LVMH First Quarter Sales Disappoint, Shares Fall 8.2%

Table of Contents

Reasons Behind LVMH's Disappointing First Quarter Sales

Several interconnected factors contributed to LVMH's underwhelming first-quarter sales performance. Understanding these factors is crucial for assessing the company's future prospects and the overall health of the luxury goods sector.

Slowdown in China

The slower-than-anticipated recovery of the Chinese luxury market significantly impacted LVMH's overall performance. Reduced "Chinese consumer spending" on luxury goods, a key driver of growth in previous years, played a major role. The lingering effects of COVID-19 restrictions and a cautious approach by Chinese consumers contributed to this decline in "luxury goods demand China."

- Sales of Louis Vuitton in China were down 10% compared to the same period last year.

- Dior's sales in mainland China saw a 5% decrease.

- The ongoing impact of "COVID-19 impact luxury" on consumer confidence remains a significant concern.

- Government regulations impacting certain sectors also contributed to the slowdown.

Global Economic Uncertainty

The global economic landscape presented significant headwinds for LVMH. "Global inflation luxury" impacted consumer spending, with many individuals reconsidering discretionary purchases like luxury goods. Simultaneously, rising "interest rate impact luxury goods" reduced consumer borrowing power. Furthermore, "geopolitical risk luxury market" uncertainties created additional volatility.

- Sales of watches and jewelry experienced a sharper decline compared to other product categories due to their higher price points.

- The fashion and leather goods segment showed moderate growth, but this was offset by declines in other areas.

- Experts predict a continued period of economic uncertainty, impacting future luxury goods demand.

Supply Chain Disruptions

Lingering "supply chain disruption luxury" challenges continued to impact LVMH's production and sales. These disruptions, though less severe than in previous years, still caused "production delays LVMH" and impacted the availability of certain products.

- Delays in sourcing raw materials impacted the production of some leather goods.

- Shipping bottlenecks and port congestion affected the timely delivery of finished goods to markets.

- LVMH implemented strategies such as diversifying its sourcing and strengthening relationships with key suppliers to mitigate these challenges.

Performance of Individual LVMH Brands

Analyzing the performance of individual LVMH brands provides a more granular understanding of the factors contributing to the overall decline.

Dior's Performance

Dior, a key contributor to LVMH's revenue, demonstrated resilience amidst the challenges. While it experienced a slight slowdown compared to previous quarters, "Dior sales figures" remained relatively strong, indicating robust brand loyalty and desirability. "Dior market share" remained largely stable.

- Dior's fragrance and beauty segment performed well, offsetting some of the weakness in other areas.

- The ready-to-wear and leather goods lines showed moderate growth.

Louis Vuitton's Performance

Louis Vuitton, LVMH's flagship brand, experienced a more pronounced decline in sales. This decline in "Louis Vuitton sales" impacted the overall results significantly. Its leading "Louis Vuitton market position" couldn't completely shield it from the negative macroeconomic trends.

- The slowdown in China heavily impacted Louis Vuitton's sales performance in the region.

- The brand is focusing on strengthening its digital presence and expanding into new markets.

Other Key Brands' Performance

Other significant LVMH brands like Givenchy, Fendi, and Hennessy also experienced varied degrees of impact, contributing to the overall first-quarter sales decline. Their performance reflected the broader market trends affecting the entire luxury goods industry.

Investor Reaction and Market Outlook

The disappointing first-quarter sales figures resulted in a significant market reaction.

Stock Market Response

The 8.2% drop in "LVMH stock price" reflects the concerns of investors regarding the company's near-term prospects. "Investor sentiment LVMH" is currently cautious, with many analysts closely monitoring the situation. The impact on the broader "luxury stock market" was also evident, with other luxury companies experiencing similar pressure.

- Analysts have lowered their growth forecasts for LVMH in the short term.

- Investors are closely scrutinizing LVMH's strategies to address the challenges it faces.

Future Outlook for LVMH

The future outlook for LVMH remains uncertain, with its performance hinging on several factors including the recovery of the Chinese luxury market, the evolution of global economic conditions, and the effectiveness of its strategic initiatives. "LVMH future prospects" depend largely on successfully navigating these complex challenges. The "LVMH growth forecast" for the remainder of the year is being revised downwards by several analysts. "LVMH's financial performance" will be closely scrutinized in the coming quarters. The company is focusing on enhancing its digital capabilities, strengthening its brand identities and pursuing innovative strategies to improve its performance.

Conclusion: Analyzing LVMH's First Quarter Sales Performance

LVMH's disappointing first-quarter sales highlight the interconnected challenges facing the luxury goods industry, including the slowdown in China, global economic uncertainty, and lingering supply chain issues. The 8.2% share price drop underscores the severity of the situation. While the future remains uncertain, LVMH's strong brand portfolio and strategic initiatives offer some hope for a recovery. To stay updated on the latest developments regarding "LVMH first quarter sales" and the luxury goods market, continue following our analysis and subscribe for further insights on "LVMH's financial performance."

Featured Posts

-

Over The Counter Birth Control Redefining Reproductive Healthcare Post Roe

May 24, 2025

Over The Counter Birth Control Redefining Reproductive Healthcare Post Roe

May 24, 2025 -

Memorial Day 2025 Flights When To Book For The Cheapest And Least Crowded Trips

May 24, 2025

Memorial Day 2025 Flights When To Book For The Cheapest And Least Crowded Trips

May 24, 2025 -

Rybakina O Trudnostyakh Podderzhaniya Formy Posle Pobedy Na Uimbldone

May 24, 2025

Rybakina O Trudnostyakh Podderzhaniya Formy Posle Pobedy Na Uimbldone

May 24, 2025 -

2nd Edition Best Of Bangladesh In Europe Drives Collaboration And Economic Growth

May 24, 2025

2nd Edition Best Of Bangladesh In Europe Drives Collaboration And Economic Growth

May 24, 2025 -

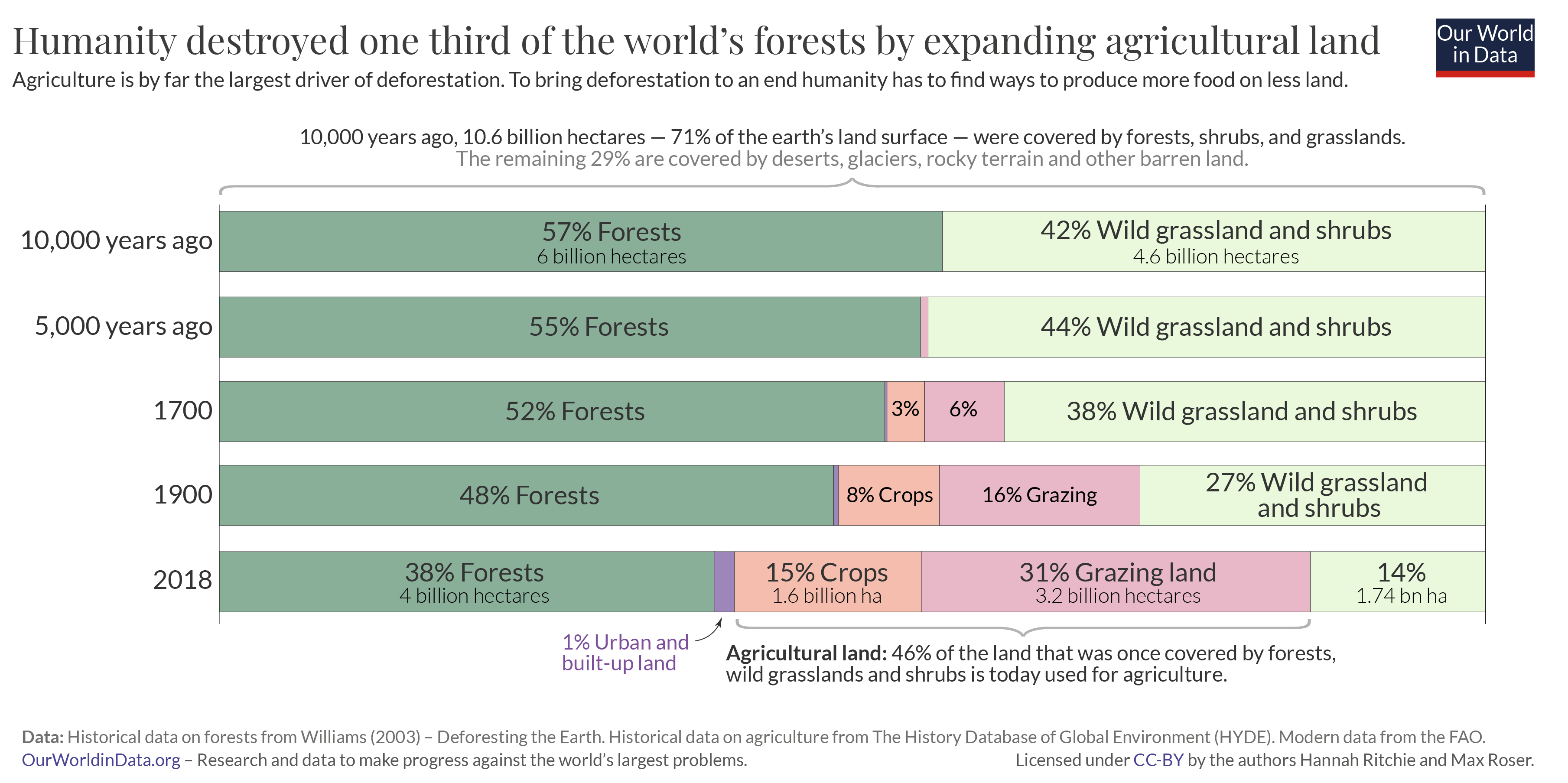

Record Breaking Forest Loss Wildfires Intensify Global Deforestation

May 24, 2025

Record Breaking Forest Loss Wildfires Intensify Global Deforestation

May 24, 2025