Lumina Gold Sold To China's CMOC For $581 Million: Analysis Of The Transaction

Table of Contents

CMOC's Strategic Rationale Behind the Lumina Gold Acquisition

CMOC, a leading global mining company with existing operations spanning various continents, has significantly enhanced its portfolio with the Lumina Gold acquisition. This move is driven by several key strategic factors:

Expanding Global Footprint and Resource Portfolio

CMOC's existing operations primarily focus on other metals. The Lumina Gold acquisition diversifies its portfolio significantly, adding substantial gold reserves and production capacity. This strategic expansion reduces CMOC's reliance on single commodities and mitigates risks associated with market fluctuations in specific sectors.

- Specific Assets Acquired: Lumina Gold's key assets include several operational mines and exploration projects, primarily located in [Insert specific locations of Lumina Gold's mines and projects]. These assets contribute significantly to CMOC's overall resource base.

- Increased Gold Reserves and Production: The acquisition is projected to increase CMOC's gold reserves by [Insert quantified increase in gold reserves] and its annual gold production capacity by [Insert quantified increase in gold production]. This strengthens CMOC's position as a major player in the global gold market.

Securing Access to Critical Minerals

Beyond gold, Lumina Gold's assets may contain other valuable minerals such as [Mention any other minerals present in Lumina Gold's assets]. Securing access to these critical minerals is crucial for China's economic growth and technological advancement, particularly considering global supply chain vulnerabilities and geopolitical tensions.

- Strategic Value of Associated Minerals: The presence of these additional minerals adds considerable strategic value to the acquisition, further justifying CMOC's significant investment. This diversification provides a buffer against market fluctuations specific to gold.

- China's Resource Security Strategy: This acquisition aligns with China's broader strategy to secure access to essential resources globally, reducing its dependence on international markets.

Market Consolidation and Synergies

This acquisition allows CMOC to consolidate its position within the highly competitive gold mining industry. It presents opportunities for significant synergies and cost savings through economies of scale and operational efficiency improvements.

- Economies of Scale: Integrating Lumina Gold's operations with CMOC's existing infrastructure is expected to generate considerable cost savings through streamlined procurement, shared resources, and improved logistical efficiencies.

- Operational Efficiency Improvements: CMOC can leverage its expertise in mining technology and operational management to optimize Lumina Gold's assets and enhance their overall productivity.

Lumina Gold's Value Proposition and Future Under CMOC Ownership

Lumina Gold's attractiveness as an acquisition target stemmed from several key factors:

Attractiveness of Lumina Gold's Assets

Lumina Gold possessed several desirable features that made it a prime acquisition candidate. These include:

- High-Grade Gold Deposits: Lumina Gold's assets are characterized by high-grade gold deposits, ensuring profitability and efficiency in extraction.

- Significant Production Capacity: Lumina Gold's existing operations boast significant production capacity, contributing immediately to CMOC's output.

- Favorable Geographic Location: The location of Lumina Gold's assets offers logistical advantages and potentially lower operational costs.

- Exploration Potential: The acquired assets may offer opportunities for further exploration and expansion of existing reserves.

Implications for Lumina Gold Shareholders

The sale resulted in a [Insert offered price per share] per share offer to Lumina Gold shareholders, representing [Compare the offered price to Lumina Gold's recent market valuation – e.g., a premium of X%]. This outcome provided a substantial financial return for Lumina Gold's investors.

- Financial Return Analysis: The transaction delivered a significant financial gain for Lumina Gold shareholders, surpassing recent market valuations and reflecting the strategic value of the company's assets.

Future Development Plans Under CMOC

CMOC's future plans for Lumina Gold's assets are likely to involve substantial investment and expansion.

- Potential Expansion Plans: CMOC may invest in expanding existing mines, developing new projects, and exploring the potential of additional mineral resources within the acquired assets.

- Technological Upgrades: CMOC is likely to implement its advanced mining technologies and operational best practices to enhance efficiency and production at Lumina Gold’s sites.

Geopolitical and Economic Implications of the Transaction

The CMOC-Lumina Gold deal has significant geopolitical and economic implications:

China's Growing Influence in Global Mining

This acquisition further solidifies China's growing influence in the global mining industry, highlighting its strategic push to secure access to critical minerals.

- China's Resource Demand: China's expanding economy and industrial sector fuel its increasing demand for resources, driving its involvement in overseas mining projects.

- Past Acquisitions: This acquisition adds to a series of similar acquisitions undertaken by Chinese mining companies in recent years, demonstrating a consistent trend of resource security efforts.

Impact on Global Gold Markets

The acquisition may have both short-term and long-term impacts on the global gold market:

- Market Consolidation: The merger could lead to a degree of market consolidation, potentially impacting gold supply and pricing dynamics.

- Competitive Landscape: The acquisition reshapes the competitive landscape, with CMOC emerging as a more significant player in the global gold mining market.

Conclusion

The $581 million acquisition of Lumina Gold by CMOC represents a significant strategic move with profound implications for both companies and the global mining industry. CMOC gains access to substantial gold reserves, diversifies its portfolio, and strengthens its position in the global market. Lumina Gold shareholders benefit from a lucrative transaction. The acquisition further highlights China's increasing influence in securing vital resources. Stay informed about further developments related to CMOC’s acquisition of Lumina Gold and similar future gold mining acquisitions and strategic resource deals to understand the evolving global mining landscape.

Featured Posts

-

Ramazan Bayrami Suriye Pazartesi Guenue Resmi Tatil Ve Kutlamalar

Apr 23, 2025

Ramazan Bayrami Suriye Pazartesi Guenue Resmi Tatil Ve Kutlamalar

Apr 23, 2025 -

Rayadas Golean Burky Lidera Con Brillante Doblete

Apr 23, 2025

Rayadas Golean Burky Lidera Con Brillante Doblete

Apr 23, 2025 -

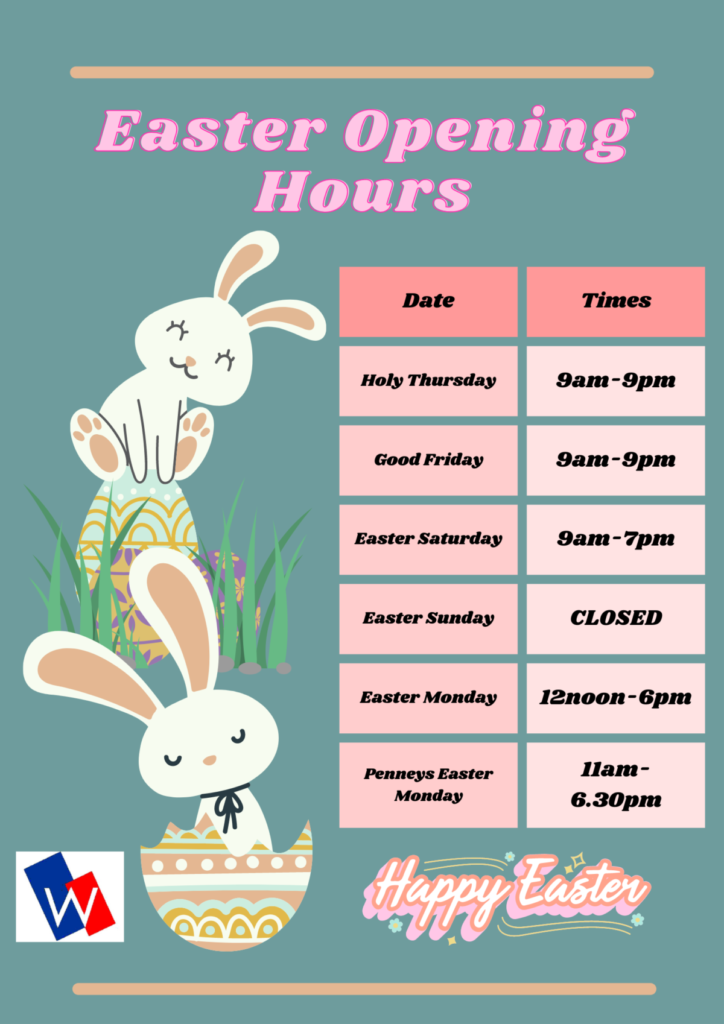

Prince Edward Island Easter Weekend A Guide To Opening Hours

Apr 23, 2025

Prince Edward Island Easter Weekend A Guide To Opening Hours

Apr 23, 2025 -

Assessing The Trump Administrations Influence On The Biotech Sector

Apr 23, 2025

Assessing The Trump Administrations Influence On The Biotech Sector

Apr 23, 2025 -

Yankees Victory Teamwork Trumps Powerful Bats

Apr 23, 2025

Yankees Victory Teamwork Trumps Powerful Bats

Apr 23, 2025