M&A Activity: How Recordati Is Responding To Tariff Volatility In Italy

Table of Contents

Recordati's M&A Strategy in Response to Tariff Uncertainty

Recordati's M&A strategy is a core component of its broader risk mitigation plan, specifically designed to counter the negative effects of unpredictable tariffs. The company’s approach centers on diversification and strategic partnerships to create a more resilient business model.

- Diversification of product portfolio: Acquisitions allow Recordati to expand its product offerings, reducing dependence on any single product or therapeutic area heavily impacted by tariff changes. This diversification spreads risk and makes the company less vulnerable to tariff hikes on specific medications.

- Expansion into new therapeutic areas: By acquiring companies operating in less tariff-sensitive therapeutic areas, Recordati reduces its overall exposure to tariff volatility. This strategic move ensures a more stable revenue stream, regardless of tariff fluctuations in specific market segments.

- Acquisitions of companies with established international distribution networks: This strategy reduces reliance on the Italian market, which is directly impacted by Italian tariffs. Expanding into other European countries and global markets offers stability and reduced exposure to domestic market instability.

- Strategic partnerships: Collaborating with other pharmaceutical companies allows Recordati to share risk and access new markets. This approach fosters greater resilience against the impacts of tariff volatility.

Key M&A Deals and Their Impact on Recordati's Resilience

Recordati's recent M&A activity demonstrates its commitment to its strategic diversification plan. Analyzing specific deals highlights the tangible impact on its resilience against tariff volatility. (Note: Due to the confidential nature of some M&A deals and the lack of publicly available detailed financial information for all transactions, specific financial figures might be limited in this analysis).

- Example Deal 1: (Insert Name of Acquired Company). This acquisition brought (mention specific product lines or therapeutic areas) to Recordati's portfolio, which are less susceptible to tariff fluctuations. The deal's success lies in (mention synergies achieved, like expanded distribution networks or increased market share). This diversification directly contributed to reducing Recordati's exposure to tariff-related risks on its core product lines.

- Example Deal 2: (Insert Name of Acquired Company). This acquisition focused on (mention geographic location or therapeutic area). The strategic rationale was to (explain the strategic benefit, e.g., access a new market less vulnerable to Italian tariff changes, expand into a new therapeutic area, gain access to a specific technology). The post-acquisition synergies resulted in (mention specific positive outcomes).

Bullet Points for each deal (to be filled with specific examples when available):

- Target company name and brief description.

- Acquisition price and financing details (if publicly available).

- Synergies achieved post-acquisition.

- Impact on Recordati's revenue streams and market share.

- Reduction in tariff-related risk.

Analyzing the Geographic Diversification Strategy

Recordati's M&A strategy significantly emphasizes geographic diversification. By strategically acquiring companies outside of Italy, Recordati reduces its dependence on a single market vulnerable to Italian tariff fluctuations.

- Acquisitions in other European countries and beyond: (Insert examples of acquisitions outside Italy, including countries and rationale). This international expansion provides a buffer against Italian-specific tariff issues.

- Assessment of diversification success: (Assess the success, using data if available on revenue generated from outside Italy compared to Italy). The extent to which this diversification strategy has been successful can be quantified by analyzing the company's revenue distribution across different geographic markets.

- Future expansion plans: Recordati’s commitment to international expansion suggests a continued focus on reducing tariff-related risk through further M&A activities in diverse geographical locations.

The Impact on the Italian Pharmaceutical Market

Recordati’s aggressive M&A strategy has considerable implications for the Italian pharmaceutical market.

- Increased competition: Recordati's expansion, through acquisitions, increases competition in the Italian pharmaceutical market, potentially impacting pricing dynamics and influencing the strategies of other players.

- Impact on innovation and drug development: M&A activity can influence the pace and direction of innovation. Recordati's acquisitions could inject new technologies and expertise into the Italian market.

- Potential for consolidation: Recordati's active role in M&A might trigger further consolidation within the Italian pharmaceutical sector, potentially leading to a more concentrated market structure.

- Recordati's leadership role: Recordati’s strategic response to tariff volatility sets a precedent for other Italian pharmaceutical companies, highlighting the importance of proactive adaptation strategies in the face of economic uncertainty.

Conclusion

Recordati's proactive use of M&A activity effectively addresses the challenges posed by tariff volatility in Italy. By diversifying its product portfolio, geographic reach, and business partnerships, Recordati has demonstrably strengthened its resilience. This strategic response showcases the critical importance of adaptable business strategies within the pharmaceutical sector facing unstable economic landscapes.

Call to Action: Learn more about how Recordati's innovative approach to Recordati M&A activity is shaping the future of the Italian pharmaceutical market and influencing strategies for mitigating tariff risks. Stay informed on the latest developments in Italian pharmaceutical mergers and acquisitions and how companies are adapting to tariff volatility.

Featured Posts

-

Churchill Downs Weather Contingency Plans Kentucky Derby 2024

May 01, 2025

Churchill Downs Weather Contingency Plans Kentucky Derby 2024

May 01, 2025 -

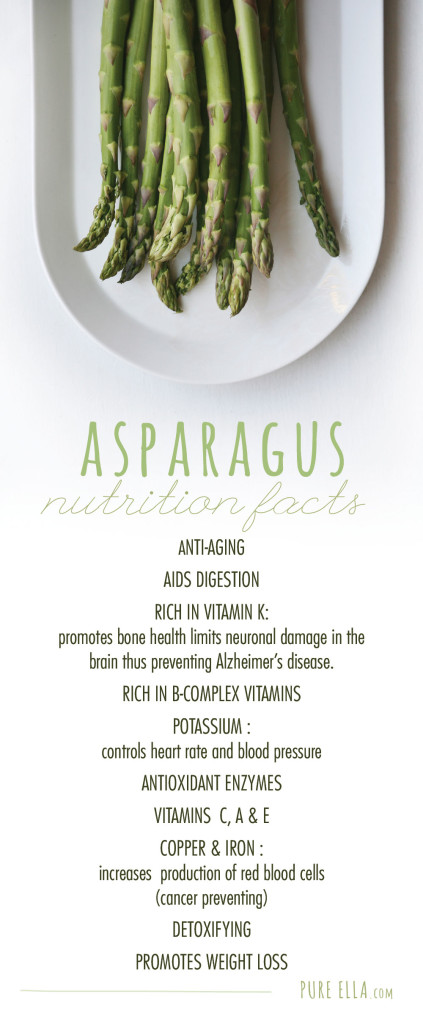

Asparagus Nutrition How This Vegetable Supports Your Health

May 01, 2025

Asparagus Nutrition How This Vegetable Supports Your Health

May 01, 2025 -

Best Family Cruises 5 Top Rated Lines Reviewed

May 01, 2025

Best Family Cruises 5 Top Rated Lines Reviewed

May 01, 2025 -

Boulangerie Normande Un Kilo De Chocolat Pour Le Premier Bebe De L Annee

May 01, 2025

Boulangerie Normande Un Kilo De Chocolat Pour Le Premier Bebe De L Annee

May 01, 2025 -

Noodstroomvoorziening Essentieel Voor Bio Based Scholen

May 01, 2025

Noodstroomvoorziening Essentieel Voor Bio Based Scholen

May 01, 2025