Market Volatility: US Fiscal Issues Impact Stock Prices

Table of Contents

The Debt Ceiling Debate and its Market Implications

The US debt ceiling is the legal limit on how much the federal government can borrow. Reaching this limit without raising it creates a significant risk of default, a situation with potentially catastrophic consequences for the US economy and global markets. Historically, the debate surrounding the debt ceiling has led to periods of heightened market volatility. The uncertainty surrounding whether, and when, the ceiling will be raised fuels investor anxiety, impacting confidence and risk appetite.

- Increased borrowing costs: The closer the US gets to its debt ceiling, the higher the perceived risk of default, leading to increased borrowing costs for the government and potentially for businesses as well.

- Credit rating downgrades: Failure to raise the debt ceiling could result in a credit rating downgrade for the US, increasing borrowing costs and potentially triggering a sell-off in US assets.

- Government shutdowns: Deadlocks over the debt ceiling have, in the past, led to partial or complete government shutdowns, further disrupting economic activity and eroding investor confidence.

- Negative impact on consumer and business confidence: The uncertainty surrounding the debt ceiling can dampen consumer and business confidence, leading to reduced spending and investment, which negatively impacts economic growth and stock prices.

For example, the debt ceiling crisis of 2011 saw the US credit rating downgraded by Standard & Poor's, triggering significant market volatility and a decline in stock prices. [Link to relevant news article]. This highlights the direct link between US fiscal policy uncertainty and market performance.

Government Spending and its Influence on Inflation

Government spending plays a significant role in influencing inflation. Increased government spending, particularly through fiscal stimulus packages, can boost demand, potentially outpacing supply and leading to inflationary pressures. This inflation, in turn, affects stock valuations. Higher inflation typically leads to increased interest rates by the Federal Reserve (the central bank of the US) as it attempts to cool the economy. Higher interest rates increase the cost of borrowing for businesses, impacting their profitability and reducing their attractiveness to investors.

- Impact of fiscal stimulus packages on inflation: Large-scale government spending programs, while aimed at boosting economic growth, can also fuel inflation if not carefully managed.

- The role of the Federal Reserve in managing inflation: The Federal Reserve uses monetary policy tools, primarily interest rate adjustments, to control inflation and maintain price stability.

- How inflation affects corporate earnings and profit margins: High inflation erodes corporate profit margins as businesses face rising costs for raw materials, labor, and other inputs. This ultimately impacts stock prices.

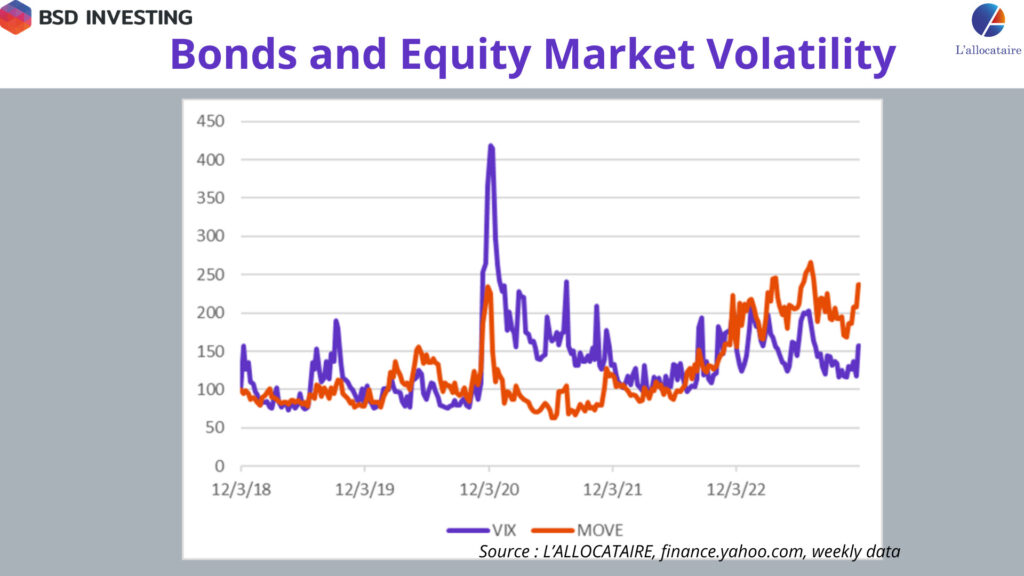

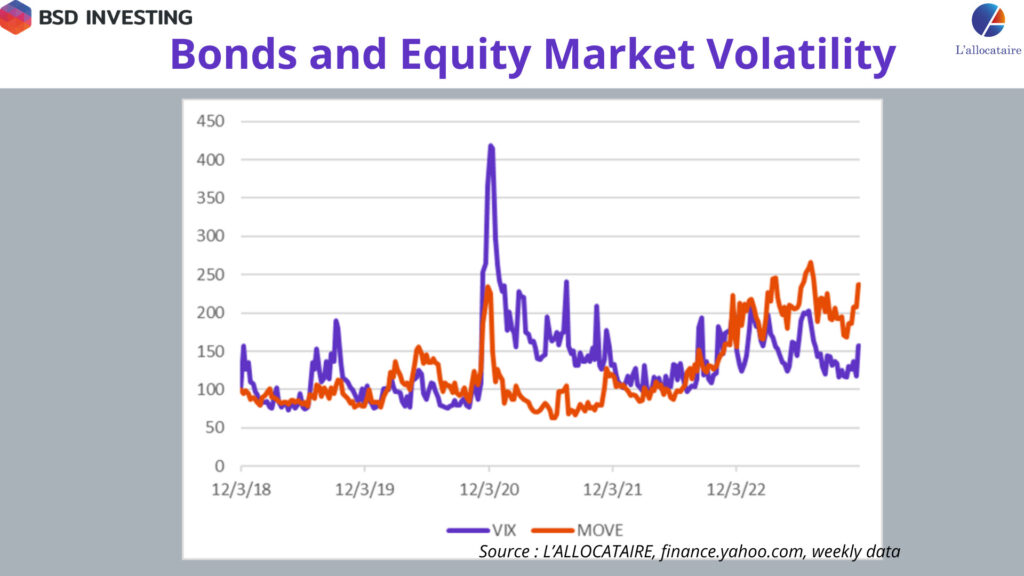

Monitoring key economic indicators such as the Consumer Price Index (CPI) and inflation expectations is crucial for understanding the impact of government spending on market volatility.

Tax Policy Changes and their Effect on Corporate Profits

Changes in tax policies, particularly corporate tax rates, significantly impact corporate profits and, consequently, stock prices. Tax cuts can boost corporate profits, leading to increased investment, job creation, and potentially higher stock prices. Conversely, tax increases can reduce corporate profits, potentially slowing investment and dampening stock market performance.

- Impact of tax cuts on corporate investment and job creation: Tax cuts can provide businesses with more capital, encouraging investment in new equipment, technology, and expansion, leading to job creation.

- Effect of tax increases on corporate earnings and dividends: Tax increases reduce corporate after-tax profits, potentially leading to lower dividends and reduced investment.

- Analysis of specific tax policy changes and their market impact: Analyzing the historical market reaction to specific tax policy changes provides valuable insights into their impact on stock prices.

For instance, the Tax Cuts and Jobs Act of 2017, which significantly lowered corporate tax rates, was initially met with positive market reaction, reflected in increased stock prices across various sectors.

Political Uncertainty and its Contribution to Market Volatility

Political gridlock and uncertainty surrounding fiscal policy are significant contributors to market volatility. Investors thrive on predictability and clear policy directions. When political divisions create uncertainty about future government actions (regarding spending, taxation, or regulation), it can lead to investor hesitation and market instability.

- Impact of political polarization on investor sentiment: Increased political polarization can create uncertainty about the direction of future fiscal policy, negatively impacting investor sentiment.

- Effects of potential policy reversals on market stability: The possibility of abrupt policy changes can create volatility as investors adjust their portfolios to reflect potential risks.

- Importance of clear and predictable fiscal policies for market confidence: Clear and consistent fiscal policies are essential for maintaining investor confidence and promoting stable market conditions.

Past political events, such as government shutdowns or contentious elections, have demonstrated the disruptive impact of political uncertainty on market stability.

Conclusion: Navigating Market Volatility Caused by US Fiscal Issues

US fiscal issues significantly impact market volatility. The debt ceiling debate, government spending policies, tax policy changes, and political uncertainty all play a crucial role in shaping investor sentiment and market performance. Understanding these interconnections is vital for investors seeking to navigate the complexities of the financial markets. To manage your portfolio effectively during periods of uncertainty, consider strategies such as diversification and careful risk management. Stay ahead of market volatility by closely monitoring US fiscal issues and adapting your investment strategy accordingly. Understanding the interplay between US fiscal policy and stock prices is crucial for long-term investment success.

Featured Posts

-

Suksesi I Kosoves Ne Ligen E Kombeve Analize E Perfitimeve

May 23, 2025

Suksesi I Kosoves Ne Ligen E Kombeve Analize E Perfitimeve

May 23, 2025 -

Bianca Andreescus Straight Sets Victory Sends Her To Italian Open Fourth Round

May 23, 2025

Bianca Andreescus Straight Sets Victory Sends Her To Italian Open Fourth Round

May 23, 2025 -

Big Rig Rock Report 3 12 98 5 The Fox Trucking Industry News And Insights

May 23, 2025

Big Rig Rock Report 3 12 98 5 The Fox Trucking Industry News And Insights

May 23, 2025 -

Disney April Lineup Includes A Real Pain

May 23, 2025

Disney April Lineup Includes A Real Pain

May 23, 2025 -

2025 Rendez Vous With French Cinema What To Expect From The Festival And Awards

May 23, 2025

2025 Rendez Vous With French Cinema What To Expect From The Festival And Awards

May 23, 2025