Major XRP Whale Acquires 20 Million Tokens: Market Analysis

Table of Contents

H2: The Significance of the 20 Million XRP Acquisition

The sheer volume of this XRP acquisition is undeniably significant. A purchase of this magnitude represents a substantial percentage of the daily trading volume, potentially impacting supply and demand dynamics. Understanding the motivation behind such a large purchase is crucial to analyzing its implications. Was this a long-term investment strategy by a seasoned investor believing in XRP's potential? Or is it a speculative move designed to manipulate the market? Or perhaps something else entirely?

- Historical Data: Examining historical data on similar large-scale XRP acquisitions can reveal patterns and potential correlations with subsequent price movements. This data can provide valuable context for understanding the current situation.

- Whale's Trading History: Analyzing the whale's past activities and trading patterns offers insight into their investment strategy. Are they known for short-term trades or long-term holdings? Their history can provide valuable clues.

- Comparison with Other Acquisitions: Comparing this 20 million XRP acquisition to other recent significant cryptocurrency purchases across different assets can help determine whether this is an outlier event or part of a broader trend.

H2: Impact on XRP Price and Market Volatility

The immediate impact of this large XRP acquisition was a noticeable increase in trading volume and, in most cases, a subsequent price surge. However, the long-term effects remain to be seen. Whale activity is notoriously correlated with price fluctuations, as their large trades can significantly influence market sentiment.

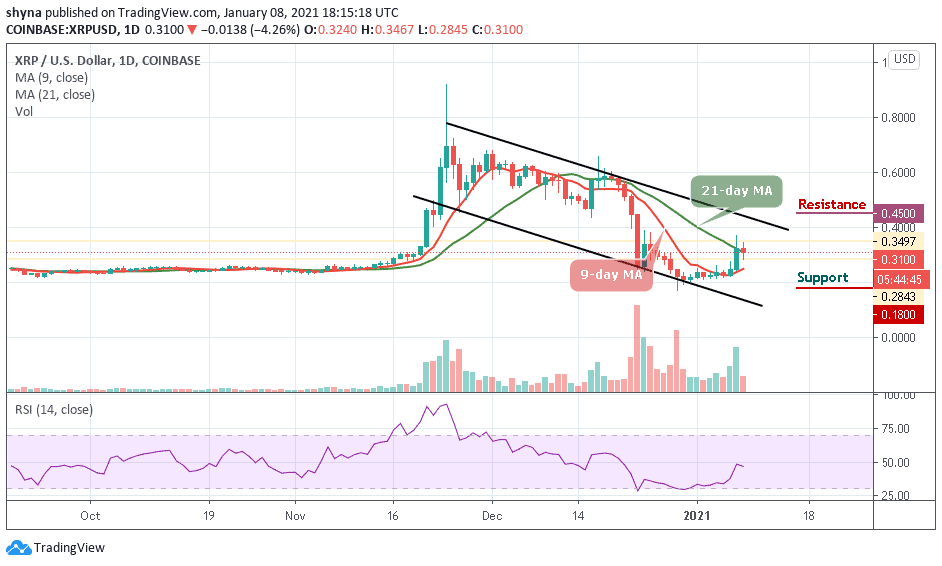

- Chart Analysis: Chart analysis examining price movements before, during, and after the acquisition is essential for determining the actual impact on XRP’s price. This technical analysis can reveal trends and patterns.

- News and Social Media Sentiment: News coverage and social media reactions to the acquisition have amplified its impact on XRP price volatility. Positive sentiment generally leads to increased demand and higher prices, while negative sentiment can trigger sell-offs.

- Potential Short Squeezes and Corrections: Large-scale buying can sometimes trigger short squeezes, pushing the price artificially higher. However, such rapid increases are often followed by price corrections, so caution is warranted.

H2: Ripple's Legal Battle and its Influence

The ongoing legal battle between Ripple and the SEC significantly impacts XRP's price. The uncertainty surrounding the case creates volatility, making it difficult to predict the long-term trajectory of XRP. The whale's recent acquisition could be interpreted as a vote of confidence in Ripple's ability to win the case, potentially influencing investor sentiment.

- Ripple vs. SEC Summary: Understanding the key aspects of the case, including the SEC's allegations and Ripple's defense, is crucial for evaluating the impact on investor confidence.

- Impact of Legal Developments: Positive legal developments, such as a favorable court ruling, are likely to boost XRP's price, while negative developments could cause a sharp decline.

- Investor Sentiment and Correlation: Investor sentiment is strongly correlated with the legal proceedings. Positive news typically boosts confidence, leading to increased demand, while negative news tends to trigger selling pressure.

H2: Market Sentiment and Future Predictions

Current market sentiment towards XRP is mixed, influenced by the legal uncertainty and the recent whale activity. Analyzing various factors, including the whale's actions and broader market trends, is crucial for forming future predictions.

- Analyst Predictions: Several prominent crypto analysts have offered price predictions for XRP, basing their forecasts on technical analysis, market sentiment, and the outcome of the Ripple case.

- Resistance and Support Levels: Identifying resistance and support levels for XRP's price using technical analysis tools is vital in predicting potential price movements.

- Macroeconomic Factors: Broad macroeconomic factors, such as inflation and interest rate changes, also influence the cryptocurrency market, indirectly affecting XRP's price.

3. Conclusion: Understanding the Ripple Effects of the XRP Whale's Move

This analysis has highlighted the significance of the recent 20 million XRP acquisition, examining its potential impact on price and volatility, and considering the influence of Ripple's legal battle on investor sentiment. Understanding whale activity is crucial in navigating the volatile world of cryptocurrency investment. The implications of this acquisition remain to be seen, but it underscores the importance of carefully monitoring market developments and conducting thorough research before making any investment decisions.

Stay updated on the latest XRP news and market analysis to make informed decisions. Understanding XRP whale activity is crucial for navigating the volatile world of cryptocurrency investment. Further research into XRP price prediction and XRP market analysis is recommended before any investment strategy is implemented.

Featured Posts

-

Analyzing Ripples Xrp Potential To Reach 3 40

May 08, 2025

Analyzing Ripples Xrp Potential To Reach 3 40

May 08, 2025 -

Ethereum Bull Run Analyzing The Current Price Strength And Future Outlook

May 08, 2025

Ethereum Bull Run Analyzing The Current Price Strength And Future Outlook

May 08, 2025 -

Kyren Paris Late Game Heroics Lift Angels Over White Sox

May 08, 2025

Kyren Paris Late Game Heroics Lift Angels Over White Sox

May 08, 2025 -

Simsek In Kripto Para Piyasasi Uyarisi Son Dakika Gelismeleri

May 08, 2025

Simsek In Kripto Para Piyasasi Uyarisi Son Dakika Gelismeleri

May 08, 2025 -

Istoriya Matchiv Ps Zh Ta Aston Villi V Yevrokubkakh

May 08, 2025

Istoriya Matchiv Ps Zh Ta Aston Villi V Yevrokubkakh

May 08, 2025