Market Uncertainty And The Freeze On IPO Activity: The Role Of Tariffs

Table of Contents

The Impact of Tariffs on Global Economic Growth

Tariffs, essentially taxes on imported goods, significantly impact global economic growth and directly influence the decision-making process for companies considering an IPO. This impact manifests in two key areas: reduced investor confidence and a slowdown in global trade.

Reduced Investor Confidence

Tariffs increase costs for businesses, impacting profitability and reducing investor confidence in the long-term prospects of companies considering an IPO. This diminished confidence translates to a more challenging environment for securing funding.

- Increased production costs due to tariffs on imported materials: Companies reliant on imported raw materials or components face higher production costs, squeezing profit margins and making their financial projections less attractive to potential investors. This directly impacts valuation during an IPO.

- Uncertainty around future tariff policies and retaliatory measures: The unpredictable nature of trade wars and tariff implementation creates significant uncertainty. Investors are hesitant to commit capital when faced with such unpredictable economic landscapes. This unpredictability makes long-term financial forecasting nearly impossible, a major deterrent for IPOs.

- Reduced consumer spending due to higher prices on goods affected by tariffs: Tariffs lead to higher prices for consumers, potentially reducing demand and impacting the revenue streams of companies. This decreased consumer spending can further erode investor confidence in a company’s future performance.

- Negative impact on global supply chains and business operations: Disruptions to global supply chains caused by tariffs can lead to delays, shortages, and increased operational costs. These disruptions make it difficult for companies to demonstrate stability and efficiency, key elements for a successful IPO.

Slowdown in Global Trade

The imposition of tariffs directly impacts international trade, creating uncertainty and reducing the attractiveness of global expansion for companies considering going public. This slowdown further exacerbates the challenges faced by companies seeking IPO funding.

- Reduced export opportunities for companies: Tariffs imposed by other countries can significantly reduce a company's ability to export its goods, limiting potential revenue growth and making its international prospects less appealing to investors.

- Difficulty in predicting future revenue streams due to trade disputes: Trade disputes and retaliatory tariffs make it extremely challenging for companies to forecast their future revenue streams with any degree of accuracy, hindering their ability to present a compelling IPO prospectus.

- Increased complexity in international business operations due to tariff regulations: Navigating the complex web of tariff regulations adds significant administrative burden and increases operational costs, adding another layer of risk for investors.

- Potential for reduced market access in key international markets: Tariffs can effectively limit a company’s market access in key regions, impacting its long-term growth potential and reducing its attractiveness for IPO investment.

How Market Uncertainty Affects IPO Decisions

Market volatility, largely fueled by trade wars and tariff uncertainty, significantly impacts IPO decisions. This uncertainty leads to increased risk aversion among investors and creates a number of significant challenges for companies planning an IPO.

Increased Risk Aversion

Market volatility caused by trade wars and tariff uncertainty leads to increased risk aversion among investors. This makes securing favorable IPO valuations more challenging.

- Investors demanding higher returns to compensate for the added risk: Investors will demand higher returns to offset the increased uncertainty and risk associated with investing in companies during periods of trade tension.

- Reduced demand for IPO shares, leading to lower pricing: Lower investor demand translates to lower share prices during the IPO, potentially resulting in a less successful capital raise for the company.

- Increased scrutiny of company financials and future prospects: Investors will conduct a far more rigorous due diligence process, scrutinizing a company's financial statements and future projections even more intensely to gauge its resilience to trade uncertainty.

- Postponement of IPOs until market conditions improve: Many companies are choosing to delay their IPO plans until market conditions become more favorable and investor sentiment improves.

Difficulty in Predicting Future Earnings

The unpredictable nature of tariffs makes it difficult for companies to accurately forecast future earnings, a critical factor for attracting investors in an IPO.

- Difficulty in modeling the financial impact of tariffs on revenue and profitability: Accurately predicting the financial impact of tariffs on revenue and profitability is nearly impossible due to the unpredictable nature of trade policies.

- Challenges in presenting a clear and stable financial outlook to investors: This lack of predictability makes it extremely difficult for companies to provide investors with a clear, stable, and credible financial outlook, a crucial aspect of a successful IPO.

- Increased pressure to demonstrate resilience and adaptability to changing trade policies: Investors will place a high premium on companies that can demonstrate resilience and adaptability in the face of changing trade policies.

- Increased reliance on hedging strategies to mitigate the risk of fluctuating tariffs: Companies may resort to complex hedging strategies to mitigate the impact of fluctuating tariffs, but these strategies can be costly and complex.

Alternative Strategies for Companies During an IPO Freeze

While an IPO might be on hold, companies can't afford to stagnate. Several alternative strategies can help companies navigate this period of market uncertainty.

Private Equity Funding

Secure funding through private equity investments to bridge the gap until market conditions improve. This provides much-needed capital to continue operations and pursue growth opportunities without the pressure of an immediate IPO.

Strategic Partnerships and Mergers

Explore strategic partnerships or mergers to strengthen the company's position and enhance its attractiveness to investors. A stronger, more diversified company is better positioned for a future IPO.

Focusing on Domestic Markets

Shift focus towards strengthening domestic market share and reducing reliance on international trade, thereby minimizing tariff impact. This reduces the vulnerability to trade disputes and improves the stability of the company's financial performance.

Conclusion

The current freeze on IPO activity is significantly linked to the market uncertainty generated by escalating tariffs. The increased risk aversion among investors, coupled with the difficulty in predicting future earnings in a volatile trade environment, discourages companies from pursuing IPOs. While the situation presents challenges, companies can explore alternative strategies to navigate this period. Understanding the impact of tariffs on IPO freezes is crucial for navigating the current market climate and making informed decisions about future funding and expansion strategies. Stay informed about evolving trade policies and market trends to make optimal decisions regarding your company's IPO plans. Don't let the current market uncertainty and the IPO freeze halt your growth; develop a strategic approach that mitigates risk and leverages opportunities amidst changing global trade dynamics.

Featured Posts

-

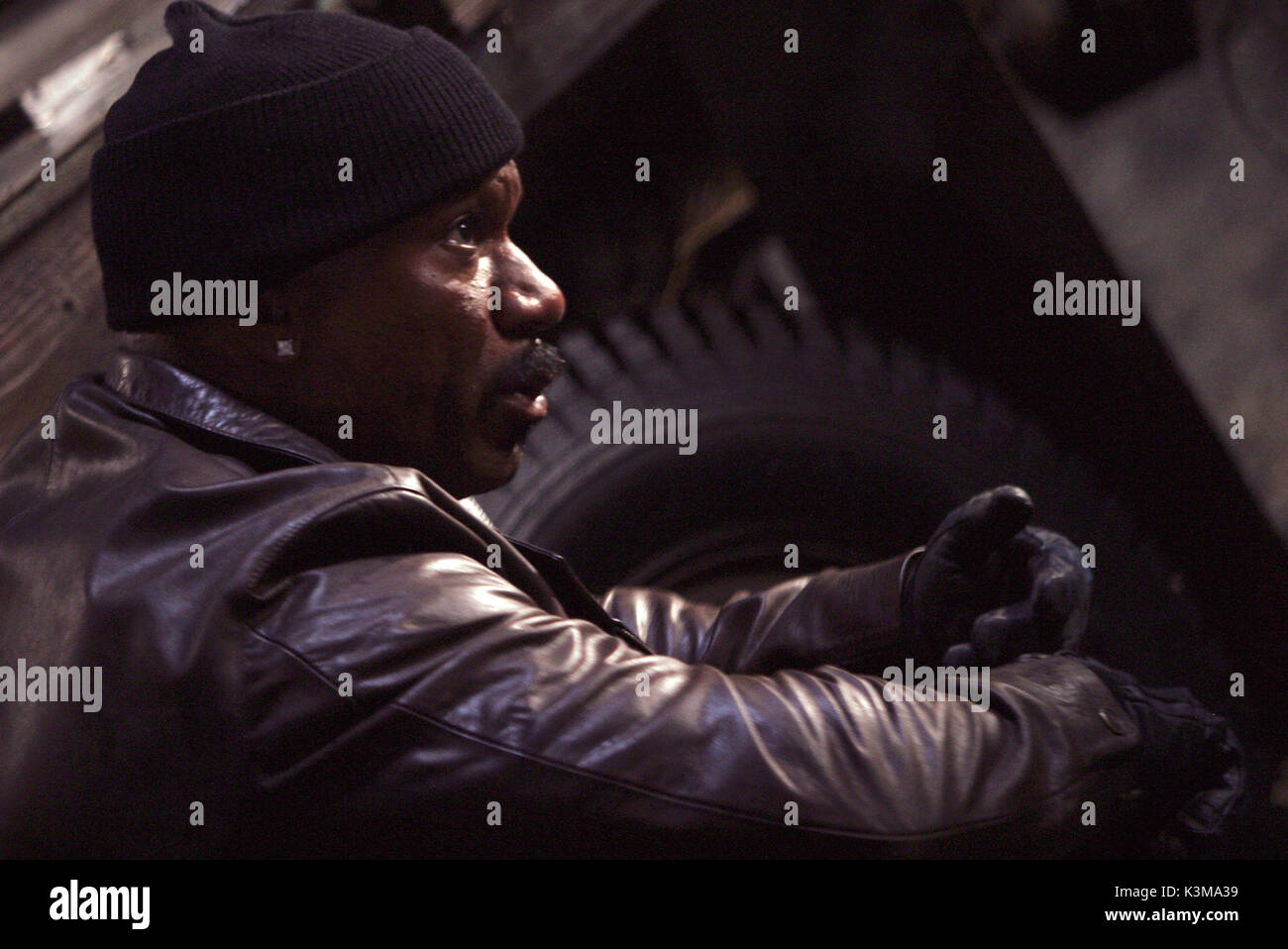

Mission Impossible Ving Rhames Discusses His Almost Death And The Emotional Final Chapter

May 14, 2025

Mission Impossible Ving Rhames Discusses His Almost Death And The Emotional Final Chapter

May 14, 2025 -

Kanye West And Bianca Censori A New Chapter

May 14, 2025

Kanye West And Bianca Censori A New Chapter

May 14, 2025 -

Zdrajcy 2 Odcinek 1 Podsumowanie Konfliktow Graczy Po Pierwszym Zadaniu

May 14, 2025

Zdrajcy 2 Odcinek 1 Podsumowanie Konfliktow Graczy Po Pierwszym Zadaniu

May 14, 2025 -

Sevilla Caparros Substitui Pimienta No Comando Tecnico

May 14, 2025

Sevilla Caparros Substitui Pimienta No Comando Tecnico

May 14, 2025 -

Eurovision 2024 In Basel Promoting Diversity And Inclusion Amidst Tensions

May 14, 2025

Eurovision 2024 In Basel Promoting Diversity And Inclusion Amidst Tensions

May 14, 2025