Live Music Stocks Surge Pre-Market Monday Following A Volatile Week

Table of Contents

Factors Contributing to the Surge in Live Music Stocks

Several key factors are driving the upward trend in live music stock prices. The post-pandemic recovery is proving stronger than many anticipated, leading to a surge in both concert attendance and positive financial reports from key players. Easing COVID-19 restrictions have further boosted investor confidence.

Increased Concert Attendance and Ticket Sales

The demand for live music experiences is booming. The post-pandemic rebound has exceeded many initial forecasts, creating a perfect storm for positive stock performance.

- Strong post-pandemic rebound in concert attendance exceeding expectations. Venues across the globe are reporting near-capacity crowds, exceeding pre-pandemic levels in many cases.

- Higher-than-anticipated ticket sales for major tours and festivals. Mega-tours and popular festivals are selling out rapidly, indicating robust consumer demand and willingness to spend on live entertainment.

- Data from ticketing platforms showing robust demand for live music experiences. Ticketing giants like Ticketmaster are reporting record sales, further solidifying the narrative of a thriving live music market.

- Successful implementation of new ticketing strategies and technologies. Improved online ticketing systems and dynamic pricing models are contributing to increased revenue and efficiency.

Positive Financial Reports from Key Players

Several major live music companies have recently released positive quarterly earnings reports, bolstering investor confidence in the sector's recovery and long-term potential.

- Several major live music companies released positive Q[Quarter] earnings reports. These reports showcase impressive financial performance, exceeding expectations in many instances.

- Reports show increased revenue, higher profit margins, and strong future projections. This positive data paints a picture of a resilient and growing industry.

- Analysis of financial reports indicates investor confidence in the sector's recovery. The positive financial performance is a key driver of the surge in live music stock prices.

- Mention specific companies and their performance (e.g., Live Nation, AEG Presents). Live Nation Entertainment (LYV), for example, reported significantly higher revenue compared to the same quarter last year, exceeding analyst expectations. AEG Presents, while privately held, is also showing signs of strong recovery, impacting the overall market sentiment.

Easing of COVID-19 Restrictions and Reduced Uncertainty

The global easing of COVID-19 restrictions is a major catalyst for the resurgence of the live music industry and a significant factor influencing live music stocks.

- Continued easing of pandemic-related restrictions globally. Many countries have lifted or relaxed capacity limits and social distancing measures, allowing for larger concerts and events.

- Reduced concerns about concert cancellations and postponements. With reduced pandemic-related uncertainty, investors are more confident in the stability of the industry's future.

- Increased consumer confidence in attending large-scale events. Consumers are increasingly comfortable attending large gatherings, boosting ticket sales and venue occupancy.

- Positive impact of successful vaccination campaigns and decreasing infection rates. High vaccination rates and declining infection numbers contribute to a safer and more appealing environment for live music events.

Analysis of Individual Live Music Stock Performance

The surge in pre-market trading affects various companies within the live music industry. Let's examine some key players:

Live Nation Entertainment (LYV)

Live Nation Entertainment (LYV), a global leader in live entertainment, is a key indicator of the overall health of the live music stock market.

- Percentage change in pre-market trading. LYV experienced a significant percentage increase in pre-market trading on Monday, reflecting the broader upward trend in live music stocks.

- Key factors driving LYV's performance. The factors discussed above, including increased concert attendance and positive financial reports, are key drivers of LYV's strong performance.

- Analyst predictions and ratings for LYV stock. Many analysts have upgraded their ratings for LYV stock, reflecting the positive outlook for the company and the broader live music industry.

Other Key Players

While Live Nation is a major player, other significant live music stocks are also experiencing gains. These include companies involved in venue management, ticketing, and artist management. Their performances will vary based on their specific business models and geographical focus. Monitoring their performance provides a more comprehensive view of the live music stock market’s health.

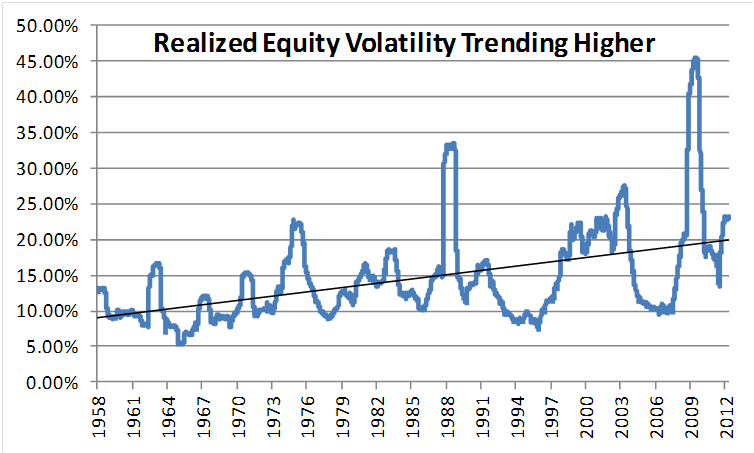

Potential Risks and Future Outlook for Live Music Stocks

Despite the positive pre-market surge, investors should acknowledge potential risks that could impact the future performance of live music stocks.

Inflationary Pressures and Economic Uncertainty

Rising inflation and economic uncertainty pose potential challenges for the live music industry.

- Discussion on the impact of rising inflation on ticket prices and consumer spending. Inflation could force ticket price increases, potentially affecting consumer demand and attendance.

- Analysis of economic indicators and their potential influence on live music demand. Recessions or economic downturns could impact discretionary spending on entertainment, affecting ticket sales.

- Potential for decreased attendance due to economic downturn. Economic uncertainty could lead consumers to prioritize essential spending over entertainment, resulting in lower attendance at live music events.

Geopolitical Factors and Supply Chain Issues

Global events and supply chain disruptions can also affect the industry's stability.

- Assessment of the impact of global events on the live music industry. Geopolitical instability or unforeseen global events can disrupt tours and festivals, impacting revenue and investor confidence.

- Challenges related to supply chain disruptions affecting tour logistics. Supply chain issues can impact the availability of equipment, transportation, and other essential resources needed for live events.

- Potential for future disruptions and their implications for the sector. Investors need to remain vigilant about potential disruptions and their impact on the live music industry's long-term growth.

Conclusion

The surge in live music stocks pre-market Monday offers a glimmer of optimism for the industry after a week of volatility. Positive financial results, strong concert attendance, and easing restrictions all contribute to this positive trend. However, investors should remain aware of potential risks, including inflation and geopolitical factors. While the future is uncertain, the current pre-market activity suggests a potential recovery and renewed confidence in the live music sector. Stay tuned for further updates on the performance of live music stocks and continue to monitor the market for informed investment decisions. Understanding the dynamics of the live music stock market is crucial for making smart investment choices.

Featured Posts

-

Guillermo Del Toro Praises Popular Shooters World Building

May 30, 2025

Guillermo Del Toro Praises Popular Shooters World Building

May 30, 2025 -

Kawasaki W175 Cafe Gaya Retro Klasik Dengan Teknologi Modern

May 30, 2025

Kawasaki W175 Cafe Gaya Retro Klasik Dengan Teknologi Modern

May 30, 2025 -

Ufc Heavyweight Title Fight Pimblett Predicts The Winner

May 30, 2025

Ufc Heavyweight Title Fight Pimblett Predicts The Winner

May 30, 2025 -

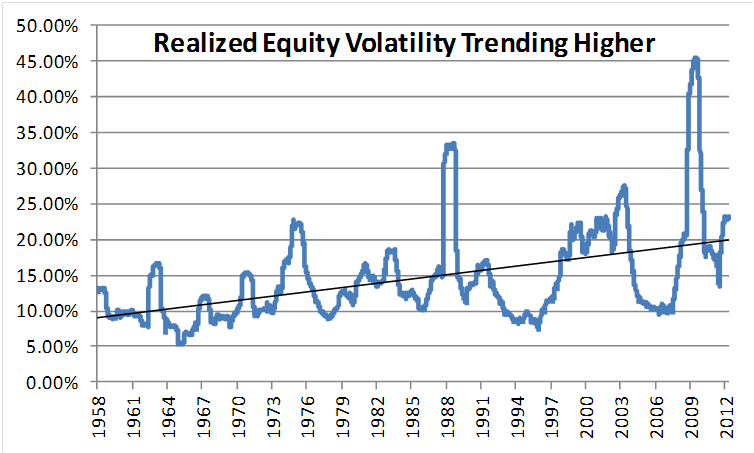

Glastonbury Ticket Resale How Much Will They Cost

May 30, 2025

Glastonbury Ticket Resale How Much Will They Cost

May 30, 2025 -

Chantier A69 Sud Ouest Un Recours De L Etat Pour Debloquer La Situation

May 30, 2025

Chantier A69 Sud Ouest Un Recours De L Etat Pour Debloquer La Situation

May 30, 2025