Japan's Bond Market: Navigating A Steep Yield Curve In A Changing Economic Landscape

Table of Contents

Understanding the Steep Yield Curve in Japan's Bond Market

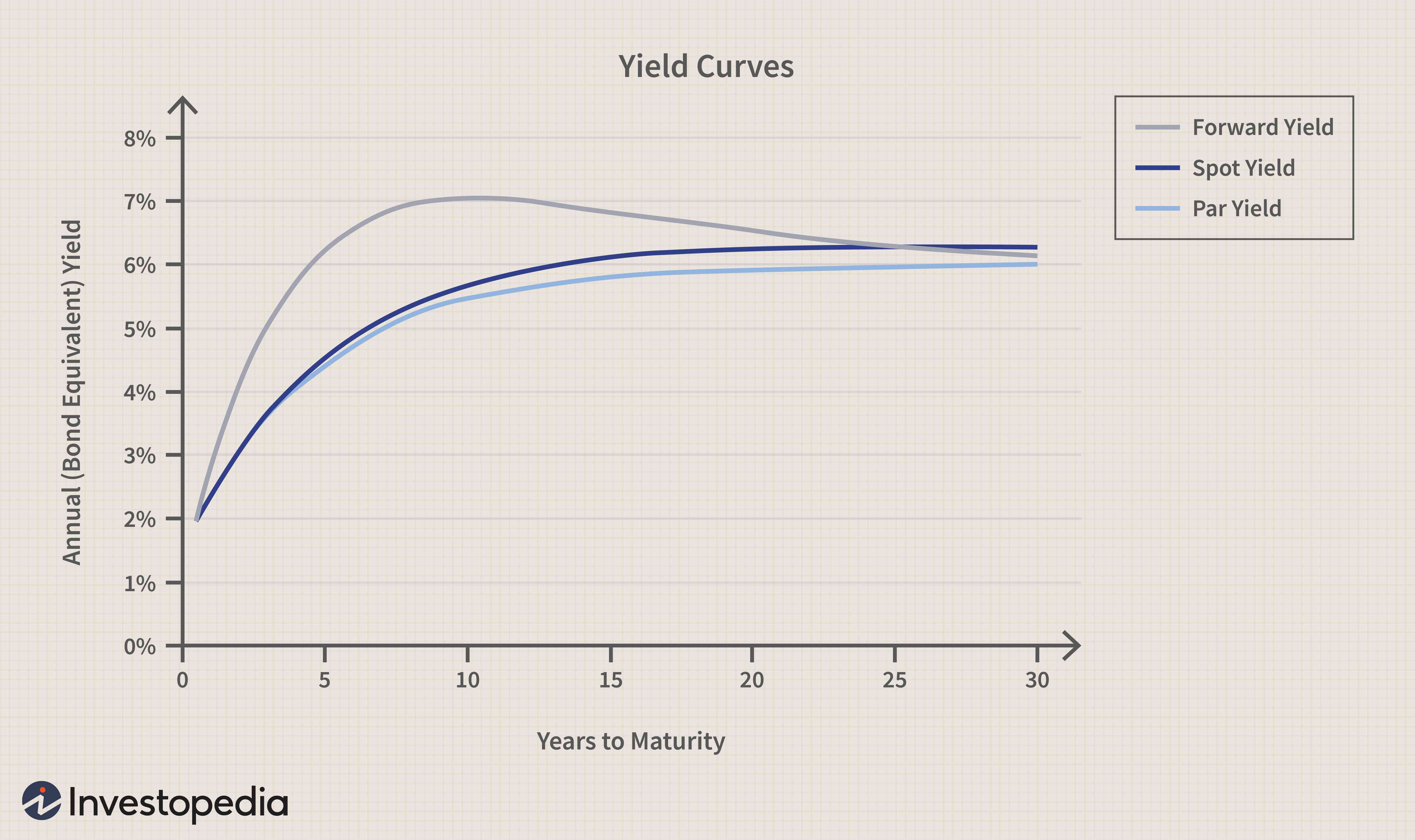

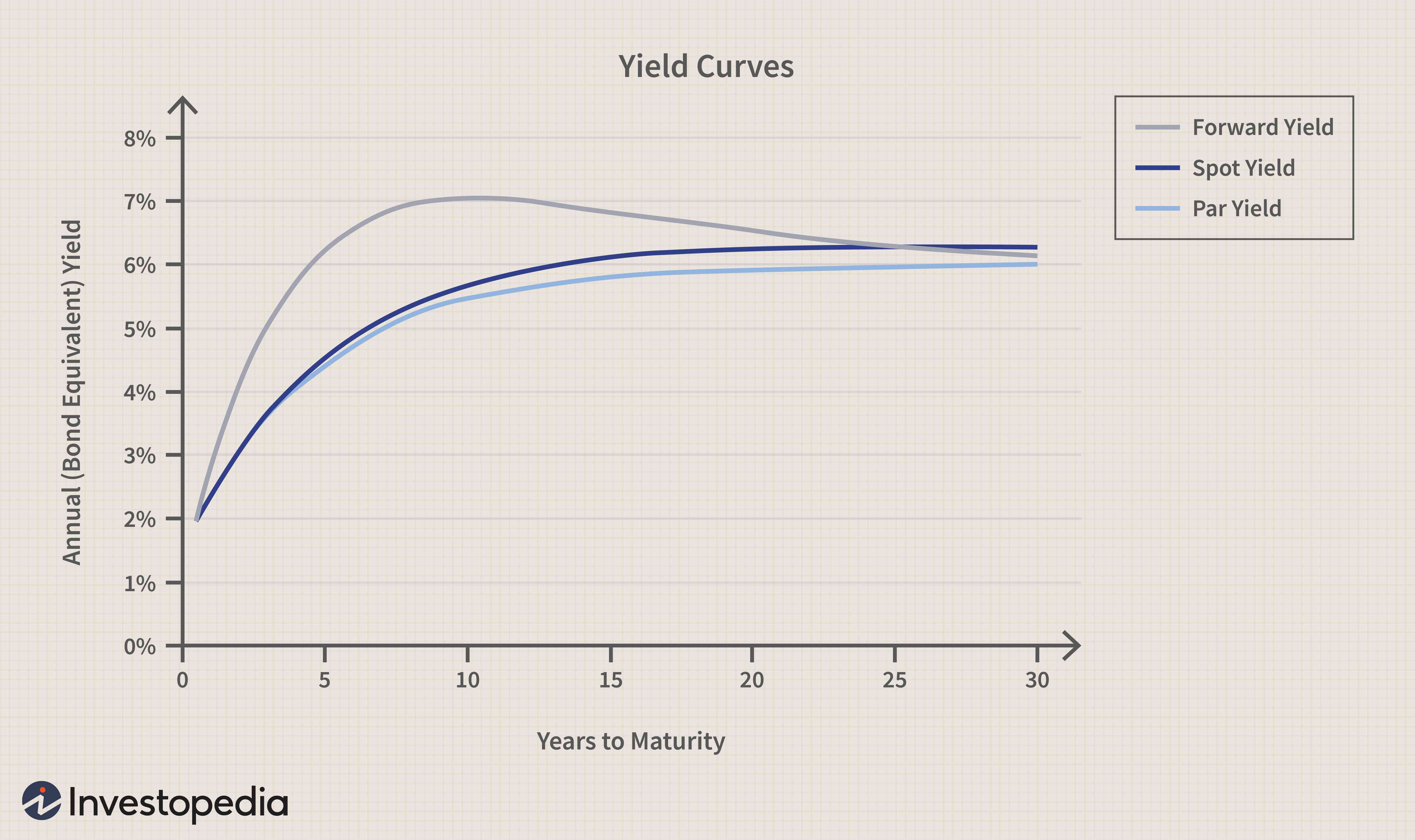

A steep yield curve occurs when the difference between long-term and short-term interest rates is significantly large. In Japan's context, this means a substantial gap between the yields of short-term Japanese Government Bonds (JGBs) and those with longer maturities. This steepness is currently driven by several factors.

- Inflation Expectations: Rising inflation expectations are pushing up long-term JGB yields as investors demand higher returns to compensate for the erosion of purchasing power. This increased demand for higher yields on longer-term bonds contributes to the steepening curve.

- Bank of Japan (BOJ) Policy: The BOJ's recent policy adjustments, including a shift away from yield curve control, have contributed to the upward pressure on long-term yields. This has increased the gap between short and long-term interest rates.

- Interest Rate Risk and Duration Risk: A steep yield curve magnifies interest rate risk and duration risk for investors. Interest rate risk refers to the potential for losses if interest rates rise, while duration risk reflects the sensitivity of bond prices to interest rate changes. Longer-term bonds, which are more sensitive to interest rate changes, experience amplified risk in a steep yield curve environment.

Bullet Points:

- The current yield spread between short and long-term JGBs is widening significantly, reflecting the steepening curve.

- Inflation's impact on JGB yields is substantial, pushing long-term yields higher.

- The BOJ's evolving monetary policy is a major driver of the yield curve's shape.

- The potential for further yield curve steepening remains a significant concern for investors.

The Impact of Changing Economic Landscape on JGBs

Japan's economic landscape is undergoing significant transformation, impacting the JGB market profoundly.

- Inflation's Influence: While still relatively low compared to other developed nations, inflation in Japan is rising, impacting investor demand for JGBs. Higher inflation erodes the real return on bonds, potentially reducing investor appetite for JGBs, especially those with longer maturities.

- BOJ's Monetary Policy Adjustments: The BOJ's adjustments to its monetary policy, including modifications to its yield curve control, have had a significant impact on JGB prices and yields. These changes have increased volatility and uncertainty in the market.

- Global Economic Factors: Global economic factors, particularly US interest rates and global inflation, exert significant influence on the Japanese bond market. Rising US interest rates can attract capital away from JGBs, potentially putting downward pressure on JGB prices.

Bullet Points:

- Japan's current inflation rate is steadily increasing, although it remains below levels seen in many other countries.

- The BOJ's recent policy shifts mark a notable change in its approach to monetary policy, impacting market sentiment.

- A strong correlation exists between US interest rates and JGB yields, with upward movements in US rates often leading to upward pressure on JGB yields.

- Global economic uncertainty introduces further complexity, influencing investor sentiment and capital flows into the JGB market.

Investment Strategies for Navigating Japan's Bond Market

Navigating Japan's bond market successfully requires a well-defined investment strategy that accounts for the steep yield curve and changing economic conditions.

- Mitigating Yield Curve Risks: Diversification across different JGB maturities is crucial for managing interest rate risk. Hedging strategies can also be employed to mitigate potential losses from interest rate fluctuations. Consideration of shorter-term bonds can reduce duration risk and exposure to interest rate volatility.

- JGB Types and Investor Profiles: Different types of JGBs, such as inflation-linked bonds and conventional bonds, cater to various investor profiles and risk tolerances. Understanding the characteristics of each type is key to making informed decisions.

- Alternative Fixed-Income Options: The Japanese fixed-income market offers alternatives to JGBs, including corporate bonds. Corporate bonds may offer higher yields but carry higher credit risk compared to government bonds.

Bullet Points:

- Strategies for managing interest rate risk involve diversification across maturities, hedging techniques, and a careful assessment of duration.

- JGBs with shorter maturities generally offer lower returns but reduced interest rate risk compared to longer-term JGBs.

- Corporate bonds may offer higher yields, but investors must carefully assess their creditworthiness and associated risks.

- Active management strategies offer the potential to outperform passive approaches, particularly in a volatile market, but may also involve higher fees.

Conclusion: Navigating the Complexities of Japan's Bond Market

The steep yield curve in Japan's bond market presents significant challenges, amplified by the evolving economic landscape. Inflation, BOJ policy adjustments, and global economic factors all play a role in shaping investor strategies. Careful risk management and diversification are paramount. Understanding the nuances of Japan's bond market requires careful analysis. To learn more about effective strategies for navigating the current yield curve and optimizing your investments in Japanese government bonds, consult with a financial advisor specializing in this market. Further research into Japanese government bonds and related investment strategies is strongly recommended.

Featured Posts

-

Local Science Educator Eagleson Receives Prestigious Award

May 17, 2025

Local Science Educator Eagleson Receives Prestigious Award

May 17, 2025 -

37 Yasindaki Djokovic Yillara Meydan Okuyan Performans

May 17, 2025

37 Yasindaki Djokovic Yillara Meydan Okuyan Performans

May 17, 2025 -

Knicks Vs Pistons Betting Preview Get A Bet365 Bonus With Code Nypbet

May 17, 2025

Knicks Vs Pistons Betting Preview Get A Bet365 Bonus With Code Nypbet

May 17, 2025 -

Tenis Te Djokovic Doenemi Zirvenin Yenilmez Ustasi

May 17, 2025

Tenis Te Djokovic Doenemi Zirvenin Yenilmez Ustasi

May 17, 2025 -

Microsoft Surface Lineup Simplification Another Device Cut

May 17, 2025

Microsoft Surface Lineup Simplification Another Device Cut

May 17, 2025