Market Update: Frankfurt DAX Closes Below 24,000 Points

Table of Contents

Key Factors Contributing to the DAX Decline

Several interconnected factors have contributed to the recent decline of the DAX index below 24,000 points. Understanding these factors is crucial for navigating the current market volatility and making informed investment decisions related to the DAX and European markets.

Geopolitical Uncertainty

Geopolitical uncertainty remains a significant headwind for the DAX. The ongoing war in Ukraine continues to disrupt global supply chains, impacting German exports and fueling inflation. The conflict's knock-on effects extend beyond energy prices, influencing investor confidence and creating a risk-averse environment.

- Specific examples of geopolitical risks: The war in Ukraine, escalating tensions between the US and China, and ongoing instability in several regions.

- Effect on German exports: Disruptions to energy supplies and trade routes, impacting key German industries like automotive and manufacturing.

- Impact on energy prices: Soaring energy costs, driven by reduced Russian gas supplies, increase production costs for German businesses and squeeze consumer spending.

- Keyword integration: Geopolitical risk, Ukraine conflict, energy crisis, inflation, DAX performance, European markets.

Inflationary Pressures and Rising Interest Rates

Persistent inflationary pressures and the subsequent interest rate hikes by the European Central Bank (ECB) are significantly impacting the DAX. Higher interest rates increase borrowing costs for businesses, potentially slowing down investment and economic growth. This makes it harder for companies to expand and invest, thus impacting their stock prices and the overall DAX performance.

- ECB interest rate decisions: The ECB's recent aggressive interest rate increases aim to curb inflation, but these measures also risk slowing economic growth.

- Inflation data: Persistent high inflation erodes purchasing power and weakens consumer confidence, impacting spending and overall economic activity.

- Impact on borrowing costs for businesses: Increased borrowing costs make expansion and investment more expensive, potentially slowing down economic growth.

- Consumer spending slowdown: Higher prices and interest rates reduce consumer spending, dampening demand and impacting business performance.

- Keyword integration: Inflation, interest rates, ECB, monetary policy, consumer confidence, economic growth, DAX investing.

Concerns about Global Economic Slowdown

Growing concerns about a potential global recession are weighing heavily on investor sentiment and the DAX. Weakening global demand, persistent supply chain disruptions, and rising interest rates all contribute to the apprehension about a slowdown in major economies, impacting German businesses significantly.

- Economic forecasts: Many leading economic institutions predict slower economic growth or even a recession in several key global economies.

- Weakening global demand: Reduced consumer spending and business investment worldwide impact German exports and industrial production.

- Supply chain disruptions: The ongoing disruptions continue to affect production and increase costs for many German companies.

- Potential for a recession in major economies: A global recession would dramatically impact German exports and economic growth, causing further downward pressure on the DAX.

- Keyword integration: Global recession, economic slowdown, supply chain issues, global trade, DAX forecast, German economy.

Impact on Investors and Investment Strategies

The DAX decline below 24,000 points has significant implications for investors, requiring a careful reassessment of investment strategies.

Investor Sentiment and Market Volatility

The current market environment is characterized by increased volatility and a shift towards risk aversion among investors. The decline in the DAX has heightened this sentiment, leading to increased trading activity and price fluctuations.

- Changes in investor sentiment indicators: Various indicators point towards a cautious and risk-averse investor sentiment.

- Increased trading volume: Higher trading volumes suggest increased uncertainty and activity in the market as investors react to the changing environment.

- Impact on short-term and long-term investments: Short-term investors might experience significant losses, while long-term investors need to carefully evaluate their portfolio's risk tolerance.

- Keyword integration: Investor sentiment, market volatility, risk aversion, trading activity, investment strategies, DAX index.

Potential Investment Opportunities Amidst the Decline

Despite the decline, the current market conditions may present potential investment opportunities for those with a long-term perspective and a tolerance for risk.

- Specific sectors less affected by the decline: Certain sectors, like healthcare or consumer staples, may be less vulnerable to economic downturns.

- Undervalued stocks: The decline might create opportunities to acquire undervalued stocks with strong long-term potential.

- Long-term investment strategies: A long-term investment strategy focusing on value investing can help navigate market volatility and capitalize on potential rebounds.

- Keyword integration: Value investing, long-term investments, undervalued stocks, DAX investing, stock market opportunities, buying the dip.

Conclusion

The Frankfurt DAX closing below 24,000 points reflects a confluence of factors, including geopolitical uncertainty, persistent inflationary pressures, and concerns about a global economic slowdown. This decline has significantly impacted investor sentiment and market volatility, highlighting the need for careful consideration of investment strategies. Understanding these influencing factors is paramount for navigating the complexities of the Frankfurt DAX and making informed decisions in the current market climate.

Call to Action: Stay informed about the evolving situation with the Frankfurt DAX and its impact on the broader European markets. Monitor key economic indicators like inflation, interest rates, and geopolitical developments to adjust your investment strategies accordingly. Understanding the factors influencing the Frankfurt DAX is crucial for navigating the current market conditions and making informed investment decisions. Keep an eye on future updates regarding the Frankfurt DAX and its performance.

Featured Posts

-

La Strategie Chinoise Pour Reduire Au Silence Les Dissidents En France

May 25, 2025

La Strategie Chinoise Pour Reduire Au Silence Les Dissidents En France

May 25, 2025 -

Frances Justice System Reforming Penalties For Underage Criminals

May 25, 2025

Frances Justice System Reforming Penalties For Underage Criminals

May 25, 2025 -

Full Soundtrack List Picture This Prime Videos New Romantic Comedy

May 25, 2025

Full Soundtrack List Picture This Prime Videos New Romantic Comedy

May 25, 2025 -

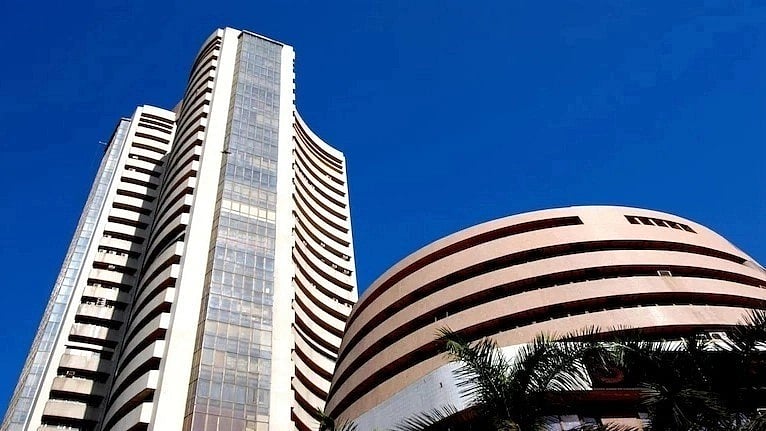

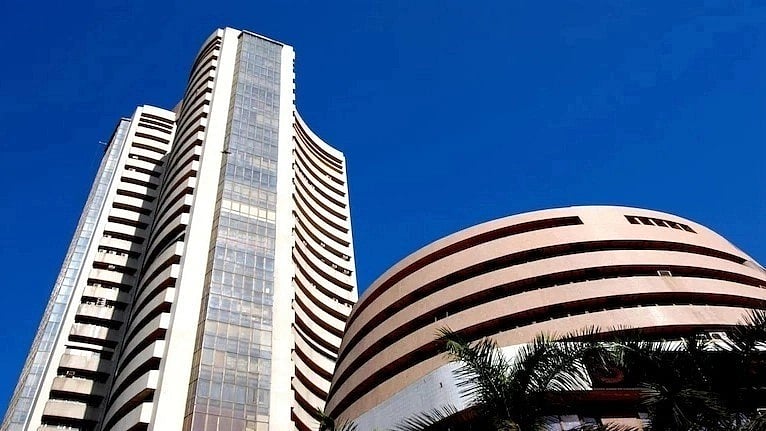

Borse In Caduta Libera L Ue Risponde Ai Nuovi Dazi

May 25, 2025

Borse In Caduta Libera L Ue Risponde Ai Nuovi Dazi

May 25, 2025 -

Paris In The Red Luxury Market Slump Impacts Citys Economy

May 25, 2025

Paris In The Red Luxury Market Slump Impacts Citys Economy

May 25, 2025