Market Dislocation Fuels Brookfield's Opportunistic Investment Strategy

Table of Contents

Brookfield's Opportunistic Investment Approach

Brookfield Asset Management employs a long-term, value-oriented approach to investing, focusing on identifying undervalued assets and distressed opportunities. Their strategy hinges on patiently deploying capital, actively managing their portfolio, and leveraging deep industry expertise across multiple sectors. This approach allows them to profit from market inefficiencies and capitalize on dislocations.

- Patient capital deployment: Brookfield isn't driven by short-term market fluctuations. They take a long-term view, allowing them to weather market storms and emerge stronger.

- Active portfolio management: They actively manage their investments, constantly seeking ways to improve asset performance through operational enhancements and strategic repositioning. This proactive approach is crucial in navigating market volatility.

- Deep industry expertise: Brookfield boasts significant expertise across diverse sectors including real estate, infrastructure, renewable power, and private equity. This broad knowledge allows them to identify undervalued assets and distressed opportunities across a wide spectrum of investment classes.

- Strong operational capabilities: Brookfield doesn't just invest; they actively improve the assets they acquire. Their operational expertise allows them to enhance asset performance, increase profitability, and ultimately generate higher returns. This is a key differentiator in their opportunistic investing strategy.

Specific Examples of Brookfield's Success During Market Dislocations

Brookfield's track record demonstrates their ability to profit from market downturns. Their success stems from identifying and capitalizing on undervalued assets and distressed opportunities during periods of market dislocation.

- Example 1: During the 2008 financial crisis, Brookfield capitalized on the distressed real estate market, acquiring significant properties at significantly discounted prices. Their strategic repositioning and operational improvements generated substantial returns on investment (ROI) exceeding expectations.

- Example 2: In the aftermath of the European debt crisis, Brookfield successfully acquired a portfolio of infrastructure assets in Spain and Italy at significantly below market value. Through operational improvements and strategic management, they achieved a significant ROI.

- Example 3: Brookfield has a proven track record in successfully restructuring distressed debt, transforming underperforming assets into profitable ventures. This expertise allows them to navigate complex situations and unlock hidden value.

Key Factors Contributing to Brookfield's Success

Brookfield's consistent success during market uncertainty can be attributed to several key factors:

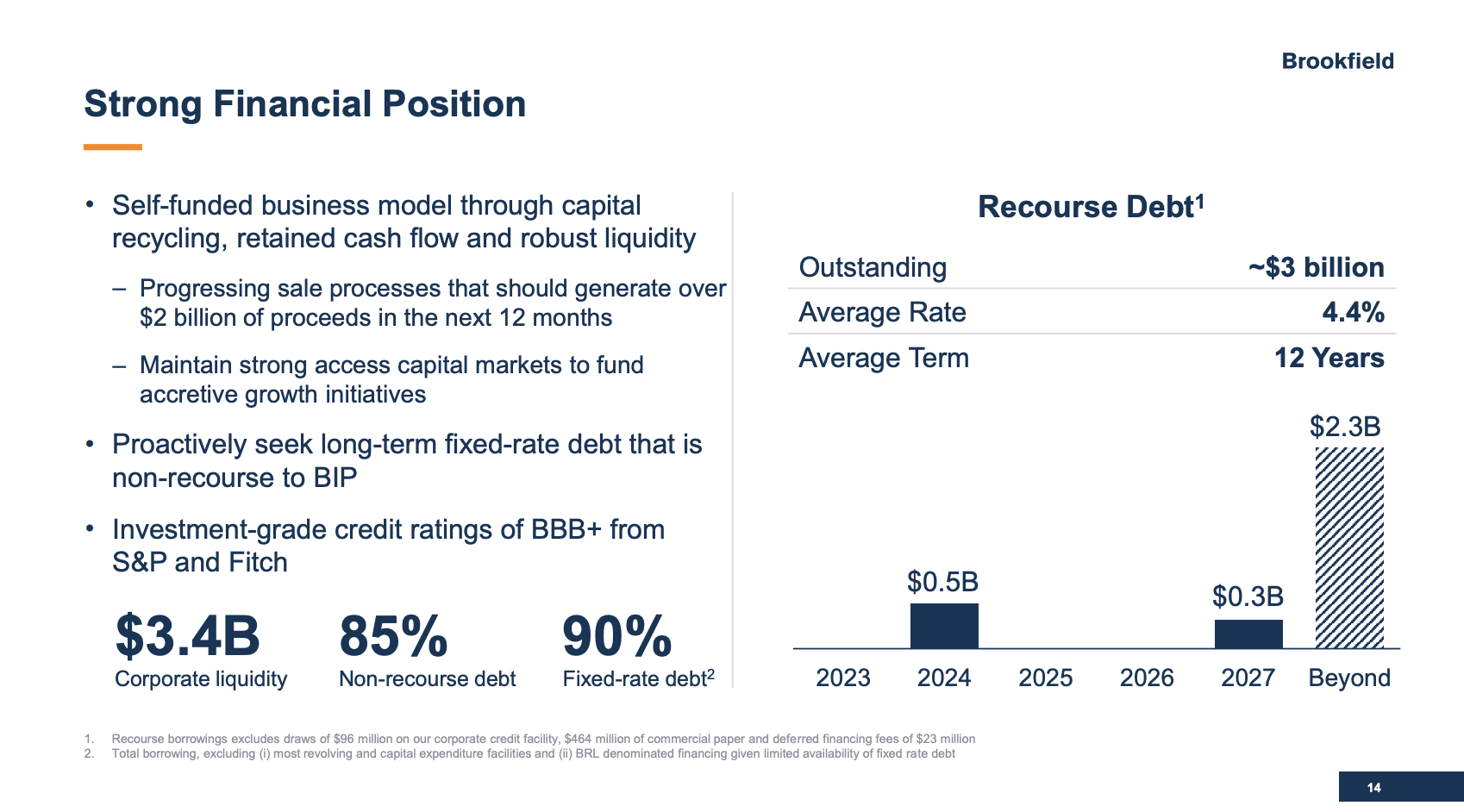

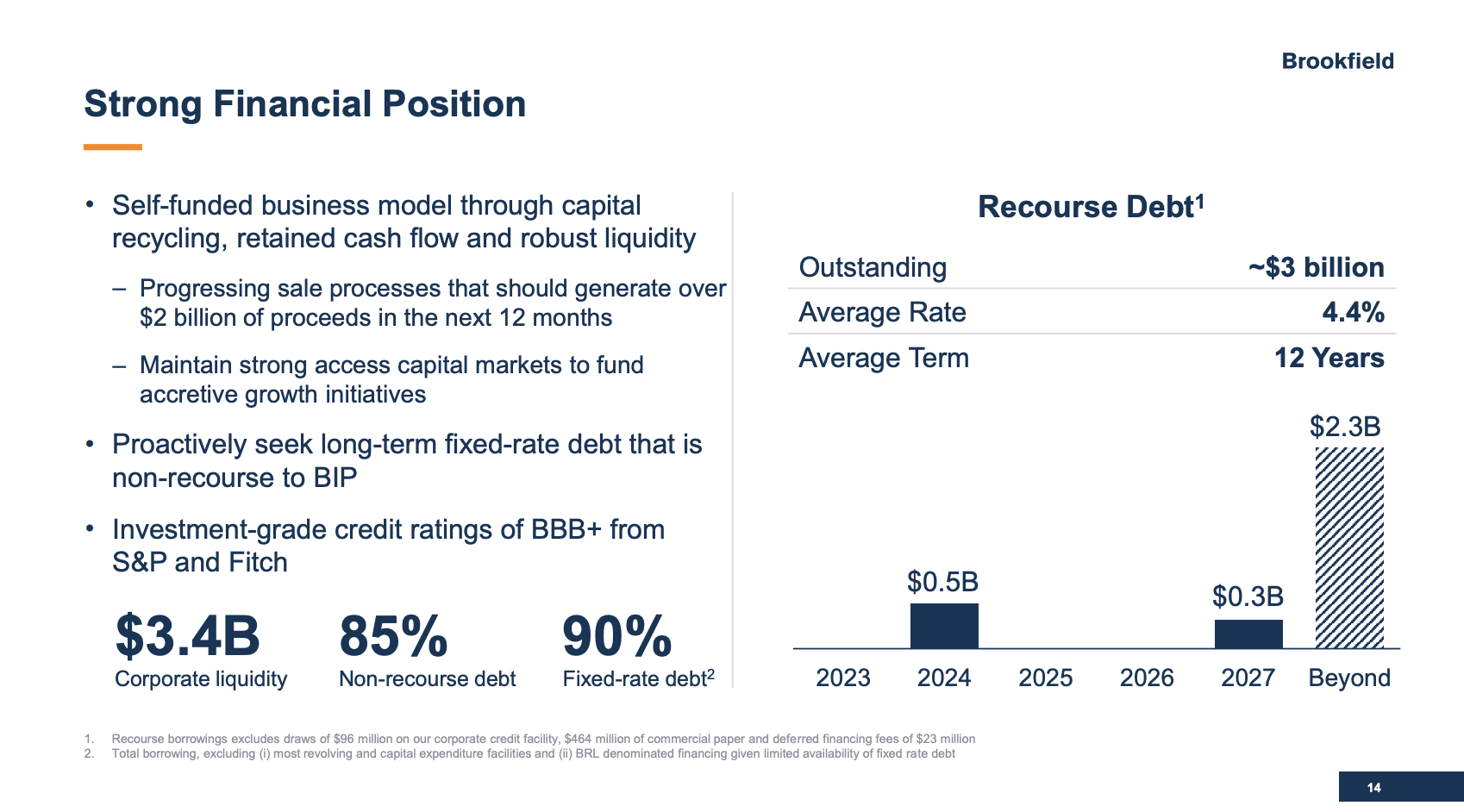

- Strong balance sheet and access to capital: Brookfield possesses a robust balance sheet and enjoys access to diverse sources of capital, enabling them to seize opportunities even during periods of market stress.

- Experienced management team: Their experienced management team possesses a proven track record in navigating challenging markets and generating superior returns on investment. This expertise is invaluable in identifying and capitalizing on market dislocations.

- Sophisticated risk assessment and mitigation strategies: Brookfield employs sophisticated risk assessment and mitigation strategies, carefully evaluating potential risks and implementing measures to protect their investments. This proactive approach minimizes losses and maximizes returns.

- Long-term investor perspective: Their long-term investment horizon allows them to remain patient and disciplined, avoiding impulsive decisions driven by short-term market fluctuations.

Future Outlook for Brookfield and Opportunistic Investing

The current market environment, characterized by ongoing volatility and uncertainty, presents numerous opportunities for Brookfield.

- Predictions for future market trends: Continued volatility is expected, creating further dislocations across asset classes. Brookfield is well-positioned to capitalize on these opportunities.

- Brookfield's potential investment targets: Brookfield is likely to focus on undervalued assets in sectors such as real estate, infrastructure, and renewable energy, seeking opportunities for value creation and operational enhancement.

- The role of ESG factors: Environmental, Social, and Governance (ESG) factors play an increasingly important role in Brookfield's investment decisions, aligning their investment strategy with long-term sustainability goals. This focus enhances their long-term value creation strategy.

Conclusion

Brookfield's successful opportunistic investment strategy during periods of market dislocation underscores the importance of a well-defined, long-term approach. Their expertise, financial strength, and sophisticated risk management capabilities allow them to consistently identify and capitalize on market opportunities. Brookfield's ability to thrive in volatility highlights the potential rewards of a strategic, value-oriented approach to opportunistic investing. Learn more about how Brookfield navigates volatility and capitalizes on market opportunities by visiting [link to Brookfield's website].

Featured Posts

-

Everything You Need To Know Before Andor Season 2 Starts

May 08, 2025

Everything You Need To Know Before Andor Season 2 Starts

May 08, 2025 -

Buy Your Psl 10 Tickets Today

May 08, 2025

Buy Your Psl 10 Tickets Today

May 08, 2025 -

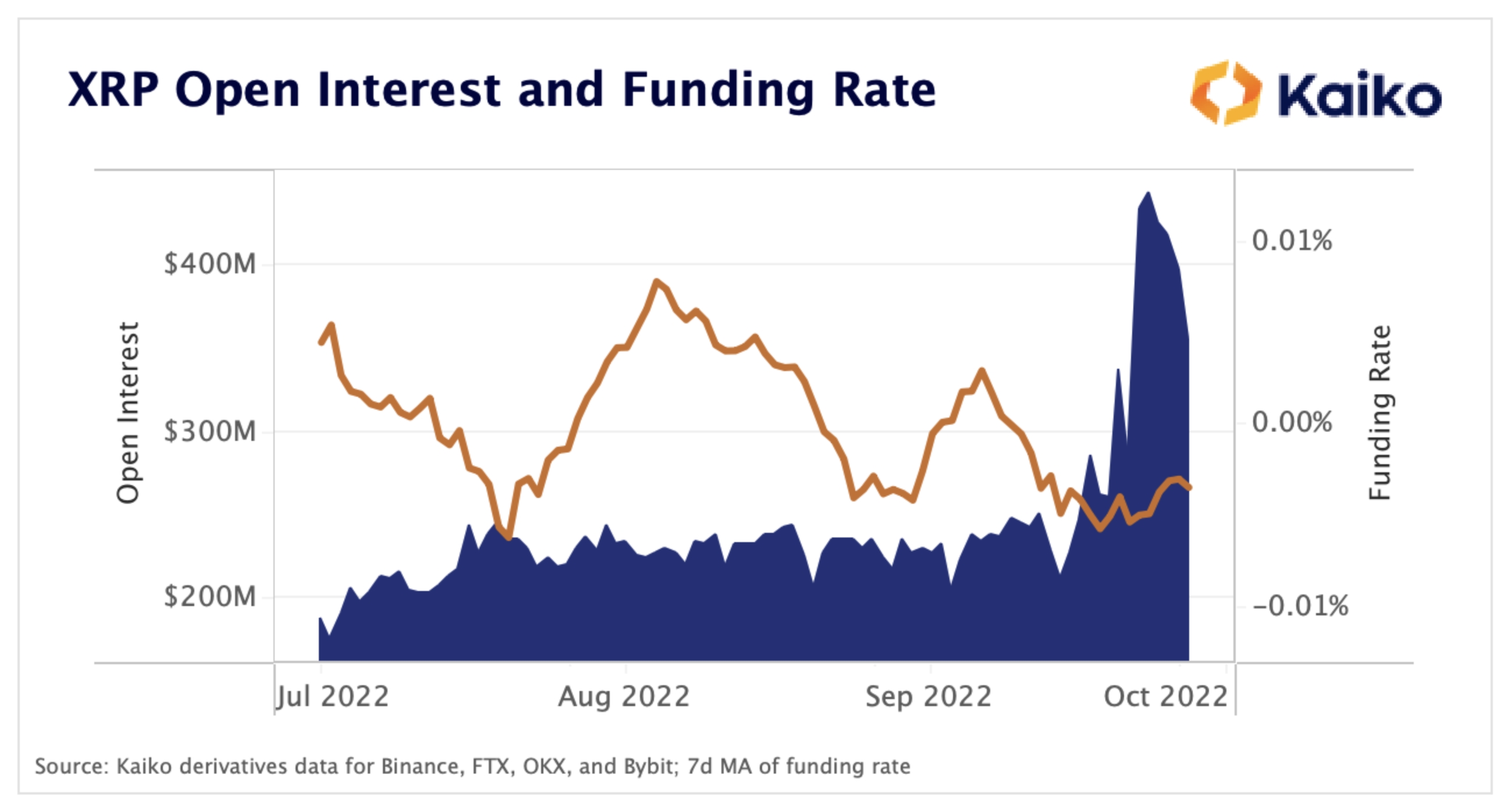

Is 5 Possible A Comprehensive Xrp Price Prediction Following Sec Developments

May 08, 2025

Is 5 Possible A Comprehensive Xrp Price Prediction Following Sec Developments

May 08, 2025 -

New Commercial Jayson Tatum And Ella Mai Announce Sons Birth

May 08, 2025

New Commercial Jayson Tatum And Ella Mai Announce Sons Birth

May 08, 2025 -

Surviving The Crypto Crash Which Cryptocurrency Might Still Succeed

May 08, 2025

Surviving The Crypto Crash Which Cryptocurrency Might Still Succeed

May 08, 2025