Is Wall Street's Resurgence The End Of The Bear Market?

Table of Contents

Analyzing Wall Street's Recent Performance

Key Indicators of a Resurgence

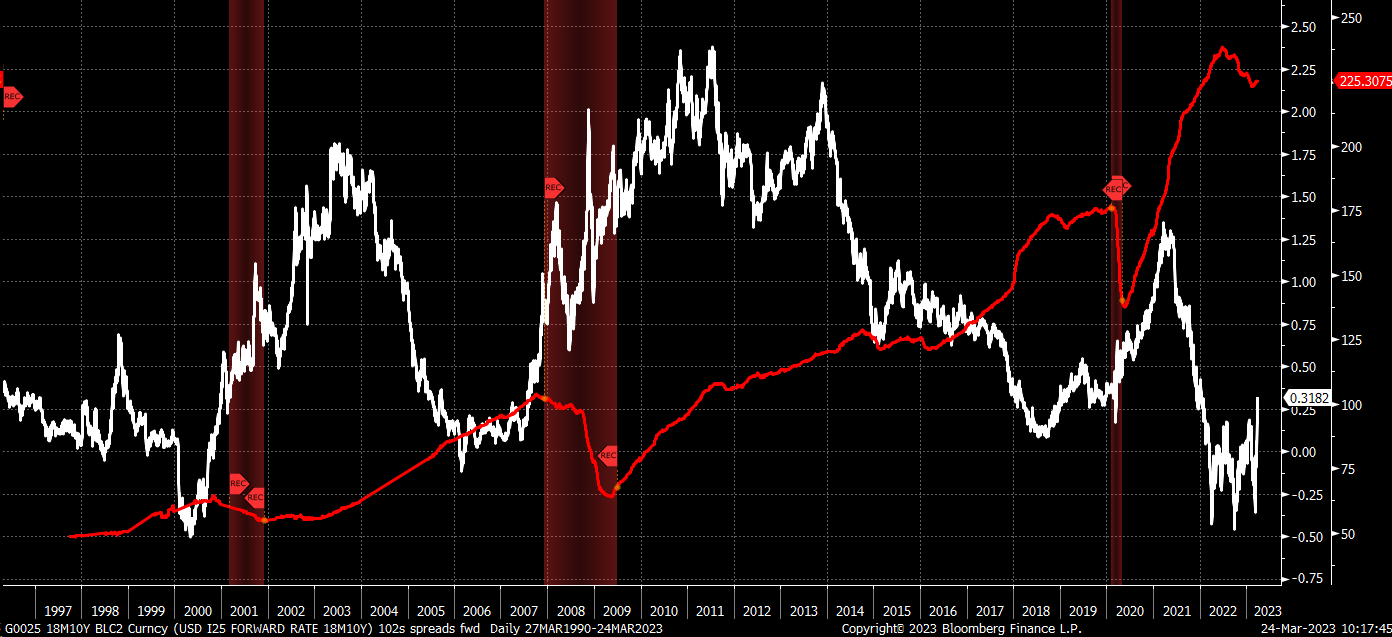

The recent market upturn is evident in several key indicators. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite have all shown significant gains in recent weeks, reversing some of the losses incurred during the prolonged bear market. We can see this clearly in the following chart (insert chart of major indices here showing recent gains). Beyond the major indices, we're seeing sector-specific gains, particularly in technology and consumer discretionary, suggesting a shift in investor confidence. Trading volumes have also increased, reflecting heightened market activity. Furthermore, the VIX volatility index, often seen as a fear gauge, has declined, suggesting reduced anxiety among investors. These factors collectively point towards a potential market resurgence.

Potential Drivers of the Resurgence

Several factors might be driving this Wall Street recovery:

- Easing Inflation Concerns: Recent economic data suggests inflation may be cooling, prompting expectations that the Federal Reserve might slow or pause its interest rate hikes. This "inflation slowdown" has injected optimism into the markets.

- Positive Economic Data: Better-than-expected economic reports, such as employment figures and consumer spending data, suggest the economy might be more resilient than previously feared. This strengthens the argument for an "economic recovery."

- Interest Rate Policy Changes: The possibility of future interest rate cuts, or at least a slower pace of increases, has positively influenced investor sentiment and contributed to the market resurgence.

- Strong Corporate Earnings Reports: Several major corporations have reported better-than-expected earnings, boosting investor confidence and driving stock prices higher. Strong "corporate profits" are a significant driver of market performance.

Counterarguments: Why the Bear Market Might Not Be Over

Despite the recent rally, several factors suggest the bear market might not be over.

Persistent Economic Headwinds

Several significant economic headwinds could hinder sustained market growth:

- Recession Risk: Many economists remain concerned about the potential for a recession, particularly given ongoing inflationary pressures and potential interest rate hikes. This "recession risk" casts a shadow over the market's long-term prospects.

- Geopolitical Uncertainty: Geopolitical instability, including the ongoing war in Ukraine and rising tensions in other regions, continues to pose a significant risk to global economic growth and market stability. This "geopolitical uncertainty" could easily trigger market corrections.

- Inflationary Pressure: Although inflation might be cooling, it remains stubbornly high in many countries, potentially leading to further interest rate hikes and economic slowdown. This persistent "inflationary pressure" could stifle any market recovery.

- Supply Chain Disruptions: While improving, supply chain issues persist, potentially hindering economic growth and contributing to inflationary pressures.

Technical Analysis and Market Indicators

Technical analysis provides a different perspective. While the recent rally is encouraging, some technical indicators suggest the market's strength may be questionable. For example (insert chart showing technical indicators, like moving averages and support/resistance levels), the recent gains haven't yet broken through significant resistance levels, hinting at potential future corrections. The market trend remains uncertain, and a sustained break above these resistance levels would be needed to definitively confirm a long-term upward trend. Careful observation of "technical indicators," such as "support levels" and "resistance levels," is crucial in assessing the sustainability of the current rally.

The Role of Investor Sentiment and Speculation

Shifting Investor Confidence

The recent market resurgence reflects a clear shift in investor sentiment. After months of pessimism and fear, investors are starting to regain confidence, fueled by the factors discussed above. However, this shift is fragile and could easily reverse if economic conditions worsen.

Speculative Bubbles and Corrections

It's essential to acknowledge the potential for speculative bubbles and subsequent corrections. The recent rally could be partly driven by speculation, leading to a potentially unsustainable market expansion. A "bear market rally" – a temporary upswing within a larger bearish trend – remains a distinct possibility. Therefore, a degree of caution is warranted. The market is susceptible to sudden "market corrections" if speculative elements drive prices to unsustainable heights.

Conclusion

Wall Street's resurgence presents a mixed picture. While recent market gains are undeniable, several economic and technical factors suggest the bear market might not be definitively over. The potential for a "bear market rally" remains a valid concern. Understanding the nuances of Wall Street's resurgence and its implications for the bear market is crucial for informed investment decisions. The interplay between easing inflation, positive economic data, and persistent risks requires careful consideration. Stay informed and continue your research to make the best choices for your financial future. Monitoring key indicators and remaining aware of potential economic headwinds is crucial for navigating the complexities of Wall Street's recovery.

Featured Posts

-

Putin Predupredil Dzhonsona O Rossiyskikh Atomnykh Submarinakh

May 11, 2025

Putin Predupredil Dzhonsona O Rossiyskikh Atomnykh Submarinakh

May 11, 2025 -

St Petersburg Gp Mc Laughlin Claims Pole Position

May 11, 2025

St Petersburg Gp Mc Laughlin Claims Pole Position

May 11, 2025 -

Kloynei And Santler Sto Jay Kelly Toy Netflix Mia Tainia Me Pithanotites Gia Oskar

May 11, 2025

Kloynei And Santler Sto Jay Kelly Toy Netflix Mia Tainia Me Pithanotites Gia Oskar

May 11, 2025 -

Shane Lowry Proud Friend Despite Mc Ilroys Masters Setback

May 11, 2025

Shane Lowry Proud Friend Despite Mc Ilroys Masters Setback

May 11, 2025 -

Henry Cavill As Cyclops Fake Marvel Trailer Takes The Internet By Storm

May 11, 2025

Henry Cavill As Cyclops Fake Marvel Trailer Takes The Internet By Storm

May 11, 2025