Malaysian Ringgit (MYR) Exchange Rate: How Front-Loading Benefits Exporters

Table of Contents

What is Front-Loading in the Context of the MYR Exchange Rate?

Front-loading, in the context of export businesses dealing with the MYR, is a proactive strategy involving securing future sales and payments in advance. This allows exporters to lock in favorable MYR exchange rates before potential depreciation. Essentially, it's about mitigating future currency risk by securing payments at a currently advantageous rate.

Imagine a Malaysian exporter selling goods to a US-based buyer with payment in USD. If the exporter anticipates MYR depreciation against the USD, a front-loading strategy would involve negotiating payment terms that receive the USD earlier than the standard delivery and payment schedule. This means securing the favorable exchange rate today for the future sale. The stronger the MYR is when they receive payment, the more MYR they receive for each USD.

Effective front-loading relies heavily on accurate forecasting and market analysis. Understanding potential shifts in the MYR exchange rate, influenced by factors like global economic trends, interest rates, and political stability, is crucial for successful implementation of this MYR hedging technique.

- Key elements of a successful front-loading strategy:

- Thorough market research and analysis of future MYR exchange rate projections.

- Strong negotiation skills to secure favorable payment terms with buyers.

- Robust internal systems for managing contracts and cash flows.

Advantages of Front-Loading for Malaysian Exporters

Front-loading offers several key advantages for Malaysian exporters dealing with the volatility of the MYR:

Protecting Against MYR Depreciation

The most significant benefit is safeguarding against losses stemming from MYR depreciation. A weakening Ringgit directly reduces the MYR value of foreign currency payments. Front-loading mitigates this risk:

- Example 1: By securing payment upfront, exporters lock in a more favorable exchange rate, avoiding potential losses if the MYR weakens before receiving payment for goods already delivered.

- Example 2: Front-loading reduces the uncertainty surrounding future revenue projections, allowing for better financial planning and budgeting.

Improving Cash Flow Management

Early payments significantly boost liquidity, streamlining operations and enabling better financial management:

- Example 1: Predictable revenue streams from front-loaded sales facilitate planning for crucial investments and business expansion.

- Example 2: Demonstrated strong cash flow, resulting from front-loading, improves access to credit and potentially secures better loan terms.

Enhancing Profitability

Securing favorable exchange rates through front-loading directly impacts profit margins positively:

- Example 1: Increased competitiveness in the global market due to the ability to offer more competitive pricing, protected from currency fluctuations.

- Example 2: Maintaining healthy profit margins despite fluctuating exchange rates, providing financial stability and long-term growth opportunities.

Potential Challenges and Considerations of Front-Loading

While front-loading presents considerable benefits, several challenges need careful consideration:

Market Demand and Sales Forecasting

Accurate sales forecasting is paramount to avoid overstocking or underselling. Inaccurate predictions can lead to either excess inventory or lost sales opportunities.

Credit Risk

Assessing the creditworthiness of buyers is crucial to prevent bad debts. Thorough due diligence is essential before agreeing to front-loaded payment terms.

Contractual Obligations

Clear, legally sound contracts are essential to protect the exporter's interests and ensure payment is received as agreed. Professional legal counsel is recommended.

Opportunity Cost

Committing to sales at a specific price involves an opportunity cost. If the MYR strengthens unexpectedly, the exporter might miss out on potentially higher profits.

Conclusion: Harnessing the Power of Front-Loading for MYR Exchange Rate Management

Front-loading offers Malaysian exporters a powerful tool to navigate the complexities of the MYR exchange rate. By securing payments early, businesses can protect against currency fluctuations, improve cash flow, and enhance profitability. However, careful planning, accurate forecasting, and thorough risk assessment are crucial for success. Consult with financial experts specializing in export finance and currency hedging to develop a personalized MYR exchange rate strategy tailored to your business needs. Learn more about optimizing your export strategies by mastering the Malaysian Ringgit (MYR) exchange rate and implementing effective front-loading techniques. Contact us today for a consultation!

Featured Posts

-

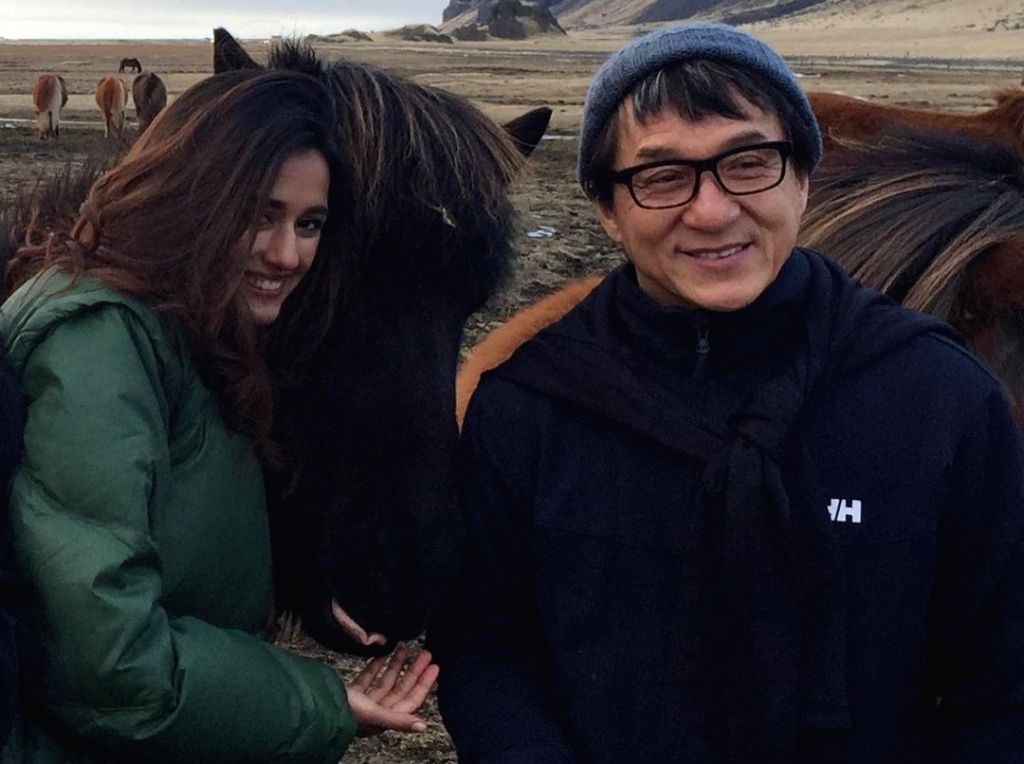

Kung Fu Yoga Co Star Disha Patani Wishes Jackie Chan A Happy Birthday

May 07, 2025

Kung Fu Yoga Co Star Disha Patani Wishes Jackie Chan A Happy Birthday

May 07, 2025 -

Legenda N Kh L Po Silovym Priemam Ukhodit Iz Khokkeya

May 07, 2025

Legenda N Kh L Po Silovym Priemam Ukhodit Iz Khokkeya

May 07, 2025 -

10 Day Contract Cavaliers Sign G League Player

May 07, 2025

10 Day Contract Cavaliers Sign G League Player

May 07, 2025 -

Laura And Jason Kenny Overcoming Fertility Challenges To Welcome A Daughter

May 07, 2025

Laura And Jason Kenny Overcoming Fertility Challenges To Welcome A Daughter

May 07, 2025 -

Popcorn Prank On Cavs Rookie Mitchells Accurate Prediction

May 07, 2025

Popcorn Prank On Cavs Rookie Mitchells Accurate Prediction

May 07, 2025