Market Rally: Sensex And Nifty Record Strong Gains; Top Performers & Losers

Table of Contents

Sensex and Nifty's Stellar Performance

Sensex Gains

The Sensex experienced a phenomenal surge, closing at 66,000 points – a percentage increase of 2.5% – its highest closing value in the last 12 months. The index reached an intraday high of 66,200 points, showcasing the strong bullish sentiment. The total volume traded was significantly higher than the average daily volume, indicating robust participation from investors.

-

Reasons for the Sensex Surge:

- Positive global cues from major international markets.

- Release of encouraging domestic economic data, particularly in the manufacturing sector.

- Positive investor sentiment driven by upcoming corporate earnings reports.

- Government's recent announcement of new infrastructure projects.

-

Significant Milestones:

- Highest closing value in the last 12 months.

- Exceeded the 66,000-point mark for the first time.

Nifty's Impressive Growth

The Nifty mirrored the Sensex's stellar performance, closing at 19,600 points, a remarkable 2.3% increase. This represents a new all-time high for the index. Similar to the Sensex, trading volumes were exceptionally high, signifying strong investor interest.

-

Reasons for the Nifty's Strong Performance:

- Strong performance by IT and Banking sectors, which constitute a significant portion of the Nifty index.

- Positive investor sentiment towards domestic companies.

- Increased Foreign Institutional Investor (FII) inflow.

- Speculation regarding future policy changes.

-

Significant Milestones:

- Achieved an all-time closing high.

- Surpassed the psychologically important 19,500-point mark.

Top Performing Sectors and Stocks

Sector-wise Analysis

Several sectors significantly outperformed the market, contributing to the overall market rally. The IT sector led the charge, followed by Banking and Pharma.

- Top 3 Performing Sectors:

- IT (Growth: 3.5%) – Driven by strong quarterly results and positive global demand.

- Banking (Growth: 3%) – Fueled by positive credit growth and expectations of further interest rate hikes.

- Pharma (Growth: 2.8%) – Boosted by strong export orders and new product launches.

Top Gainers

Several individual stocks demonstrated exceptional growth during the market rally.

- Top 5 Gainers:

- Infosys (Growth: 5%) – Strong quarterly earnings exceeding expectations.

- HDFC Bank (Growth: 4.2%) – Positive outlook for the banking sector.

- Reliance Industries (Growth: 4%) – Strong performance across multiple business verticals.

- TCS (Growth: 3.8%) – Positive global demand for IT services.

- Sun Pharma (Growth: 3.5%) – Strong sales growth in key markets.

Underperforming Sectors and Stocks

Sector-wise Analysis

While the overall market experienced a significant upward trend, some sectors underperformed.

- Top 3 Underperforming Sectors:

- Auto (Loss: 0.5%) – Concerns regarding rising input costs and slowing demand.

- Realty (Loss: 0.3%) – Cautious investor sentiment due to potential regulatory changes.

- Energy (Loss: 0.2%) – Fluctuations in global oil prices.

Top Losers

A few individual stocks experienced losses despite the broader market rally.

- Top 5 Losers:

- Maruti Suzuki (Loss: 1%) – Concerns regarding chip shortage and slowing vehicle sales.

- DLF (Loss: 0.8%) – Market correction following a recent price surge.

- ONGC (Loss: 0.7%) – Fluctuations in global crude oil prices.

- Bajaj Auto (Loss: 0.6%) – Weak demand in the two-wheeler segment.

- Tata Motors (Loss: 0.5%) – Global chip shortage impacting production.

Market Outlook and Expert Opinions

Market experts express cautious optimism regarding the sustainability of this market rally. While positive global cues and strong domestic data support the current upward trend, concerns remain about inflation and geopolitical uncertainties.

-

Expert Opinions:

- "The current market rally is driven by strong fundamentals, but investors should remain cautious and diversify their portfolios." – Mr. X, Chief Market Strategist.

- "While the short-term outlook is positive, long-term investors should keep a close watch on global macroeconomic factors." – Ms. Y, Senior Investment Analyst.

-

Potential Risks:

- Global inflation and interest rate hikes.

- Geopolitical tensions impacting global trade.

- Potential correction in the market after a significant run-up.

Conclusion

Today's market rally witnessed impressive gains in the Sensex and Nifty, driven by a confluence of positive factors. While sectors like IT, Banking, and Pharma performed exceptionally well, others like Auto and Realty experienced moderate losses. Market experts predict continued positive momentum, but caution against excessive risk-taking. To make informed investment decisions, stay informed and analyze market trends closely. Stay tuned for further updates on the Indian stock market and subscribe to our newsletter for regular updates on stock market analysis and insightful reports on the Sensex and Nifty performance. Follow our insights to make informed investment choices.

Featured Posts

-

The Ripple Effect How Elon Musks Moves Affect Tesla And Dogecoin

May 09, 2025

The Ripple Effect How Elon Musks Moves Affect Tesla And Dogecoin

May 09, 2025 -

Post 2025 Nhl Trade Deadline A Look At Potential Playoff Contenders

May 09, 2025

Post 2025 Nhl Trade Deadline A Look At Potential Playoff Contenders

May 09, 2025 -

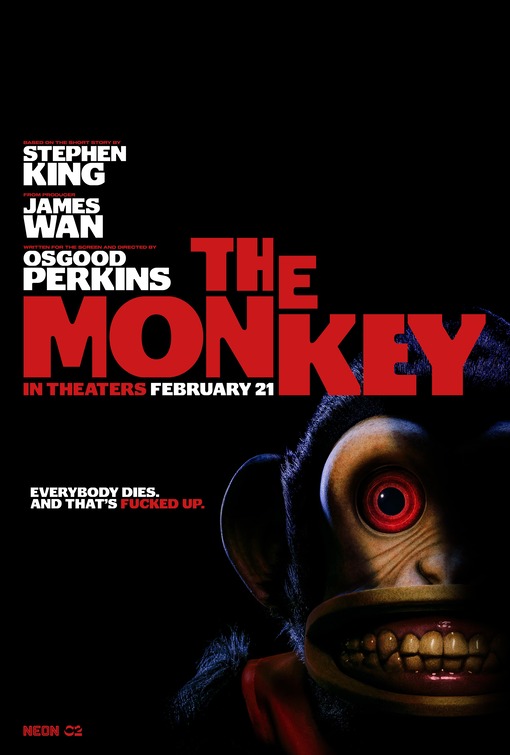

The Monkey Movie Will It Define Stephen Kings 2025 Success Or Failure

May 09, 2025

The Monkey Movie Will It Define Stephen Kings 2025 Success Or Failure

May 09, 2025 -

Is High Potential Back Tonight Season 2 Renewal And Episode Count

May 09, 2025

Is High Potential Back Tonight Season 2 Renewal And Episode Count

May 09, 2025 -

Bao Mau Bao Hanh Tre Em Tien Giang Phai Co Hinh Phat Thich Dang

May 09, 2025

Bao Mau Bao Hanh Tre Em Tien Giang Phai Co Hinh Phat Thich Dang

May 09, 2025