Lion Electric's Future Uncertain: Monitor Recommends Liquidation

Table of Contents

Financial Difficulties at Lion Electric

Lion Electric's current predicament stems from a confluence of significant financial challenges. The company's struggles underscore the difficulties faced by even innovative companies navigating the competitive and capital-intensive EV landscape.

Mounting Debt and Cash Flow Problems

Lion Electric has been grappling with substantial debt and persistent cash flow problems. This has severely hampered its ability to fund operations, meet its financial obligations, and invest in future growth.

- High levels of debt compared to revenue: The company's debt-to-revenue ratio has been consistently high, indicating a precarious financial position. This high debt burden limits its financial flexibility and increases its vulnerability to economic downturns.

- Consistent losses reported in recent financial statements: Repeated losses have eroded investor confidence and made it increasingly difficult to attract further investment. These losses point to a fundamental issue in the company's operational efficiency and market strategy.

- Difficulty securing additional funding: Lion Electric's struggles have made it challenging to secure necessary funding from investors or lenders, further exacerbating its financial constraints. This lack of access to capital has hindered its ability to invest in research and development, production, and marketing.

- Delays in production and delivery schedules: Production delays and missed delivery targets have damaged the company's reputation and contributed to declining sales. These delays have resulted in lost revenue and customer dissatisfaction.

Weak Sales and Market Competition

Alongside its financial woes, Lion Electric has also faced significant challenges in achieving its projected sales targets. Intense competition within the rapidly expanding EV market has added considerable pressure.

- Competition from established automotive manufacturers: Lion Electric faces fierce competition from established automotive giants with deep pockets and extensive distribution networks. These established players possess significant advantages in terms of brand recognition, economies of scale, and access to capital.

- Price pressures impacting profitability: The competitive landscape has led to significant price pressure, squeezing profit margins and making it difficult for Lion Electric to achieve profitability. This pressure makes it increasingly difficult to compete on price while maintaining adequate profit margins.

- Challenges in scaling production to meet demand: Despite demand for electric vehicles, Lion Electric has struggled to scale its production capacity efficiently to meet the growing demand. This inability to scale effectively has limited the company's ability to capitalize on market opportunities.

- Concerns about the long-term viability of its business model: The combination of these factors has raised serious concerns about the long-term sustainability of Lion Electric's current business model. A fundamental reassessment of its strategy may be necessary for survival.

The Monitor's Recommendation for Lion Electric Liquidation

The financial monitor's recommendation for Lion Electric liquidation underscores the gravity of the company's situation. It reflects a thorough assessment of the company's financial health and the lack of viable alternatives.

Reasons Behind the Recommendation

The recommendation for liquidation stems from Lion Electric's persistent inability to overcome its financial difficulties and secure a sustainable path to profitability.

- Unsuccessful attempts at restructuring: Previous attempts to restructure the company's operations and finances have proven unsuccessful, indicating the depth of the problems. These failures suggest that fundamental changes are required.

- Lack of viable alternative solutions: The monitor has concluded that no other viable solutions exist to address the company's financial challenges. This indicates the severity of the situation and the limited options available.

- Assessment of the company's assets and liabilities: A comprehensive assessment of Lion Electric's assets and liabilities likely revealed an unsustainable imbalance, making liquidation the most appropriate course of action. This assessment would have taken into account the value of the company's assets and the amount of its liabilities.

- Doubt about the ability to repay creditors: The monitor's assessment likely concluded that there is little chance of Lion Electric repaying its creditors, leading to the recommendation for liquidation. This would protect the interests of creditors as much as possible.

Potential Impact on Creditors and Investors

A Lion Electric liquidation would have significant repercussions for its creditors and investors. The potential financial losses could be substantial.

- Loss of invested capital for shareholders: Shareholders would likely experience a significant loss of their invested capital. The value of Lion Electric's stock is expected to decline significantly.

- Potential for significant debt write-offs for creditors: Creditors might experience significant losses as they are unlikely to recover the full amount of their outstanding loans. This would negatively affect the financial health of these creditors.

- Uncertainty regarding the recovery of assets: The recovery of assets during liquidation is uncertain, and creditors and investors may not recover a significant portion of their investments. The sale of assets might fetch less than their book value.

- Impact on employee jobs and the broader EV industry: Liquidation would result in job losses for Lion Electric employees and could have broader implications for the EV industry, particularly for smaller players. This would contribute to uncertainty and decreased confidence in the sector.

Alternative Scenarios and Future Outlook

While Lion Electric liquidation is a strong possibility, alternative scenarios remain theoretically possible, although they appear increasingly unlikely given the current circumstances.

Potential for Restructuring or Acquisition

Restructuring or acquisition could offer alternatives to liquidation, but these paths present significant hurdles.

- Challenges in finding a suitable buyer or investor: The current financial state of Lion Electric makes it difficult to attract a buyer or investor willing to invest the necessary capital. Potential buyers would demand significant concessions.

- Negotiations with creditors to restructure debt: Successful debt restructuring requires negotiations with creditors, which could be challenging given the extent of Lion Electric's debt. Creditors may be unwilling to accept significant losses.

- Need for a significant injection of capital: Even with restructuring, a substantial injection of capital would be needed to stabilize the company's finances and fund future operations. This funding may be difficult to secure.

- Uncertain timeline for any potential outcome: The timeline for any alternative scenarios is highly uncertain, and it may take considerable time to negotiate with creditors and potential investors. This uncertainty adds further pressure to the situation.

Conclusion

The recommendation for Lion Electric liquidation represents a critical juncture with potentially profound consequences. The company's financial struggles exemplify the considerable challenges faced by even innovative businesses in the competitive EV market. While alternative scenarios like restructuring or acquisition remain technically possible, their likelihood appears slim. The prospect of Lion Electric liquidation underscores the importance of continuous monitoring of the situation and a thorough understanding of the ramifications for investors and stakeholders. Staying informed about developments concerning Lion Electric liquidation is crucial. Keep abreast of the latest news and financial reports to navigate the uncertainty surrounding this significant player in the electric vehicle industry.

Featured Posts

-

Nba Playoffs Cavaliers Earn 1 Seed

May 07, 2025

Nba Playoffs Cavaliers Earn 1 Seed

May 07, 2025 -

Chicago Bulls Vs Cleveland Cavaliers Cavaliers Win By 22 Points

May 07, 2025

Chicago Bulls Vs Cleveland Cavaliers Cavaliers Win By 22 Points

May 07, 2025 -

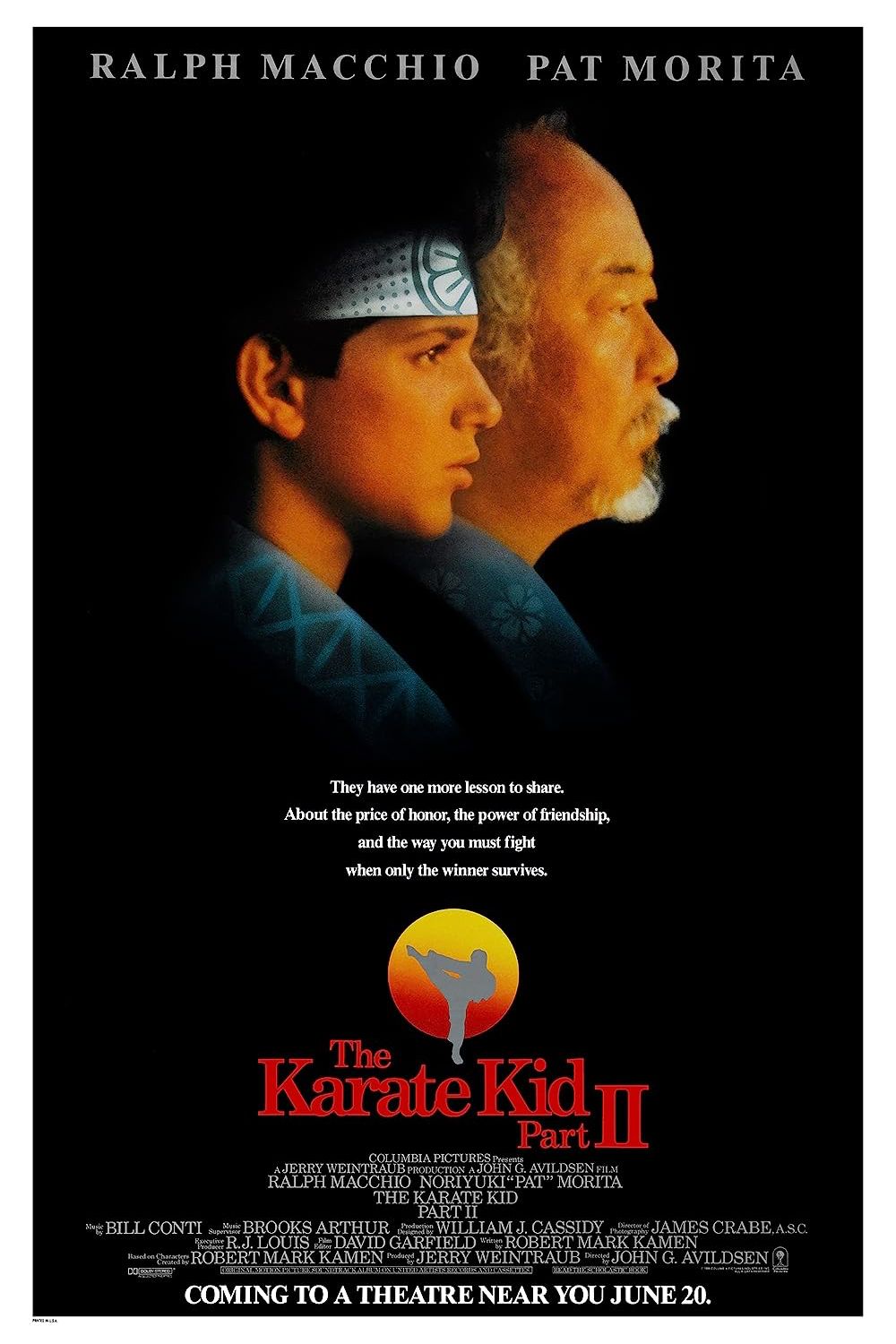

The Karate Kid Part Ii A Deeper Dive Into Daniels Journey

May 07, 2025

The Karate Kid Part Ii A Deeper Dive Into Daniels Journey

May 07, 2025 -

Jenna Ortega Es A Szineszno Aki Inspiralta Ot

May 07, 2025

Jenna Ortega Es A Szineszno Aki Inspiralta Ot

May 07, 2025 -

Lotto Winning Numbers For Wednesday April 16 2025

May 07, 2025

Lotto Winning Numbers For Wednesday April 16 2025

May 07, 2025