Lower BOE Rate Cut Probability: Pound's Appreciation After UK Inflation Announcement

Table of Contents

UK Inflation Data Surprises Markets

The latest UK inflation figures released have sent shockwaves through the financial markets. Headline inflation deviated significantly from analyst predictions, exceeding expectations by a considerable margin. This unexpected surge in inflation has drastically altered market sentiment regarding the BOE's upcoming monetary policy decisions.

- Headline Inflation: The reported inflation figure was [Insert Actual Figure], considerably higher than the anticipated [Insert Predicted Figure].

- CPI Breakdown: A detailed analysis reveals that several factors contributed to this increase. Energy prices played a significant role, alongside a notable rise in food costs. [Include data points on specific increases in energy and food prices]. Other contributing factors include [mention other significant contributors to inflation].

- Month-on-Month and Year-on-Year Comparison: Compared to the previous month, inflation increased by [percentage]%. The year-on-year change is even more striking, showing an increase of [percentage]%. [Include relevant charts and graphs to visualize this data].

- Market Sentiment Shift: This unexpectedly high inflation data has shifted market sentiment dramatically. The expectation of a BOE rate cut has all but vanished, with many analysts now predicting either a rate hold or, potentially, even a rate hike. This shift in expectation is a key driver of the Pound's recent appreciation. Keywords: UK inflation, CPI, RPI, inflation data, UK economic data

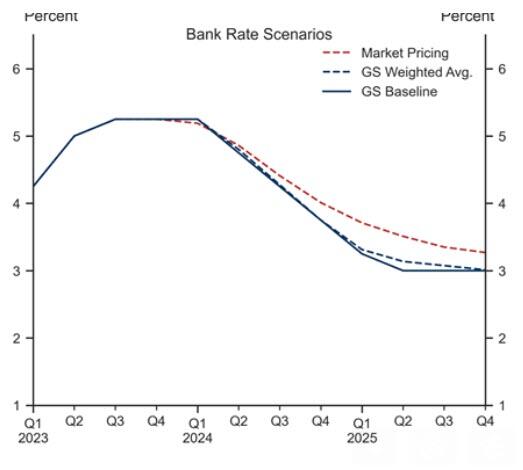

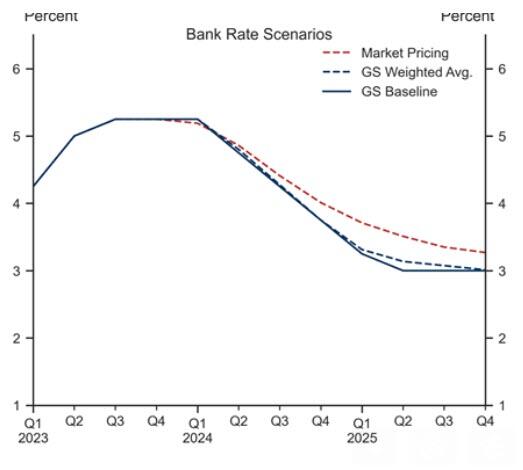

BOE Rate Cut Probability Plummets

The implications of the surprising inflation data for the BOE's monetary policy are profound. The central bank's primary mandate is to maintain price stability, and the recent figures clearly indicate that this target is under pressure. This significantly reduces the likelihood of a rate cut.

- BOE's Monetary Policy Response: The BOE is now likely to carefully consider the implications of sustained high inflation. A rate cut is now highly improbable.

- Revised Market Expectations: Before the inflation announcement, the probability of a BOE rate cut was estimated at around [Insert Percentage]%. Following the release, this probability has plummeted to approximately [Insert Percentage]%, according to market analysts.

- BOE Interest Rate Futures Contracts: The change in market sentiment is reflected in the trading of BOE interest rate futures contracts, which have experienced a significant shift since the inflation announcement.

- Potential for Rate Hike: The possibility of a rate hike, once considered remote, is now being discussed by several market analysts as a potential response to curb inflation. Keywords: BOE interest rates, monetary policy, interest rate decision, rate cut probability, BOE rate hike

Pound Sterling Appreciates Against Major Currencies

The reduced probability of a BOE rate cut, coupled with higher-than-expected inflation, has boosted investor confidence in the Pound. This has led to a significant appreciation of the GBP against major currencies.

- GBP/USD: The Pound has strengthened against the US dollar, with the GBP/USD exchange rate rising from [Previous Rate] to [Current Rate].

- GBP/EUR: Similarly, the GBP has gained ground against the Euro, showing an increase from [Previous Rate] to [Current Rate].

- Reasons for Appreciation: The Pound's appreciation can be attributed to a combination of factors, including reduced risk aversion among investors and a renewed confidence in the UK economy’s resilience despite inflationary pressures.

- Implications for UK Businesses: The stronger Pound presents challenges for UK exporters, making their goods more expensive in foreign markets. Conversely, it benefits importers by reducing the cost of imported goods. Keywords: GBP/USD, GBP/EUR, Pound Sterling, exchange rates, currency trading

Implications for UK Economy and Investors

The higher-than-expected inflation and the resulting shift in BOE rate cut probability have wide-ranging implications for the UK economy and investors.

- Long-term Economic Effects: Sustained high inflation could lead to a slowdown in economic growth, impacting consumer spending and business investment.

- Impact on Businesses and Consumers: Businesses may face increased costs, potentially leading to price increases for consumers. Consumers will experience a reduction in purchasing power due to inflation.

- Impact on Asset Classes: The shift in monetary policy expectations will influence different asset classes. For instance, government bonds may see decreased yields, while certain equities could perform differently depending on their sensitivity to interest rates.

- Investor Advice: Investors should carefully review their portfolios and adjust their strategies based on the evolving economic landscape. Diversification remains crucial to mitigate risk. Keywords: UK economy, economic outlook, investor sentiment, investment strategy

Conclusion: Navigating the Lower BOE Rate Cut Probability Landscape

In conclusion, the recent UK inflation announcement has dramatically altered the outlook for the BOE's monetary policy. The higher-than-expected inflation figures have significantly reduced the lower BOE rate cut probability, leading to a strengthening of the Pound Sterling. This development has wide-ranging implications for the UK economy, businesses, and investors. The future trajectory of the Pound and BOE interest rates remains uncertain, but understanding the current dynamics is crucial for navigating this evolving landscape. To stay informed about further developments regarding the lower BOE rate cut probability and its impact on the GBP, regularly consult reputable financial news sources and economic analysis. Closely monitoring the situation will enable you to make informed decisions and adapt your strategies accordingly. The unexpected surge in inflation underscores the importance of keeping a close eye on economic indicators and their impact on the financial markets.

Featured Posts

-

Faiz Indirimi Sonrasi Avrupa Borsalari Analiz Ve Degerlendirme

May 25, 2025

Faiz Indirimi Sonrasi Avrupa Borsalari Analiz Ve Degerlendirme

May 25, 2025 -

Eala Ready For Paris Grand Slam Debut

May 25, 2025

Eala Ready For Paris Grand Slam Debut

May 25, 2025 -

Uusi Ferrari Kuljettaja Vain 13 Vuotias Taessae On Nimi

May 25, 2025

Uusi Ferrari Kuljettaja Vain 13 Vuotias Taessae On Nimi

May 25, 2025 -

The Fallout From The Nvidia Rtx 5060 Impact On Consumer Trust

May 25, 2025

The Fallout From The Nvidia Rtx 5060 Impact On Consumer Trust

May 25, 2025 -

Fed Chair Powell Tariffs And The Challenges To Monetary Policy

May 25, 2025

Fed Chair Powell Tariffs And The Challenges To Monetary Policy

May 25, 2025