Live Stock Market Updates: Gold At Record High, Dow Futures React To Tariffs And Fed Policy

Table of Contents

Gold Reaches Record High: Safe Haven Demand Surges

Gold prices have recently experienced a dramatic surge, reaching a record high of $2,000 per troy ounce (replace with actual current data). This significant increase reflects a surge in safe-haven demand, driven by several interconnected global factors. Investors are seeking refuge from escalating geopolitical uncertainties and anxieties surrounding inflation.

-

Geopolitical instability driving safe-haven demand. Rising tensions in various regions of the world contribute to investor apprehension, increasing the appeal of gold as a traditional safe haven asset. Uncertainty surrounding international relations and potential conflicts significantly impacts market stability.

-

Inflationary pressures eroding purchasing power of fiat currencies. Persistent inflation erodes the value of traditional currencies, prompting investors to seek assets that retain their value, like gold. The rising cost of living and concerns about the long-term stability of fiat currencies are key drivers of gold's appeal.

-

Weakening US dollar boosts gold's appeal to international investors. A weaker US dollar makes gold more affordable for international investors, increasing demand and driving up prices. The dollar's relative strength or weakness significantly impacts the price of gold, which is typically priced in USD.

-

Increased investment in gold ETFs and physical gold. The rise in gold prices is further fueled by increased investment in gold exchange-traded funds (ETFs) and physical gold purchases, demonstrating strong investor confidence in gold as a hedge against market volatility. This increase in both institutional and individual investment signifies a broader shift towards gold as a portfolio diversification strategy.

Dow Futures Respond to New Tariffs and Trade Tensions

New tariffs and escalating trade tensions have cast a shadow over global markets, impacting investor sentiment and influencing the performance of the Dow futures. These trade disputes create uncertainty, impacting businesses' ability to plan and potentially leading to slower economic growth.

-

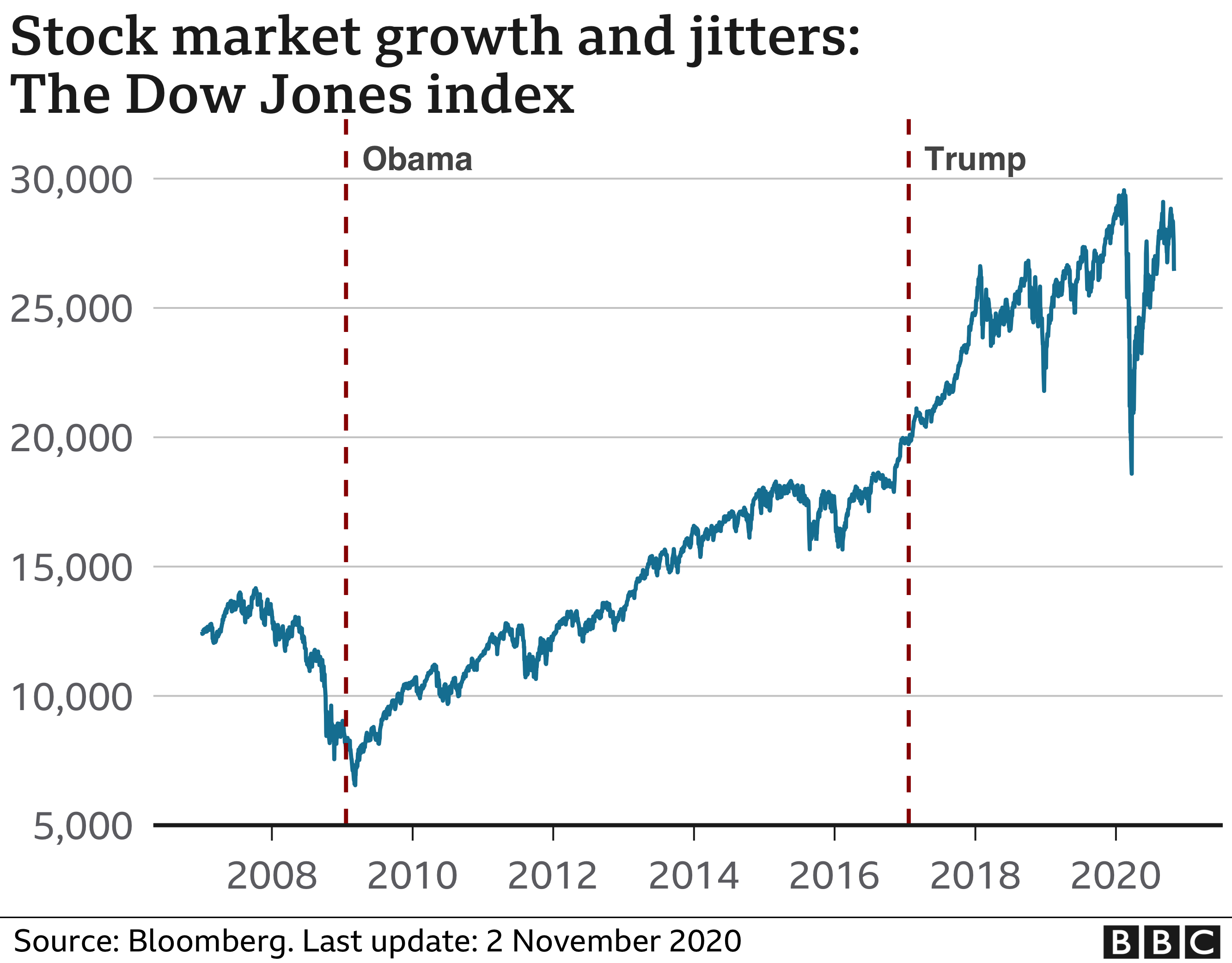

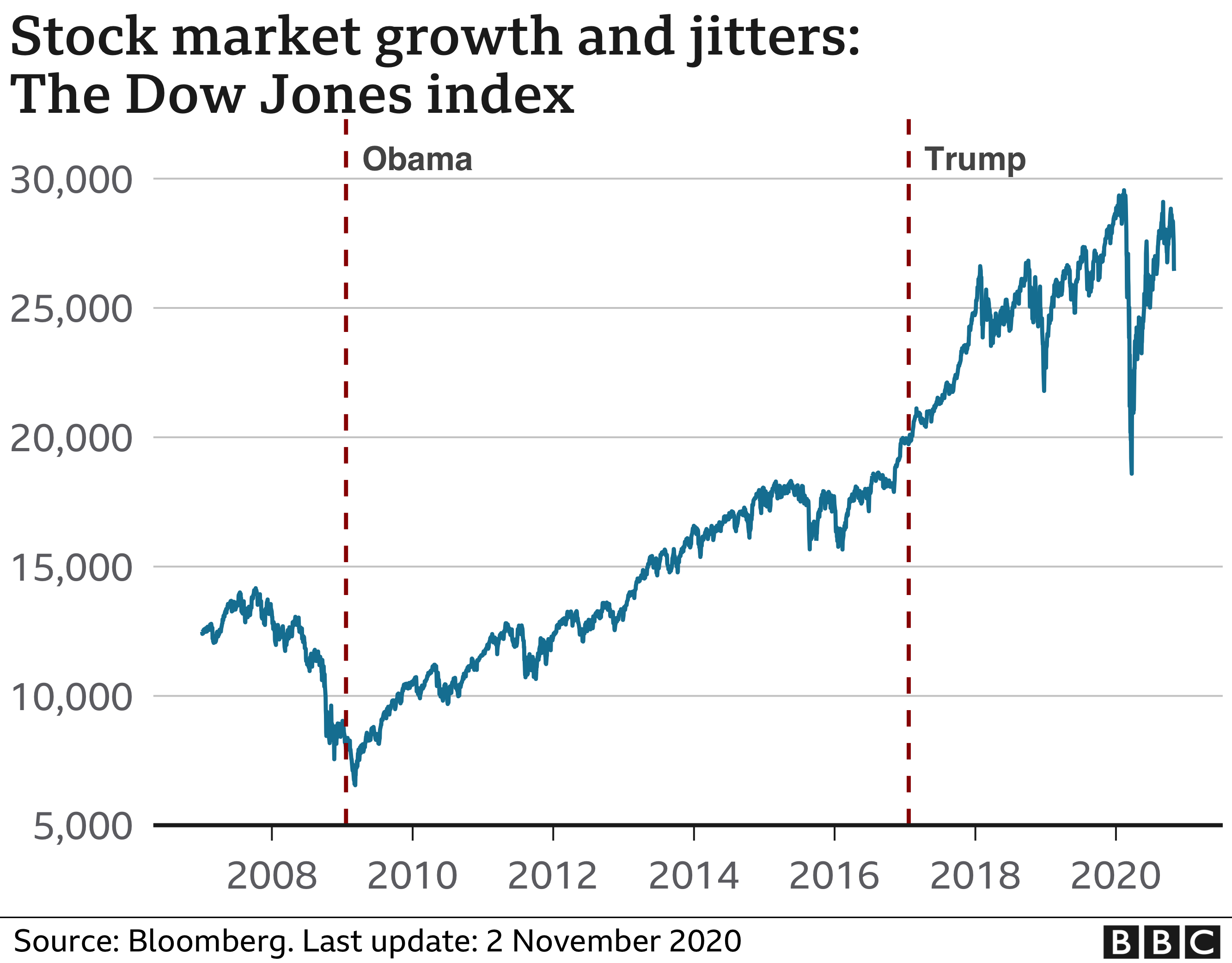

Dow Jones Industrial Average futures trading reflects investor sentiment towards tariffs. The Dow futures, a key indicator of market sentiment, are highly sensitive to trade policy developments. Negative news concerning tariffs often results in decreased futures prices, reflecting investor concerns.

-

Impact of tariffs on specific sectors (e.g., technology, manufacturing). Specific sectors, particularly technology and manufacturing, are disproportionately affected by new tariffs, leading to supply chain disruptions and increased costs. The sensitivity of different sectors varies greatly depending on their level of global trade integration.

-

Uncertainty surrounding trade negotiations impacting market volatility. The ongoing uncertainty surrounding trade negotiations amplifies market volatility, making it challenging for investors to predict market direction with any certainty. This uncertainty often results in increased market fluctuations and heightened risk aversion.

-

Potential for further market corrections depending on trade developments. Depending on the outcome of ongoing trade negotiations, further market corrections remain a possibility. Positive developments could lead to a market rebound, but negative developments could trigger further declines.

Federal Reserve Policy and its Influence on Market Sentiment

The Federal Reserve's monetary policy plays a pivotal role in shaping market sentiment and influencing the direction of stock prices, bond yields, and the dollar's value. Decisions concerning interest rates and quantitative easing (QE) have wide-reaching consequences.

-

Fed's interest rate decisions and their impact on borrowing costs. The Fed's interest rate decisions directly impact borrowing costs for businesses and consumers. Higher interest rates typically slow economic growth, while lower rates stimulate borrowing and investment.

-

Effect of quantitative easing (or lack thereof) on liquidity in the market. QE programs, where the Fed injects liquidity into the market by purchasing assets, influence market liquidity and can impact inflation. The ending or continuation of QE can heavily influence investor behavior and market trends.

-

The dollar's strength and weakness in relation to Fed policy. Fed policy significantly influences the strength of the US dollar. A stronger dollar can negatively impact US exports, while a weaker dollar can boost exports.

-

How investor expectations of future Fed actions shape market behavior. Investor expectations about future Fed actions play a significant role in shaping market behavior. Anticipation of future interest rate hikes or changes in QE can lead to market volatility and influence investment strategies.

Analyzing the Interplay of Gold, Dow Futures, and Fed Policy

These three market forces are deeply interconnected. For example, rising gold prices often reflect a lack of confidence in fiat currencies, potentially influencing the Fed's decisions on interest rates and QE. Conversely, the Fed's actions can impact the dollar's value, influencing gold's price and investor sentiment towards the Dow. Historically, periods of high inflation, often accompanied by a weakening dollar, have seen increased demand for gold as a hedge against inflation, while concurrently putting downward pressure on equity markets.

Conclusion

Today's live stock market updates highlight a complex interplay between gold prices, Dow futures, and Federal Reserve policy. The record-high gold prices reflect a flight to safety amid global uncertainty, while Dow futures react to the ongoing impact of tariffs and trade tensions. The Federal Reserve's actions continue to shape investor sentiment and market direction. Staying informed on these intertwined factors is crucial for navigating the current market environment. To stay up-to-date on the latest live stock market updates and make informed investment decisions, subscribe to our newsletter and receive daily market analysis. Don't miss out on crucial insights into the ever-changing world of live stock market updates.

Featured Posts

-

Burky El Doblete Que Le Dio La Victoria A Rayadas

Apr 23, 2025

Burky El Doblete Que Le Dio La Victoria A Rayadas

Apr 23, 2025 -

Yankees Cortes Dominates Reds Pitches Shutout Inning

Apr 23, 2025

Yankees Cortes Dominates Reds Pitches Shutout Inning

Apr 23, 2025 -

Ser Aldhhb Alywm Alathnyn 17 Fbrayr 2025 Sbykt 10 Jramat

Apr 23, 2025

Ser Aldhhb Alywm Alathnyn 17 Fbrayr 2025 Sbykt 10 Jramat

Apr 23, 2025 -

Lg C3 77 Inch Oled Tv Pros Cons And My Experience

Apr 23, 2025

Lg C3 77 Inch Oled Tv Pros Cons And My Experience

Apr 23, 2025 -

Guemueshane Okullar Tatil Mi 24 Subat Pazartesi Son Dakika Okul Durumu

Apr 23, 2025

Guemueshane Okullar Tatil Mi 24 Subat Pazartesi Son Dakika Okul Durumu

Apr 23, 2025