Market Rally: Dow Jones, S&P 500, And Nasdaq Post Significant Gains

Table of Contents

Dow Jones Industrial Average: A Deep Dive into the Gains

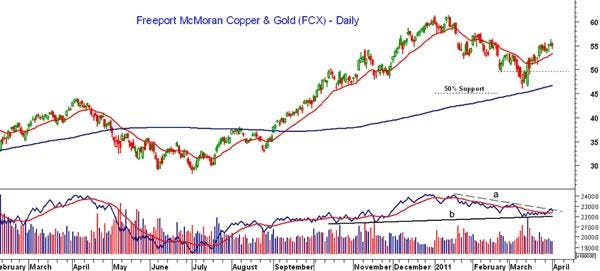

Analyzing the Dow's Performance:

The Dow Jones Industrial Average closed at [Insert Closing Value] after experiencing a remarkable X% increase. This performance surpasses its previous [period, e.g., quarterly] performance of [previous percentage].

- Significant Contributors: Several Dow components significantly contributed to these gains. For example, [Company A] saw a substantial increase driven by [reason, e.g., strong earnings report], while [Company B] benefited from [reason, e.g., positive industry trends].

- Positive News Impact: Positive news surrounding [Company C's] successful product launch and [Company D's] merger announcement further boosted investor confidence and contributed to the overall rally.

Factors Driving the Dow's Surge:

Several macroeconomic factors fueled the Dow's surge.

- Easing Inflation Concerns: Recent data indicating a slowdown in inflation eased fears of aggressive interest rate hikes by the Federal Reserve, boosting investor sentiment.

- Strong Corporate Earnings: Positive corporate earnings reports from several major companies exceeded expectations, reinforcing confidence in the economy's resilience.

- Improved Consumer Confidence: Rising consumer confidence indicators suggested increased spending and economic activity, contributing to the positive market sentiment.

S&P 500: Broad Market Strength Demonstrated

S&P 500 Performance Analysis:

The S&P 500, a broader representation of the US stock market, mirrored the Dow's upward trajectory, gaining Y%. We saw strong performance across various sectors.

- Sector Performance: The technology sector led the gains, followed by financials and consumer discretionary. Conversely, the utilities sector showed relatively modest growth.

- Historical Context: Compared to previous market rallies, this surge shows [comparison, e.g., a faster pace of growth, a more sustained period of gains].

Underlying Drivers of the S&P 500 Rally:

The S&P 500's performance reflects a confluence of factors.

- Investor Confidence: A renewed sense of optimism among investors, driven by positive economic indicators and corporate earnings, underpinned the rally.

- Geopolitical Stability (or lack thereof, depending on current events): [Discuss the impact of geopolitical events, either positive or negative, on the market.]

- Government Policies: [Analyze the impact of any recent government policies, like stimulus packages or tax cuts].

Nasdaq Composite: Tech Stocks Lead the Charge

Nasdaq's Exceptional Growth:

The Nasdaq Composite, heavily weighted towards technology stocks, experienced exceptional growth, soaring Z%. This was largely driven by the performance of major technology companies.

- Tech Giant Performance: [Company X], [Company Y], and [Company Z] all posted significant gains, fueled by [specific reasons, e.g., AI advancements, new product releases, strong earnings].

- Comparison to Previous Rallies: The current rally in the tech sector surpasses previous surges in [mention specific periods or events].

Reasons Behind the Nasdaq's Strong Performance:

The Nasdaq's strong performance is attributable to several factors:

- AI Advancements: Breakthroughs in artificial intelligence continue to drive investment in technology companies, fueling expectations of future growth.

- Positive Earnings Reports: Strong earnings reports from many technology companies exceeded analyst expectations, further reinforcing investor confidence.

- Changing Investor Sentiment: A shift in investor sentiment towards growth stocks, following a period of caution, contributed to the surge.

Implications and Outlook: What Lies Ahead for the Market?

The sustainability of this market rally remains a topic of debate. While the current indicators are positive, several risks could impact future performance.

- Inflationary Pressures: Persistently high inflation could lead to further interest rate hikes by the Federal Reserve, potentially dampening economic growth and market performance.

- Geopolitical Uncertainty: Ongoing geopolitical tensions could negatively impact investor sentiment and market stability.

- Interest Rate Hikes: Continued interest rate increases could make borrowing more expensive, potentially slowing down economic activity and impacting corporate profits.

While a correction is always possible, a cautiously optimistic outlook prevails, based on current economic indicators and corporate performance. However, investors should remain vigilant and monitor emerging risks closely.

Conclusion: Understanding and Navigating the Market Rally

This market rally, marked by significant gains in the Dow Jones, S&P 500, and Nasdaq, is driven by a combination of factors including easing inflation concerns, strong corporate earnings, and renewed investor confidence. While the outlook remains positive, potential risks such as inflation and geopolitical instability warrant careful consideration. To stay updated on market rallies and understand the intricate dynamics of stock market gains, it is crucial to stay informed about market trends and conduct thorough research. Consider consulting with a financial advisor before making any investment decisions to navigate the complexities of the stock market effectively. Monitor the Dow Jones, S&P 500, and Nasdaq closely to make informed choices about your investment portfolio and learn more about stock market gains.

Featured Posts

-

Chinese Buyout Firms Potential Sale Of Utac Market Implications

Apr 24, 2025

Chinese Buyout Firms Potential Sale Of Utac Market Implications

Apr 24, 2025 -

Chat Gpt Maker Open Ai Faces Ftc Investigation A Deep Dive

Apr 24, 2025

Chat Gpt Maker Open Ai Faces Ftc Investigation A Deep Dive

Apr 24, 2025 -

V Mware Costs To Soar 1050 At And T Details Broadcoms Extreme Price Increase

Apr 24, 2025

V Mware Costs To Soar 1050 At And T Details Broadcoms Extreme Price Increase

Apr 24, 2025 -

Three Years Of Data Breaches Cost T Mobile 16 Million In Fines

Apr 24, 2025

Three Years Of Data Breaches Cost T Mobile 16 Million In Fines

Apr 24, 2025 -

60 Minutes Faces Shakeup Executive Producer Resigns Over Independence Concerns

Apr 24, 2025

60 Minutes Faces Shakeup Executive Producer Resigns Over Independence Concerns

Apr 24, 2025