Last Week's CoreWeave (CRWV) Stock Rally: A Detailed Look

Table of Contents

Potential Factors Driving the CoreWeave (CRWV) Stock Rally

Several factors likely contributed to the impressive CoreWeave (CRWV) stock rally observed last week. Let's explore these key elements in detail.

Increased Investor Interest in AI and Cloud Computing

The surge in CoreWeave's stock price is inextricably linked to the booming interest in artificial intelligence (AI) and its insatiable demand for advanced cloud computing infrastructure. The rapid advancements in large language models (LLMs) and generative AI have ignited a massive need for high-performance computing (HPC) resources, precisely the area where CoreWeave excels.

- Rising adoption of AI models requiring significant computing power: The growth of AI applications across various industries—from healthcare and finance to entertainment and research—is driving exponential demand for powerful computing resources. This translates directly into increased business for companies like CoreWeave that specialize in providing this critical infrastructure.

- CoreWeave's specialization in high-performance computing for AI workloads: CoreWeave's strategic focus on providing optimized cloud infrastructure specifically designed for AI workloads positions them advantageously within this rapidly expanding market. Their specialized hardware and software solutions cater to the unique needs of AI applications, attracting significant investor attention.

- Positive analyst reports on the future of the AI cloud computing market: Numerous reputable analysts have issued positive reports projecting substantial growth in the AI cloud computing market over the next several years. This positive outlook has infused investor confidence, boosting demand for stocks of leading companies like CoreWeave.

Strong Financial Performance and Growth Projections

While specific financial details may require further investigation from publicly available sources like SEC filings, any strong financial performance reported by CoreWeave likely played a significant role in the stock rally. Positive growth projections further reinforce investor optimism.

- Strong revenue growth in the most recent quarter (if applicable): Solid revenue growth exceeding expectations would naturally attract investor interest and drive up the stock price. This demonstrates the company's ability to capitalize on market opportunities and translate demand into tangible financial results.

- Positive outlook for future revenue growth: A robust and credible forecast for future revenue growth, supported by concrete plans and strategic initiatives, would further bolster investor confidence and fuel the stock price increase. This demonstrates a clear path to sustained growth and long-term profitability.

- Increasing customer base and key partnerships: Expansion of the customer base and the formation of strategic partnerships with major players in the technology industry would be strong indicators of CoreWeave's market position and growth trajectory, influencing investor sentiment positively.

Strategic Partnerships and Market Positioning

CoreWeave's strategic partnerships and its strong market positioning within the cloud computing landscape also likely contributed to the stock surge.

- New partnerships with major technology companies: Strategic alliances with major technology companies could significantly enhance CoreWeave's market reach and credibility, attracting more clients and further solidifying its position as a leading provider of AI-focused cloud infrastructure.

- Strategic acquisitions that strengthen CoreWeave's capabilities: Acquisitions of complementary technologies or companies would broaden CoreWeave's capabilities, enabling them to offer more comprehensive and competitive solutions to their clients, thereby boosting their market share and overall value.

- Successful expansion into new geographic markets: Successful expansion into new markets would indicate CoreWeave's adaptability and global growth potential, creating an attractive investment proposition for investors seeking diversified exposure.

Market Sentiment and Speculative Trading

The broader market sentiment and speculative trading activities also likely influenced the CoreWeave (CRWV) stock rally.

- Overall market conditions during the rally: A generally positive market environment during the period of the rally could have amplified the positive response to CoreWeave’s positive news and increased investor appetite for growth stocks.

- Short squeeze potential: A potential short squeeze, where investors who bet against the stock are forced to buy shares to cover their positions, could artificially inflate the stock price, leading to a rapid and significant increase.

- Impact of social media and news coverage on investor sentiment: Positive news coverage and discussions on social media platforms could have amplified investor enthusiasm, leading to increased buying pressure and pushing the stock price higher.

Conclusion: Assessing the Future of CoreWeave (CRWV) Stock

The CoreWeave (CRWV) stock rally last week appears to be a confluence of several positive factors, primarily driven by the increasing demand for AI-focused cloud computing solutions, strong (potential) financial performance, strategic partnerships, and favorable market conditions. However, investors should approach this rally with a balanced perspective, acknowledging both the potential for continued growth and the inherent risks associated with any investment in the stock market. The sustainability of this rally will depend on CoreWeave's ability to continue delivering on its promises, maintain its competitive edge, and navigate the evolving landscape of the cloud computing and AI industries.

Before making any investment decisions related to CoreWeave (CRWV) stock, we strongly encourage you to conduct thorough due diligence, carefully reviewing CoreWeave's financial statements, industry reports, and independent analyst opinions. Understanding the company’s long-term strategy and its ability to execute its plans is crucial for making informed investment decisions. Further research into CoreWeave's financials and a broader analysis of the cloud computing and AI investment landscape will provide a more complete picture before investing in CoreWeave stock or any other similar investment opportunities.

Featured Posts

-

Senator Graham Urges Strong Us Sanctions Against Russia Over Ukraine Ceasefire

May 22, 2025

Senator Graham Urges Strong Us Sanctions Against Russia Over Ukraine Ceasefire

May 22, 2025 -

Music World Mourns The Loss Of Adam Ramey Dropout Kings Vocalist

May 22, 2025

Music World Mourns The Loss Of Adam Ramey Dropout Kings Vocalist

May 22, 2025 -

Anchor Brewing Companys Closure What Next For San Franciscos Iconic Brewery

May 22, 2025

Anchor Brewing Companys Closure What Next For San Franciscos Iconic Brewery

May 22, 2025 -

Ex Councillors Wife Challenges Racial Hatred Tweet Conviction

May 22, 2025

Ex Councillors Wife Challenges Racial Hatred Tweet Conviction

May 22, 2025 -

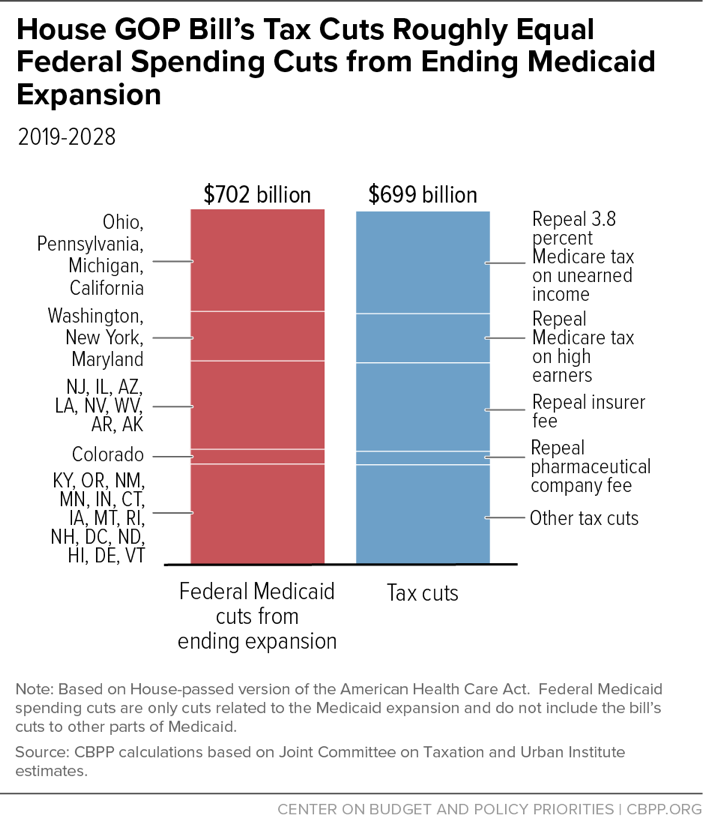

The Future Of Trumps Economic Agenda The Importance Of Gop Support For Tax Cuts

May 22, 2025

The Future Of Trumps Economic Agenda The Importance Of Gop Support For Tax Cuts

May 22, 2025