Low Mental Health Insurance Claims: Exploring The Barriers To Care

Table of Contents

Financial Barriers and Affordability

The high cost of mental healthcare is a significant deterrent to seeking help, directly contributing to low mental health insurance claims. Many individuals face insurmountable financial obstacles, even with insurance.

High Premiums and Deductibles

Mental health services, including therapy and medication, can be incredibly expensive. High premiums and substantial deductibles often leave individuals with significant out-of-pocket costs, making treatment unaffordable for many. Insurance plans frequently impose limitations, further exacerbating the problem.

- High co-pays: Even with insurance, the cost of each therapy session or medication refill can be prohibitive.

- Limited network of providers: Many plans only cover in-network providers, limiting choices and potentially requiring longer commutes or waits.

- Lack of affordable out-of-network options: Finding affordable care outside the insurance network is often difficult, leaving individuals with few viable options.

Lack of Comprehensive Insurance Coverage

A major contributor to low mental health insurance claims is the inadequate coverage for mental health services compared to physical healthcare. This disparity is unacceptable and needs urgent attention.

- Inadequate coverage for medication management: The cost of prescription medications for mental health conditions can be substantial, and many plans don't fully cover them.

- Restrictions on types of therapy covered: Some insurance plans limit coverage to specific types of therapy, excluding others that may be more suitable for an individual's needs.

- Insufficient coverage for hospitalization: Mental health hospitalizations can be extremely costly, and limited coverage can leave individuals facing substantial debt.

Access to Care Issues

Beyond financial limitations, access to care itself presents considerable hurdles, further explaining low mental health insurance claims.

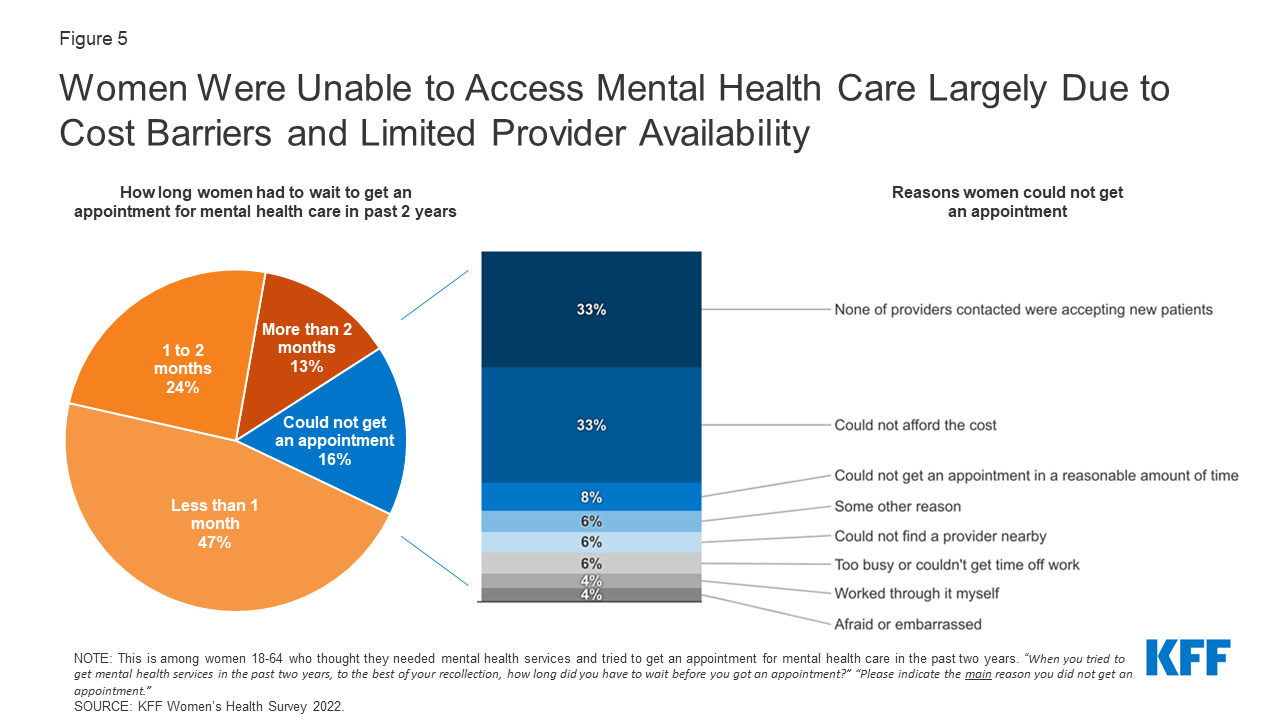

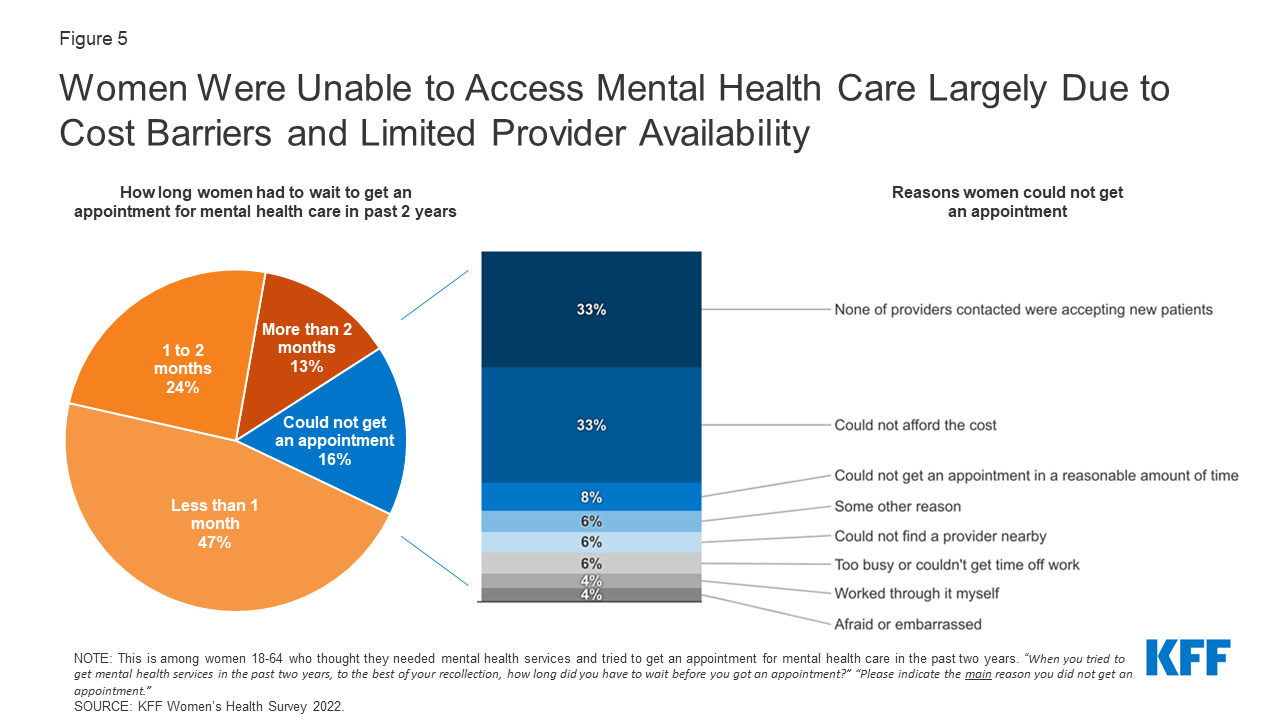

Geographic Barriers and Provider Shortages

The distribution of mental health professionals is uneven, leading to significant disparities in access, particularly in rural and underserved communities. Finding providers who accept specific insurance plans adds another layer of complexity. Long wait times for appointments with specialists are also common, discouraging timely intervention.

- Limited availability of specialists (e.g., psychiatrists, psychologists): A shortage of mental health professionals creates long wait lists and limits access to specialized care.

- Long waiting lists: Individuals may be forced to wait weeks or even months for an initial appointment, leading to delays in treatment and potential worsening of symptoms.

- Lack of telehealth options in underserved areas: Limited access to technology and reliable internet in rural areas hinders the expansion of telehealth services, a crucial tool for improving access to care.

Stigma and Misconceptions about Mental Healthcare

Societal stigma significantly impacts help-seeking behavior. Misconceptions about mental illness and its treatment contribute to individuals avoiding care. Fear of judgment, discrimination, and the potential negative consequences of seeking help (e.g., job loss) are powerful deterrents.

- Fear of losing their job: The stigma surrounding mental health can lead individuals to fear disclosure to their employers.

- Concern about social repercussions: Individuals may worry about the reactions of family, friends, and colleagues if they seek mental healthcare.

- Misunderstandings about treatment effectiveness: Misinformation and lack of understanding about the benefits of mental healthcare can dissuade individuals from seeking help.

Navigational Challenges and Systemic Issues

The complexities of the insurance system itself contribute significantly to low mental health insurance claims.

Complexity of the Insurance System

Navigating insurance policies and benefits related to mental health can be overwhelming. The claims process is often cumbersome and confusing, adding to the burden on individuals already struggling with their mental health.

- Confusing insurance terminology: Insurance policies are frequently filled with jargon that is difficult for non-experts to understand.

- Lengthy claim processing times: The delay in processing claims can be frustrating and discouraging for individuals seeking timely care.

- Difficulty understanding benefits and limitations: Understanding the specific coverage for mental health services under a particular insurance plan can be challenging.

Lack of Provider Education and Collaboration

Improved communication and coordination between insurance providers and mental health professionals are essential. Better provider education on insurance requirements, billing processes, and mental health parity laws is crucial.

- Lack of understanding of insurance requirements by providers: Many mental health professionals struggle with the complexities of insurance billing and reimbursement.

- Poor communication between providers and insurance companies: Lack of communication can lead to delays in payment and claims denials.

- Inadequate training for providers on insurance billing: Improved training can equip providers with the skills to navigate the complexities of insurance effectively.

Conclusion: Addressing Low Mental Health Insurance Claims for Better Outcomes

The low rate of mental health insurance claims stems from a confluence of factors: significant financial constraints, limited access to care, and systemic challenges within the insurance system. Addressing these barriers requires a multi-pronged approach. Policy changes, increased insurance coverage that mirrors physical health parity, expansion of provider networks, especially in underserved areas, and robust public awareness campaigns to combat stigma are crucial steps. Let's work together to reduce low mental health insurance claims and ensure that everyone has access to the mental healthcare they need and deserve. Demand better mental health coverage – your well-being depends on it.

Featured Posts

-

Tuerkiye Nin Avrupa Ile Is Birligi Politikalari

May 02, 2025

Tuerkiye Nin Avrupa Ile Is Birligi Politikalari

May 02, 2025 -

Louisiana School Desegregation Order Terminated Implications And Analysis

May 02, 2025

Louisiana School Desegregation Order Terminated Implications And Analysis

May 02, 2025 -

Selena Gomezs 80s Inspired High Waisted Power Suit

May 02, 2025

Selena Gomezs 80s Inspired High Waisted Power Suit

May 02, 2025 -

City Of Tulsa Deploys 66 Salt Trucks For Winter Weather

May 02, 2025

City Of Tulsa Deploys 66 Salt Trucks For Winter Weather

May 02, 2025 -

Smart Rings And Fidelity A New Era Of Relationship Trust

May 02, 2025

Smart Rings And Fidelity A New Era Of Relationship Trust

May 02, 2025