Leveraged Semiconductor ETFs: A Case Study Of Investor Timing

Table of Contents

Understanding Leveraged Semiconductor ETFs

Definition and Mechanics

Leveraged ETFs, specifically those tracking the semiconductor industry, aim to deliver a multiple (e.g., 2x, 3x) of the daily performance of an underlying index. This means a 2x leveraged ETF aims to return twice the daily percentage change of its benchmark index. However, a crucial aspect is the daily resetting mechanism. This means the leverage is applied daily, not cumulatively over longer periods. This can lead to significant deviations from the intended multiple return over longer time frames, especially in volatile markets.

Types of Leveraged Semiconductor ETFs

Several leveraged semiconductor ETFs exist, offering varying degrees of leverage. You'll find 2x leveraged ETFs (e.g., aiming for double the daily return), 3x leveraged ETFs (aiming for triple the daily return), and even inverse ETFs (aiming for the opposite daily return). Examples include (but aren't limited to) hypothetical ETFs like the "2x Semiconductor Bull ETF" (Ticker: SEMIBULL2X) and a "3x Semiconductor Bear ETF" (Ticker: SEMIBEAR3X). Note: These are hypothetical examples; always research real-world ETFs before investing. Each type carries a distinct risk profile. 3x leveraged ETFs, while offering potentially higher returns, also magnify losses significantly.

Expense Ratios and Fees

Leveraged ETFs generally have higher expense ratios than traditional ETFs. These fees eat into returns, further impacting the overall performance. Carefully compare expense ratios across different leveraged semiconductor ETFs before making a decision. A seemingly small difference in expense ratio can significantly impact your long-term returns.

Analyzing Market Timing Strategies

Long-Term vs. Short-Term Investments

Leveraged semiconductor ETFs are generally not suitable for long-term buy-and-hold strategies due to the daily resetting mechanism and volatility drag (explained in a later section). Their amplified returns and losses make them more appropriate for short-term trading strategies, often within well-defined market windows. Long-term investors should consider alternative investment approaches.

Identifying Market Trends

Successful timing with leveraged semiconductor ETFs requires keen analysis of market trends. Methods include:

- Technical Analysis: Utilizing chart patterns, indicators (RSI, MACD, moving averages), and other technical tools to predict price movements.

- Fundamental Analysis: Examining the financial health and prospects of semiconductor companies, industry growth rates, and technological advancements.

- News Analysis: Monitoring news and events impacting the semiconductor sector (e.g., government regulations, geopolitical factors, supply chain disruptions).

Risk Management Techniques

Even with careful timing, significant risk remains. Essential risk management techniques include:

- Stop-Loss Orders: Automatically selling the ETF if the price falls below a predetermined level, limiting potential losses.

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio, reducing reliance on a single leveraged ETF.

- Position Sizing: Investing only a small percentage of your overall portfolio in leveraged semiconductor ETFs, limiting the impact of potential losses.

Case Study: A Specific Period of Market Volatility

Selection of a Period

Let's analyze the performance of a hypothetical 2x leveraged semiconductor ETF (SEMIBULL2X) during the semiconductor industry downturn in the second half of 2022. This period saw considerable volatility due to factors like increased interest rates and reduced consumer demand.

Performance Analysis

During this period, let's assume the underlying semiconductor index dropped by 20%. A non-leveraged ETF tracking this index would have experienced a similar 20% loss. However, the SEMIBULL2X ETF, with its 2x leverage, would have experienced a significantly greater loss, potentially exceeding 40%. This highlights the magnified impact of downward trends.

Lessons Learned

This case study clearly illustrates that while leveraged ETFs can amplify profits during market upswings, they also dramatically amplify losses during downturns. Accurate market timing is absolutely crucial for success. Poor timing can lead to substantial losses that outweigh any potential gains.

The Impact of Volatility on Leveraged Semiconductor ETFs

Volatility Drag

Volatility drag is the phenomenon where daily price fluctuations erode the returns of a leveraged ETF over time, especially during periods of high volatility. This is particularly relevant to long-term holdings of leveraged ETFs.

Compounding Effects

The daily resetting of leverage leads to compounding effects. Small daily gains can compound into significant profits, but equally, small daily losses can compound into substantial losses over time. This makes accurate prediction crucial.

Hedging Strategies

Hedging strategies, such as using options or inverse ETFs, can help mitigate some of the risk associated with volatility in leveraged semiconductor ETFs, but they introduce their own complexities.

Conclusion

Investing in leveraged semiconductor ETFs is a high-risk, high-reward endeavor. Our case study emphasized the critical role of accurate market timing. Poor timing can lead to severe losses, easily outweighing any potential gains. The daily resetting mechanism, volatility drag, and compounding effects must be thoroughly understood. Before investing in leveraged semiconductor ETFs, conduct thorough research and consider consulting with a financial advisor to determine if this investment strategy aligns with your risk tolerance and financial goals. Careful consideration of investor timing is paramount to success when utilizing leveraged semiconductor ETFs.

Featured Posts

-

Gotovnost Velikobritanii K Obsuzhdeniyu Soglasheniya O Bezopasnosti S Es

May 13, 2025

Gotovnost Velikobritanii K Obsuzhdeniyu Soglasheniya O Bezopasnosti S Es

May 13, 2025 -

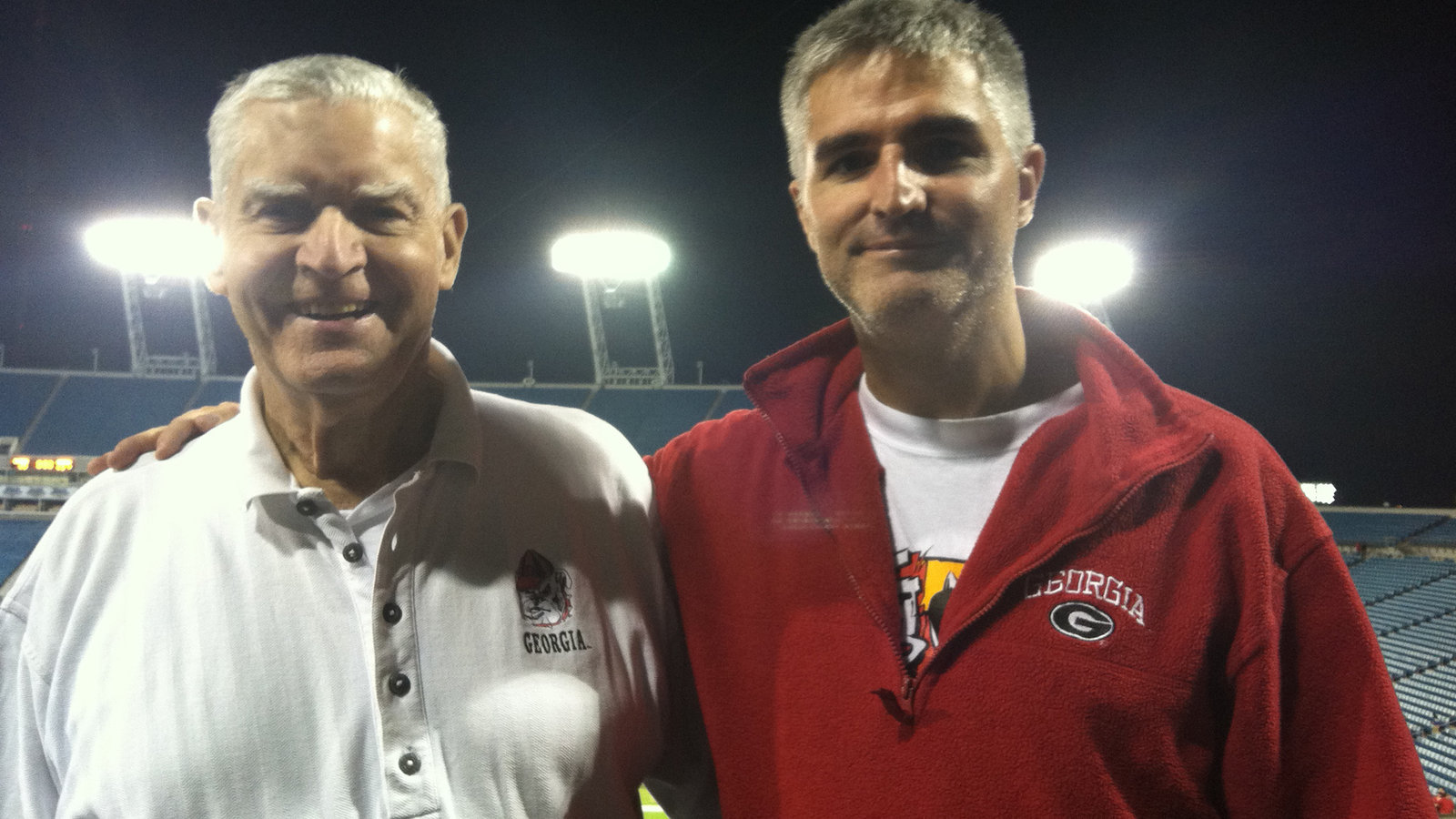

Cp Music Productions A Father Son Legacy In Music

May 13, 2025

Cp Music Productions A Father Son Legacy In Music

May 13, 2025 -

Unending Nightmare Gaza Hostages Families Face Ongoing Hardship

May 13, 2025

Unending Nightmare Gaza Hostages Families Face Ongoing Hardship

May 13, 2025 -

Worcester Ice Arrest Crowd Intervention Leads To Chaos

May 13, 2025

Worcester Ice Arrest Crowd Intervention Leads To Chaos

May 13, 2025 -

A Csillagaszati Gazsik Kora Leonardo Di Caprio Es A Mozik Joevoje

May 13, 2025

A Csillagaszati Gazsik Kora Leonardo Di Caprio Es A Mozik Joevoje

May 13, 2025