Losses On Frankfurt Stock Exchange: DAX Closes Near 24,000

Table of Contents

Key Factors Contributing to DAX Losses

Several interconnected factors contributed to the substantial DAX losses observed today. Understanding these elements is crucial for investors seeking to navigate the current market volatility.

Global Economic Uncertainty

Global economic uncertainty is a primary driver of the current DAX losses. High inflation rates in many major economies, coupled with aggressive interest rate hikes by central banks to combat inflation, are dampening economic growth and impacting investor sentiment. This global market volatility is directly impacting the DAX.

- Inflationary Pressures: Persistent high inflation erodes purchasing power and increases the cost of doing business, negatively impacting corporate profits and investor confidence. Recent inflation data releases, exceeding expectations in several key economies, fueled further concerns.

- Rising Interest Rates: Central banks' efforts to curb inflation through interest rate hikes increase borrowing costs for businesses and consumers, potentially slowing economic activity and impacting corporate investment. The impact of these interest rate hikes on the DAX is significant.

- Geopolitical Instability: Ongoing geopolitical tensions, including the war in Ukraine and escalating trade disputes, contribute to global uncertainty and risk aversion among investors.

Performance of Specific Sectors

The decline in the DAX is not uniform across all sectors. Some sectors experienced more significant losses than others, reflecting specific industry challenges.

- Technology Stock Losses: The technology sector, particularly sensitive to interest rate changes, witnessed substantial losses. Higher borrowing costs make it more expensive for tech companies to fund expansion and innovation, impacting their valuations.

- Energy Sector Downturn: Fluctuations in energy prices, influenced by geopolitical events and supply chain disruptions, led to significant volatility in the energy sector, contributing to the overall DAX decline.

- Automotive Sector Weakness: Supply chain bottlenecks and reduced consumer demand due to economic uncertainty weighed heavily on the automotive sector, resulting in considerable losses for automotive companies listed on the DAX.

Impact of Geopolitical Events

Geopolitical events play a significant role in shaping investor sentiment and driving market volatility. The ongoing war in Ukraine and associated sanctions continue to impact global supply chains and fuel inflation, creating uncertainty for businesses and investors. Trade tensions between major economies also contribute to this negative sentiment.

- Ukraine Conflict Impact: The ongoing conflict in Ukraine continues to disrupt energy markets and supply chains, increasing input costs for many businesses and fueling inflationary pressures. This uncertainty significantly impacts investor confidence in the DAX.

- Trade War Concerns: Rising trade protectionism and trade disputes between major economic powers create uncertainty and hinder global trade, further impacting business confidence and negatively influencing the DAX.

Investor Reactions and Market Sentiment

The DAX losses have led to significant shifts in investor behavior and market sentiment. Risk aversion is high, with investors moving towards safer assets like government bonds.

- Increased Market Volatility: The DAX experienced increased volatility, reflecting the uncertainty and shifting investor sentiment.

- Decline in Trading Volumes: Trading volumes have seen a decline as investors adopt a wait-and-see approach, monitoring the unfolding economic and geopolitical landscape.

- Flight to Safety: Investors are seeking refuge in safer assets, leading to increased demand for government bonds and a decrease in riskier investments. This is a clear indicator of negative market sentiment.

Potential Implications and Future Outlook for the DAX

The current DAX losses have significant implications for the short-term and long-term outlook. Several scenarios are possible.

- Continued Decline: If global economic uncertainty persists and geopolitical tensions escalate, further declines in the DAX are possible.

- Market Recovery: However, if inflation begins to cool, central banks adopt a more accommodative monetary policy, and geopolitical risks ease, a market recovery is possible.

- Consolidation: A period of consolidation, where the DAX fluctuates within a relatively narrow range, is also a plausible scenario. This would depend on the evolution of several macroeconomic and geopolitical factors.

Conclusion

The significant DAX losses reflect a confluence of factors including global economic uncertainty, sector-specific challenges, and ongoing geopolitical instability. Investor reactions indicate a high degree of risk aversion, with a flight to safety observable in the markets. The future outlook for the DAX remains uncertain, depending on the resolution of these underlying issues. Staying informed about ongoing developments is crucial.

Call to Action: Stay informed about the ongoing developments affecting the DAX and its constituent companies. Monitor news and analysis related to DAX losses to make informed investment decisions. Consider diversifying your portfolio to mitigate risks associated with DAX fluctuations. Regularly review your investment strategy in light of these DAX losses to adapt to changing market conditions. Understanding DAX losses and their implications is vital for effective investment management.

Featured Posts

-

French Lawmakers Push For Dreyfus Promotion A Century After The Scandal

May 24, 2025

French Lawmakers Push For Dreyfus Promotion A Century After The Scandal

May 24, 2025 -

Free Agent Kyle Walker Peters Crystal Palace Interest Confirmed

May 24, 2025

Free Agent Kyle Walker Peters Crystal Palace Interest Confirmed

May 24, 2025 -

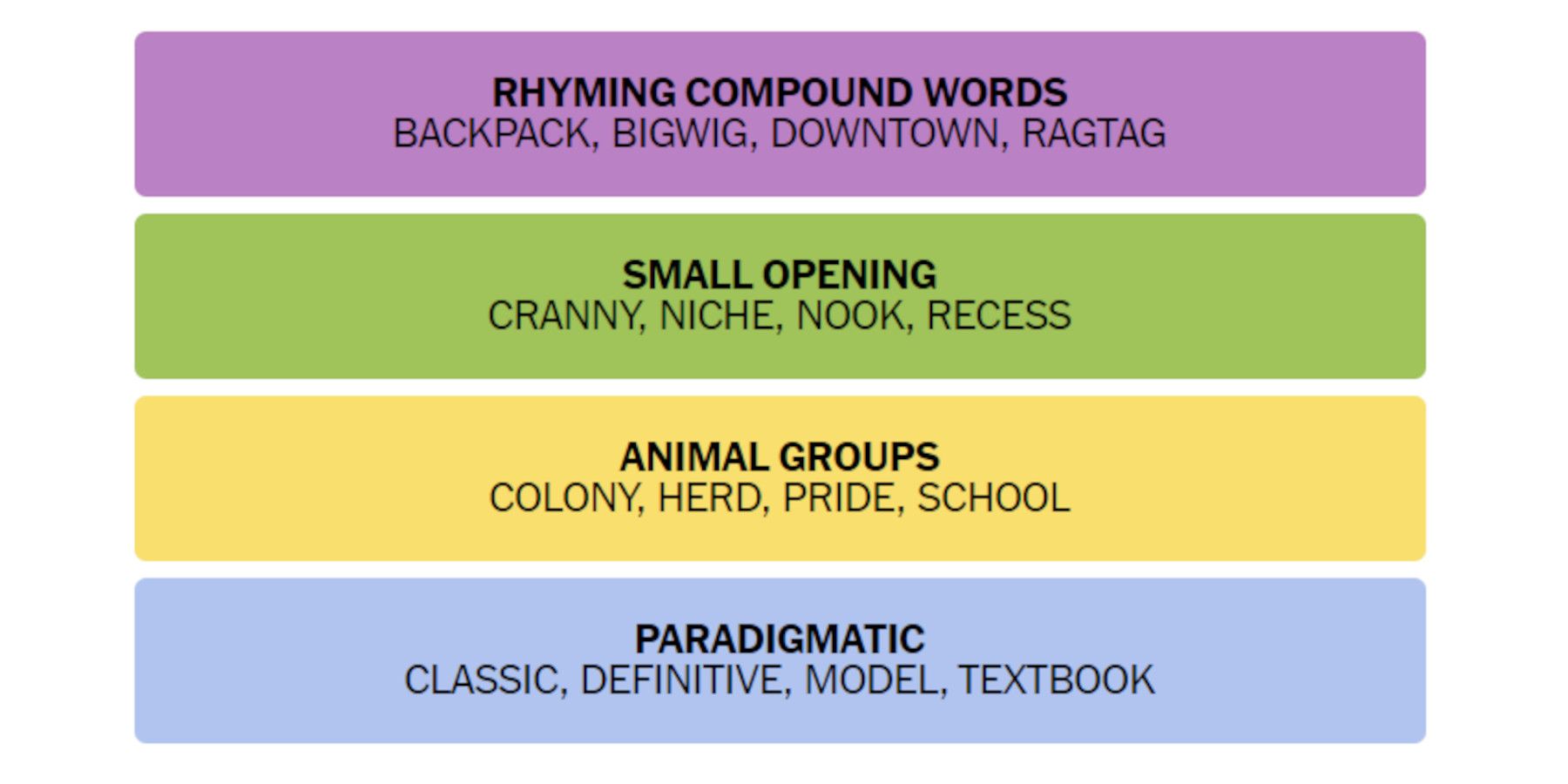

March 18 2025 New York Times Connections Puzzle 646 Solutions

May 24, 2025

March 18 2025 New York Times Connections Puzzle 646 Solutions

May 24, 2025 -

Couples Hilarious Fight Over Joe Jonas His Perfect Response

May 24, 2025

Couples Hilarious Fight Over Joe Jonas His Perfect Response

May 24, 2025 -

Almanya Emlyat Mdahmt Waset Lmshjey Krt Alqdm

May 24, 2025

Almanya Emlyat Mdahmt Waset Lmshjey Krt Alqdm

May 24, 2025