Live Stock Market Updates: Tracking The Dow And Key Earnings Reports

Table of Contents

Understanding the Dow Jones Industrial Average (DJIA)

What is the Dow?

The Dow Jones Industrial Average, or simply the Dow, is a price-weighted average of 30 large, publicly traded companies in the United States. It's one of the most widely followed stock market indices globally, providing a snapshot of the overall health of the US economy. Understanding its movements is crucial for any investor. The index's components are carefully selected to represent various sectors of the economy, from technology giants like Apple and Microsoft to industrial powerhouses like Boeing and Caterpillar. The Dow's calculation involves summing the prices of the 30 component stocks and dividing by a divisor (a number adjusted periodically to account for stock splits and other corporate actions).

Tracking the Dow in Real-Time

Monitoring the Dow's performance requires access to real-time data. Several methods can help you stay informed:

- Reputable Financial Websites: Websites like Yahoo Finance, Google Finance, and Bloomberg provide live updates, charts, and historical data for the Dow.

- Dedicated Stock Market Tracking Apps: Many mobile apps, including those from Robinhood, Fidelity, and TD Ameritrade, offer real-time Dow tracking alongside other market data and investment tools.

- Brokerage Platforms: If you use an online brokerage account, your platform likely provides live stock market updates, including the Dow, alongside your portfolio information.

Interpreting Dow Movements

Analyzing Dow fluctuations requires understanding the interplay of various factors:

- Economic News: Positive economic indicators like strong GDP growth or low unemployment generally correlate with a rising Dow. Conversely, negative economic news can lead to declines.

- Geopolitical Events: Global events such as political instability or international conflicts significantly influence market sentiment and Dow performance.

- Sector-Specific Trends: Strong performance in certain sectors (e.g., technology) can boost the Dow, while weakness in others can drag it down.

Positive Dow movements usually signal investor optimism and potential portfolio growth. Conversely, negative movements can indicate risk aversion and potential losses. Technical analysis indicators, such as moving averages and relative strength index (RSI), can provide further insights into potential trends, although they should be used in conjunction with fundamental analysis.

Analyzing Key Earnings Reports

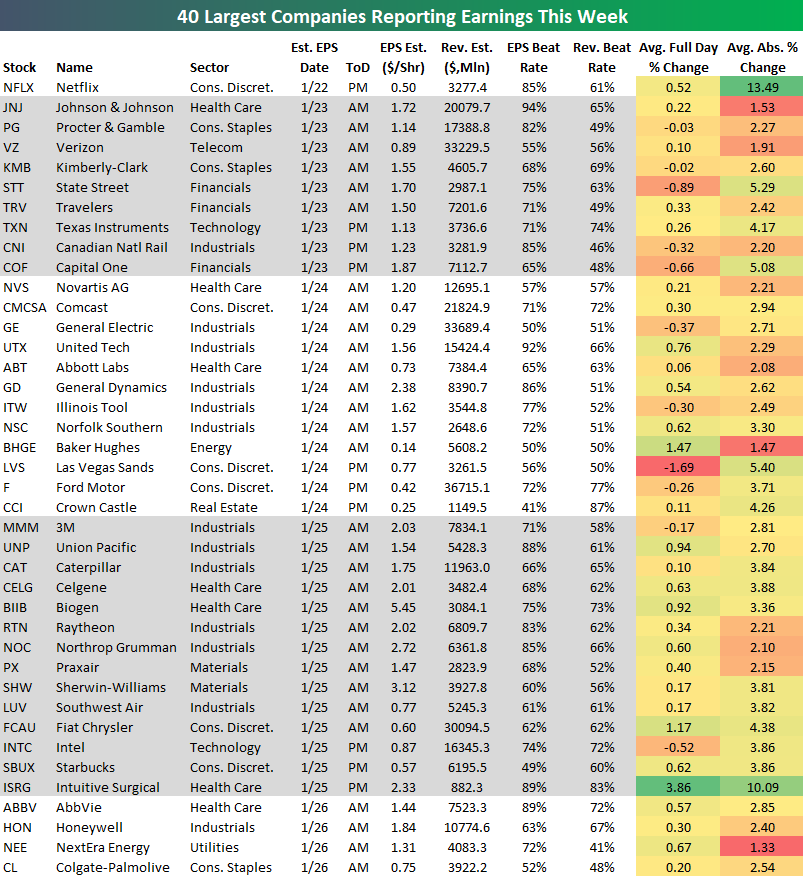

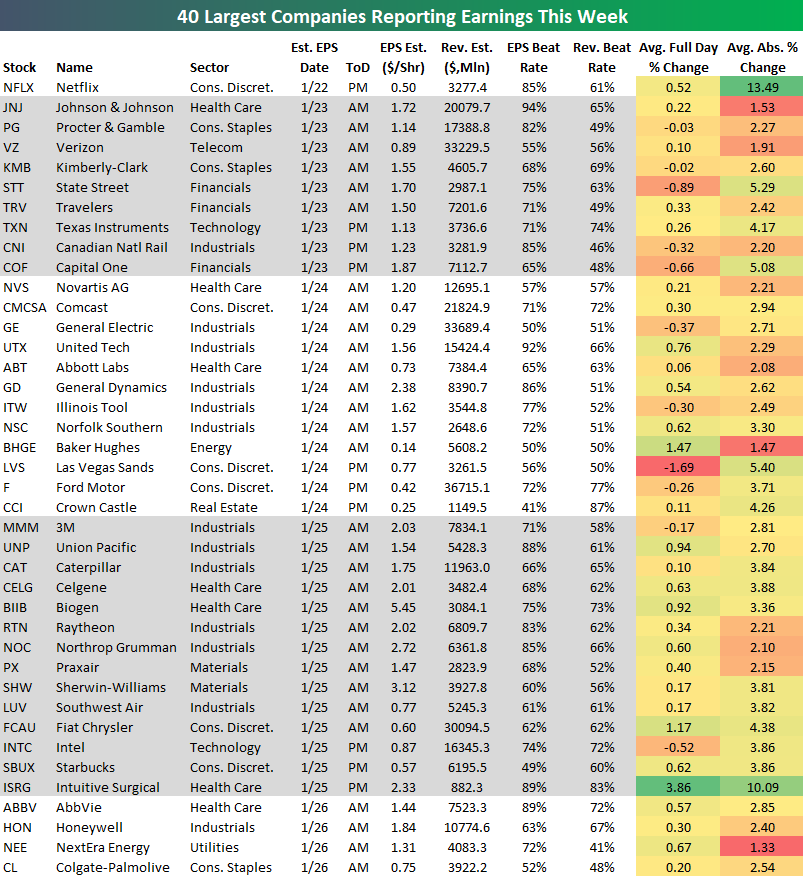

Identifying Key Earnings Announcements

Finding upcoming earnings reports is straightforward using various resources:

- Financial News Websites: Major financial news outlets publish earnings calendars and regularly update their coverage of upcoming announcements.

- Company Investor Relations Websites: Most publicly traded companies have investor relations sections on their websites, detailing upcoming earnings releases and past reports.

- Dedicated Financial Calendars: Several websites and apps specialize in providing comprehensive earnings calendars, allowing you to filter by sector, date, and company.

Understanding Earnings Report Components

Earnings reports contain vital information for investors:

- Earnings Per Share (EPS): This metric shows a company's profitability on a per-share basis, a key indicator of financial health.

- Revenue: Total revenue generated by the company during the reporting period provides insights into sales growth and overall business performance.

- Guidance: Management's future projections provide clues about the company's expected performance in the coming quarters.

- Key Performance Indicators (KPIs): Industry-specific KPIs provide further insights into operational efficiency and other relevant aspects of the business.

Interpreting Earnings Reports and Their Impact on Stock Prices

Evaluating earnings reports involves comparing actual results against expectations:

- Beating Expectations: Exceeding projected EPS and revenue often leads to positive stock price movements, as investors reward exceeding expectations.

- Missing Expectations: Failing to meet expectations typically results in negative stock price reactions, as investors may lose confidence.

Remember, the broader market context is crucial. A strong earnings report might not result in significant price appreciation if the overall market is experiencing a downturn.

Resources for Earnings Report Analysis

Several resources assist in analyzing earnings reports:

- Financial News Outlets: Reputable news organizations provide detailed analyses of earnings reports, offering expert opinions and market context.

- Analyst Reports: Financial analysts from investment banks and research firms publish in-depth reports with forecasts and valuations.

- Investor Relations Presentations: Companies often provide presentations alongside their earnings releases, offering management's perspective on the results.

Combining Dow Tracking and Earnings Analysis for Informed Decisions

Correlation Between Dow and Earnings

Individual company performance and the overall Dow are intertwined. Strong earnings reports from major Dow components can positively impact the index's overall performance, while weak earnings can contribute to declines.

Developing a Strategy

A successful investment strategy incorporates both live stock market updates and in-depth earnings report analysis. Regularly monitoring the Dow provides a sense of the overall market sentiment, while analyzing individual earnings reports helps assess the prospects of specific companies.

Risk Management

Diversification is crucial. Don't put all your eggs in one basket. Spread your investments across different asset classes and sectors to mitigate risk. Understand your risk tolerance before making any investment decisions based on live stock market updates.

Conclusion

Staying informed about live stock market updates, particularly the Dow and key earnings reports, is paramount for successful investing. By utilizing the resources and strategies outlined above, you can develop a more comprehensive understanding of market movements and make informed decisions. Remember to actively monitor live stock market updates regularly, interpret the data critically, and manage risk effectively. Consider subscribing to a reputable financial newsletter or following a respected financial analyst for continuous updates and insights. Take control of your financial future with consistent monitoring of live stock market updates!

Featured Posts

-

Quick Shrimp Ramen Stir Fry Recipe With Noodles

May 01, 2025

Quick Shrimp Ramen Stir Fry Recipe With Noodles

May 01, 2025 -

Kort Geding Kampen Vs Enexis Duurzame School Zonder Stroom

May 01, 2025

Kort Geding Kampen Vs Enexis Duurzame School Zonder Stroom

May 01, 2025 -

Lich Thi Dau Vong Chung Ket Thaco Cup 2025 Thoi Gian Va Noi Xem Truc Tiep

May 01, 2025

Lich Thi Dau Vong Chung Ket Thaco Cup 2025 Thoi Gian Va Noi Xem Truc Tiep

May 01, 2025 -

The Worst Food For Your Health Doctor Says Its Worse Than Smoking

May 01, 2025

The Worst Food For Your Health Doctor Says Its Worse Than Smoking

May 01, 2025 -

1 Billion Investment Merck Expands Us Production Of Blockbuster Drug

May 01, 2025

1 Billion Investment Merck Expands Us Production Of Blockbuster Drug

May 01, 2025