Lagarde's Strategy: Elevating The Euro's Global Influence Via EUR/USD

Table of Contents

ECB Monetary Policy and its Impact on EUR/USD

The ECB's monetary policy decisions directly influence the EUR/USD exchange rate. Higher interest rates generally attract foreign investment, increasing demand for the Euro and strengthening EUR/USD. Conversely, quantitative easing (QE) measures, like those implemented in the past, can weaken the currency by increasing the money supply. The interplay between inflation targets, interest rate adjustments, and the resulting impact on the EUR/USD is a complex but crucial relationship for understanding Lagarde's strategy.

- Analyzing the correlation between ECB interest rate changes and EUR/USD fluctuations: Historically, periods of rising interest rates have coincided with a stronger Euro, while periods of low or negative rates have seen the EUR/USD weaken. This correlation is not always perfect, however, as other factors come into play.

- Examining the impact of past quantitative easing programs on the Euro's value: The ECB's QE programs, designed to stimulate the European economy, injected significant liquidity into the market, leading to a period of relative Euro weakness against the US dollar. The effectiveness of these programs in achieving their economic goals while managing currency valuation is a subject of ongoing debate.

- Discussing the potential future implications of ECB monetary policy on EUR/USD: Lagarde's future decisions on interest rates and potential QE tapering will significantly influence the EUR/USD exchange rate. Market participants closely watch her pronouncements for clues about future policy direction, leading to significant volatility in the EUR/USD pair.

Geopolitical Factors and their Influence on the Euro

Global events significantly impact the Euro's value. Geopolitical instability, energy crises, and trade disputes can create uncertainty, affecting investor confidence and the EUR/USD exchange rate. The Eurozone's interconnectedness with the global economy means that external shocks can have a significant impact on its currency.

- Assessing the impact of the ongoing war in Ukraine on the Euro's strength: The war has created significant energy price volatility and economic uncertainty in Europe, negatively impacting the Euro's value against the dollar. This highlights the sensitivity of the Euro to geopolitical risks.

- Analyzing the role of energy prices in driving EUR/USD volatility: Europe's reliance on Russian energy has made it particularly vulnerable to energy price shocks. Fluctuations in energy prices directly impact inflation and economic growth, consequently impacting the EUR/USD exchange rate.

- Examining the influence of EU political stability on the Euro's value: Political stability within the European Union is crucial for maintaining investor confidence. Any perceived weakening of the EU's unity or internal disagreements can negatively affect the Euro's value.

Lagarde's Communication Strategy and Market Sentiment

Lagarde's public statements and communication strategies play a crucial role in shaping market sentiment and influencing the EUR/USD exchange rate. Clear and consistent communication about future monetary policy can boost investor confidence, while ambiguous or conflicting messages can lead to uncertainty and volatility. Her skillful communication is a key element of Lagarde’s strategy to manage expectations and guide market behavior.

- Analyzing the impact of Lagarde's press conferences on EUR/USD movements: Lagarde's press conferences are closely scrutinized by financial markets. Her comments on inflation, interest rates, and the economic outlook can trigger significant movements in the EUR/USD exchange rate.

- Examining the effectiveness of the ECB's forward guidance strategy: The ECB uses forward guidance to manage market expectations. Clear communication about future policy intentions can help to stabilize the EUR/USD and reduce uncertainty. The effectiveness of this strategy depends on the credibility of the ECB's communications.

- Evaluating the role of market expectations in driving EUR/USD fluctuations: Market participants constantly form expectations about future ECB policy. These expectations are incorporated into EUR/USD pricing, making the management of market sentiment a critical aspect of Lagarde’s approach.

Long-Term Outlook for the EUR/USD and the Euro's Global Role

Predicting the long-term outlook for the EUR/USD and the Euro's global role requires considering various factors, including economic growth in the Eurozone, global economic trends, and geopolitical risks. While projecting future exchange rates is inherently uncertain, understanding the key drivers is vital for informed decision-making.

- Predicting potential future scenarios for the EUR/USD exchange rate: Different scenarios might include a stronger Euro driven by robust Eurozone growth and higher interest rates, or a weaker Euro due to persistent geopolitical uncertainty or a global economic slowdown.

- Analyzing the factors that could contribute to long-term Euro strength or weakness: Factors such as the Eurozone's economic performance relative to the US, the level of global risk aversion, and the ECB's success in managing inflation will all impact the Euro's long-term value.

- Assessing the Euro's potential to become a more dominant global currency: The Euro's potential to challenge the US dollar's dominance depends on the Eurozone's continued economic strength, political stability, and the credibility of the ECB's policies.

Conclusion

Lagarde's strategy to elevate the Euro's global influence via EUR/USD involves a complex interplay of monetary policy, geopolitical factors, and effective communication. By carefully managing interest rates, navigating geopolitical challenges, and maintaining transparent communication, the ECB aims to bolster the Euro's value and its role in the global economy. While predicting future EUR/USD movements remains challenging, understanding the factors influencing the exchange rate is crucial for investors and businesses operating in the global market. Continue to monitor the ECB's actions and Lagarde's pronouncements to stay informed about the future of the Euro and its impact on the EUR/USD. Understanding Lagarde’s strategy and its impact on the EUR/USD is key for navigating the complexities of the global financial markets.

Featured Posts

-

Kho Bau Khong Lo 13 Trieu Usd Cua Rau Den Cuoc San Lung Day Cam Go

May 28, 2025

Kho Bau Khong Lo 13 Trieu Usd Cua Rau Den Cuoc San Lung Day Cam Go

May 28, 2025 -

Le Samsung Galaxy S25 Ultra 256 Go Caracteristiques Prix Et Avis

May 28, 2025

Le Samsung Galaxy S25 Ultra 256 Go Caracteristiques Prix Et Avis

May 28, 2025 -

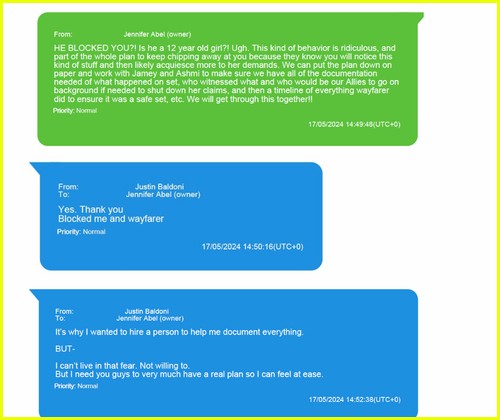

Justin Baldonis Lawyer Responds To Blake Livelys Motion To Dismiss

May 28, 2025

Justin Baldonis Lawyer Responds To Blake Livelys Motion To Dismiss

May 28, 2025 -

Six Run 8th Inning Leads Angels To Victory Against Blue Jays

May 28, 2025

Six Run 8th Inning Leads Angels To Victory Against Blue Jays

May 28, 2025 -

Mitchell Explodes For 43 As Cavaliers Defeat Pacers 126 104 Series Now 2 1

May 28, 2025

Mitchell Explodes For 43 As Cavaliers Defeat Pacers 126 104 Series Now 2 1

May 28, 2025