Land A Private Credit Job: 5 Essential Do's And Don'ts

Table of Contents

Do's: Maximize Your Chances of Landing a Private Credit Job

1. Network Strategically: Build Relationships in Private Credit

Networking is paramount in the private credit space. Actively cultivate relationships to gain insights and open doors.

- Attend industry events: SuperReturn, PEI conferences, and smaller, niche events offer invaluable networking opportunities. These private credit networking events are where you'll meet key players and learn about unadvertised roles.

- Leverage LinkedIn: Connect with professionals at private credit firms. Engage with their posts, join relevant groups, and personalize your connection requests.

- Informational interviews: Prepare targeted questions showcasing your knowledge of private debt and the firm's investment strategy. These conversations can lead to unexpected opportunities.

- Join professional organizations: Organizations focused on alternative investments provide access to networking events and industry insights.

2. Tailor Your Resume and Cover Letter to the Specific Role

Generic applications rarely succeed. Each private credit job application should be meticulously tailored.

- Highlight relevant skills: Emphasize financial modeling, credit analysis, due diligence, and your understanding of credit risk assessment. Showcase experience with private debt instruments.

- Quantify achievements: Instead of simply stating responsibilities, quantify your impact. For example, "Increased portfolio yield by 15% through effective credit underwriting" is far more compelling than "Managed a portfolio of loans."

- Use keywords: Incorporate keywords from the job description into your resume and cover letter. This helps Applicant Tracking Systems (ATS) identify your application as a strong match.

- Customize for each application: Each private credit resume and cover letter should be unique, reflecting the specific requirements and culture of the target firm.

3. Master the Art of the Private Credit Interview

The interview is your chance to shine. Preparation is key to demonstrating your expertise in private credit.

- Practice behavioral questions (STAR method): The STAR method (Situation, Task, Action, Result) helps structure your answers to behavioral questions effectively.

- Demonstrate market understanding: Showcase your knowledge of the private credit market, including current trends, regulatory changes, and different investment strategies within private debt.

- Showcase analytical skills: Be ready to discuss complex financial statements, credit metrics, and your problem-solving abilities in a private credit context.

- Prepare insightful questions: Asking thoughtful questions demonstrates your engagement and interest in the role and the firm.

- Thorough firm research: Demonstrate your understanding of the firm's investment strategy, portfolio, and recent transactions.

4. Highlight Relevant Experience (Even if Indirect)

Even if your background isn't directly in private credit, transferable skills are valuable.

- Showcase transferable skills: Experience in banking, accounting, consulting, or other finance-related fields can translate well into a private credit role. Highlight skills in financial modeling, valuation, and credit risk assessment.

- Emphasize financial statement analysis: Demonstrate a deep understanding of financial statements and key credit metrics used in evaluating potential investments in private debt.

- Connect past experiences: Clearly articulate how your past experiences have prepared you for the demands of a private credit role, emphasizing the transferable skills you've gained.

5. Develop a Strong Understanding of the Private Credit Market

Staying informed about the private credit market is essential for success.

- Stay updated: Follow industry news, market trends, and regulatory changes impacting the private credit space.

- Read industry publications: Private Equity International (PEI), PEI Media, and other specialized publications offer valuable insights.

- Follow key players: Engage with influential figures on LinkedIn and Twitter to stay abreast of current events and perspectives within the private debt market.

- Develop expertise: Focus on specific areas like direct lending, distressed debt, or mezzanine financing to demonstrate specialized knowledge.

Don'ts: Avoid These Common Mistakes When Seeking a Private Credit Job

1. Don't Neglect Networking

Networking is crucial; don't rely solely on online applications.

- Don't rely only on online applications: Networking significantly increases your chances of discovering unadvertised roles and making a personal connection with hiring managers.

- Don't underestimate personal connections: Leverage your existing network and actively build new relationships within the private credit industry.

- Don't be afraid to reach out: Proactively contact people in the field, even if you don't have a direct connection.

2. Don't Submit Generic Applications

Each application should be tailored to the specific firm and role.

- Avoid generic applications: Sending the same materials to multiple firms shows a lack of effort and reduces your chances of success.

- Don't overlook tailoring: Each application must be customized to reflect the specific requirements and culture of the target firm.

- Don't fail to research: Thoroughly research each firm and the specific role before applying.

3. Don't Underprepare for Interviews

Thorough preparation is essential for a successful private credit interview.

- Avoid unpreparedness: Practice your answers to common interview questions and anticipate potential challenges.

- Don't be caught off guard: Prepare for both technical and behavioral questions, and tailor your responses to the specific firm and role.

- Don't forget to ask questions: Prepare insightful questions to demonstrate your interest and engagement.

4. Don't Downplay Your Achievements

Showcase your accomplishments and quantify your impact whenever possible.

- Avoid modesty: Clearly articulate your achievements and contributions in previous roles.

- Don't hesitate to showcase strengths: Highlight your key skills and experiences relevant to a private credit role.

- Quantify achievements: Use numbers and data to demonstrate the impact of your work.

5. Don't Ignore the Importance of Due Diligence

Thoroughly research each firm before applying.

- Avoid applying blindly: Research the firm's investment strategy, portfolio, recent transactions, and team members.

- Don't underestimate understanding the firm's strategy: Demonstrate your understanding of their investment focus and how your skills align with their needs.

- Don't neglect researching the team: Learn about the individuals you might be working with to ensure a good cultural fit.

Conclusion

Securing a private credit job is a challenging but achievable goal. By following these do's and don'ts, and by focusing on strategic networking, tailored applications, interview preparation, and demonstrating a strong understanding of the private credit market, you'll significantly increase your chances of landing your dream private credit job. Don't delay – start building your private credit career today!

Featured Posts

-

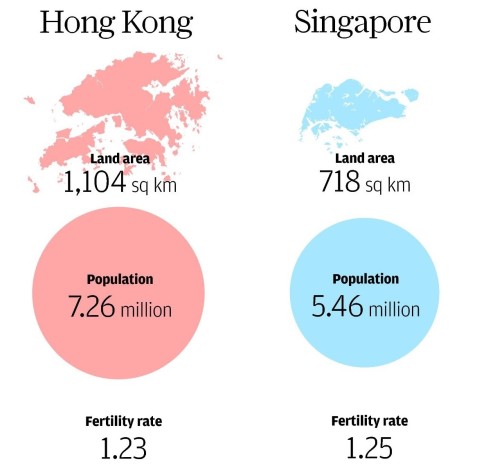

Covid 19 Cases Surge In Hong Kong And Singapore Assessing Indias Risk

May 31, 2025

Covid 19 Cases Surge In Hong Kong And Singapore Assessing Indias Risk

May 31, 2025 -

The Hollywood Strike What It Means For The Film Industry

May 31, 2025

The Hollywood Strike What It Means For The Film Industry

May 31, 2025 -

Unraveling The Mystery Donald Trump And His Overweight Friend

May 31, 2025

Unraveling The Mystery Donald Trump And His Overweight Friend

May 31, 2025 -

Rosemary And Thyme Companion Planting And Pest Control

May 31, 2025

Rosemary And Thyme Companion Planting And Pest Control

May 31, 2025 -

Gym Magnate Duncan Bannatynes Stance On Men In Womens Changing Rooms After Supreme Court Ruling

May 31, 2025

Gym Magnate Duncan Bannatynes Stance On Men In Womens Changing Rooms After Supreme Court Ruling

May 31, 2025