Martin Lewis Issues Urgent Four-Week Post Warning

Table of Contents

Money-saving expert Martin Lewis has issued an urgent warning about a crucial four-week post-office deadline affecting millions. Missing this deadline could result in significant financial penalties or missed opportunities, potentially costing you hundreds, even thousands, of pounds. This article breaks down the key information you need to know and what actions you should take immediately to avoid the consequences of this Martin Lewis four-week post warning.

Understanding the Four-Week Post-Office Deadline

Martin Lewis's urgent warning relates to the four-week deadline for submitting self-assessment tax returns. While the official deadline is typically in January, many individuals and businesses may have filed for extensions, bringing them to this critical four-week post-office deadline.

Missing this deadline carries severe consequences:

- Late filing penalties: HMRC (Her Majesty's Revenue and Customs) imposes substantial penalties for late tax returns. These penalties can accumulate quickly, adding significant financial burden.

- Interest charges: Aside from penalties, you'll also face interest charges on any unpaid tax owed.

- Potential legal action: In extreme cases, HMRC may take legal action to recover unpaid taxes.

Key facts about the deadline:

- Specific date of the deadline: The exact date varies depending on the extension granted but typically falls within a four-week window of the original deadline. Check your HMRC communication for the precise date.

- Who is affected by the deadline: This deadline primarily affects self-employed individuals and those with business income who need to file a tax return.

- Where to find more information: For detailed information, visit the official HMRC website: [insert HMRC website link here]. You can also find helpful guides and resources on Martin Lewis's website: [insert Martin Lewis website link here].

Martin Lewis's Advice: Key Actions to Take Within Four Weeks

Martin Lewis strongly advises immediate action to avoid the penalties associated with missing this crucial deadline. His key advice includes:

- Gather necessary documentation: Collect all relevant financial documents, including P60s, invoices, bank statements, and expense receipts.

- Complete and submit the relevant forms: Carefully complete your self-assessment tax return form online via the HMRC website. Ensure all information is accurate and complete.

- Track your application/submission: Keep a record of your submission, including a confirmation number or email receipt.

- Contact relevant authorities if issues arise: If you encounter any problems during the submission process, contact HMRC immediately for assistance.

Common Mistakes to Avoid

Many individuals miss crucial deadlines due to avoidable errors. Here are some common mistakes to avoid:

- Procrastination: Don't leave completing your tax return until the last minute. Start early and allow ample time to gather documentation and accurately complete the forms.

- Incorrect addressing of postal items: Ensure your tax return is correctly addressed to the relevant HMRC office to avoid delays.

- Insufficient postage: Use sufficient postage to guarantee timely delivery of your tax return.

- Failure to keep proof of postage: Always obtain proof of postage, whether via a recorded delivery service or a certificate of posting.

Alternative Methods for Timely Submission

While postal services are an option, consider alternative methods for submitting your tax return:

- Online submission: HMRC encourages online submissions, which are generally faster and more efficient.

- Email submission: In some cases, you might be able to submit via email, but confirm this with HMRC beforehand.

Comparison of Submission Methods:

| Method | Advantages | Disadvantages |

|---|---|---|

| Online Submission | Fast, efficient, confirmation of receipt | Requires internet access, technical skills |

| Postal Submission | Simple, traditional method | Slower, risk of delays, proof of postage needed |

| Email Submission | Potentially faster than post | May not be accepted for all submissions |

Additional Resources & Further Information

For more information and assistance, refer to these resources:

- HMRC Website: [insert HMRC website link here]

- Martin Lewis's Website: [insert Martin Lewis website link here]

- Gov.uk (Government Website): [insert Gov.uk website link here]

Conclusion

Martin Lewis's urgent four-week post warning underscores the importance of timely tax return submissions. By understanding the deadline, following his advice, and avoiding common mistakes, you can ensure compliance and protect yourself from significant financial penalties. Don't miss out! Take action today and avoid the consequences of missing the crucial four-week post-office deadline highlighted by Martin Lewis. Check your deadlines now and ensure you're compliant. Learn more about the Martin Lewis four-week post warning and protect your finances!

Featured Posts

-

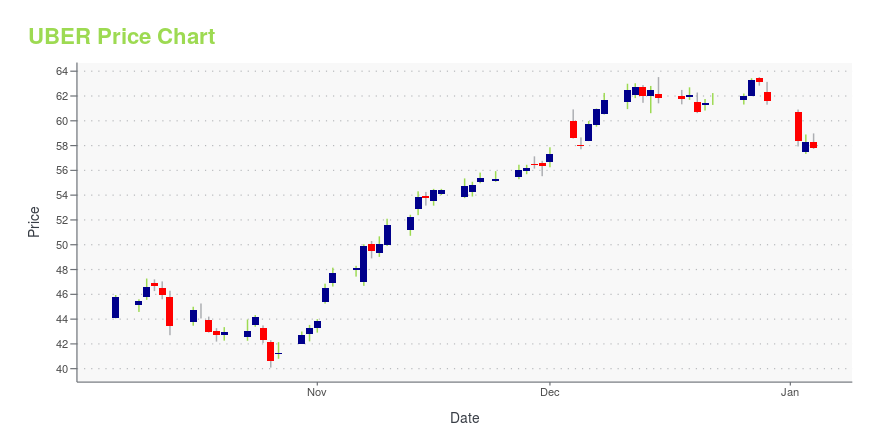

The Uber Investment Case Examining Uber Stock Performance

May 19, 2025

The Uber Investment Case Examining Uber Stock Performance

May 19, 2025 -

Large Scale Rave Events An Economic Driver

May 19, 2025

Large Scale Rave Events An Economic Driver

May 19, 2025 -

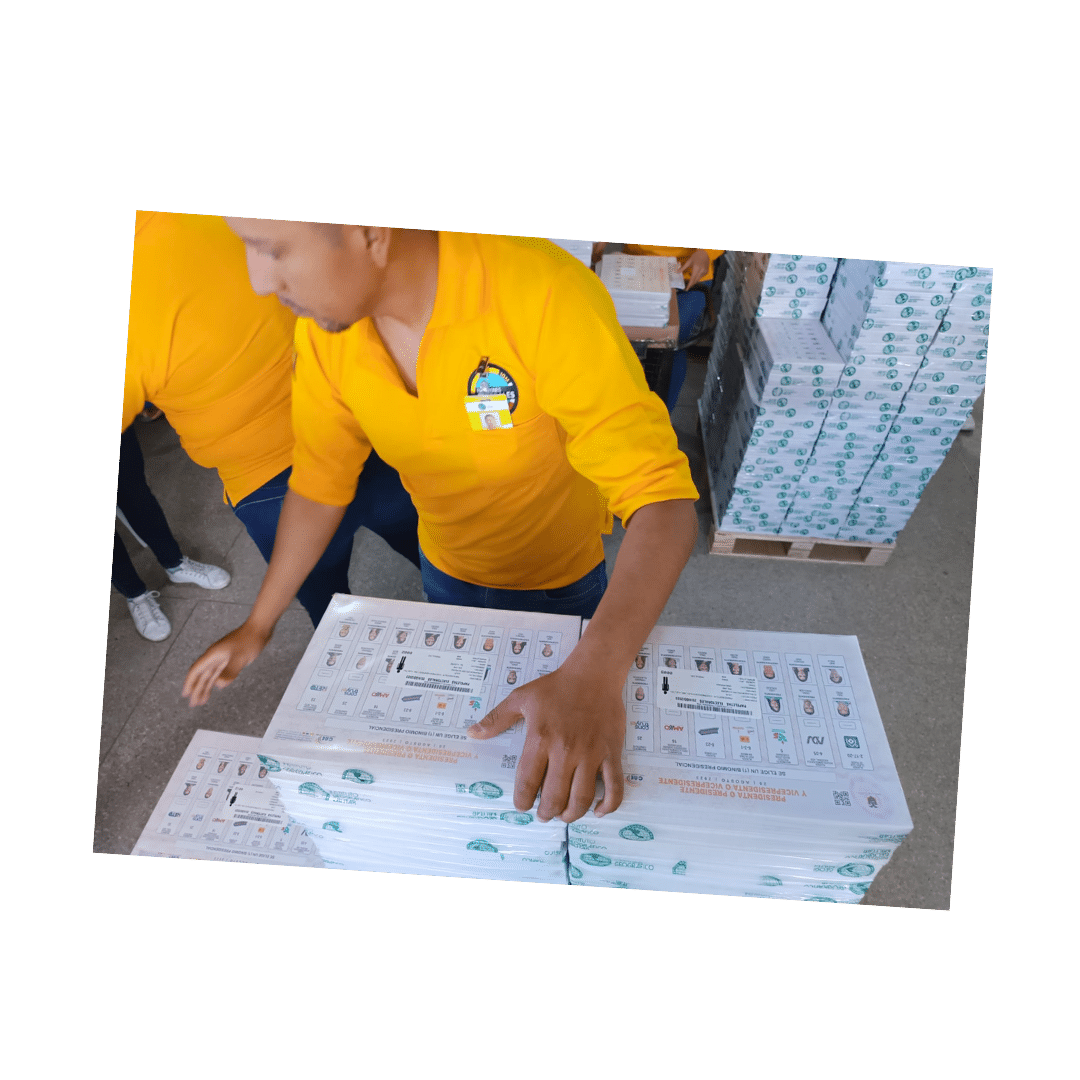

Cuando Seran Las Primarias 2025 El Cne Responde

May 19, 2025

Cuando Seran Las Primarias 2025 El Cne Responde

May 19, 2025 -

Ufc 313 Full Fight Results And Key Highlights

May 19, 2025

Ufc 313 Full Fight Results And Key Highlights

May 19, 2025 -

Ierosolyma Antioxeia I Nea Epoxi Stis Ekklisiastikes Sxeseis

May 19, 2025

Ierosolyma Antioxeia I Nea Epoxi Stis Ekklisiastikes Sxeseis

May 19, 2025