Land Your Dream Private Credit Role: 5 Key Strategies

Table of Contents

Master the Fundamentals of Private Credit

Before you even begin crafting your resume, you need a solid foundation in private credit principles. This involves both theoretical knowledge and practical skills.

Deepen Your Knowledge of Credit Analysis

To succeed in private credit, you must become proficient in credit analysis. This requires a deep understanding of:

- Financial Modeling: Building and interpreting complex financial models to assess a company's financial health and predict future performance.

- Valuation: Mastering various valuation techniques, including discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions.

- Credit Risk Assessment: Accurately assessing the creditworthiness of borrowers and predicting the likelihood of default.

- Financial Statement Analysis: Thoroughly analyzing financial statements (balance sheets, income statements, cash flow statements) to identify key trends and risks.

Consider pursuing relevant certifications like the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst) to enhance your credentials and demonstrate your commitment to the field. Numerous online courses and books are available to bolster your understanding, providing a pathway to becoming a skilled private credit analyst.

Understand Different Private Credit Strategies

The private credit market encompasses a diverse range of strategies. Familiarity with these strategies is crucial for success:

- Direct Lending: Providing loans directly to companies, often bypassing traditional banks.

- Mezzanine Financing: Providing subordinated debt that combines features of debt and equity.

- Distressed Debt: Investing in the debt of financially troubled companies.

- Real Estate Private Credit: Providing financing for real estate projects.

Each strategy has its own unique risks and rewards. Understanding the nuances of each and the current market landscape is vital for making informed investment decisions. A strong grasp of these strategies will set you apart from other candidates vying for private credit jobs.

Craft a Compelling Resume and Cover Letter

Your resume and cover letter are your first impression on potential employers. They must effectively highlight your skills and experience while showcasing your passion for private credit.

Highlight Relevant Experience and Skills

Tailor your resume and cover letter to each specific private credit role. Quantify your achievements whenever possible, focusing on results rather than simply listing responsibilities. Use keywords found in the job descriptions to improve your chances of getting noticed by Applicant Tracking Systems (ATS).

- Example: Instead of saying "Managed a portfolio of assets," say "Managed a $50 million portfolio of assets, resulting in a 15% increase in portfolio value."

Showcase Your Passion for Private Credit

Demonstrate your genuine interest in private credit beyond simply listing it as a career goal.

- Personal Projects: Consider undertaking personal projects related to private credit, such as analyzing a company's financial statements or building a financial model.

- Extracurricular Activities: Join relevant clubs or societies related to finance or alternative investments.

- Strong Personal Brand: Develop a strong professional online presence, showcasing your expertise through LinkedIn, a personal website, or engaging in industry discussions.

Network Strategically Within the Private Credit Industry

Networking is paramount in securing a private credit role. Building relationships within the industry opens doors to unadvertised opportunities and provides invaluable insights.

Attend Industry Events and Conferences

Attend conferences, workshops, and networking events focused on private credit and alternative investments. These events are invaluable for meeting potential employers and learning about industry trends.

- Examples: Search for relevant conferences and industry-specific networking groups online.

Leverage LinkedIn and Other Professional Platforms

Optimize your LinkedIn profile to highlight your skills and experience. Join relevant groups and participate actively in discussions to establish yourself as an expert in the field. Connect with professionals working in private credit and engage with their content.

Ace the Private Credit Interview

The interview is your chance to shine and demonstrate your understanding of private credit principles and your analytical skills.

Prepare for Common Interview Questions

Prepare answers to common private credit interview questions:

- Behavioral Questions: Focus on demonstrating your problem-solving skills, teamwork abilities, and resilience. Use the STAR method (Situation, Task, Action, Result) to structure your responses.

- Technical Questions: Be prepared to discuss financial modeling, valuation techniques, and credit risk assessment.

Showcase Your Analytical and Problem-Solving Skills

Practice case studies and be prepared to demonstrate your analytical abilities during the interview. Explain your thought process clearly and concisely. Showcase your ability to break down complex problems into manageable parts and arrive at well-reasoned conclusions.

Follow Up and Stay Persistent

Even after the interview, your work isn't done. Consistent follow-up and persistent networking can significantly increase your chances of landing your dream role.

Send a Thank-You Note After Each Interview

Send a personalized thank-you note to each interviewer, reiterating your interest and highlighting key aspects of your conversation.

Continue Networking and Building Relationships

Maintain contact with interviewers and recruiters. Continue networking and attending industry events. Landing your dream job in private credit may take time and persistence.

Secure Your Private Credit Dream Job

Landing your dream private credit job requires a multi-faceted approach. Mastering the fundamentals, crafting a compelling application, networking strategically, acing the interview, and following up persistently are all crucial steps. By implementing these five strategies, you’ll significantly increase your chances of success. Start implementing these five strategies today and land your dream private credit role! Check out [link to relevant job boards or resources] for current private credit job openings.

Featured Posts

-

Confirmed Kermit The Frog Addresses University Of Maryland Graduates In 2025

May 23, 2025

Confirmed Kermit The Frog Addresses University Of Maryland Graduates In 2025

May 23, 2025 -

Jonathan Groff And Asexuality An Honest Conversation

May 23, 2025

Jonathan Groff And Asexuality An Honest Conversation

May 23, 2025 -

A Real Pain Kieran Culkins Optreden In Theater Het Kruispunt

May 23, 2025

A Real Pain Kieran Culkins Optreden In Theater Het Kruispunt

May 23, 2025 -

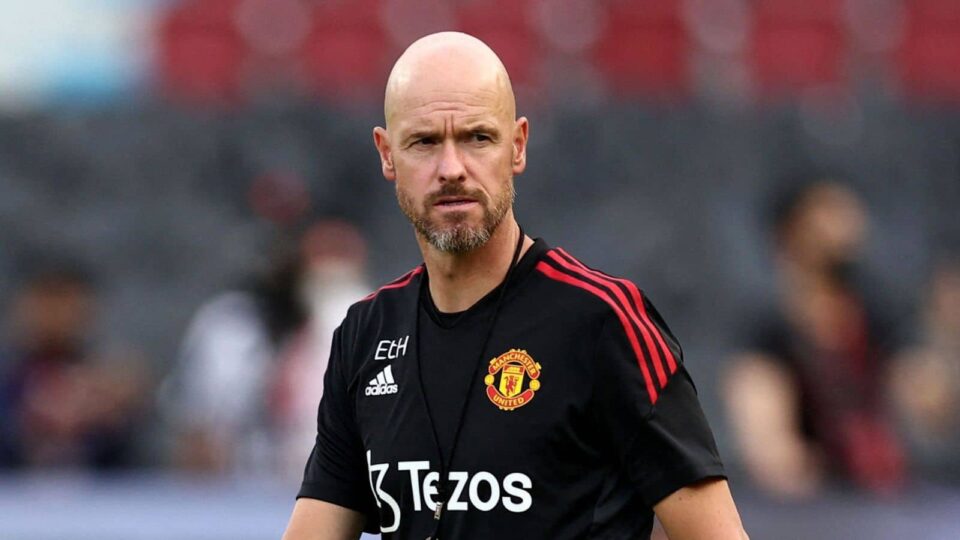

Ten Hag To Leipzig Analyzing The Rumored Transfer Of The Ex Man United Manager

May 23, 2025

Ten Hag To Leipzig Analyzing The Rumored Transfer Of The Ex Man United Manager

May 23, 2025 -

The Last Rodeo Neal Mc Donough On His New Project And The Role Of Faith

May 23, 2025

The Last Rodeo Neal Mc Donough On His New Project And The Role Of Faith

May 23, 2025