Is XRP's 400% 3-Month Rally A Buying Opportunity?

Table of Contents

XRP, the native cryptocurrency of Ripple, has experienced a phenomenal 400% surge in the past three months. This dramatic price increase has left many investors wondering: is this a genuine buying opportunity, or a speculative bubble waiting to burst? This article delves into XRP's recent performance, examining the contributing factors and potential risks to help you make an informed decision about whether or not to invest.

Analyzing XRP's Recent Price Surge

Factors Contributing to the Rally

Several factors have contributed to XRP's impressive rally. These include:

-

Increased Trading Volume and Market Capitalization: The surge in XRP's price has been accompanied by a significant increase in trading volume, indicating heightened investor interest and market activity. This increased trading activity has directly impacted XRP's market capitalization, pushing it higher in the cryptocurrency rankings.

-

Positive Developments in the Ongoing SEC Lawsuit Against Ripple: The ongoing legal battle between Ripple and the Securities and Exchange Commission (SEC) has significantly influenced XRP's price. Recent court filings and perceived positive developments in the case have boosted investor confidence, leading to increased buying pressure. For example, the [insert date] court ruling regarding [insert specific detail] was seen as a positive sign by many analysts.

-

Growing Adoption of XRP in Cross-Border Payments: Ripple's technology continues to gain traction in the cross-border payment space. Increased adoption by financial institutions and partnerships with key players in the remittance market have fueled the narrative around XRP's utility and potential for long-term growth. This growing adoption contributes to a more bullish outlook for XRP's future.

-

Overall Positive Sentiment in the Broader Cryptocurrency Market: The recent positive sentiment in the broader cryptocurrency market has also played a role in XRP's price surge. Positive news about other cryptocurrencies and a general increase in investor confidence have created a more favorable environment for XRP's price appreciation. This positive market sentiment acts as a tailwind for XRP price growth.

-

Specific News & Court Filings:

- Favorable court ruling on [Insert Date] significantly reduced investor concerns.

- Partnership announcement with [Insert Company Name] boosted confidence in Ripple's technology adoption.

- Increased institutional interest highlighted by [Insert Source].

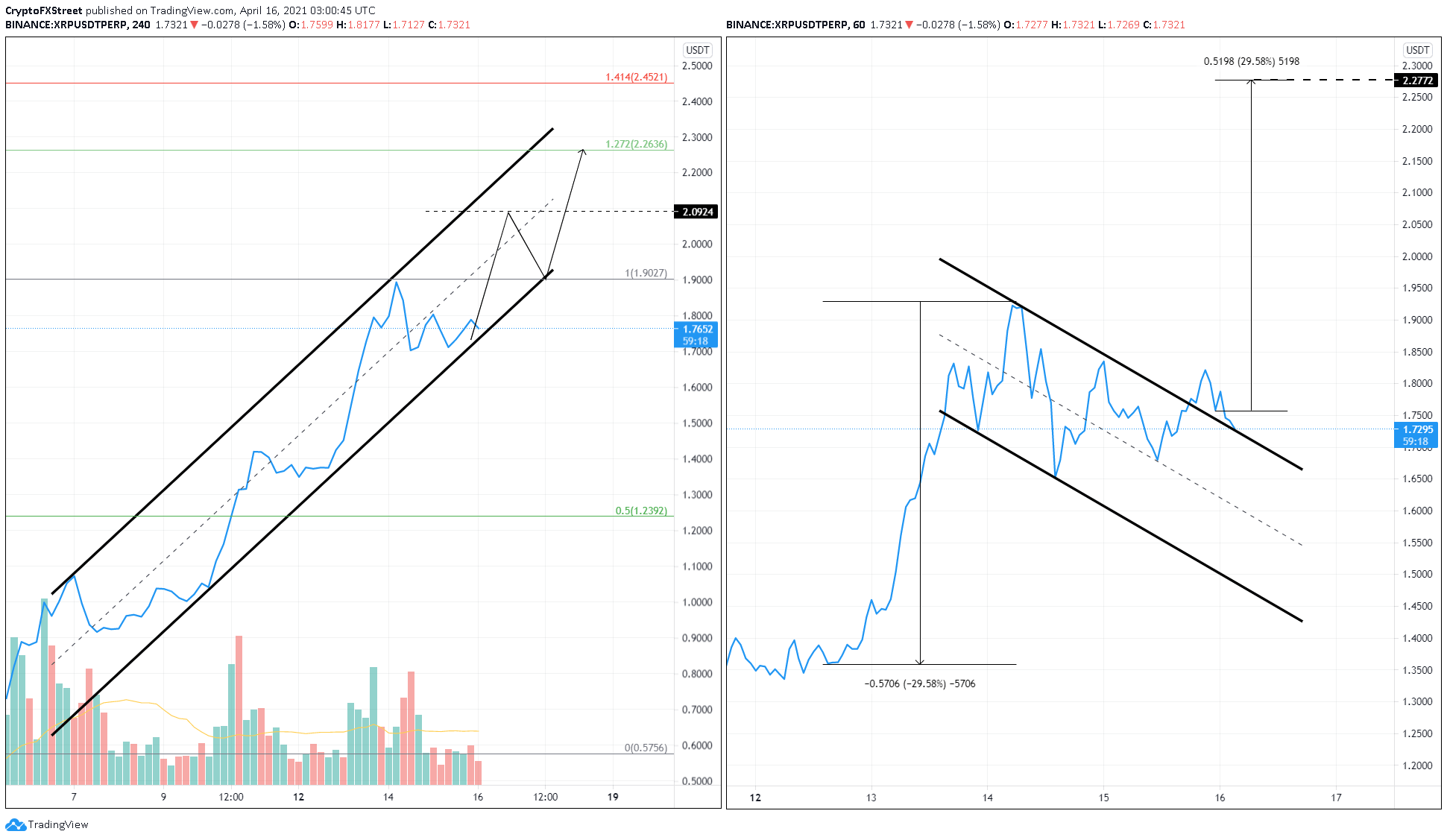

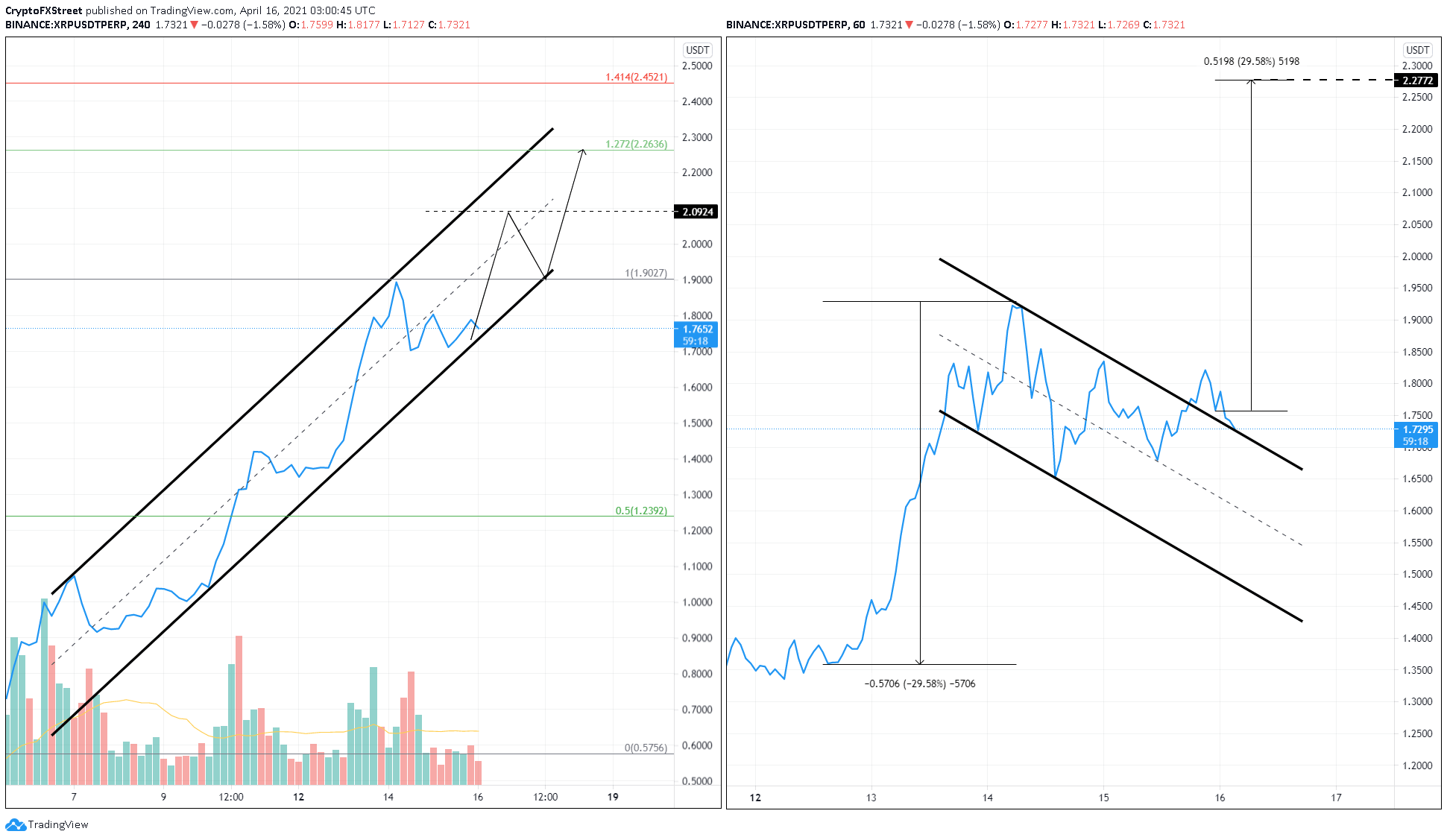

Technical Analysis of XRP's Chart

Analyzing XRP's chart using technical indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and moving averages provides insights into potential overbought conditions. Currently, [Insert Current RSI/MACD values and interpretation]. Support levels are identified around [Insert Support Levels], while resistance sits near [Insert Resistance Levels]. [Include chart/graph showing price trends]. Based on these technical indicators, the potential for further price movement depends on [Insert Analysis based on technical indicators; e.g., whether support holds, resistance is broken].

Understanding the Risks Associated with Investing in XRP

The Ongoing SEC Lawsuit

The SEC lawsuit against Ripple remains a significant risk factor for XRP. The outcome of this legal battle could significantly impact XRP's price, potentially leading to a substantial drop if the SEC prevails. A favorable ruling, however, could lead to further price appreciation. The legal arguments from both sides are complex, and understanding the intricacies of the case is crucial for any potential investor.

Volatility of the Cryptocurrency Market

Cryptocurrency markets are inherently volatile. XRP's price is subject to significant swings based on market sentiment, news events, and regulatory developments. Past cryptocurrency market crashes demonstrate the potential for substantial losses. This necessitates a robust risk management strategy and diversified investment portfolio.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is constantly evolving, creating uncertainty for XRP's future. Different jurisdictions have varying regulatory approaches, creating complexities for investors. Changes in regulations can significantly impact the price and trading of XRP.

Evaluating XRP as a Long-Term Investment

Ripple's Technology and Adoption

Ripple's technology, beyond its use in cross-border payments, shows promise in various applications. The company's partnerships and collaborations with financial institutions indicate a growing level of adoption. Its future potential hinges on its ability to further penetrate the financial services industry and expand into new markets.

XRP's Potential Future Value

Predicting XRP's future value involves considerable uncertainty. Different scenarios exist, depending on the outcome of the SEC lawsuit, the pace of adoption, and broader market conditions. Technological advancements and successful implementation of Ripple's technology could contribute significantly to XRP's future value. Comparing its growth potential against other cryptocurrencies in the market is essential for a comprehensive evaluation.

Conclusion

XRP's 400% rally is undeniably impressive, but whether it signifies a genuine buying opportunity remains a complex question. Several factors, including positive developments in the SEC lawsuit, increased adoption, and broader market sentiment, contribute to the price surge. However, the inherent volatility of the cryptocurrency market and regulatory uncertainty introduce significant risks. Remember, investing in XRP involves considerable risk.

Call to Action: Before making any XRP investment decisions, thorough research and a careful assessment of your risk tolerance are crucial. Conduct your own due diligence, consult a financial advisor, and only invest what you can afford to lose. Carefully evaluate whether this buying opportunity aligns with your risk tolerance and investment goals before making any decisions about XRP investment.

Featured Posts

-

Turnuvaya Katilacak Eski Doktor Adayi Boksoeruen Muecadelesi

May 01, 2025

Turnuvaya Katilacak Eski Doktor Adayi Boksoeruen Muecadelesi

May 01, 2025 -

Bebe De L Annee En Normandie Gagnez Un Kilo De Chocolat

May 01, 2025

Bebe De L Annee En Normandie Gagnez Un Kilo De Chocolat

May 01, 2025 -

Lich Thi Dau Va Phat Song Truc Tiep Tran Chung Ket Thaco Cup 2025

May 01, 2025

Lich Thi Dau Va Phat Song Truc Tiep Tran Chung Ket Thaco Cup 2025

May 01, 2025 -

Yankees Defeat Guardians 5 1 Rodons Dominant Performance Fuels Win

May 01, 2025

Yankees Defeat Guardians 5 1 Rodons Dominant Performance Fuels Win

May 01, 2025 -

Former Wkrn Anchors Nikki Burdine And Neil Orne Partner On New Ventures

May 01, 2025

Former Wkrn Anchors Nikki Burdine And Neil Orne Partner On New Ventures

May 01, 2025