Is XRP A Commodity? The SEC's Uncertainty Fuels Debate

Table of Contents

The SEC's Case Against XRP as a Security

The SEC's core argument rests on the Howey Test, a legal framework used to determine whether an investment constitutes a security. The SEC contends that XRP sales by Ripple constituted an unregistered securities offering, violating federal laws.

- Ripple's Sales and Distribution: The SEC alleges that Ripple's distribution of XRP, through institutional sales and programmatic sales, resembled a traditional securities offering, generating profits for Ripple. They highlight the significant amount of XRP sold to institutional investors.

- Investment Contract: The SEC emphasizes that purchasers of XRP were anticipating profits based on Ripple's efforts, fulfilling the "investment contract" aspect of the Howey Test. This implies investors were relying on Ripple's development and marketing for returns, not solely on XRP’s inherent utility.

- Lack of Decentralization (Initially): At the time of XRP's initial distribution, the SEC points to a lack of complete decentralization, arguing that Ripple maintained significant control over XRP's distribution and development, further strengthening their case against XRP being solely a commodity.

Arguments for XRP as a Commodity

Counterarguments exist that posit XRP functions more like a commodity than a security. These arguments often center around XRP's current functionality and market dynamics.

- Decentralized Network: Unlike many cryptocurrencies that were launched with significant pre-mining or centralized control, XRP now operates on a largely decentralized network, facilitating fast and cheap cross-border payments. This decentralization weakens the SEC's argument of a central controlling entity.

- Lack of Centralized Control: The price of XRP is determined by market forces, not by Ripple. Ripple does not control its price or distribution in the way a centralized entity might control a traditional security. This is a key distinction in the argument.

- Expert Opinions and Legal Analyses: Several legal experts and commentators argue that XRP's characteristics align more closely with those of a commodity, like gold or oil, than a security. They point to the decentralized nature of its current network and its use as a medium of exchange.

The Impact of Regulatory Uncertainty on XRP and the Crypto Market

The lack of clear regulatory classification for XRP has created significant uncertainty within the cryptocurrency market. This impacts investors, businesses, and the future of crypto regulation.

- Volatility: The ongoing legal battle has created significant price volatility for XRP, making it a risky investment for some. The uncertainty surrounding its legal status directly affects investor confidence.

- Challenges for Exchanges: Many cryptocurrency exchanges have delisted or restricted trading of XRP due to the legal risks involved, limiting accessibility for investors. The regulatory uncertainty makes it difficult for exchanges to comply with varying jurisdictions.

- Implications for Future Crypto Projects: The outcome of the Ripple case will likely set a precedent for the classification of other cryptocurrencies, impacting the development and adoption of future projects. This uncertainty chills innovation in the crypto space.

The Ripple vs. SEC Lawsuit: Key Developments and Their Implications

The Ripple vs. SEC lawsuit has seen several key developments, each significantly influencing the perception and value of XRP.

- Key Court Rulings: The court's decisions on motions to dismiss and other procedural matters have provided insights into the judge's thinking and potential outcomes, significantly influencing market sentiment.

- Potential Outcomes: A SEC win could result in harsh penalties for Ripple and further regulatory pressure on the crypto industry. A Ripple win could provide greater clarity and potentially boost XRP's value. A settlement could offer a compromise, but may not fully address the core issues of XRP classification.

- Expert Predictions and Market Reactions: Market reactions to significant developments in the case demonstrate the high level of investor sensitivity to the ongoing legal battle. Expert opinions and predictions further shape the narrative.

Navigating the Future of XRP Classification

The question of whether XRP is a commodity or a security remains unanswered. The SEC argues that Ripple's actions constitute an unregistered securities offering, citing the Howey Test and Ripple’s control over XRP distribution. However, counterarguments highlight XRP's decentralized nature, its use as a payment method, and the lack of centralized price control. The ongoing regulatory uncertainty significantly impacts XRP's price volatility, exchange listings, and the broader crypto market.

The Ripple vs. SEC lawsuit's outcome will shape the future of XRP and likely set precedents for the regulation of other digital assets. Staying informed about this legal battle and other developments in the cryptocurrency market is crucial for making informed decisions about XRP and other digital assets. Further research into the legal arguments and technical aspects of XRP is essential to understanding its true nature and potential future. Continue to monitor the evolving classification of XRP to effectively navigate the crypto landscape.

Featured Posts

-

Piotr Zielinskis Calf Injury Expected Absence For Inter Milan

May 08, 2025

Piotr Zielinskis Calf Injury Expected Absence For Inter Milan

May 08, 2025 -

Copa Libertadores Liga De Quito Vs Flamengo Termina En Empate

May 08, 2025

Copa Libertadores Liga De Quito Vs Flamengo Termina En Empate

May 08, 2025 -

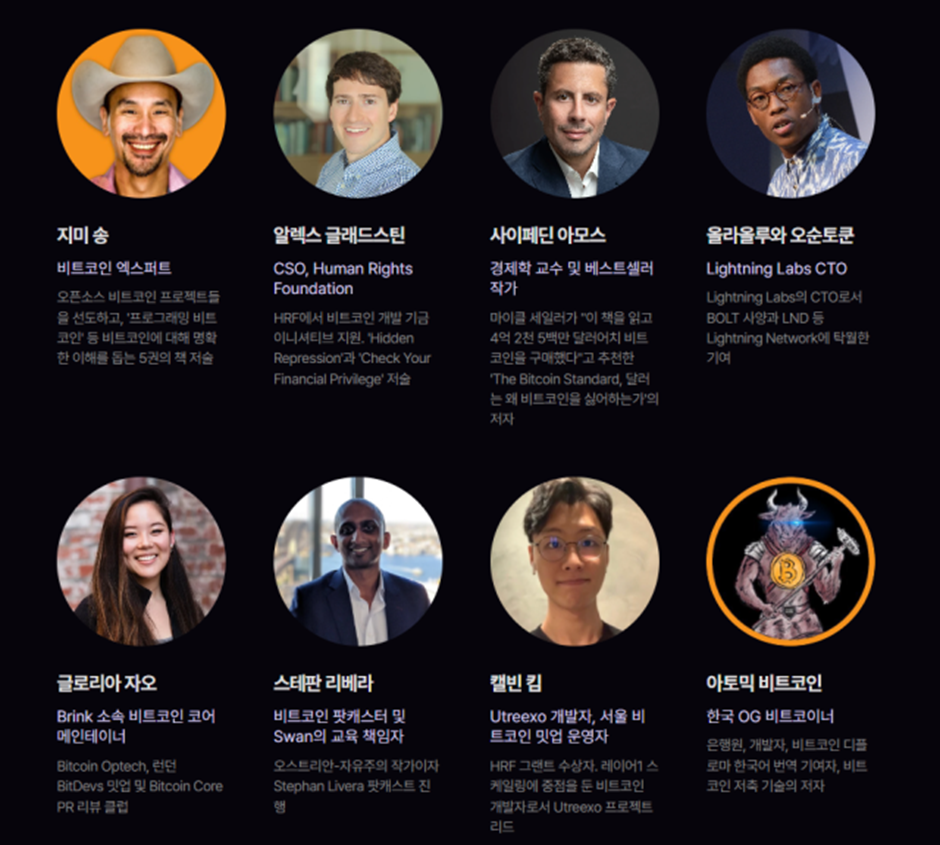

Bitcoin Seoul 2025 Asias Largest Bitcoin Conference

May 08, 2025

Bitcoin Seoul 2025 Asias Largest Bitcoin Conference

May 08, 2025 -

Digital Identity In Europe The Upcoming European Digital Identity Wallet

May 08, 2025

Digital Identity In Europe The Upcoming European Digital Identity Wallet

May 08, 2025 -

Arsenal News Artetas Headache Dembele Injury Update

May 08, 2025

Arsenal News Artetas Headache Dembele Injury Update

May 08, 2025