Market Volatility Today: Analyzing The Dow, Bonds, And Bitcoin

Table of Contents

Analyzing the Dow Jones Industrial Average's Volatility

The Dow Jones Industrial Average (Dow), a benchmark for US equities, has experienced significant swings recently. Its volatility reflects the complex interplay of various macroeconomic factors. Inflation, impacting consumer spending and corporate profits, remains a primary driver. Interest rate hikes by central banks, aimed at curbing inflation, further contribute to market uncertainty. Geopolitical events and unpredictable earnings reports add to the instability.

- Recent Dow Movements: In the last quarter, the Dow experienced a 5% increase followed by a 3% decline, showcasing the rapid shifts characterizing the current market.

- Key Sectors Driving Volatility: The technology sector, heavily reliant on investor sentiment, and the energy sector, sensitive to global supply and demand fluctuations, have been significant contributors to Dow volatility.

- Potential Future Scenarios: Experts predict continued volatility, with potential for further corrections depending on inflation's trajectory and the effectiveness of monetary policy.

- [Insert relevant chart or graph showing Dow performance over the last year]

Understanding the Dow's volatility requires monitoring key economic indicators and staying abreast of global events. This knowledge is crucial for effective stock market trend analysis and informed decision-making regarding your stock market investments.

Understanding the Fluctuations in the Bond Market

The bond market, traditionally considered a safe haven, is also exhibiting increased volatility. This is largely due to the inverse relationship between bond prices and interest rates. As interest rates rise, bond yields increase, pushing down the price of existing bonds. Inflation significantly impacts bond yields, as investors demand higher returns to compensate for the erosion of purchasing power. Central bank policies play a pivotal role, influencing interest rate trajectories and therefore bond market behavior.

- Different Types of Bonds and Volatility: Government bonds (like Treasury bonds) are generally considered less volatile than corporate bonds, which carry higher risk due to the potential for default.

- Yield Curve Analysis: An inverted yield curve (where short-term yields exceed long-term yields) is often seen as a recessionary predictor, indicating increased market uncertainty and potential downward pressure on bond prices.

- Correlation with the Dow: The Dow and the bond market often exhibit an inverse correlation; when stock prices fall, investors often flock to bonds, driving up their prices (and lowering yields).

- [Insert relevant chart or graph showing bond yield movements over time]

Navigating the bond market requires a keen understanding of interest rates, inflation expectations, and central bank actions. Investors should consider the correlation between bond yields and the Dow Jones to strategically allocate assets and reduce overall portfolio risk.

Deciphering Bitcoin's Price Volatility

Bitcoin, the flagship cryptocurrency, is notorious for its extreme price volatility. Unlike the Dow and the bond market, its price is influenced by a unique blend of factors. Regulatory changes, institutional adoption (or lack thereof), and macroeconomic trends all play significant roles. News events, both positive and negative, can dramatically impact Bitcoin's price.

- Recent Significant Price Changes: Bitcoin's price has swung wildly in recent months, experiencing both double-digit percentage gains and losses within short periods.

- Relationship with Other Assets: While Bitcoin is often touted as a hedge against inflation, its correlation with traditional assets like the Dow and gold is inconsistent and often weak.

- Impact of News and Events: Regulatory crackdowns in specific countries or positive announcements about institutional adoption can cause significant price spikes or drops.

- [Insert relevant chart showing Bitcoin's price history over the last year]

Bitcoin's volatility underscores the high-risk, high-reward nature of cryptocurrency investments. Understanding the factors driving price fluctuations is crucial for managing risk effectively within this volatile asset class. Bitcoin price predictions are notoriously difficult, highlighting the need for careful consideration before investing.

The Interconnectedness of the Dow, Bonds, and Bitcoin

While seemingly distinct, the Dow, the bond market, and Bitcoin are increasingly interconnected. Global events, such as geopolitical instability or economic downturns, impact all three asset classes simultaneously. Understanding asset correlation is paramount for effective risk management.

- Historical Correlations: While not always consistent, historical data reveals periods of correlation between these asset classes, highlighting the need for a diversified investment strategy.

- Impact of Global Events: Major global events can trigger simultaneous movements in stock prices, bond yields, and Bitcoin's price, emphasizing the importance of a diversified portfolio that accounts for correlations.

- Managing Risk Across Asset Classes: Diversification across these different asset classes can help mitigate risk, as the movements of one asset class may offset those of another, reducing overall portfolio volatility.

Understanding these interrelationships is crucial for developing a robust investment strategy. Effective portfolio diversification is key to navigating market volatility effectively.

Market Volatility Today: Navigating Uncertainty

In summary, the current market exhibits significant volatility across the Dow, the bond market, and Bitcoin. The interconnectedness of these assets underscores the importance of understanding their individual characteristics and their interplay. Navigating this uncertainty requires a proactive approach to investment strategy and risk management. Diversification across asset classes, coupled with a well-defined plan, is crucial for mitigating risk and potentially capitalizing on opportunities within a volatile market. To effectively manage your investments during this period of heightened market volatility, dedicate time to thorough research and the development of a robust financial plan tailored to your specific risk tolerance and investment goals.

Featured Posts

-

The Aftermath Freddie Flintoff Speaks On His Horrific Crash

May 23, 2025

The Aftermath Freddie Flintoff Speaks On His Horrific Crash

May 23, 2025 -

Programma Eleny Rybakinoy Dlya Podderzhki Yunykh Tennisistok Kazakhstana

May 23, 2025

Programma Eleny Rybakinoy Dlya Podderzhki Yunykh Tennisistok Kazakhstana

May 23, 2025 -

Nrw Eis Trend Die Unerwartete Nummer Eins In Essen

May 23, 2025

Nrw Eis Trend Die Unerwartete Nummer Eins In Essen

May 23, 2025 -

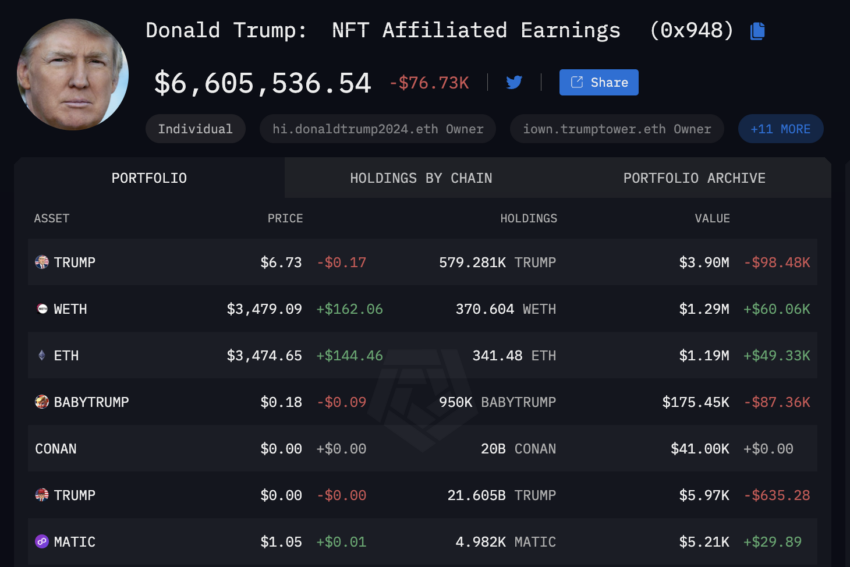

Anonymity At Trumps Memecoin Dinner A Look At The Guest List

May 23, 2025

Anonymity At Trumps Memecoin Dinner A Look At The Guest List

May 23, 2025 -

Altqryr Alkaml Lmbarat Qtr Walkhwr Msharkt Ebd Alqadr

May 23, 2025

Altqryr Alkaml Lmbarat Qtr Walkhwr Msharkt Ebd Alqadr

May 23, 2025