Key Changes To Universal Credit: How The DWP Will Verify Claims

Table of Contents

Strengthened Identity Verification Procedures

The DWP is significantly enhancing its identity verification processes to combat fraud and ensure accurate benefit allocation. This involves both improved online verification and increased use of biometric data.

Enhanced Online Verification

The online verification process for Universal Credit claims is becoming more robust. The DWP is implementing several improvements designed to deter fraudulent applications and strengthen security.

- Stronger password requirements: Claimants will now be required to use more complex passwords, making it harder for unauthorized individuals to access accounts.

- Multi-factor authentication: Additional security layers, such as one-time passwords or verification codes sent to mobile phones, are being introduced to confirm the claimant's identity.

- Data sharing agreements: The DWP is expanding its data-sharing agreements with other government agencies, such as the Driver and Vehicle Licensing Agency (DVLA) and HMRC, to cross-reference information and verify claimant details more efficiently. This allows for quicker and more accurate identity checks.

Increased Use of Biometric Data

While not yet fully implemented across all Universal Credit claims, the DWP is exploring and in some instances utilizing biometric data to further strengthen identity verification. This could include facial recognition technology to confirm the identity of claimants during online applications or at physical appointments.

- Data security and privacy: The DWP is committed to complying with all relevant data protection regulations, such as the General Data Protection Regulation (GDPR), to ensure the safe and responsible use of biometric data. Strict protocols are in place to protect claimant information.

- Transparency and consent: Claimants will be informed about the use of biometric data and will be given the opportunity to provide their consent.

More Rigorous Income Verification

The DWP is also tightening its income verification processes to ensure that benefit payments accurately reflect claimants' financial circumstances. This includes automated data matching and increased scrutiny of self-employed income.

Automated Income Data Matching

The DWP is increasingly using automated systems to cross-reference claimant-provided income data with information held by employers and HMRC. This significantly speeds up the verification process and improves accuracy.

- Real-time data matching: The system automatically matches data from various sources, allowing for near real-time verification of income.

- Reduced processing times: Automated income verification reduces the time it takes to process claims, leading to faster payment times for eligible claimants.

- Sources of income data: Data is sourced from various reliable channels such as PAYE records from HMRC, employer payroll systems and self-assessment tax returns.

Increased Scrutiny of Self-Employment Income

Claimants who are self-employed now face more rigorous income verification. This involves increased requests for evidence and more frequent reviews of their income declarations.

- Evidence requirements: Self-employed claimants may be required to provide more comprehensive evidence of their income, including tax returns, bank statements, and invoices.

- Frequency of reviews: The DWP may conduct more frequent reviews of self-employed claimants' income to ensure continued eligibility for Universal Credit.

- Challenges for self-employed: While this increased scrutiny helps ensure accuracy, it's important for self-employed individuals to maintain meticulous records and be prepared to provide the necessary documentation promptly.

Changes to Sanctions and Appeals Process

The DWP has also made changes to the sanctions and appeals process for Universal Credit claimants. These changes aim to clarify the criteria for sanctions and improve the appeals process for those who disagree with a decision.

Clarified Sanctions Criteria

The criteria for applying sanctions for non-compliance with Universal Credit requirements have been clarified, providing more transparency for claimants.

- Reasons for sanctions: Sanctions are generally applied for failing to meet agreed job search requirements or for providing false information.

- Types of sanctions: Sanctions can range from temporary reductions in benefit payments to complete suspension of benefits.

- Appeals process: Claimants have the right to appeal any sanction imposed by the DWP.

Improved Appeals Process

The DWP has made efforts to improve the appeals process, making it more efficient and claimant-friendly.

- Faster turnaround times: The aim is to reduce the time it takes to process appeals.

- Clearer guidance: Improved guidance and support is available to help claimants understand the appeals process and navigate it effectively.

- Access to support: Claimants are encouraged to seek support and advice from organizations like Citizens Advice during the appeals process.

Conclusion

The DWP's key changes to Universal Credit claim verification are designed to improve the accuracy and efficiency of the benefit system, preventing fraud and ensuring that benefits reach only those eligible. Strengthened identity and income verification procedures, combined with a clarified sanctions and appeals process, represent a significant step towards ensuring the integrity of Universal Credit. Understanding the key changes to Universal Credit claim verification is crucial. Visit the DWP website today for more information on how these changes affect your claim.

Featured Posts

-

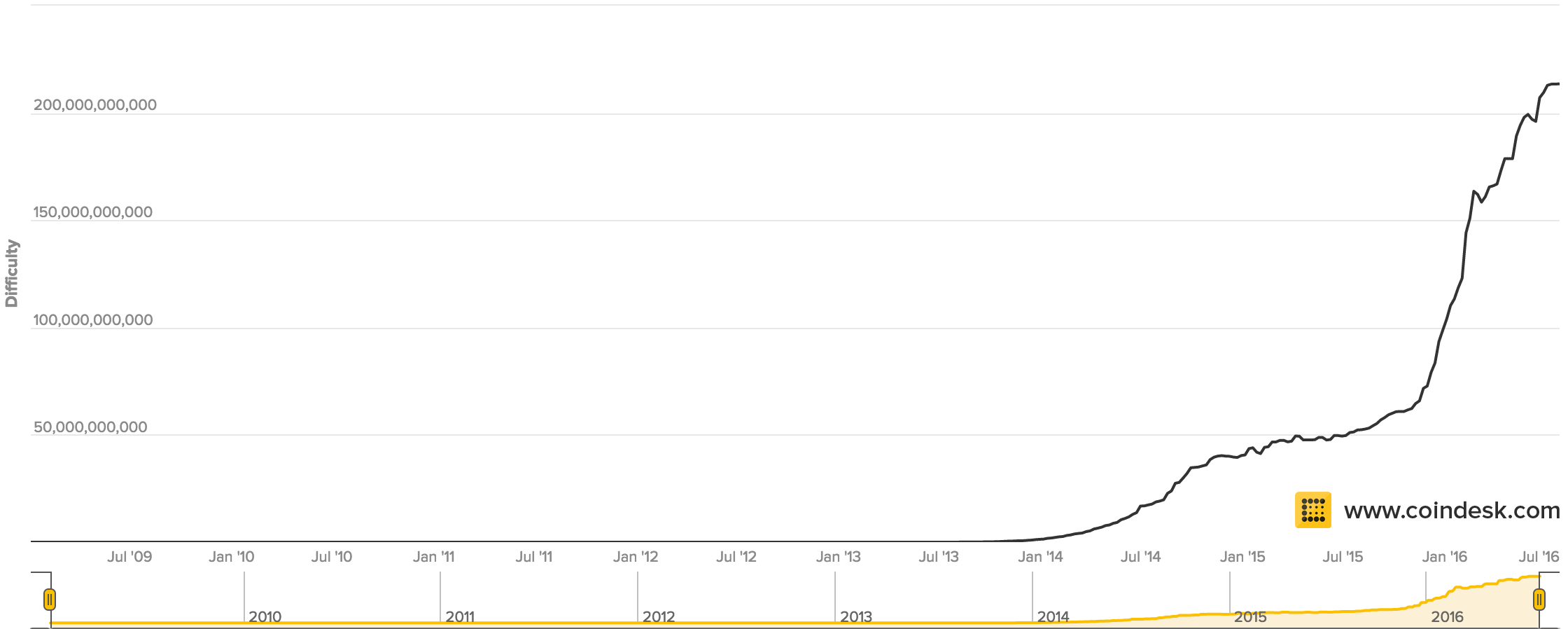

Understanding The Recent Spike In Bitcoin Mining Activity

May 08, 2025

Understanding The Recent Spike In Bitcoin Mining Activity

May 08, 2025 -

Gjranwalh Myn Fayrng 5 Afrad Qtl Dyrynh Dshmny Ka Ntyjh Mlzm Pwlys Mqable Myn Hlak

May 08, 2025

Gjranwalh Myn Fayrng 5 Afrad Qtl Dyrynh Dshmny Ka Ntyjh Mlzm Pwlys Mqable Myn Hlak

May 08, 2025 -

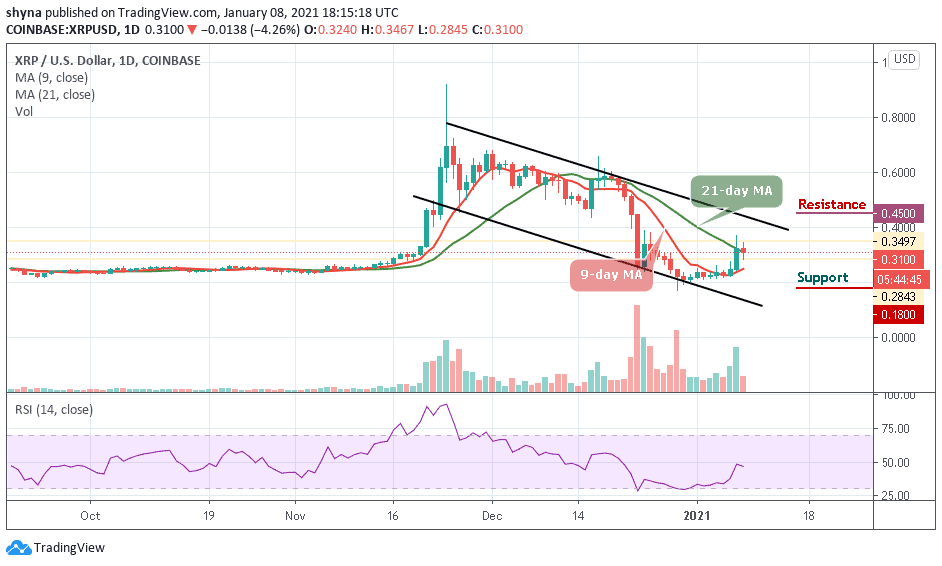

Analyzing Ripples Xrp Potential To Reach 3 40

May 08, 2025

Analyzing Ripples Xrp Potential To Reach 3 40

May 08, 2025 -

Sifresiz Kripto Para Mirasi Kayip Nasil Oenlenir

May 08, 2025

Sifresiz Kripto Para Mirasi Kayip Nasil Oenlenir

May 08, 2025 -

Ai Generated Poop Podcast Analyzing Repetitive Scatological Documents

May 08, 2025

Ai Generated Poop Podcast Analyzing Repetitive Scatological Documents

May 08, 2025