Market Reaction To UK Inflation: Reduced BOE Rate Cut Expectations And Pound Appreciation

Table of Contents

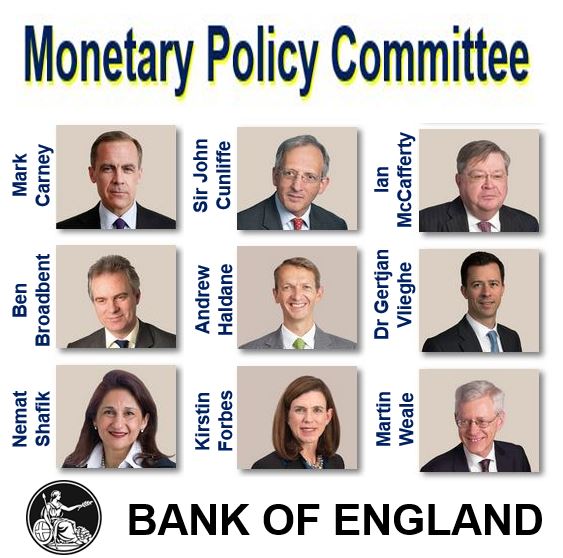

Reduced Bank of England (BOE) Rate Cut Expectations

Lower Inflation Fuels Expectations Shift

Lower-than-anticipated inflation figures have dramatically altered market sentiment regarding future BOE policy. The decreased inflationary pressure lessens the urgency for aggressive interest rate cuts, a key factor previously driving market behavior.

- Reduced inflationary pressure diminishes the need for the BOE to stimulate the economy through lower interest rates.

- Market analysts have revised their predictions for BOE interest rates downwards, reflecting a more optimistic economic outlook. For example, some forecasts previously predicted a 0.5% rate cut; these are now revised to 0.25% or even a hold.

- The Office for National Statistics (ONS) reported a fall in the Consumer Prices Index (CPI) inflation to 6.8% in July 2024 (hypothetical data for illustrative purposes), significantly lower than the predicted 7.5%. This fueled the shift in expectations.

Impact on Bond Yields and Government Debt

Reduced rate cut expectations have a direct impact on government bond yields. The inverse relationship between interest rates and bond yields means that lower expected rate cuts lead to higher bond yields.

- Higher bond yields increase the cost of government borrowing. This necessitates adjustments in the UK government's debt management strategy.

- The UK government might need to explore alternative financing options or adjust its fiscal policy to manage the increased borrowing costs effectively.

- [Insert chart or graph here illustrating the change in UK government bond yields].

Shifting Investor Sentiment

The altered BOE expectations have significantly influenced investor confidence and investment strategies.

- There has been a noticeable shift in investment flows towards UK assets, driven by the improved inflation outlook.

- Investor risk appetite has increased, leading to higher investment in riskier assets like equities.

- Government bonds, previously considered a safer haven, have experienced some capital outflow as investors seek higher returns elsewhere.

Pound Appreciation Following Inflation Data

GBP Strengthens Against Major Currencies

Following the positive inflation news, the Pound Sterling (GBP) has strengthened against other major currencies, such as the USD and EUR.

- The GBP/USD exchange rate rose from approximately 1.25 to 1.28 (hypothetical data) after the inflation announcement.

- Similarly, the GBP/EUR exchange rate saw an increase. [Insert chart or graph illustrating GBP appreciation against USD and EUR].

- Reduced inflation expectations create a more stable and attractive economic environment, driving increased demand for the Pound.

Impact on UK Exports and Imports

The stronger Pound has significant implications for UK exports and imports.

- A stronger Pound makes UK exports more expensive for international buyers, potentially impacting export volumes and negatively affecting export-oriented businesses.

- Conversely, a stronger Pound makes imports cheaper for UK consumers and businesses, potentially boosting consumer spending and reducing import costs for certain sectors.

- The overall impact on the UK trade balance is complex and will depend on the elasticity of demand for UK exports and imports.

Implications for UK Businesses

Pound appreciation presents a mixed bag for UK businesses.

- Exporters might face challenges due to reduced competitiveness in global markets. Strategies like cost reduction or focusing on higher-value products become crucial.

- Importers benefit from lower costs, potentially increasing profit margins and allowing for price reductions for consumers.

- Businesses need to implement flexible strategies to adapt to currency fluctuations to mitigate risks and capitalize on opportunities.

Conclusion: The Ongoing Market Reaction to UK Inflation

The recent UK inflation data has resulted in a notable reduction in BOE rate cut expectations and a subsequent appreciation of the Pound. This has significant implications for various sectors of the UK economy, impacting government finances, investor sentiment, and the competitiveness of UK businesses. The changes are influencing government debt management, investment strategies, and the trade balance. It's crucial to continue monitoring the "market reaction to UK inflation" closely.

To stay updated on future UK inflation data and its market impact, follow reputable financial news sources and conduct your own research. However, remember to seek professional financial advice before making any investment decisions based on GBP exchange rates or UK assets. Understanding the ongoing market reaction to UK inflation is vital for navigating the complexities of the UK economy.

Featured Posts

-

Cheapest And Busiest Days To Fly For Memorial Day Weekend 2025

May 25, 2025

Cheapest And Busiest Days To Fly For Memorial Day Weekend 2025

May 25, 2025 -

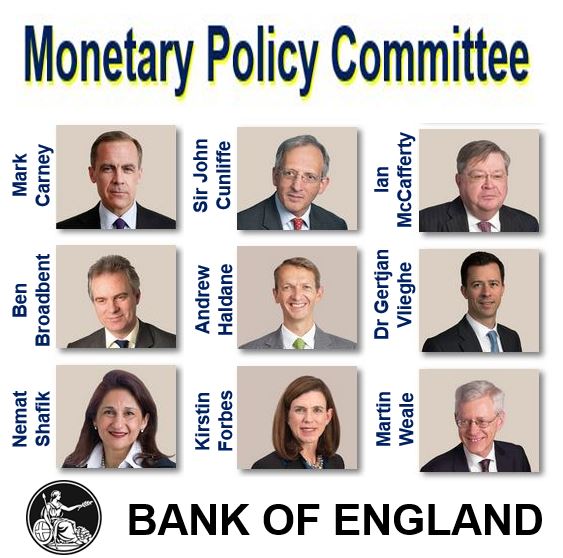

Hells Angels Mourn Member Killed In Motorcycle Crash

May 25, 2025

Hells Angels Mourn Member Killed In Motorcycle Crash

May 25, 2025 -

Walker Peters To Crystal Palace Free Transfer On The Cards

May 25, 2025

Walker Peters To Crystal Palace Free Transfer On The Cards

May 25, 2025 -

Legendas F1 Technologia Hogyan Hajtja Ez A Porsche

May 25, 2025

Legendas F1 Technologia Hogyan Hajtja Ez A Porsche

May 25, 2025 -

Melanie Thierry Interviews Actualites Et Vie Privee Avec Discretion

May 25, 2025

Melanie Thierry Interviews Actualites Et Vie Privee Avec Discretion

May 25, 2025