les Babouins

May 08, 2025

La Geometrie Chez Les Corneilles Une Intelligence Insoupconnee Qui Surpasse Les Babouins

May 08, 2025 -

Ohio Train Derailment Aftermath Prolonged Presence Of Toxic Chemicals In Structures

May 08, 2025

Ohio Train Derailment Aftermath Prolonged Presence Of Toxic Chemicals In Structures

May 08, 2025 -

The Future Of Xrp Analyzing The Impact Of Potential Etfs And Sec Decisions

May 08, 2025

The Future Of Xrp Analyzing The Impact Of Potential Etfs And Sec Decisions

May 08, 2025