Japan's Economic Slowdown: A Q1 Review Before Trump's Tariffs

Table of Contents

- Key Factors Contributing to Japan's Q1 Economic Slowdown

- Weak Consumer Spending

- Declining Exports

- Impact of the Rising Yen

- The Looming Threat of Trump's Tariffs (and Other Trade Tensions)

- Potential Impact on Japanese Industries

- Countermeasures and Government Response

- Analyzing Japan's Economic Slowdown and the Implications of Trump's Tariffs

Key Factors Contributing to Japan's Q1 Economic Slowdown

Several interconnected factors contributed to Japan's disappointing Q1 economic performance. Understanding these elements is crucial to predicting future economic trends and formulating effective policy responses.

Weak Consumer Spending

A noticeable decline in consumer confidence directly impacted spending during Q1 2023. Rising prices, particularly for essential goods and energy, coupled with persistent wage stagnation, led to a more cautious approach among consumers. This resulted in decreased spending across various sectors.

- Decreased spending in the automobile sector: Sales of new vehicles fell, reflecting a reluctance to make large purchases.

- Reduced spending on electronics and durables: Consumers delayed purchases of non-essential items like televisions and refrigerators.

- Lower retail sales across various sectors: Data from the Japanese Cabinet Office showed a significant dip in retail sales figures for Q1 2023, confirming the slowdown in consumer spending.

Declining Exports

Japan's export sector experienced a significant contraction in Q1 2023, exacerbating the overall economic slowdown. This decline can be attributed to several factors, including a global trade slowdown and the strengthening yen.

- Weakening global demand: Reduced demand from key trading partners, particularly in China and the US, negatively impacted Japanese exports.

- Reduced exports to China: The slowdown in China's economy directly impacted Japanese exports of machinery, electronics, and other manufactured goods.

- Stronger Yen: The appreciation of the yen against other major currencies made Japanese exports more expensive in international markets, impacting competitiveness. Q1 2023 saw a noticeable strengthening of the Yen against the US dollar.

Impact of the Rising Yen

The appreciation of the yen during Q1 2023 presented significant challenges for Japanese businesses, particularly exporters. A stronger yen reduces the value of export earnings when converted to Japanese yen, impacting profitability and competitiveness.

- Reduced export profitability: Exporters saw lower profit margins due to the higher yen value, eroding their competitiveness in global markets.

- Impact on corporate earnings: Many Japanese companies reported reduced earnings in Q1 2023 due to the impact of the stronger yen on their export revenues.

- Yen appreciation vs. other currencies: The yen's appreciation against major currencies like the US dollar and the Euro significantly impacted export revenue.

The Looming Threat of Trump's Tariffs (and Other Trade Tensions)

While the threat of escalated tariffs may seem outdated, the underlying tensions in US-Japan trade relations persist, posing a significant risk to the Japanese economy. Although not directly impacting Q1 2023 results, this uncertainty is a crucial factor in long-term economic forecasting.

Potential Impact on Japanese Industries

Several key Japanese industries remain vulnerable to potential future trade restrictions. The automobile and electronics sectors, in particular, would likely experience substantial negative impacts from any escalation in tariffs.

- Auto sector vulnerability: Japanese automobile manufacturers exporting to the US would likely face significant challenges if tariffs were increased.

- Electronics industry concerns: The electronics sector, another major exporter to the US, also faces potential substantial losses if trade barriers were imposed.

- Impact on major companies: Companies like Toyota, Honda, and Sony could face significant disruptions to their supply chains and profitability.

Countermeasures and Government Response

The Japanese government is likely to employ several strategies to mitigate the impact of future trade barriers. These could include diplomatic efforts to renegotiate trade agreements or implementing domestic economic stimulus measures.

- Negotiating trade agreements: Japan may seek to renegotiate bilateral trade agreements with major trading partners to reduce trade barriers.

- Economic stimulus packages: The government might implement fiscal measures to boost domestic demand and offset the negative impact of reduced exports.

- Investment in domestic industries: Government may promote diversification of export markets and investment in domestic industries to lessen reliance on export-oriented growth.

Analyzing Japan's Economic Slowdown and the Implications of Trump's Tariffs

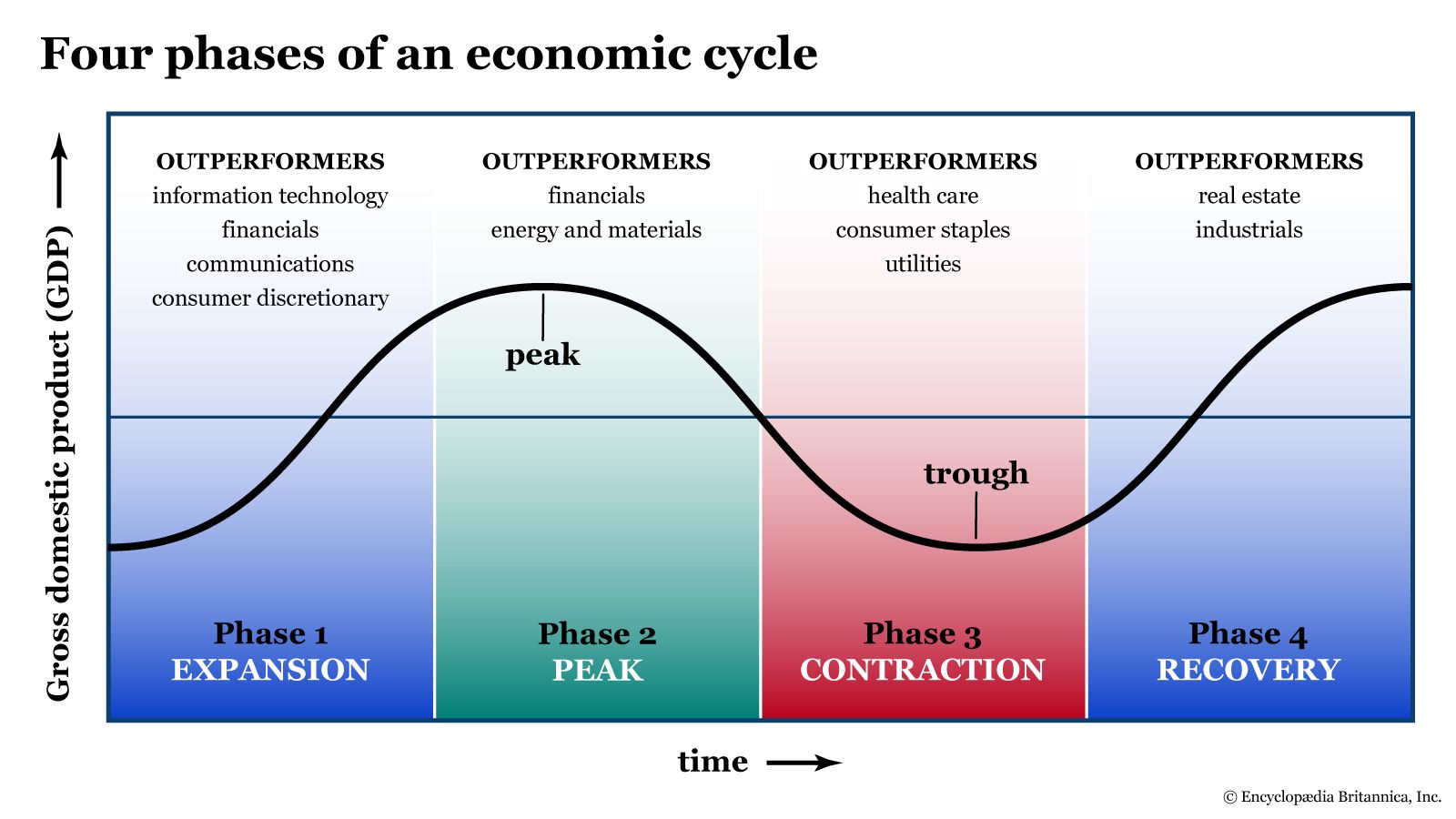

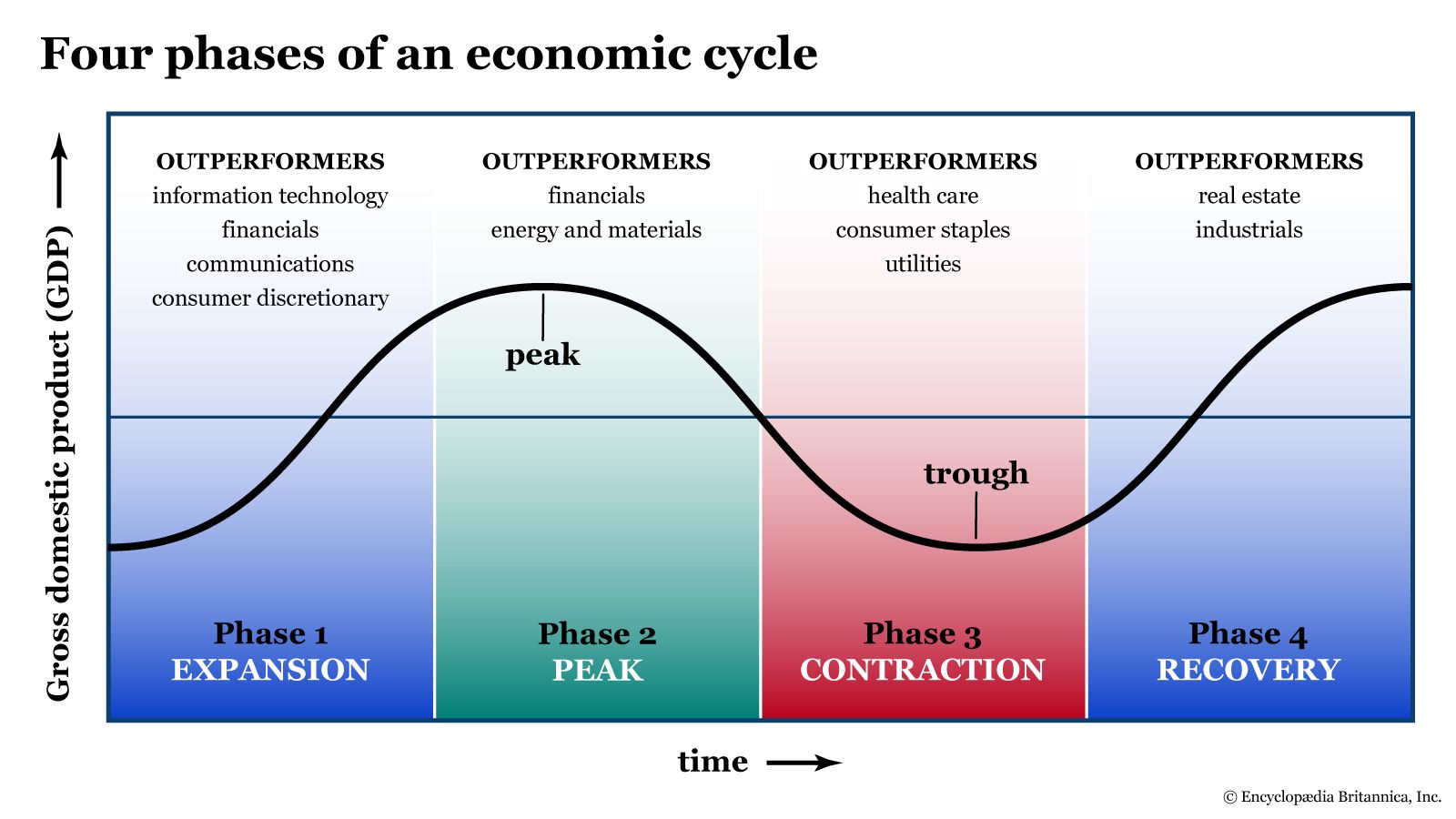

In summary, Japan's Q1 2023 economic slowdown was primarily driven by weak consumer spending, declining exports, and the negative impact of a strengthening yen. While not directly impacting Q1 results, the potential threat of renewed trade tensions and higher tariffs poses significant long-term risks to the Japanese economy. These factors underscore the interconnectedness of global economic forces and the challenges faced by even highly developed economies like Japan. Continue to monitor Japan's economic slowdown and the unfolding impact of trade negotiations for further insights.

Jazz Fest New Orleans Your Guide To The Ultimate Music Experience

Jazz Fest New Orleans Your Guide To The Ultimate Music Experience

Nba Playoffs 76ers Vs Celtics A Winning Prediction

Nba Playoffs 76ers Vs Celtics A Winning Prediction

Fortnite Tmnt Skins A Comprehensive Guide To Obtaining Every Shellhead

Fortnite Tmnt Skins A Comprehensive Guide To Obtaining Every Shellhead

Donald Trumps Family Tree Understanding The Relationships And Background

Donald Trumps Family Tree Understanding The Relationships And Background

Is Jackbit The Best Crypto Casino For Fast Withdrawals A Comprehensive Review

Is Jackbit The Best Crypto Casino For Fast Withdrawals A Comprehensive Review