Is XRP (Ripple) A Buy Under $3? A Detailed Investment Analysis

Table of Contents

Ripple's Ongoing Legal Battle with the SEC

Understanding the SEC Lawsuit

The SEC's lawsuit against Ripple Labs, filed in December 2020, alleges that Ripple sold unregistered securities in the form of XRP. This legal battle significantly impacts XRP's price and future trajectory. The core of the SEC's argument centers around whether XRP qualifies as a security under U.S. law, a determination that could have far-reaching consequences for the entire cryptocurrency market.

-

Summary of the SEC's allegations: The SEC claims Ripple conducted an unregistered securities offering, violating federal securities laws. They argue XRP sales were not conducted through a registered exchange, and Ripple benefited financially from these sales.

-

Potential outcomes of the lawsuit (positive and negative): A favorable outcome for Ripple could lead to a significant surge in XRP's price, as regulatory uncertainty would be significantly reduced. Conversely, an unfavorable ruling could result in a substantial price drop and potentially damage Ripple's reputation and future prospects.

-

Impact of the lawsuit on XRP price volatility: The lawsuit has already caused significant price volatility for XRP. Positive news regarding the case often leads to price increases, while negative developments trigger sell-offs. This volatility makes XRP a high-risk investment.

-

Legal experts' opinions and predictions: Legal experts offer varying opinions on the potential outcome. Some predict a settlement, while others anticipate a protracted legal battle. These varying perspectives contribute to the uncertainty surrounding XRP's future.

Keyword Optimization: SEC lawsuit, Ripple lawsuit, XRP SEC case, regulatory uncertainty, legal battle impact on XRP, unregistered securities offering.

Ripple's Technology and Use Cases

xRapid and RippleNet

Ripple's technology focuses on facilitating faster and more cost-effective cross-border payments through its RippleNet platform and its native cryptocurrency, XRP. RippleNet utilizes blockchain technology to connect financial institutions, enabling near real-time transactions. xRapid, a key component of RippleNet, leverages XRP to bridge different currencies, making international transfers significantly more efficient.

-

Explanation of xRapid and its role in the Ripple ecosystem: xRapid acts as a liquidity solution, allowing financial institutions to avoid delays and high costs associated with traditional correspondent banking. It provides a faster and more efficient pathway for cross-border transactions.

-

Adoption rate of RippleNet by financial institutions: While RippleNet boasts a growing number of financial institutions as clients, widespread adoption is still ongoing. The pace of adoption plays a critical role in the long-term success and value of XRP.

-

Potential future use cases for Ripple's technology: Ripple's technology has the potential to expand beyond cross-border payments, potentially facilitating other financial transactions, such as supply chain finance and micropayments.

-

Advantages and limitations of XRP in cross-border payments: XRP offers speed and efficiency, but its reliance on the success of RippleNet and the overall cryptocurrency market remains a significant factor.

Keyword Optimization: xRapid, RippleNet, cross-border payments, blockchain technology, remittance, financial institutions, XRP adoption, liquidity solution, correspondent banking.

Market Sentiment and Price Prediction

Analyzing Current Market Conditions

XRP's price is influenced by the overall cryptocurrency market and specific events affecting Ripple. Analyzing current market conditions provides crucial context for potential investment decisions.

-

Current market capitalization of XRP: The market capitalization provides an indication of XRP's overall value and market standing compared to other cryptocurrencies.

-

Sentiment analysis of social media and news regarding XRP: Monitoring social media and news sentiment reveals the prevailing attitude toward XRP and can help predict potential price movements.

-

Technical analysis of XRP price charts (support and resistance levels): Technical analysis involves examining price charts to identify potential support and resistance levels, which can offer insights into future price movements.

-

Predictions from reputable cryptocurrency analysts: While price predictions are inherently uncertain, insights from reputable analysts can provide valuable context and perspective.

Keyword Optimization: XRP price prediction, cryptocurrency market analysis, market sentiment, technical analysis, XRP chart, trading volume, market capitalization, support and resistance.

Risks and Rewards of Investing in XRP Under $3

Potential Risks

Investing in XRP, particularly at a price point under $3, carries significant risk.

-

Risk of further price decline due to the SEC lawsuit: An unfavorable outcome in the SEC lawsuit could lead to a further decline in XRP's price.

-

Volatility of the cryptocurrency market: The cryptocurrency market is inherently volatile, and XRP is no exception. Sharp price swings are common and can lead to substantial losses.

-

Potential for loss of investment capital: There is always a risk of losing some or all of your investment capital when investing in cryptocurrencies.

Potential Rewards

Despite the risks, investing in XRP under $3 could offer significant rewards.

-

Potential for significant price appreciation if the SEC lawsuit is resolved favorably: A favorable outcome could result in a substantial increase in XRP's price.

-

Growing adoption of Ripple's technology by financial institutions: Wider adoption of RippleNet could boost the demand for XRP and drive its price upward.

-

Long-term potential for XRP as a key player in the global payments system: XRP has the potential to become a significant player in the future of global finance.

Keyword Optimization: XRP investment risks, XRP investment rewards, risk assessment, return on investment, potential profits, cryptocurrency investment, price appreciation.

Conclusion

The decision of whether to buy XRP under $3 is highly individual, relying heavily on your risk tolerance and investment timeline. While the SEC lawsuit poses a considerable risk, Ripple's technology and potential for widespread adoption offer substantial potential for reward. Before making any investment decisions, carefully evaluate the risks and rewards outlined above. Conduct your own thorough due diligence and consider consulting a financial advisor. Remember, investing in XRP (Ripple) involves inherent risks, and the price may not remain under $3. Make an informed decision based on your own research and understanding of the market. Is XRP a buy for you? Only you can answer that question after careful consideration.

Featured Posts

-

Is A Us Xrp Etf Imminent Latest Xrp Price Predictions And Ripple News

May 01, 2025

Is A Us Xrp Etf Imminent Latest Xrp Price Predictions And Ripple News

May 01, 2025 -

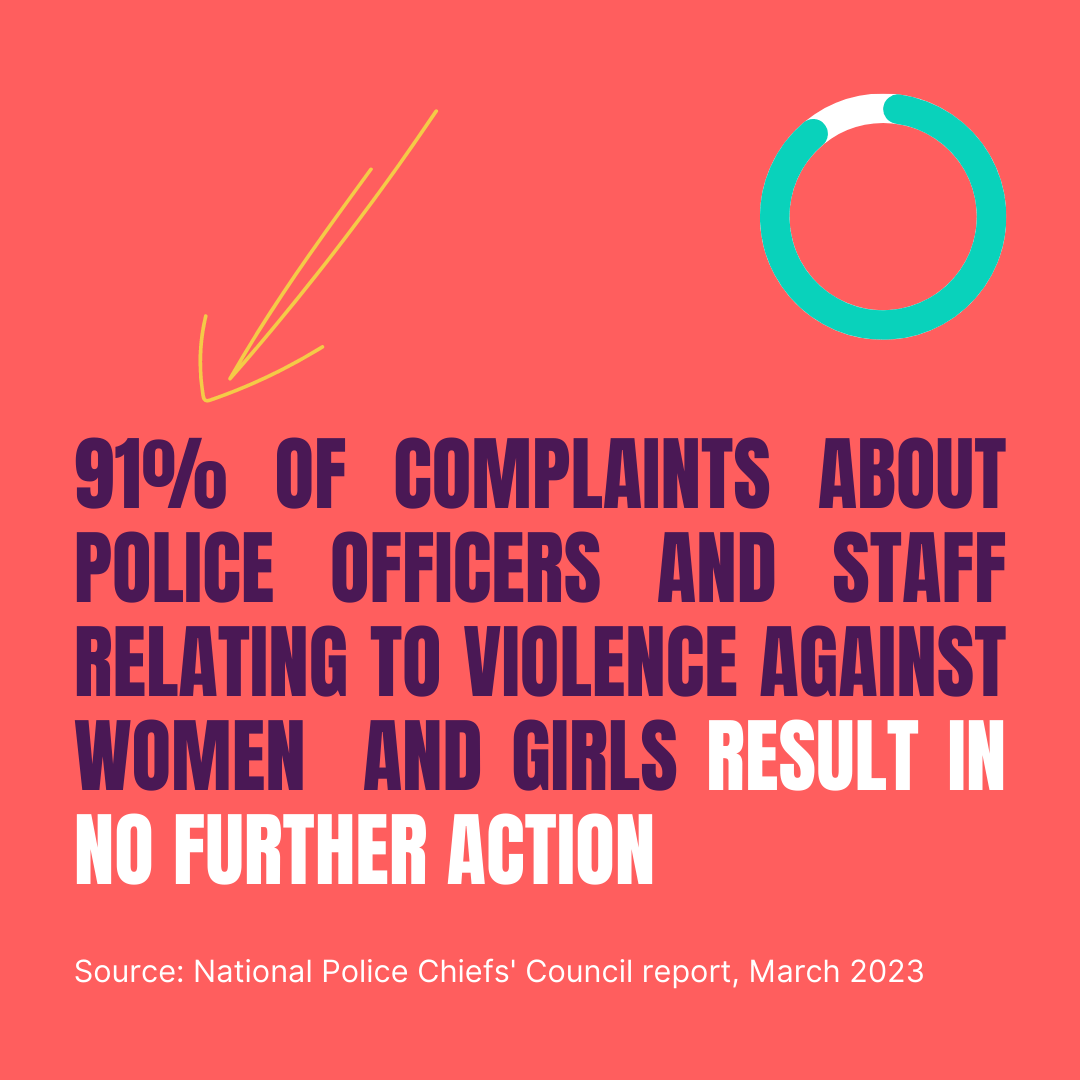

Lack Of Police Accountability Campaigners Voice Strong Concerns

May 01, 2025

Lack Of Police Accountability Campaigners Voice Strong Concerns

May 01, 2025 -

Blockchain Analytics Leader Chainalysis Integrates Ai With Alterya Acquisition

May 01, 2025

Blockchain Analytics Leader Chainalysis Integrates Ai With Alterya Acquisition

May 01, 2025 -

Becciu Deve Risarcire 40 000 Euro La Sentenza Del Tribunale

May 01, 2025

Becciu Deve Risarcire 40 000 Euro La Sentenza Del Tribunale

May 01, 2025 -

127 Years Of Brewing History Anchor Brewing Company Shuts Down

May 01, 2025

127 Years Of Brewing History Anchor Brewing Company Shuts Down

May 01, 2025