Is XRP A Commodity? The SEC's Decision And Ongoing Debate

Table of Contents

The SEC's Case Against Ripple and its Implications for XRP Classification

The Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs, its CEO Brad Garlinghouse, and its co-founder Chris Larsen, alleging that XRP is an unregistered security. This action has significantly impacted XRP's price and the broader cryptocurrency market.

The SEC's Definition of a Security: The Howey Test

The SEC's case hinges on the Howey Test, a landmark Supreme Court decision that defines an investment contract as a security. The Howey Test considers four elements: an investment of money, in a common enterprise, with a reasonable expectation of profits, derived primarily from the efforts of others. The SEC argues that XRP sales meet all these criteria, claiming investors purchased XRP expecting profits generated by Ripple's efforts to develop and promote the cryptocurrency.

- The SEC's Argument: The SEC claims Ripple's ongoing efforts to develop XRP's ecosystem, marketing campaigns, and partnerships created a reasonable expectation of profit for investors. They argue this constitutes an unregistered securities offering, violating federal securities laws.

- Alleged Violations: The SEC alleges Ripple violated Section 5 of the Securities Act of 1933, which requires registration of securities offerings. This carries significant penalties, including fines and potential injunctions.

- Key Individuals Involved: The lawsuit directly targets Ripple, Brad Garlinghouse, and Chris Larsen, holding them accountable for the alleged unregistered securities offerings.

Ripple's Defense and Arguments

Ripple vehemently denies the SEC's allegations, arguing XRP is a decentralized digital asset functioning as a currency, not a security.

- Ripple's Position: Ripple emphasizes XRP's operational independence from the company, highlighting its use in cross-border payments and its decentralized nature. They argue that XRP's price is determined by market forces, not Ripple's actions.

- Counterarguments to the Howey Test: Ripple contests the application of the Howey Test, arguing XRP lacks the necessary elements of an investment contract. They point to XRP's use as a medium of exchange, independent of Ripple's efforts, to refute the "reasonable expectation of profits" criterion.

- Legal Precedents and Expert Testimony: Ripple's defense incorporates expert testimonies and cites legal precedents related to other cryptocurrencies to support their arguments. Their strategy aims to demonstrate XRP's distinct nature compared to other assets deemed securities by the SEC.

The Commodity Futures Trading Commission (CFTC) and its Potential Role

While the SEC focuses on securities regulation, the Commodity Futures Trading Commission (CFTC) oversees the commodities market. This creates a potential alternative classification for XRP.

The CFTC's Jurisdiction Over Commodities

The CFTC regulates futures and options contracts on commodities, including virtual currencies in some circumstances. Its regulatory power differs from the SEC's, focusing on market integrity and preventing manipulation rather than investment contract definitions.

- XRP as a Commodity: Some argue XRP’s decentralized nature and utility as a medium of exchange align more closely with a commodity than a security. This classification would fall under the CFTC's jurisdiction.

- Implications of CFTC Jurisdiction: If deemed a commodity, XRP's regulatory burden would shift from the SEC to the CFTC. This could entail different compliance requirements and potentially a less stringent regulatory framework.

- Existing Precedents and Discussions: The CFTC has shown increasing interest in regulating cryptocurrencies, and ongoing discussions explore classifying certain digital assets as commodities. This evolving regulatory landscape may influence XRP's eventual classification.

The Ongoing Debate and Legal Uncertainty Surrounding XRP's Status

The legal battle highlights the fundamental disagreements over XRP's classification, with compelling arguments on both sides.

Arguments for XRP as a Commodity

Proponents of XRP as a commodity emphasize its inherent characteristics:

- Decentralized Nature: XRP operates on a decentralized network, independent of Ripple's direct control, suggesting a commodity-like nature.

- Diverse Use Cases: XRP's use extends beyond investment, functioning as a medium of exchange in cross-border payments, reducing reliance on Ripple's activities.

- Independent Price Fluctuations: XRP's price is influenced by market dynamics, not solely by Ripple's actions, reinforcing the argument against it being a security.

Arguments Against XRP as a Commodity

Conversely, arguments against XRP's classification as a commodity include:

- Profit Potential Tied to Ripple's Efforts: Some argue that early investors anticipated profits based on Ripple's development and marketing efforts, aligning with the security definition.

- Initial Distribution Model: The initial distribution of XRP, primarily through Ripple, raises concerns about centralized control and potential securities implications.

- Ripple's Role in the XRP Ecosystem: Ripple's significant influence on the XRP ecosystem, including partnerships and technological development, strengthens the security argument.

The Impact of the XRP Classification on the Cryptocurrency Market

The XRP classification debate has far-reaching implications for the entire cryptocurrency market.

Regulatory Uncertainty and Investor Sentiment

The ongoing legal battle creates significant regulatory uncertainty, impacting investor confidence and market stability.

- Price Fluctuations: XRP's price has been highly volatile, reflecting the fluctuating market sentiment concerning the SEC's case. This volatility extends to other cryptocurrencies, demonstrating interconnectedness within the market.

- Broader Implications for Regulation: The outcome will set a precedent for how other cryptocurrencies are regulated, influencing future investment decisions and industry development.

Potential Future Regulatory Frameworks

The XRP case highlights the need for clearer regulatory frameworks for cryptocurrencies.

- Legislative Changes: The outcome of the lawsuit could lead to legislative changes and updated regulatory guidance regarding the classification of digital assets.

- Comprehensive Framework for Digital Assets: A comprehensive regulatory framework that addresses the unique characteristics of different cryptocurrencies could provide greater clarity and stability for the market.

Conclusion: Navigating the Complexities of XRP's Classification

The debate over whether XRP is a commodity highlights the complex legal and regulatory challenges in the cryptocurrency space. The SEC's stance against Ripple, based on the Howey Test, is countered by Ripple's arguments emphasizing XRP's decentralized nature and functionality. The potential role of the CFTC and the broader market implications underscore the importance of this ongoing legal battle. The outcome will significantly impact investor sentiment, market stability, and the future regulatory landscape of cryptocurrencies. Stay updated on the XRP classification debate and follow the legal proceedings surrounding XRP to understand the complexities of XRP as an investment and its implications for the wider cryptocurrency market.

Featured Posts

-

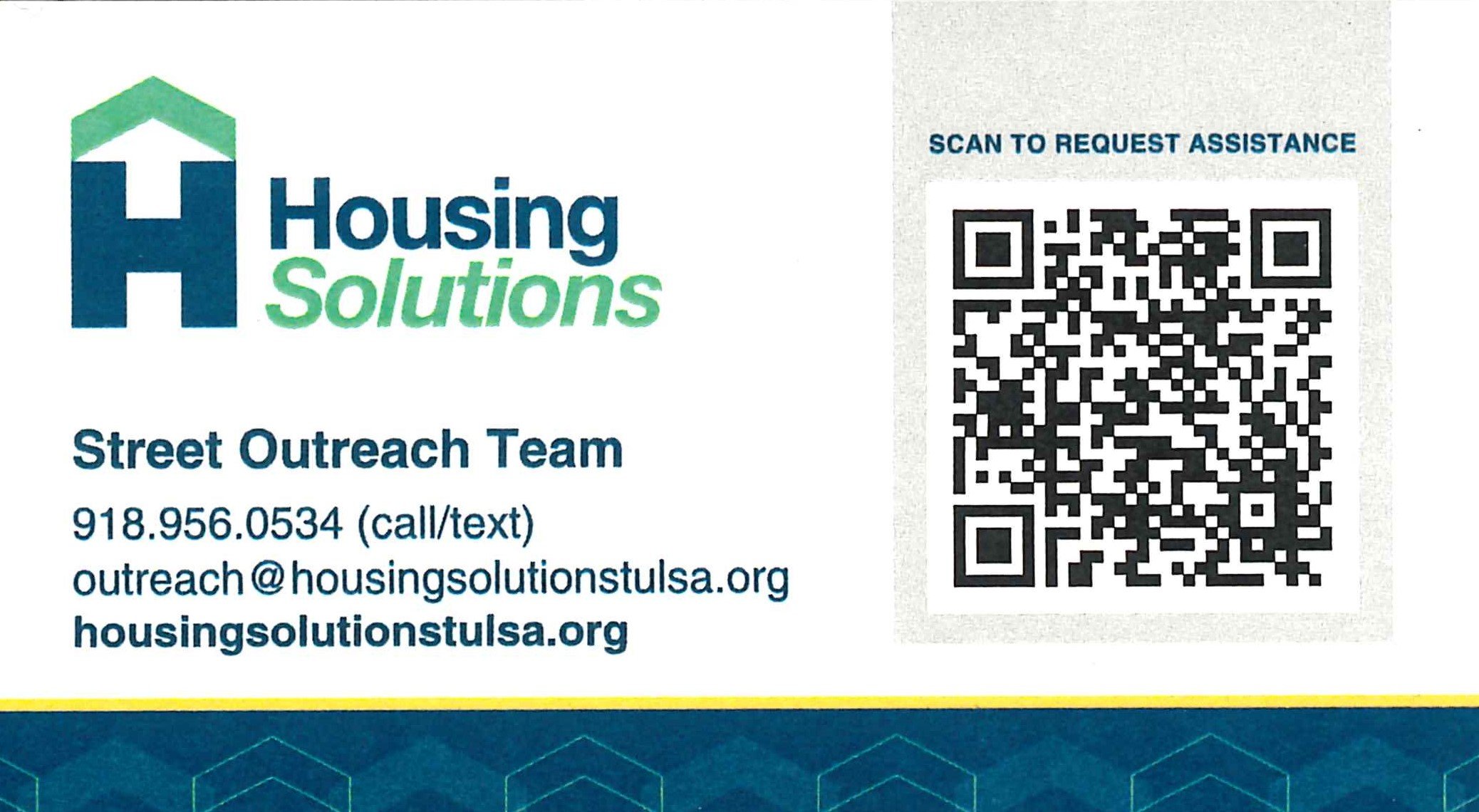

Rising Homelessness In Tulsa Insights From The Tulsa Day Center

May 02, 2025

Rising Homelessness In Tulsa Insights From The Tulsa Day Center

May 02, 2025 -

Rust Reviewing Alec Baldwins Role Post Tragedy

May 02, 2025

Rust Reviewing Alec Baldwins Role Post Tragedy

May 02, 2025 -

Top Mental Health Courses Offered By Ignou Tiss Nimhans

May 02, 2025

Top Mental Health Courses Offered By Ignou Tiss Nimhans

May 02, 2025 -

Rugby Highlights Duponts Exceptional Display In Frances Win Over Italy

May 02, 2025

Rugby Highlights Duponts Exceptional Display In Frances Win Over Italy

May 02, 2025 -

Manchester United And Bayern Munich Honour Poppy Atkinson

May 02, 2025

Manchester United And Bayern Munich Honour Poppy Atkinson

May 02, 2025