Lion Electric Acquisition: Investors Submit New Offer

Table of Contents

Details of the New Offer for Lion Electric

While the specifics of the offer are still emerging (and confidentiality agreements may limit immediate public disclosure), reports indicate a significant offer from [Insert Offeror Name if known, otherwise use "an undisclosed party"]. The reported offer amount is [Insert Offer Amount if known, otherwise use "substantial and significantly higher than previous bids," or similar phrasing]. The terms and conditions are likely to include [Insert Payment Method if known, e.g., "a combination of cash and stock,"] with a proposed timeline of [Insert Timeline if known, otherwise use "completion expected within the next [number] months," or similar phrasing].

- Key Financial Details: The exact financial structure remains unclear, but analysts speculate it involves [insert speculated financial details, e.g., a significant premium per share, etc.].

- Synergies: The potential synergies between the offeror and Lion Electric are considerable, potentially leading to [insert speculated synergies, e.g., expanded market reach, access to new technologies, increased production capacity].

- Conditions Precedent: The successful completion of the acquisition is likely contingent upon [insert speculated conditions, e.g., regulatory approvals, shareholder approval].

Analysis of the New Offer's Impact on Lion Electric's Stock

The new Lion Electric acquisition offer is expected to significantly impact the company's stock price. The initial market reaction was [insert observed market reaction, e.g., a sharp increase in share price]. This new offer represents a [insert comparison, e.g., substantial premium] compared to previous bids. This could lead to a revaluation of Lion Electric, potentially pushing its market capitalization [insert speculated direction of change, e.g., significantly higher].

- Short-Term & Long-Term Effects: Short-term, volatility is expected as investors react to the news. Long-term, the outcome of the acquisition will be the primary driver of the stock price.

- Investor Sentiment: Investor sentiment is likely to be positive, given the higher offer, but uncertainty remains until a definitive outcome is reached.

- Industry Benchmarks: Compared to competitors in the EV sector, Lion Electric’s valuation, depending on the acquisition's success, may align more closely with industry benchmarks.

Potential Outcomes of the Lion Electric Acquisition Battle

The new offer dramatically alters the landscape of the Lion Electric acquisition. Several scenarios are now possible:

- Successful Acquisition: The new offeror successfully acquires Lion Electric, leading to [insert potential consequences, e.g., integration of operations, potential job changes, restructuring].

- Counter-Offer: Another party might submit a counter-offer, potentially escalating the bidding war and further driving up Lion Electric's valuation.

- Rejection of All Offers: Lion Electric’s board might reject all offers, allowing the company to continue independent operations. This scenario is less likely given the current higher offer.

- Negotiated Settlement: A revised offer, possibly incorporating elements from competing bids, may emerge through negotiation.

Expert Opinions and Market Speculation on the Lion Electric Acquisition

Industry analysts are closely watching this developing Lion Electric acquisition. [Insert Quote from Analyst 1] This highlights the considerable interest in Lion Electric's future and the potential for significant growth in the EV sector. [Insert Quote from Analyst 2, offering a contrasting or supporting perspective].

- Fairness of the Offer: Opinions on the offer's fairness are divided, with some arguing it represents a significant undervaluation while others see it as a fair price reflecting market conditions.

- Future Performance Forecasts: Market forecasts for Lion Electric's future performance are positive, largely driven by growth projections within the EV market.

- Competitive Landscape Impact: The successful acquisition could significantly reshape the competitive landscape of the EV industry, potentially leading to [insert speculated consequences, e.g., consolidation, increased competition].

Conclusion: The Future of the Lion Electric Acquisition Remains Uncertain

The new offer for Lion Electric significantly impacts the company’s future, presenting several potential scenarios with implications for investors and the broader EV industry. The outcome remains uncertain, depending on counter-offers, negotiations, and regulatory approvals. Keeping a close eye on developments is crucial. To stay updated on the Lion Electric acquisition and its potential implications, subscribe to financial news sources, follow Lion Electric's official announcements, and share your thoughts and predictions in the comments section below. What do you think the future holds for the Lion Electric Acquisition?

Featured Posts

-

The Judd Family An Intimate Docuseries

May 14, 2025

The Judd Family An Intimate Docuseries

May 14, 2025 -

Dean Huijsens Next Move Arsenal And Chelsea Lead The Chase

May 14, 2025

Dean Huijsens Next Move Arsenal And Chelsea Lead The Chase

May 14, 2025 -

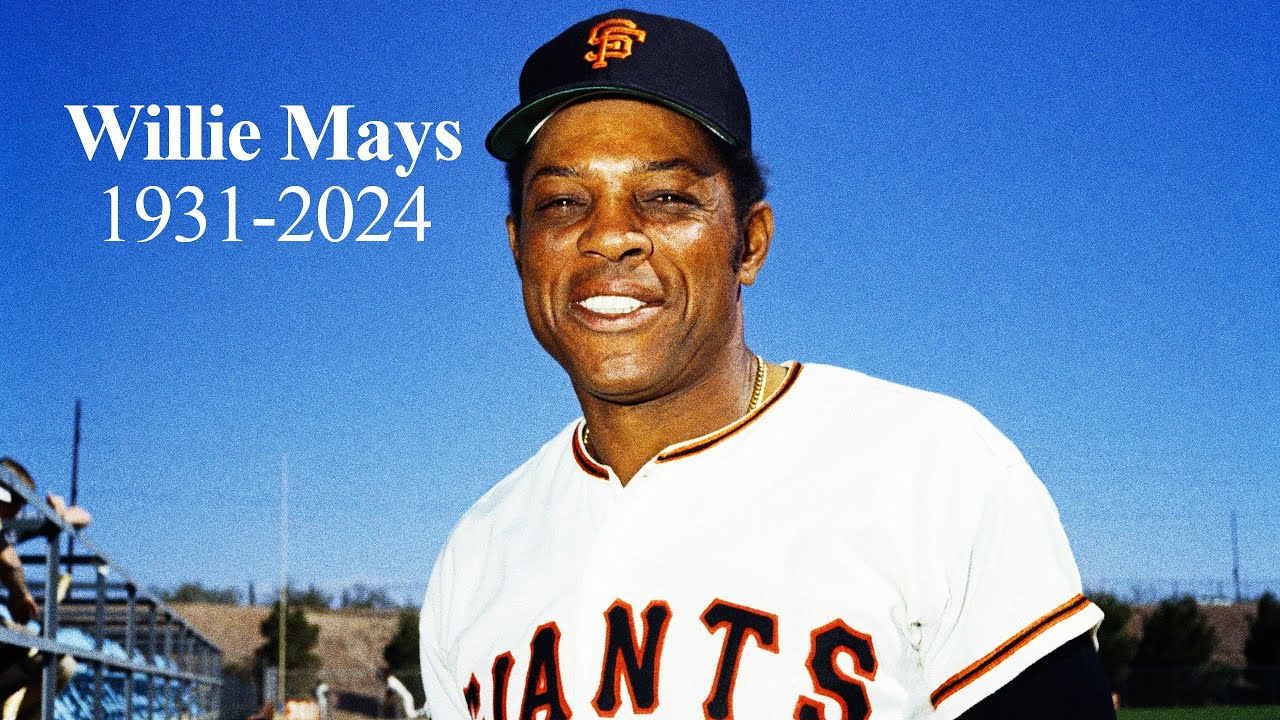

Remembering A Giants Legend His Impact Today

May 14, 2025

Remembering A Giants Legend His Impact Today

May 14, 2025 -

Jetzt Buchen Direkte Bahnverbindungen Von Oschatz In Die Saechsische Schweiz

May 14, 2025

Jetzt Buchen Direkte Bahnverbindungen Von Oschatz In Die Saechsische Schweiz

May 14, 2025 -

Judd Sisters Docuseries Raw And Honest Family Portraits

May 14, 2025

Judd Sisters Docuseries Raw And Honest Family Portraits

May 14, 2025