Joe Biden And The Economy: An In-Depth Look At The Current Slowdown

Table of Contents

Inflation and its Impact on American Households

Rising Prices and Consumer Spending

The surge in inflation during the Biden administration has significantly impacted American households. Several factors contributed to this rise, including supply chain disruptions stemming from the pandemic, increased energy prices (particularly oil and gas), and robust consumer demand. This has led to a decrease in purchasing power, forcing families to make difficult choices about their spending.

- Specific examples of rising prices: Gas prices soared to record highs in 2022, impacting commuting costs and transportation expenses. Grocery prices have also increased significantly, affecting the cost of essential food items. Housing costs, including rent and mortgage payments, have also seen substantial increases, putting a strain on household budgets.

- Impact on different income brackets: Low- and middle-income households have been disproportionately affected by rising prices, as a larger portion of their income is spent on necessities. Higher-income households have more disposable income to absorb these price increases, although they are not immune to the effects of inflation.

The Federal Reserve's Response and its Implications

To combat inflation, the Federal Reserve (the Fed) has implemented a series of interest rate hikes. These increases aim to cool down the economy by making borrowing more expensive, thus reducing consumer spending and business investment.

- Mechanics of interest rate increases: Higher interest rates make loans more costly, discouraging businesses from taking out loans for expansion and consumers from borrowing for large purchases like homes and cars.

- Potential negative effects: While aiming to curb inflation, these interest rate increases could lead to a slowdown in economic growth, potentially even a recession. The housing market is particularly vulnerable, as higher mortgage rates reduce affordability and dampen demand. Business investment could also decline, slowing job creation.

The Job Market Under Biden: A Mixed Bag

Job Growth and Unemployment Rates

The job market under Biden has presented a mixed picture. While significant job growth has been recorded, challenges persist.

- Job creation and unemployment rates: The unemployment rate has fallen to historically low levels, indicating a strong labor market. However, this positive trend needs to be viewed in the context of inflation's impact on real wages.

- Types of jobs being created: The types of jobs being created vary widely, with growth in some sectors outpacing others. While many new jobs have been added, the quality and wages of these jobs are important factors to consider.

Wage Stagnation and Income Inequality

Despite the low unemployment rate, many workers are experiencing wage stagnation. Wage growth has not kept pace with inflation, resulting in a decline in real wages – meaning that workers' purchasing power has decreased.

- Wage growth vs. inflation rates: Comparing wage growth to inflation rates reveals a concerning trend. Even with job growth, many workers are not seeing their incomes rise at a rate that keeps up with the increasing cost of living.

- Impact on different demographics: Wage stagnation disproportionately affects lower-income workers and specific demographics, exacerbating existing income inequality.

Biden's Economic Policies and their Effectiveness

American Rescue Plan and Infrastructure Investment

The Biden administration has implemented significant economic initiatives, including the American Rescue Plan and the Infrastructure Investment and Jobs Act. These measures aimed to stimulate economic growth and address long-term infrastructure needs.

- Intended and unintended consequences: The American Rescue Plan provided substantial fiscal stimulus, boosting demand but also potentially contributing to inflation. The Infrastructure Investment and Jobs Act aims for long-term economic growth through investments in infrastructure projects, creating jobs and improving productivity, but its full impact is yet to be seen.

- Distribution of benefits and criticisms: The distribution of benefits from these programs has been a subject of debate, with criticisms focusing on potential inefficiencies and inequitable outcomes.

Supply Chain Issues and Energy Policy

The administration has also tackled supply chain bottlenecks and implemented energy policies that aim to shift towards renewable energy sources.

- Success of initiatives: Efforts to alleviate supply chain issues have yielded mixed results, with ongoing disruptions affecting various sectors. The transition to renewable energy presents both economic opportunities and challenges, influencing energy prices and overall economic stability.

- Role of global factors: Global factors, such as the war in Ukraine, have significantly impacted energy prices and supply chains, creating economic headwinds beyond the scope of domestic policy.

Conclusion

The current economic slowdown under President Biden is a multifaceted issue. While job growth shows some positives, high inflation and concerns about wage stagnation represent significant challenges for American households. The effectiveness of Biden's economic policies remains a subject of ongoing debate. A thorough understanding of these intertwined factors is essential for navigating the present economic climate. To stay informed about the latest developments regarding the Joe Biden economy, continue to follow reputable news sources and economic analysis. Understanding the nuances of the Biden economic policies and their implications for the future is paramount for informed civic engagement. Continue your research on the US economic slowdown to better grasp the intricacies of this critical issue.

Featured Posts

-

Wyroznienia Solidarnosc I Republika Porownanie Retoryki Sakiewicza

May 03, 2025

Wyroznienia Solidarnosc I Republika Porownanie Retoryki Sakiewicza

May 03, 2025 -

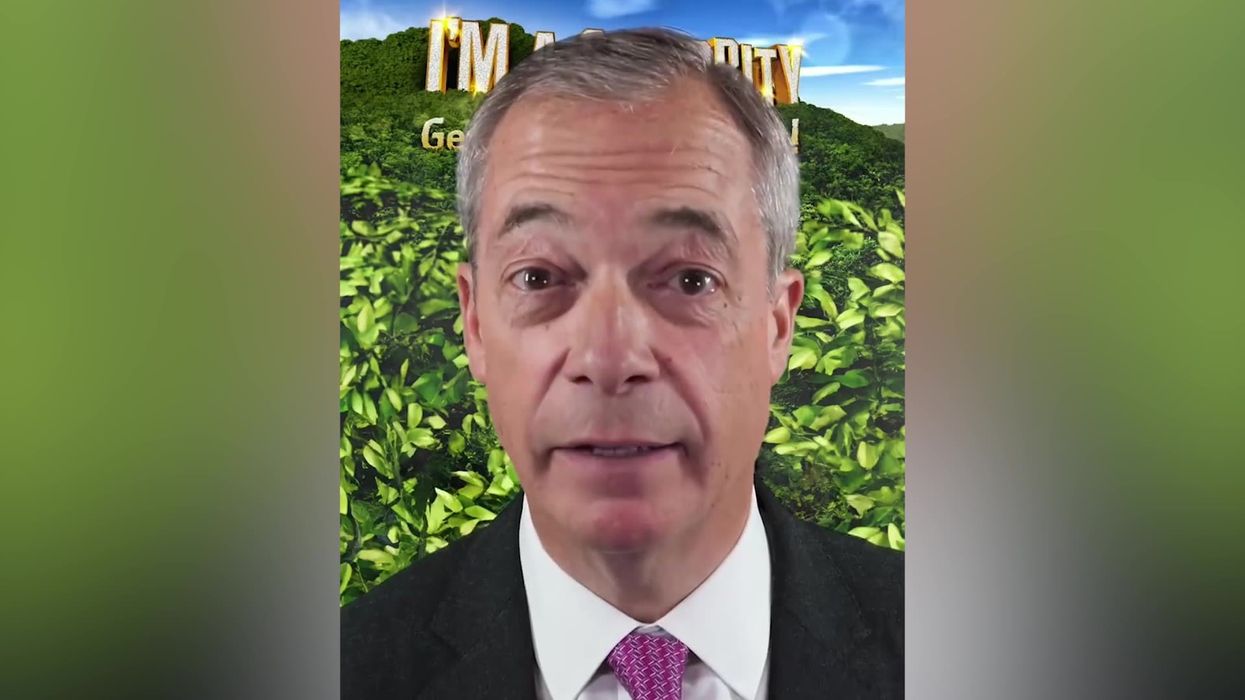

Reform Partys Savile Reference Nigel Farage Faces Backlash

May 03, 2025

Reform Partys Savile Reference Nigel Farage Faces Backlash

May 03, 2025 -

Reaction Emue D Emmanuel Macron Une Rencontre Marquante Avec Les Victimes De L Armee Israelienne

May 03, 2025

Reaction Emue D Emmanuel Macron Une Rencontre Marquante Avec Les Victimes De L Armee Israelienne

May 03, 2025 -

Lacrosse Hazing Investigation 11 Players Avoid Kidnapping Charges In Syracuse

May 03, 2025

Lacrosse Hazing Investigation 11 Players Avoid Kidnapping Charges In Syracuse

May 03, 2025 -

How To Style A High Waisted Suit Like Selena Gomez 80s Office Inspiration

May 03, 2025

How To Style A High Waisted Suit Like Selena Gomez 80s Office Inspiration

May 03, 2025