Live Stock Market Updates: Trump's China Tariffs And UK Trade Deal

Table of Contents

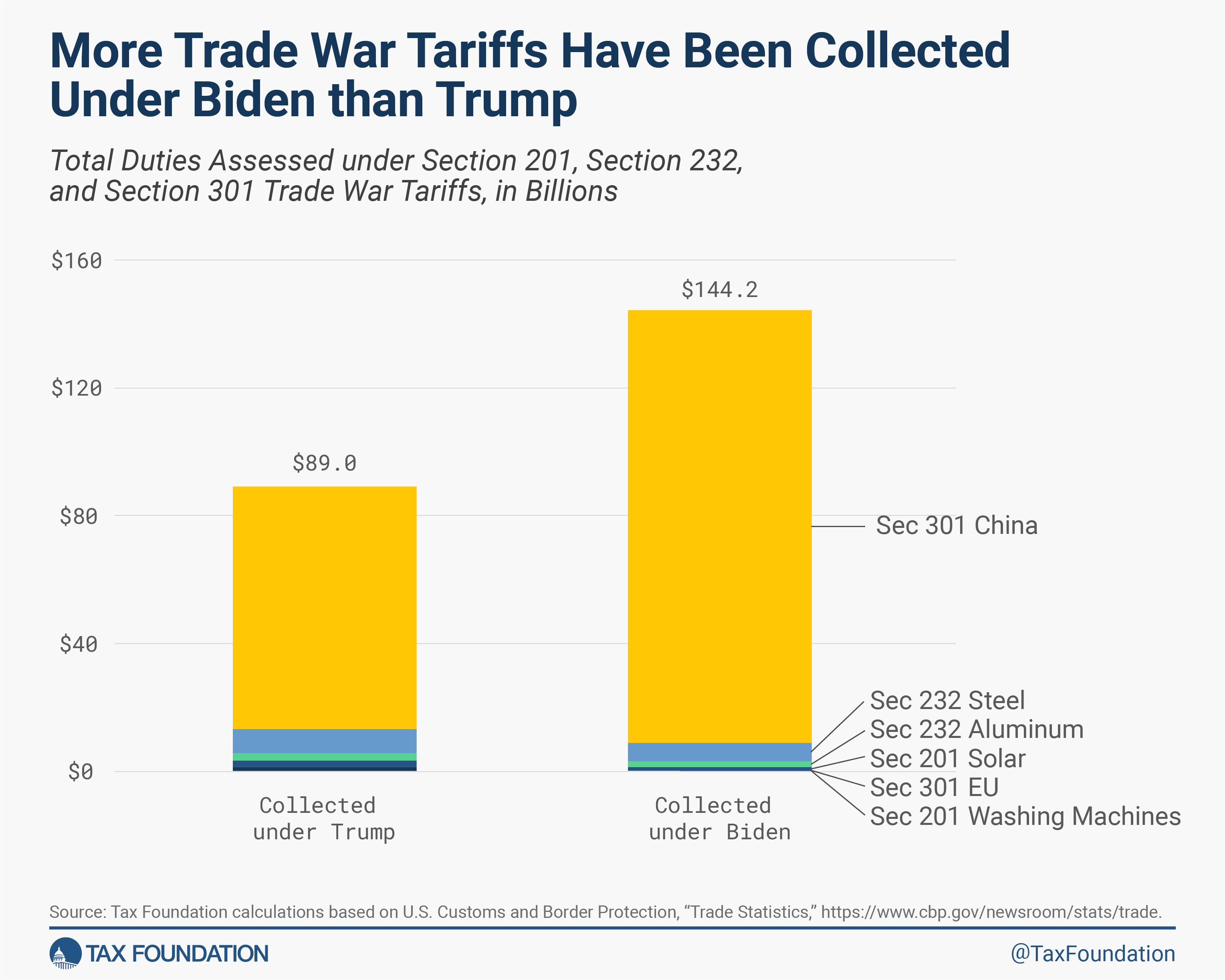

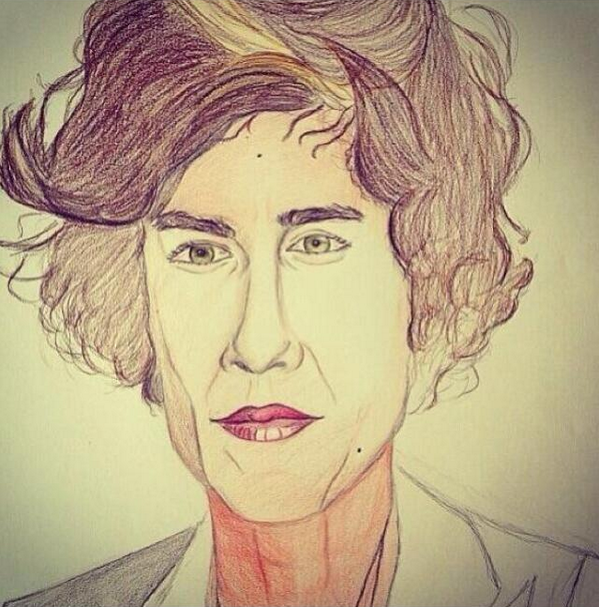

Trump's China Tariffs: A Lingering Shadow on Global Trade

Trump's imposition of tariffs on Chinese goods initiated a trade war that significantly impacted global trade and the stock market. While the initial intensity has subsided, the lingering effects continue to influence market sentiment and create uncertainty. Keywords: China Tariffs, Trade War, US-China Relations, Tariff Impact, Stock Market Reaction

-

Long-Term Consequences on Supply Chains: The tariffs disrupted established supply chains, forcing companies to re-evaluate sourcing strategies and leading to increased costs and logistical complexities. This uncertainty continues to affect business investment decisions and overall economic growth.

-

Disproportionate Sectoral Impact: Certain sectors, such as technology and agriculture, were disproportionately affected by the tariffs. The technology sector faced restrictions on the import and export of crucial components, while farmers experienced reduced demand for their products in the Chinese market.

-

Current State of US-China Trade Relations: While a formal trade war may have ended, tensions remain between the US and China on various fronts. The future trajectory of US-China relations will significantly impact global trade and stock market stability. Any escalation of trade disputes could trigger renewed market volatility.

-

Impact on Inflation and Consumer Spending: The tariffs contributed to increased prices for consumers, impacting purchasing power and potentially slowing economic growth. This inflationary pressure adds another layer of complexity for investors to consider when making investment decisions.

The UK Trade Deal: Navigating a New Economic Landscape

The UK's departure from the European Union and the subsequent trade deal have created a new economic landscape with both opportunities and challenges. Keywords: UK Trade Deal, Brexit, Post-Brexit Trade, EU Trade, Global Market Access, Economic Uncertainty

-

Benefits and Drawbacks of New Trade Agreements: The UK has secured new trade agreements with several countries, but these agreements may not fully compensate for the loss of frictionless trade with the EU. Some sectors have gained access to new markets, while others face increased trade barriers and bureaucratic hurdles.

-

Challenges Faced by UK Businesses: UK businesses now face increased administrative burdens, customs checks, and potential tariff costs when trading with the EU. This has added to operational costs and reduced competitiveness for some businesses.

-

Impact on UK Economic Growth: Brexit and the associated trade complexities have undoubtedly contributed to uncertainty and slowed economic growth in the UK. The long-term economic impact remains a subject of debate and ongoing analysis.

-

Implications for Investors in UK and EU Markets: Investors need to carefully assess the risks and opportunities presented by the evolving trade landscape between the UK and the EU. Diversification and a thorough understanding of the specific sectors affected are crucial for effective investment strategies.

Investment Strategies in a Volatile Market

The combined effects of Trump's China tariffs and the UK's post-Brexit trade deal create a volatile market environment. Investors need robust strategies to mitigate risk and potentially benefit from opportunities. Keywords: Investment Strategies, Risk Management, Diversification, Portfolio Management, Market Volatility, Stock Market Investment

-

Diversification: Diversification across asset classes, geographies, and sectors is crucial to reduce exposure to specific risks associated with geopolitical events. A well-diversified portfolio can withstand market shocks more effectively.

-

Risk Management: Investors should implement rigorous risk management techniques, including setting stop-loss orders and regularly reviewing their portfolio's risk profile. Understanding the correlation between different asset classes is essential for effective risk management.

-

Asset Class Considerations: Investors may consider allocating a portion of their portfolio to defensive assets, such as government bonds, during periods of heightened market uncertainty. Alternatively, opportunities might arise in sectors less impacted by the specific geopolitical risks discussed.

-

Long-Term Investment Strategy: A long-term investment strategy that is not overly reactive to short-term market fluctuations is essential for success in a volatile market. Consistent rebalancing and adherence to a well-defined investment plan are key to navigating uncertainty.

Conclusion

This analysis of live stock market updates demonstrates that the ongoing effects of Trump’s China tariffs and the UK’s post-Brexit trade deal continue to shape the global investment landscape. Understanding these complexities is crucial for making informed investment decisions. The lingering impact on supply chains, inflation, and economic growth necessitates a proactive and adaptable approach to portfolio management.

Call to Action: Stay informed on the latest live stock market updates and adapt your investment strategy accordingly. Regularly monitor developments in US-China trade relations and the evolution of the UK's post-Brexit trade agreements to effectively navigate this volatile environment and maximize your returns. Follow our blog for more in-depth live stock market updates and expert analysis.

Featured Posts

-

Snls Failed Harry Styles Impression His Disappointed Reaction

May 10, 2025

Snls Failed Harry Styles Impression His Disappointed Reaction

May 10, 2025 -

Snls Bad Harry Styles Impression The Singers Response

May 10, 2025

Snls Bad Harry Styles Impression The Singers Response

May 10, 2025 -

Uk Tightens Visa Rules Overstay Concerns Prompt Stricter Measures For Nigerians

May 10, 2025

Uk Tightens Visa Rules Overstay Concerns Prompt Stricter Measures For Nigerians

May 10, 2025 -

Jazz Cash And K Trade Making Stock Trading Accessible To All

May 10, 2025

Jazz Cash And K Trade Making Stock Trading Accessible To All

May 10, 2025 -

5 Hour Stephen King Binge The Best Short Series To Watch Now

May 10, 2025

5 Hour Stephen King Binge The Best Short Series To Watch Now

May 10, 2025